November 6, 2025

Two in a Row: LSI's Lighting Momentum Continues

Behind the scenes moves reveal a company primed for more acquisitions

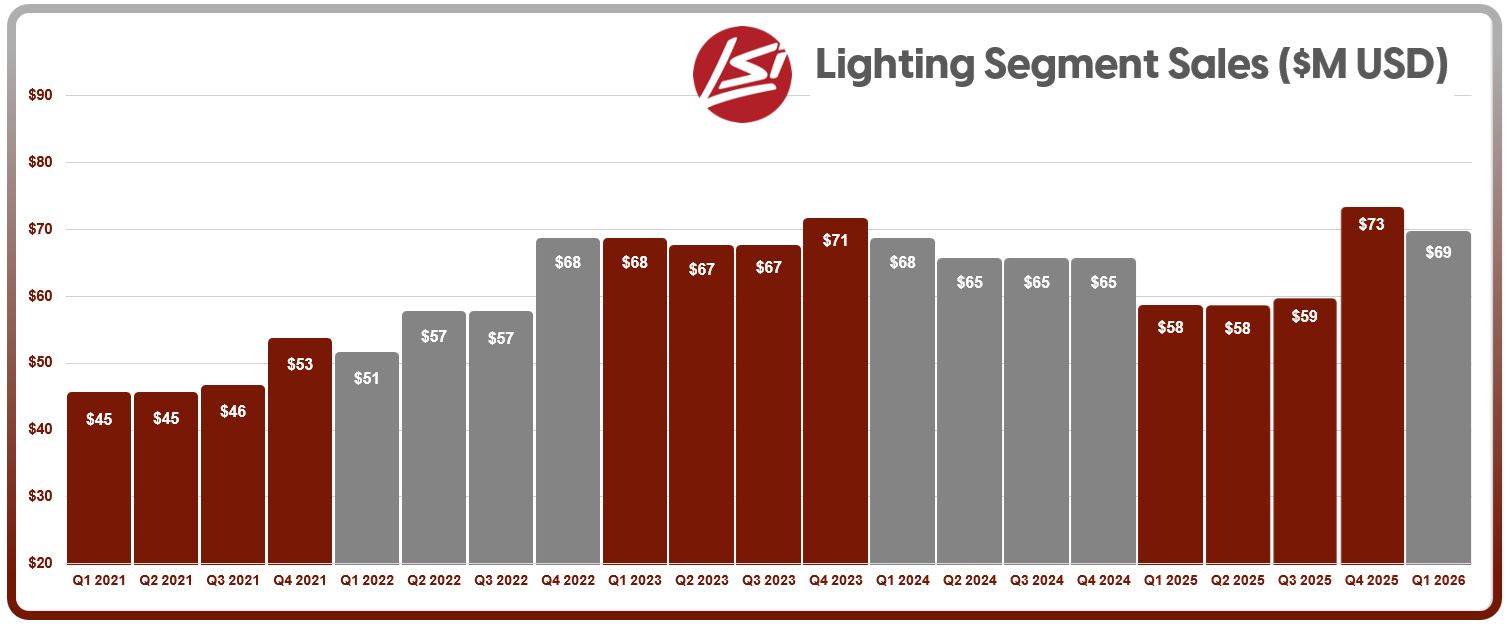

LSI Industries is proving that lightning can strike twice, or at least two quarters in a row. Coming off a breakout fiscal Q4 2025 that saw the lighting segment rebound sharply after months of muted activity, LSI kicked off fiscal 2026 with another strong showing. First quarter revenues climbed 14% year-over-year to $157.3 million, with lighting pulling in $69.1 million — an 18% increase over the prior-year period. That puts lighting at 44% of Q1 sales, with display solutions contributing the remaining 56% at $88.2 million.

While lighting didn’t eclipse the display segment, its performance suggests that August’s optimism wasn’t a one-off. Adjusted operating income for lighting soared 43%, and gross margin jumped 170 basis points. Tariff-inflated inventory was cleared out, pricing discipline held, and cost-cutting measures are now kicking in. “We continue to convert lighting accounts to LSI, displacing our competitors,” said CEO James Clark. “These share gains are the result of investments we’ve made in the features and functionality of our products.”

That might sound like standard CEO-speak — until you consider the numbers. Lighting has grown 18% in the past quarter alone, after trailing for much of 2024 and early 2025.

Display Still Dominates, But Lighting's Not Shrinking

It’s impossible to analyze LSI’s financials without acknowledging the gravitational pull of its display segment. Display solutions, now 56% of the company’s revenue mix, continue to benefit from acquisitions like JSI, EMI Industries, and most recently Canada’s Best Holdings. The latter deal closed in March and is already showing up in earnings, fueling 11% year-over-year display growth.

The broader strategy is clear: LSI wants to own more of the physical retail environment, from displays to lighting to signage. That convergence is paying off. National programs in convenience stores and grocery chains are expanding, with new display work feeding adjacent lighting opportunities. But don’t confuse strategic balance with surrender. Lighting still commands 44% of the business — and this quarter’s numbers prove it’s not going quietly.

Backlog, quoting activity, and project awards for lighting remain strong. Clark didn’t break out specifics on the lighting pipeline, but pointed to “project activity increasing across both our Lighting and Display Solutions businesses.” That’s consistent with the late-fiscal-year surge we reported in August and hints at sustained demand.

Liquidity Moves Signal Acquisition Readiness

While revenue and margin growth stole the spotlight, another subplot played out quietly behind the scenes: LSI expanded its credit revolver from $75 million to $125 million, terminated a $25 million term loan, and extended the maturity to 2031. Pricing stayed favorable (SOFR plus 100–225 bps), and LSI exited the quarter with $80 million in liquidity and net leverage of just 0.8x.

The strategic takeaway? This is not about plugging holes. It’s about greasing the wheels for speed.

By eliminating friction around cash-funded acquisitions — lenders no longer need to sign off each time — LSI has effectively put its M&A engine on standby. This follows the $200 million shelf registration filed in September, which gives the company the ability to raise capital quickly in public markets.

Put together, these moves don’t confirm a deal is imminent. But they do say something important: LSI doesn’t want to wait if the right asset becomes available.

What's Next?

LSI’s “Fast Forward 2028” plan is still the guiding star, and if Q1 is any indication, lighting is reasserting itself within that roadmap. Whether that means future acquisitions will skew toward lighting — to rebalance the company’s now-display-heavy portfolio — remains to be seen. But with growth returning and gross margins expanding, the lighting segment is no longer a passenger.

As Clark put it, “Our product development pipeline across both segments…remained at high levels entering fiscal 2026.” That suggests lighting isn’t just benefiting from backlog conversions — it’s evolving.

Inside Lighting will continue tracking whether those R&D investments, pricing strategies, and market share gains hold. For now, the takeaway is clear: LSI’s lighting business is growing, profitable, and increasingly central to a broader vertical-integration play. And the company is quietly arming itself for what may be its next act — one that could involve more than just organic growth.