January 6, 2026

2025 Lighting Stock Results: Turnarounds Trump Titans

The year's biggest gains came from companies clawing back from crisis

For the third year in a row — and the sixth time in seven years — the S&P 500 delivered double-digit returns, climbing 16.4% in 2025 and recording 38 new all-time highs along the way. Tech juggernauts and AI heavyweights led the charge: Nvidia gained 39%, while Micron Technology surged more than 250%. Even Amazon’s 5.2% increase would’ve satisfied most investors playing the long game. But for some in the lighting world — where stock ownership isn’t a side hustle but a sign of corporate strength, a piece of compensation or an M&A enabler — the picture is far more complicated.

This is a story about share price at two points in time: December 31, 2024, and December 31, 2025. But a stock chart is more than just a snapshot — it’s a window into how a company is perceived to be performing, and often, how well it’s positioned to grow. For public lighting companies, stock performance shapes more than investor sentiment. It can influence leadership stability, dictate how much capital is available for R&D or acquisitions, and determine how attractive the company is to top-tier talent.

A rising share price doesn’t just benefit shareholders — it can serve as a feedback loop, enabling a company to reinvest, reward employees, and make strategic moves from a position of strength. Conversely, flat or falling shares can create headwinds that ripple through hiring, budgeting, and innovation. What may look like a “winning” year on paper might be masking long-term vulnerabilities, while an unremarkable gain could reflect a quietly compounding strength.

Just ask longtime Cooper Lighting employees:

Nearly six years after Eaton sold Cooper Lighting to Signify, the investment outcomes for employees who regularly received stock compensation in those companies couldn’t look more different. Had Cooper remained with Eaton, a hypothetical staffer receiving $10,000 annually in Eaton stock from 2020 through 2025 would now have over $122,000 — more than double her money.

Instead, the same annual investment in Signify stock would have shrunk to under $44,000 — a 27% loss. And just one county over, at Acuity’s Atlanta headquarters, that same $60,000 invested over six years would now be worth more than $131,000 — a 119% gain. These aren’t abstract fluctuations. They represent retirement accounts, college savings plans and long-term compensation strategies for people who built their careers in lighting.

Before diving into the stories behind each company’s stock movement, let’s take a look at how the sector performed across the board in 2025.

| Company | Exchange | Currency | Market Cap | 2024 Adj. Close | 2025 Adj. Close | Change |

|---|---|---|---|---|---|---|

| Dialight plc (DIA.L) |

LSE (London) | GBP | £144.8 M | £1.10 | £3.50 | +218.2% |

| Energy Focus (EFOI) |

NASDAQ | USD | $13.3 M | $1.19 | $2.31 | +94.1% |

| Orion Energy Systems (OESX) |

NASDAQ | USD | $60.4 M | $8.00 | $15.38 | +92.3% |

| Legrand SA (LR.PA) |

Euronext Paris | EUR | €33.7 B | €92.14 | €127.25 | +38.1% |

| Acuity, Inc. (AYI) |

NYSE | USD | $11.6 B | $291.46 | $360.04 | +23.5% |

| Signify N.V. (LIGHT.AS) |

Euronext Amsterdam | EUR | €2.6 B | €19.87 | €20.96 | +5.5% |

| LSI Industries (LYTS) |

NASDAQ | USD | $586.1 M | $19.22 | $18.32 | -4.7% |

| Zumtobel Group (ZAG.VI) |

Vienna SE | EUR | €149.9 M | €4.72 | €3.42 | -27.6% |

The chart tells a story, but not the whole story.

Acuity, Inc. — widely regarded by analysts and insiders as the most operationally sound lighting company in North America — isn’t in the top three by percentage gain. Yet few would argue against its superior financial fundamentals, healthy balance sheet, and long-term strategic vision. Meanwhile, thinly traded and struggling Energy Focus posted a stunning 94% stock price gain despite shrinking revenues and a liquidity crisis — conditions under which few, if any, serious investors would recommend buying in.

Orion and Dialight sit towards the top of the performance list, but those gains must be viewed in context. Both companies are in the early stages of turnaround efforts, coming off years of operational dysfunction, leadership changes, and market challenges. Their stock gains reflect sharp improvement from low baselines, not dominance in their segments. In other words, 2025’s top performers were often companies correcting poor past performance — not those with sustained competitive advantages.

Let’s unpack the deeper narratives driving these numbers:

Dialight: Stability Becomes the Catalyst

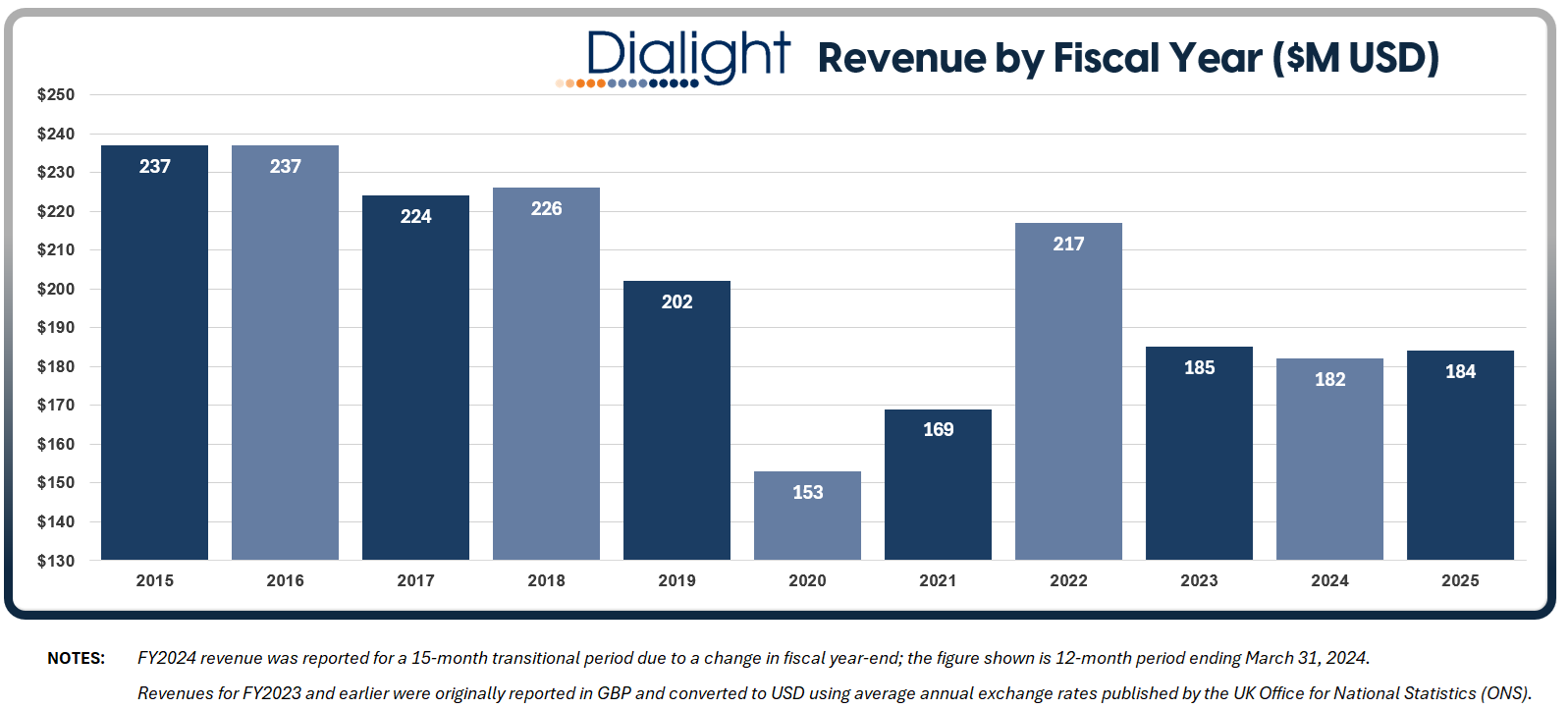

Dialight’s 218% stock surge in 2025 was less about growth and more about relief. After years defined by leadership churn, legal battles, and operational dysfunction, the company finally delivered what investors had been waiting for: a stable, functioning business. Under CEO Steve Blair, Dialight focused on simplification, cost discipline, and repairing credibility rather than chasing revenue.

In early 2025, Dialight returned to underlying profitability and expanded gross margins to roughly 35.6 percent, driven by product rationalization and tighter operations. Just as important, it resolved its long-running dispute with Sanmina, removing a financial overhang that had spooked investors for years. As Inside Lighting reported in June, the absence of new crises became the story itself.

By the second half of the year, revenues were still soft, but cash flow improved, net debt fell sharply, and operating discipline held. The stock’s rally reflected a market reassessing Dialight not as a perpetual turnaround case, but as a company that might finally stay upright.

IMPORTANT NOTE: One competing trade publication has, for years, published Dialight’s daily share price inflated by a factor of 100. If the stock trades at £3.40, they report it as £340.00. This has occurred consistently — day after day, year after year — and reflects a fundamental misunderstanding of what they’re reporting. Dialight’s market capitalization is not greater than Acuity’s — not even close — and repeated errors like this are a reminder that reporting the news isn’t the same as understanding it.

Energy Focus: A Stock Move Untethered From Fundamentals

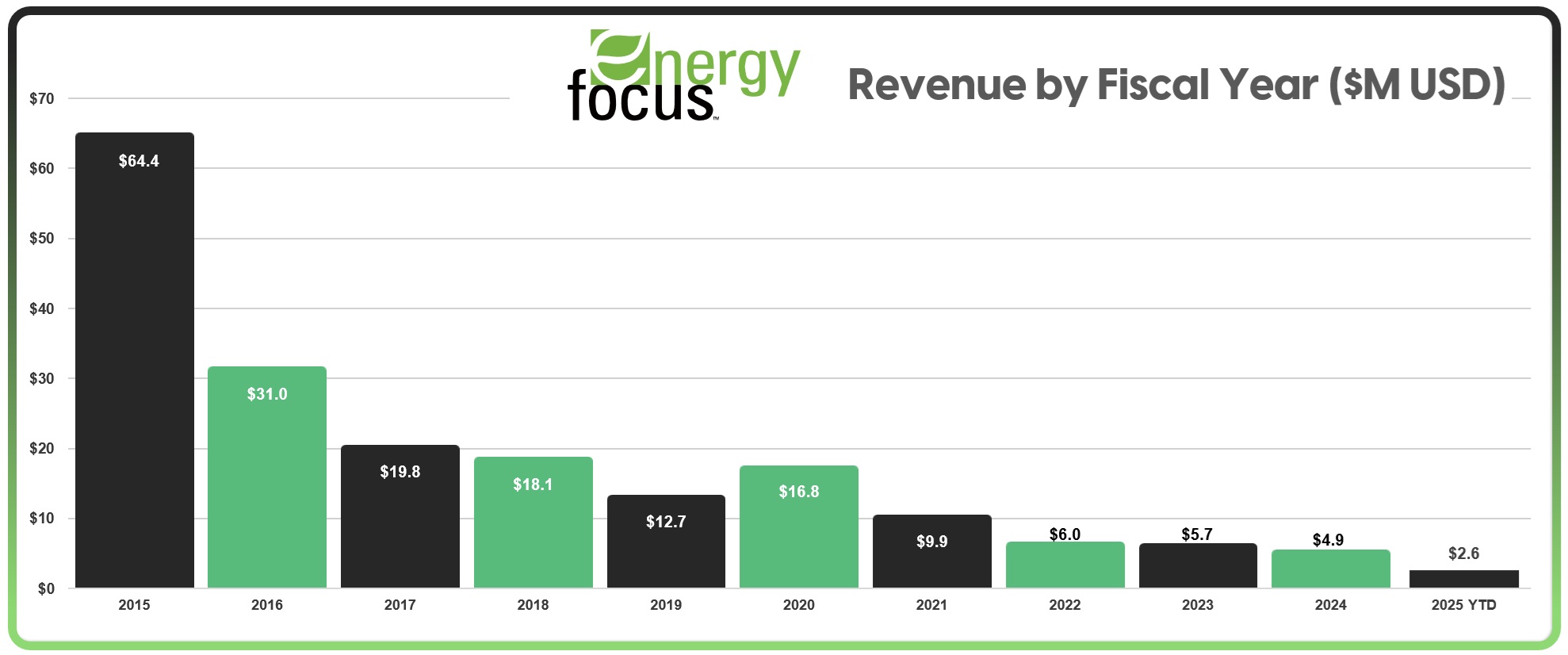

Energy Focus nearly doubled its stock price in 2025, but the business beneath it remained fragile. Revenue fell 28 percent, military orders continued to decline, and cash on hand dipped below $500,000 at points during the year. Survival depended almost entirely on CEO Jay Huang, who injected roughly $900,000 of personal capital to keep the company solvent.

Throughout the year, Energy Focus talked up future opportunities in AI-driven power systems and overseas markets. As Inside Lighting reported in November, none of those initiatives materially translated into revenue. Instead, narrowing losses were driven almost entirely by cost cuts, not demand recovery.

The stock’s rise appears disconnected from institutional confidence or operational strength. It looks more like volatility driven by thin trading and speculation than a re-rating of the business. For industry professionals, Energy Focus serves as a reminder that percentage gains can obscure existential risk — and that market gains do not always align with commercial reality.

Orion Energy Systems: A Second Chance Earned

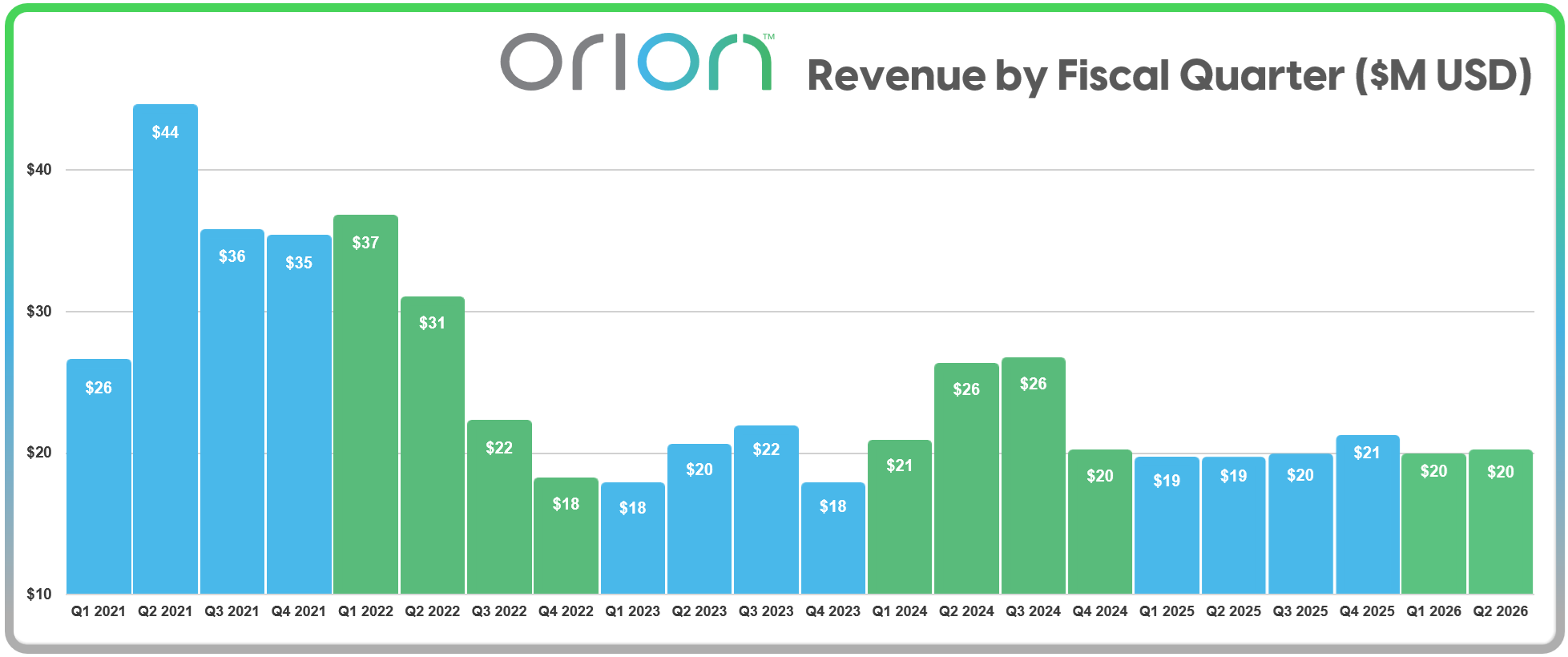

Orion’s 92% stock gain in 2025 tells a more coherent story than many realize. Entering the year, the company faced Nasdaq delisting and persistent losses. A 1-for-10 reverse stock split stabilized the share price, but the real change came operationally under new CEO Sally Washlow.

Orion delivered three consecutive quarters of positive adjusted EBITDA, narrowed losses materially, and posted its highest gross margin in six years. Revenue remained largely flat, but pricing discipline and cost reductions improved the quality of earnings. Inside Lighting highlighted in August how Orion shifted from reactive cost cutting to deliberate restructuring.

The stock’s rise reflects investors granting Orion something it had lost: time. Liquidity remains tight and growth is modest, but the company demonstrated enough operational traction to be seen as viable rather than terminal. In that sense, 2025 was less a victory lap than a reprieve — one Orion now has to justify.

Legrand: Quiet Execution, Predictable Confidence

Legrand’s 38% stock gain in 2025 was impressive precisely because it lacked drama. As a global electrical and digital infrastructure company, Legrand does not live or die by lighting alone. Yet its U.S. lighting brands — Wattstopper, Focal Point, Kenall, Finelite, and others — remain strategically important.

Throughout 2025, Legrand delivered steady organic growth, healthy margins near 20 percent, and strong free cash flow. Its lighting and controls businesses benefited from broader investments in data centers, smart buildings, and energy infrastructure. As Inside Lighting reported in February, Legrand uses diversification as insulation rather than distraction.

While lighting revenue is not broken out separately, continued product development and integration into connected systems reinforced investor confidence. Legrand’s stock performance reflects trust in a company that rarely surprises — and rarely disappoints. In a volatile industry, predictability can be a competitive advantage.

Acuity Brands: Strength Without Spectacle

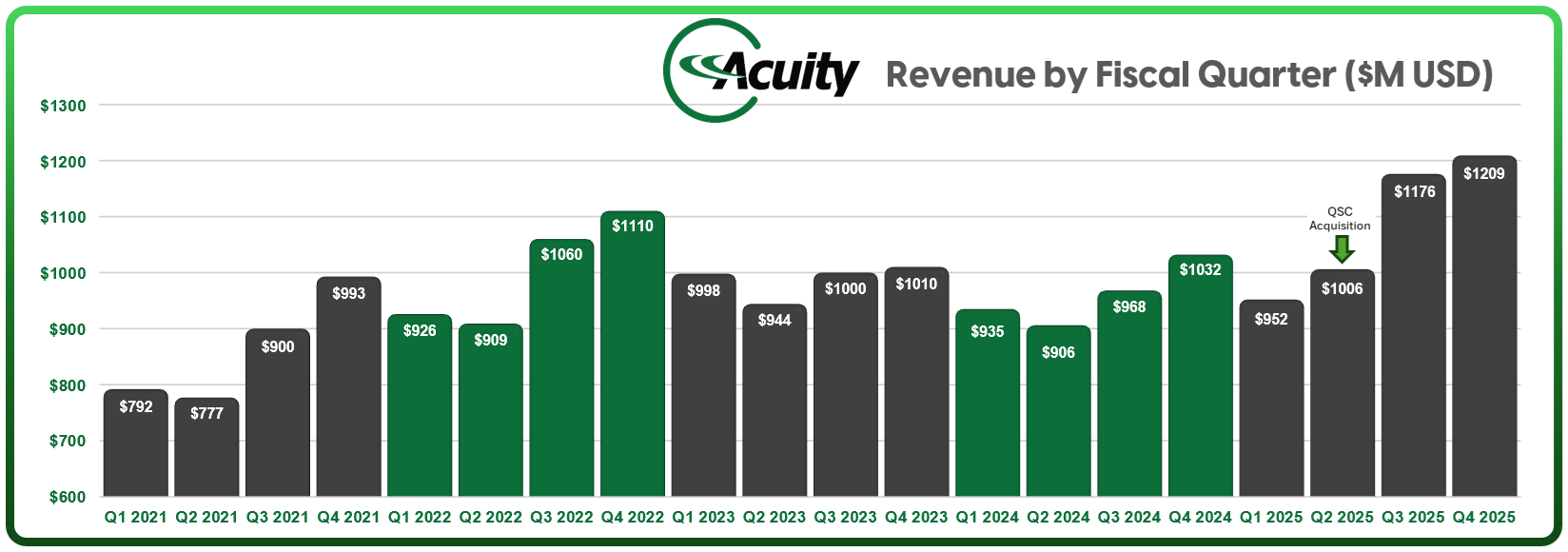

Acuity Brands’ 23.5% stock gain in 2025 understates how strong the company looked operationally. The stock hit all-time highs during the year, driven by record revenue, expanding margins, and disciplined execution. Acuity remains one of the few lighting companies consistently growing profitability even as demand softens.

Lighting revenue grew modestly, but margins improved for the fifth consecutive year. The company’s $1.2 billion acquisition of QSC accelerated growth in its Intelligent Spaces division, which expanded more than 160 percent year over year. As Inside Lighting reported in October, Acuity’s strategy is not about chasing growth, but extracting value.

With a strong balance sheet, minimal leverage, and clear strategic priorities, Acuity may not top the percentage-change chart, but many industry observers would argue it remains the strongest business on it. The company will report its next quarterly results in two days, offering another checkpoint in a story defined by consistent strength rather than volatility.

Signify: A Year Lost to Transition

Signify shares finished 2025 up just 5.5 percent, masking a year marked by instability. The company cycled through three CEOs, reduced global headcount by roughly 1,400 employees, and faced persistent weakness in its largest markets. U.S. professional lighting demand softened, public sector projects stalled, and European pricing pressure intensified.

Inside Lighting chronicled in October how revenues declined quarter after quarter, with 2025 shaping up as one of the weakest sales years since Signify spun off from Philips in 2016. Cost cuts helped stabilize margins, but they could not offset volume declines. Consumer lighting and niche segments offered pockets of resilience, but not enough to change the overall trajectory.

New CEO As Tempelman has outlined a strategic reset focused on connected lighting and specialty applications. For now, the stock reflects patience rather than confidence. Signify’s challenge is no longer vision — it is execution under pressure.

LSI Industries: Long-Term Momentum Meets a Choppy Year

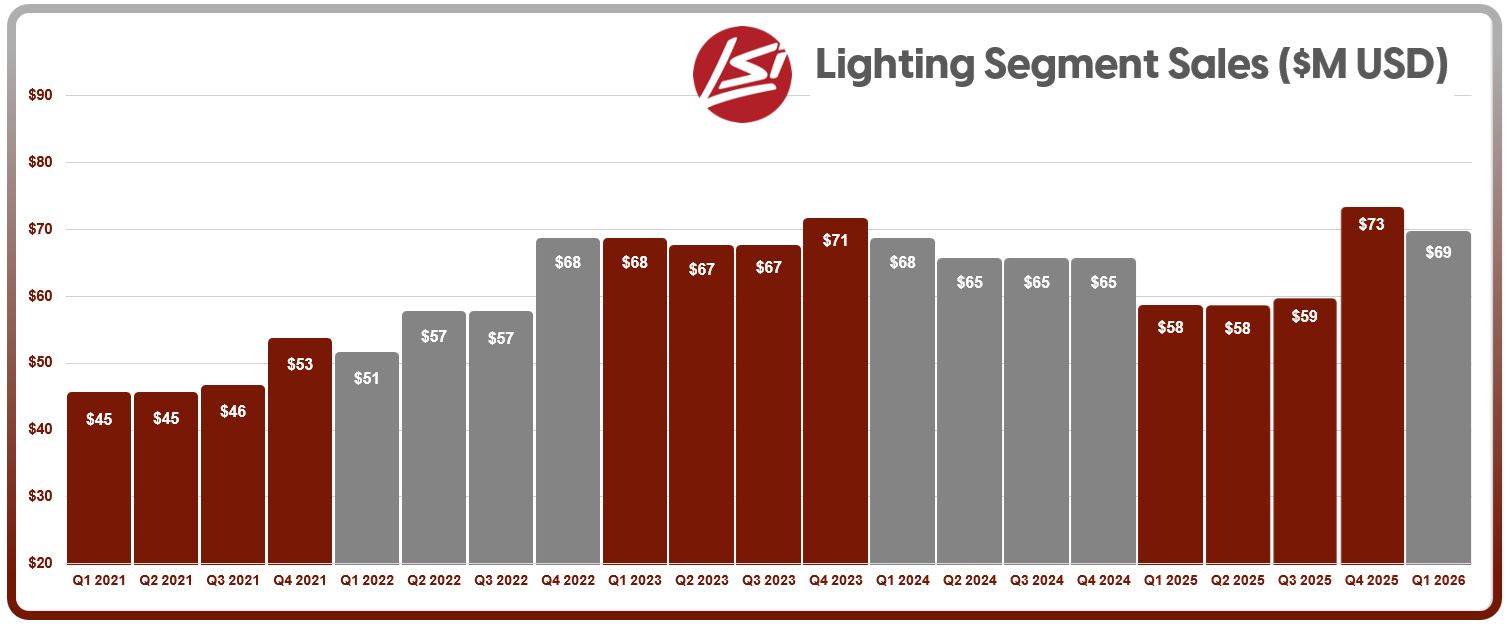

LSI Industries stock ended 2025 down roughly 5 percent, but that single-year figure obscures a much stronger longer-term story. The stock reached an all-time high earlier in 2025 and has delivered excellent performance over the past three years, currently over $18 compared to under $6 in 2022.

Operationally, 2025 was uneven. Lighting revenue declined for much of the year as projects were delayed, then rebounded strongly in the fourth quarter with a 12 percent year-over-year increase and a growing backlog. Meanwhile, LSI’s Display Solutions business continued to expand, now representing roughly 57 percent of total revenue.

As Inside Lighting highlighted in August, this diversification helped drive overall revenue growth and strong free cash flow despite lighting volatility. The stock’s year-end pullback appears more reflective of timing and market sentiment than business deterioration. LSI enters 2026 with momentum across both platforms and a strategy focused on execution rather than reinvention.

Zumtobel Group: Retrenchment Becomes Strategy

Zumtobel’s 27% stock decline in 2025 reflected a company shifting decisively into defensive mode. Demand weakened across Europe and Asia, margins compressed, and revenue declined. The response was structural: plant closures, workforce reductions, and a multi-year cost-cutting program targeting up to €50 million in savings.

For North American lighting people, the most symbolic move was the closure of Zumtobel’s only U.S. manufacturing facility, effectively ending domestic production. As Inside Lighting reported in December, this was an acknowledgment that the North American business had become structurally unprofitable. The Americas now account for only a small fraction of Zumtobel’s revenue.

Management has been candid about continued headwinds and limited near-term growth prospects. The stock’s decline mirrors that realism. Zumtobel is not positioning for expansion; it is positioning to endure. Whether that restraint becomes a foundation for future recovery remains an open question.

Markets move fast. Real performance moves deeper.

In lighting, what happens between two share prices can reveal much about leadership, strategy, and resilience. 2025 rewarded companies that stabilized, executed, or simply avoided disaster — while penalizing those stuck in transition. The scoreboard may favor percentage gainers, but in a sector where market confidence shapes real-world outcomes, operational clarity and financial discipline remain the true differentiators.

As 2026 begins, investors will keep watching the numbers. But lighting people know the deeper truths often live beyond the ticker.