November 17, 2025

Energy Focus Sales Drop Amid Mounting Pressure

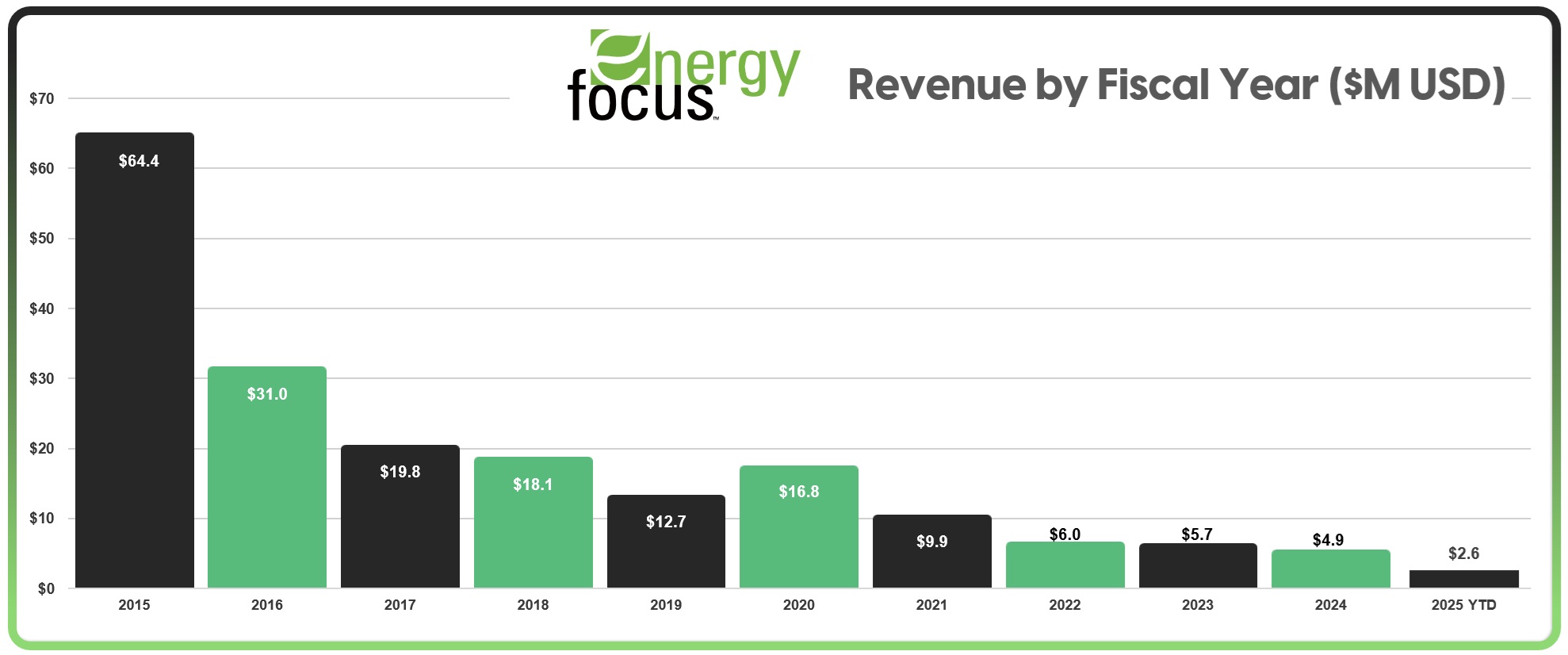

Once a $64 million brand, now battling for relevance and Nasdaq compliance

The latest quarterly filings from Energy Focus confirm what’s become an increasingly familiar pattern: deep cuts, fleeting wins, and a future staked on hope — and the personal checkbook of its CEO.

In last week's documents filed with the SEC, the Ohio-based LED manufacturer reported $826,000 in Q3 revenue, bringing year-to-date sales to $2.6 million — a 28% decline from the same period last year. Military sales, once the company's lifeline, have plummeted 46.5% year-over-year, while commercial revenue ticked up modestly thanks to a one-off Q2 data center project in Taiwan. The company remains unprofitable, despite cutting its quarterly net loss to $172,000 — a slimmer deficit than in past quarters but still part of a long-running losing streak.

Compared to the same quarter in 2024, total sales dropped by nearly a third. Commercial revenue was down 42.3%, and military sales fell 26.6% amid continued federal budget delays and inflation-related slowdowns. The company managed to improve its gross margin to 17.8%, up from 12.9% in Q2, by shaving expenses — not boosting sales.

Operating losses remained steady at $175,000. Adjusted EBITDA, the company’s preferred non-GAAP metric, improved slightly to a $100,000 loss, helped by a leaner cost structure and improved product mix. Still, the third quarter continued the broader 2025 theme: cost control in place of growth, and financial breathing room provided by a single shareholder — CEO and CFO Jay Huang.

Three Capital Infusions, One Investor

In 2025 alone, Huang has invested $900,000 of his personal funds into Energy Focus through private stock purchases in March, June, and August. Each transaction was priced above the company’s then-market value and approved by independent directors.

The most recent investment — $500,000 in August — isn’t fresh news, but remains the latest tangible vote of confidence in a company otherwise starved of outside investor interest. Huang now controls more than 2 million shares, a sizable chunk of a firm with fewer than 6 million outstanding.

This pattern of inside-only fundraising raises two possibilities: Either the company has a clear plan, and Huang is committed to funding it — or Energy Focus has become dependent on one man’s wallet to survive, with limited alternatives.

Also buried in the week’s filings: a Form S-8 registration to issue 200,000 new shares under the company’s amended stock incentive plan. For a firm with under $900,000 in cash and ongoing losses, expanding the equity pool reads more like a structural requirement than a strategic move. The dilution risk may be low, but it adds to the perception of a company that’s fighting to stand still.

Pivot, But From Where?

Energy Focus continues to frame its future around high-tech pivots: AI-powered uninterruptible power supplies, microgrid technologies, and energy storage systems. The company says it is targeting growth in the Gulf Cooperation Council and Central Asia. But no significant revenue from these initiatives has seemingly appeared on the books yet.

Meanwhile, the company’s Nasdaq compliance remains precarious. As of September 30, it technically meets the $2.5 million stockholders’ equity requirement — but just barely, with only $3.1 million in equity and $5.2 million in total assets. The 10-Q again warns of “substantial doubt” about Energy Focus’s ability to continue as a going concern.

For now, the story continues — but not because the business has found stable footing. It continues because Jay Huang hasn’t closed his checkbook.