August 21, 2025

LSI’s Fiscal Year Ends with a Lighting Rebound

Lighting gains complement a breakout year for LSI's display segment

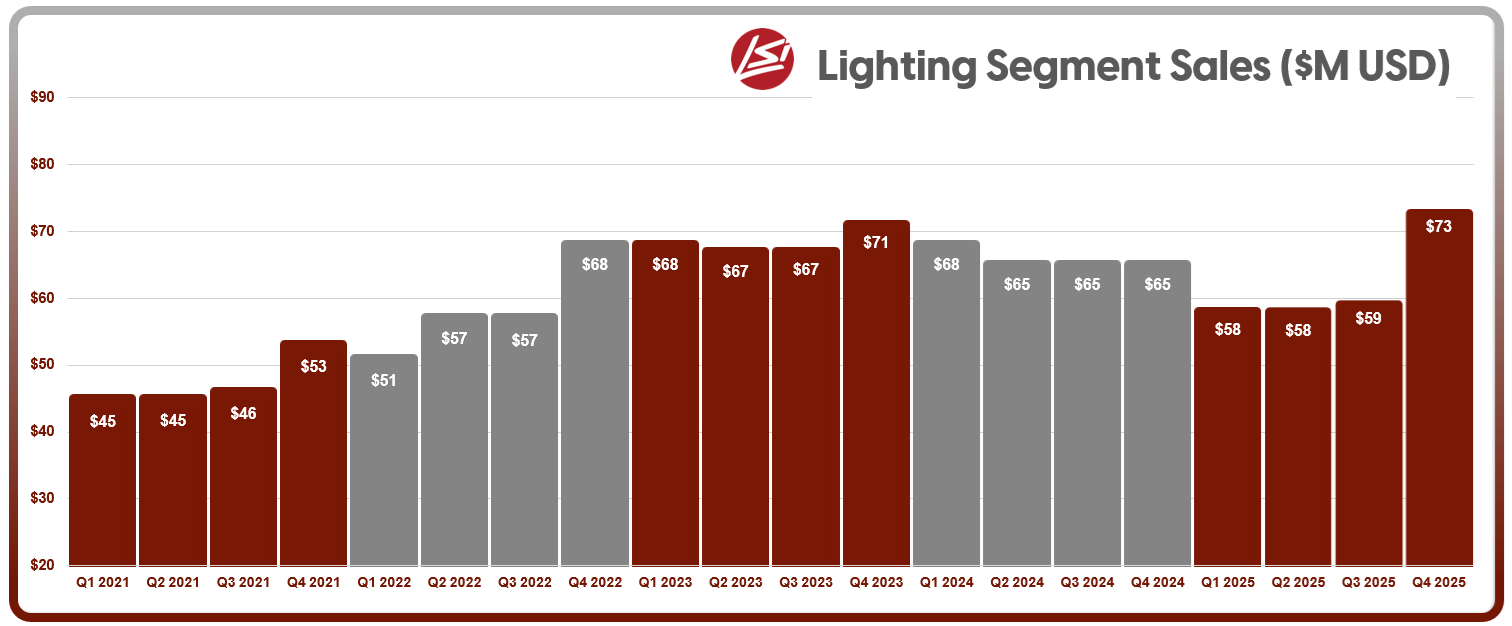

LSI Industries ended fiscal 2025 with its strongest quarter in two years for its lighting segment, posting $72.7 million in Q4 revenue, up 12% from the prior year. The rebound came after three straight quarters of muted performance, as delayed projects in key verticals began to release.

“The Lighting Segment generated sales growth of 12% in the fiscal fourth quarter, reflecting improved project order rates, particularly in larger projects, where market activity had slowed the last twelve months,” said President and CEO James A. Clark.

Margins improved as well, with adjusted operating income up 32% and operating margin rising 250 basis points compared to last year. Backlog for the segment ended the fiscal year 20% higher than in 2024, suggesting that the momentum could carry into early fiscal 2026.

Shortly after the market opened, LSI’s shares were trading up 6% at $20.52

A Year of Mixed Results

Despite the strong finish, lighting revenue for the full fiscal year slipped to $248.4 million, a 5% decline from fiscal 2024. Most of the softness came in the first nine months of the year, when many customers delayed decisions on large projects.

The fourth-quarter surge provides a more optimistic outlook for fiscal 2026. Combined with a growing backlog and steady quoting activity, the segment is positioned to regain some of the ground it lost earlier in the year.

Display Solutions Drives Growth

While lighting showed late-year improvement, LSI’s Display Solutions segment remained the primary growth driver. Display sales climbed 29% in Q4 to $82.3 million, and full-year sales soared 57% to $325 million.

Growth was fueled by strong demand in convenience-store and grocery verticals, as well as contributions from the Canada’s Best acquisition completed in March 2025. The shift highlights how much the company’s revenue mix has evolved: lighting now accounts for 43% of sales, down from roughly two-thirds five years ago, while display represents 57%.

Stronger Margins and Cash Flow

Across the company, profitability improved. Adjusted EBITDA reached $17 million in the fourth quarter, or 11% of sales, and $55 million for the full year. Free cash flow totaled $8.5 million in Q4 and $34.7 million for the year, while the company reduced its net debt-to-EBITDA ratio to 0.8x, maintaining balance-sheet flexibility.

LSI also declared a $0.05 quarterly dividend, continuing its annual rate of $0.20 per share.

Looking Ahead to Fiscal 2026

Management acknowledged that recently imposed tariffs will raise costs for certain lighting components in the first quarter of fiscal 2026. However, because the majority of the company’s components are sourced domestically, and pricing adjustments are already in place, the financial impact is expected to be limited.

Clark said the company’s “Fast Forward 2028” plan will guide its strategy moving forward, focusing on deeper vertical integration, cross-selling initiatives, and operational discipline. “Our balanced fourth-quarter performance across Lighting and Display Solutions reflects the sustained vitality of our key vertical markets and increasing customer recognition of our expanding suite of products and services,” he said.

For the lighting business, the priorities are clear: convert the expanding backlog into steady revenue and maintain the margin improvements seen in Q4. If those trends hold, fiscal 2026 could mark a return to consistent growth in LSI’s core segment, even as display continues to lead the company’s broader expansion.