June 24, 2025

After Tumultuous Years, Dialight Posts Signs of Stability

Net losses persist under legal cloud. Operational gains point to longer-term momentum.

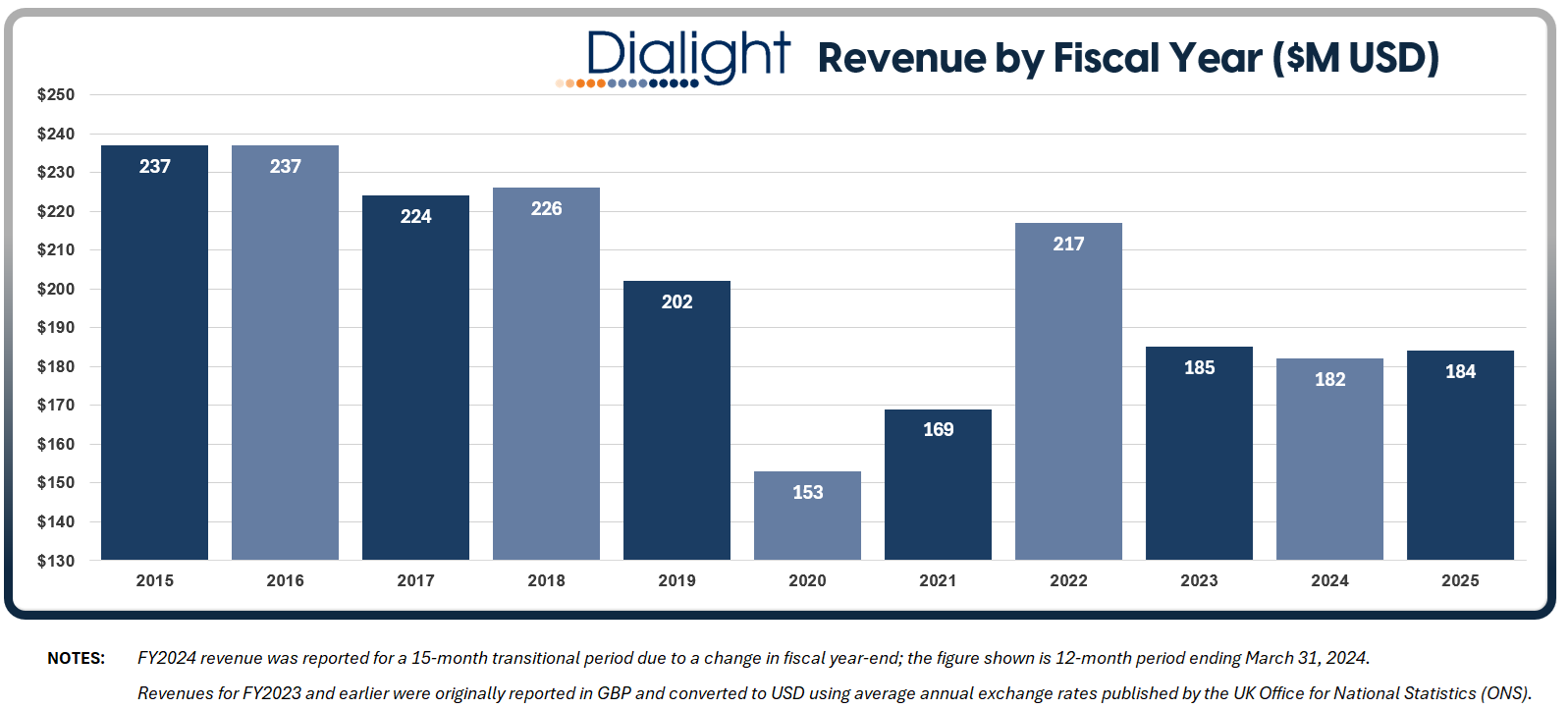

After years of upheaval, red ink, and shareholder jitters, Dialight — the industrial LED lighting company — may have found its footing again. The numbers from its March 2025 year-end results don’t scream victory, but they whisper something almost as important for the company: stability.

In a fiscal climate defined by geopolitical turbulence and legacy liabilities, the UK-headquartered but North America-reliant manufacturer has managed to claw its way back to underlying profitability. Group revenue ticked up slightly to $183.5 million, while underlying operating profit improved to $4.2 million, reversing a prior-year loss. Even more significantly, underlying gross margins increased from 30% to 35.6%, reflecting tighter cost control, a sharper product mix, and operational discipline.

But the statutory picture remains sobering. Dialight reported a net loss after tax of $13.6 million, with a statutory operating loss of $11.6 million. These headline losses are largely attributed to $21.6 million in non-underlying costs, primarily stemming from a long-running legal settlement with Sanmina, its former manufacturing partner.

Clearing the Decks: Lawsuit Resolved

The Sanmina saga, which has loomed over Dialight’s balance sheet for years, was formally settled this past March for $12 million. The first installment — $4 million — was paid immediately, with eight additional quarterly payments to follow. While the financial hit was substantial, the strategic value of closure may prove more meaningful.

With this legal overhang resolved, Dialight’s leadership insists the company can now focus fully on executing its multi-year Transformation Plan. That plan, which centers on cost discipline, SKU reduction, and organizational alignment, is beginning to show results in both financial metrics and employee morale.

“We have resolved a large number of historic issues and are now more focused on better positioning the Group for future progress,” CEO Steve Blair noted.

Leadership Turnover — and Signs of Financial Stability

Dialight’s return to underlying profitability follows a turbulent stretch of executive turnover, including the exit of three CFOs and a CEO within 14 months. The instability delayed financial reporting and raised doubts about strategic direction. But recent stability in the finance office has helped restore discipline.

By year-end, net bank debt stood at $17.8 million, and inventory levels continued to decline. The company also secured an extension of its $28.8 million revolving credit facility through July 2027—providing vital breathing room as it continues its operational rebuild.

North American Stability in an Uncertain World

Despite its UK roots, Dialight’s core commercial activity is tied to North America — where macroeconomic signals are mixed but lighting demand remains resilient. Fortunately, most of Dialight’s imports from its Ensenada, Mexico facility are exempt from U.S. tariffs under the USMCA agreement, insulating the company from some global supply shocks.

The group will also benefit in fiscal 2026 from a one-off $1.4 million COVID-19 Employee Retention Credit received from the U.S. Internal Revenue Service — a modest but timely tailwind.

As industrial buyers across the U.S. and Canada recalibrate their vendor relationships for reliability and value, Dialight’s tightening margins and reduced complexity could position it as a preferred partner, particularly for hazardous and high-performance environments.

Financial Foundation Before Growth Ambitions

Dialight isn’t popping champagne. There’s no dividend. The pension plan saw actuarial losses. The risk register remains thick with geopolitical and supply chain vulnerabilities. But the numbers this time offer something more concrete than vision — they show traction.

Whether this marks the start of a growth era or simply a breather between storms remains to be seen. But for now, an unprofitable lighting company has posted a clean, modest profit underneath its statutory losses, closed the books on a costly lawsuit, and brought its margins back into respectable territory. In today’s market, that’s not just a comeback — it’s a reset.