October 1, 2025

Acuity Sets New Heights After Record 2025 Results

Company posts all-time high revenue while core lighting growth stays relatively flat

Two weeks ago, Acuity’s stock closed at an all-time high. Today, despite broader market jitters tied to government shutdown headlines, Acuity is on its way to another record close. In early trading today, shares were up 8.2% to $372.60, following a stronger-than-expected earnings report.

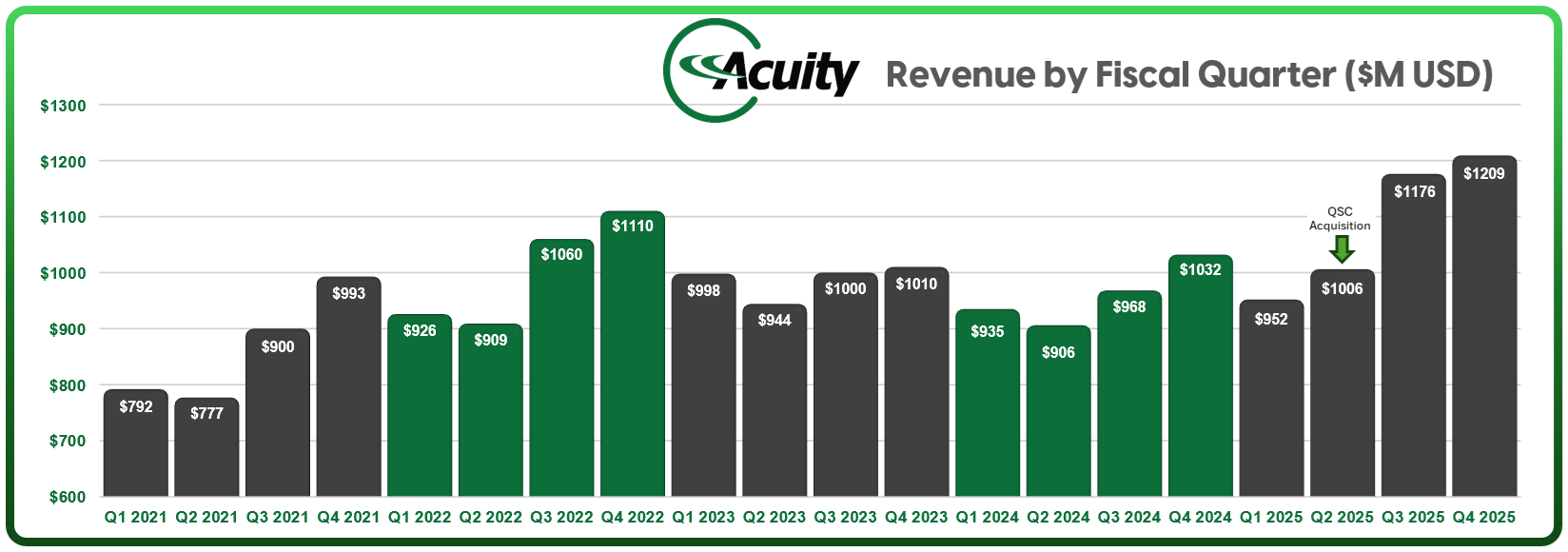

The company posted adjusted earnings per share of $5.20, comfortably ahead of the $4.84 analyst consensus. But if you're looking for a revenue beat, it wasn’t there. Fourth-quarter sales landed at $1.21 billion, just below Wall Street’s $1.23 billion estimate. Still, full-year revenue reached a record $4.3 billion, boosted in part by the midyear acquisition of QSC, a $535 million company in 2024.

And in Acuity’s core Lighting business? Growth was technically positive, but only just.

Still, company leadership is making a case that’s hard to argue with: in a stagnant market, even low single-digit growth is a signal of strength — and they’re probably right.

Lighting’s Low Ceiling Looks Better From the Top

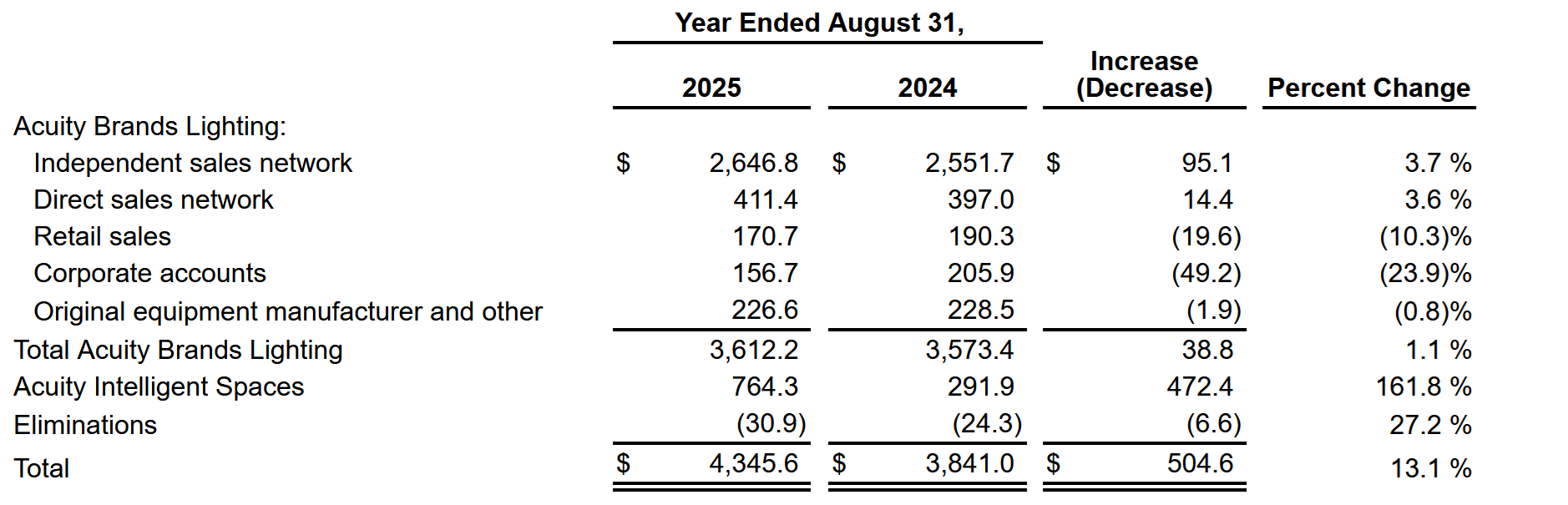

Acuity’s Lighting business delivered 1.1% full-year revenue growth. That's $3.6 billion in sales, up a modest $38.8 million from the prior year. For the fourth quarter, Lighting was essentially flat at +0.8%. But CEO Neil Ashe wasn’t apologizing.

“Our belief is that we’ve outperformed the industry,” Ashe said, more than once during the earnings call. He even agreed with an analyst who characterized the 2026 lighting market outlook as “flat to down.” When the bar is that low, a small jump can look like a leap.

Especially when it's coupled with margin gains.

Lighting’s adjusted operating margin rose to 18.3% for the year — up 80 basis points. That followed a year of deliberate restructuring, productivity pushes, and a tough-to-swallow round of layoffs that Ashe tried to frame delicately, ultimately stating the company “eliminated a chunk of employees” to reduce costs.

“We reevaluated the organizational structure… to accelerate some productivity efforts,” Ashe said. “I’m pleased with the work that the team has done there in this environment.”

Lighting Margins: Up and to the Right

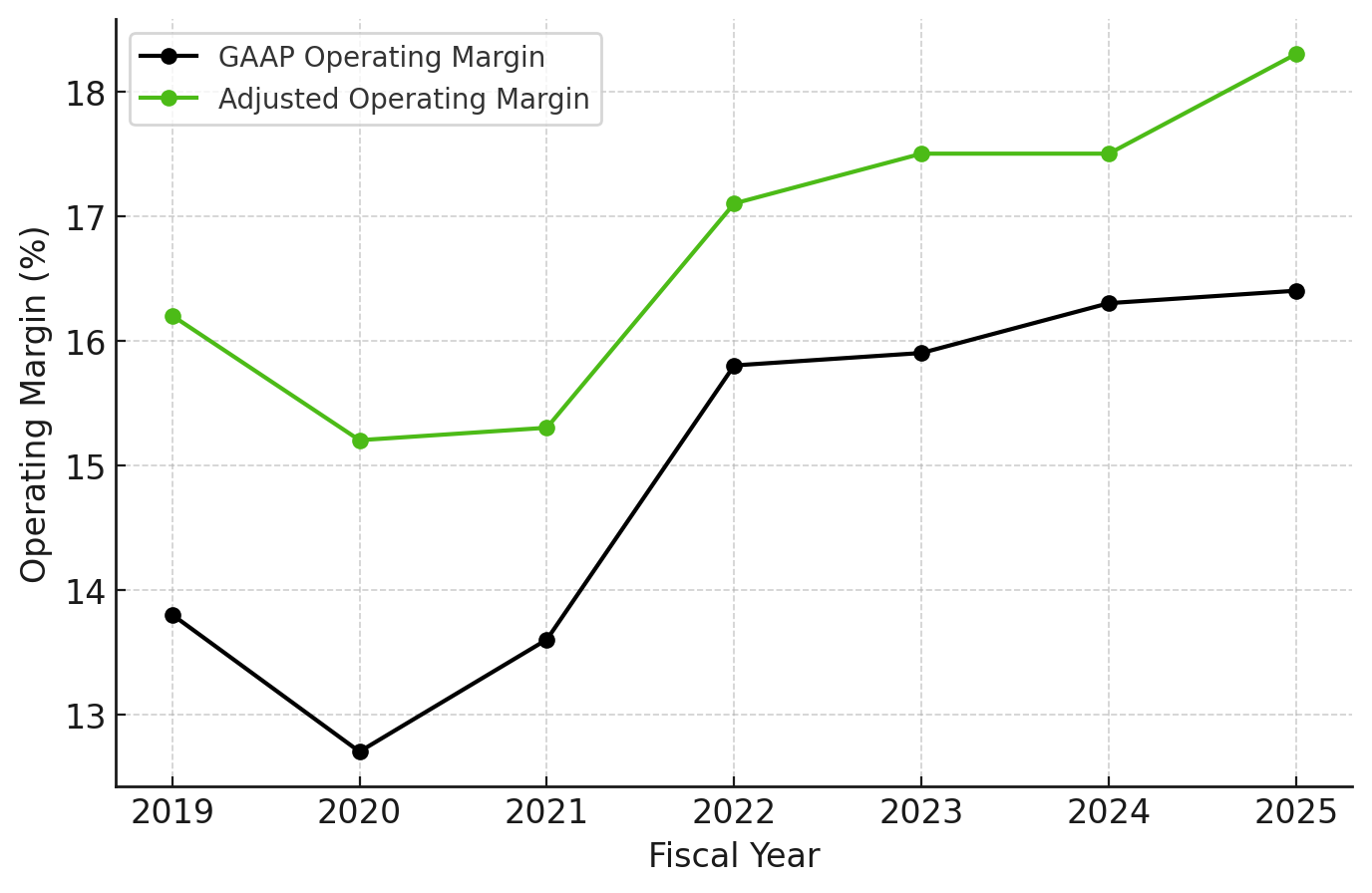

If there’s a single metric that captures what Acuity’s Lighting business has become under Neil Ashe’s leadership, it’s not just revenue. It’s margin.

“From where we've come from, from fiscal '19, fiscal '20, to where we are today is pretty dramatic,” Ashe said on the earnings call. And, unsurprisingly, he’s 100% right. We pulled the numbers.

Above: Margins for Acuity Brands (entire company) 2019 – 20 and Acuity Brands Lighting (ABL division) 2021 – 25

Since 2021, when Acuity formally split its operations into separate Lighting and Intelligent Spaces divisions, the Lighting segment has posted five consecutive years of margin improvement. Adjusted operating margin has climbed from 15.3% to 18.3%, with not a single backslide. That’s not the result of explosive revenue growth or flashy acquisitions. It’s structure. It’s discipline. It’s years of slow, methodical work: restructuring teams, reshaping product lines, moving away from high-tariff manufacturing zones, and managing price with the precision of a goniophotometer. The result? A lighting business that’s not growing fast — but getting relentlessly more profitable.

Lighting Channel Details and Market Realities

The company noted strength in its independent agent network, where project activity remains steady, even as other sectors within the Lighting business saw less traction. Though Acuity didn’t provide a full expense breakdown, they acknowledged the need to adjust expenses midyear when some sales “didn’t materialize the way that we had predicted.” Notably, Corporate Accounts were down 24%, a figure Ashe explained as reflecting the variable capital spending of a concentrated group of large customers.

Products and Portfolios: What Ashe Mentioned

The company highlighted performance from key portfolios:

- The Contractor Select portfolio did especially well in Q4.

- Specification lighting brands are “taking share,” per Ashe.

- In healthcare, Acuity launched the Care Collection and expanded the Nightingale line with products such as the Respond and Observe luminaires. A gratuitous SensorSwitch shout-out was slipped in, noting the fixtures are compatible with SensorSwitch controls.

- IES Progress Report inclusions were highlighted by Gotham Ivo Cylinders, Holophane’s Holobay, Lithonia’s REBL LED High Bay, and Hydrel Wander Pathway.

Intelligent Spaces: QSC Effect, India in Focus

Much of Acuity’s headline growth comes not from fixtures but from systems. The Intelligent Spaces business — home to Atrius, Distech Controls, and newly acquired QSC — grew more than 160% year-over-year – mostly due to the increased revenue attributed to QSC. Sales hit $764 million.

Ashe described Acuity's overall business as “a data, controls and luminaires business” — a telling order of operations that points to the growing importance of data monetization in Intelligent Spaces. He also emphasized the international expansion powered by QSC, especially in India, where Acuity recently expanded its Intelligent Spaces Experience Center. The site now includes product demos, design workshops, and serves as a development hub for collaborative use cases.

Notably absent from the earnings call: any mention of Acuity’s new digital center in Cork, Ireland, which just a month ago was billed as a potential future European headquarters. Perhaps the Ireland strategic plan is still stewing.

Cash, Exceptions, and Looking Ahead

Acuity closed the year with $601 million in operating cash flow, added $504 million in top-line growth, and boosted its dividend 13%. However, headline numbers are being complicated by one-time items: a $31 million non-cash charge from pension plan transfers, an expected future $10 million UK pension-related charge, and an $8 million tax benefit.

Looking ahead, CFO Karen Holcom forecast net sales of $4.7 to $4.9 billion for fiscal 2026, assuming that Lighting will generate “low single-digit sales growth,” consistent with current trends. Meanwhile, the company is seemingly keeping its powder dry on lighting-sector mergers and acquisitions.

“We continue to see a consistent pipeline of potential acquisitions that could expand the Intelligent Spaces portfolio,” Ashe said, carefully excluding Lighting from M&A talk.