December 16, 2025

Regional Rollups Reshape the Rep Game for Manufacturers

Guest author: Geoff Marlow

Local trust meets regional scale as independent lighting brands face tough rep decisions

For decades, the lighting and controls industry operated under a simple principle. Business is conducted locally. Success is achieved locally. Contracts are issued locally. The manufacturer representative model thrived on this foundation. Local relationships. Local accountability. Local trust.

Certain rules governed the channel. A rep who “bootlegged” product into another territory faced contract termination. Pricing stayed contained within assigned markets. Reps did not manufacture or carry products that competed with their principals across CSI Division 26. These were not arbitrary restrictions. They were the structural integrity of a channel. They enabled specifiers, distributors, contractors, and manufacturers to function with predictability.

Today, that structure is evolving. Consolidation patterns are reshaping who represents whom. Independent manufacturers must understand these shifts to make smart representation decisions market by market. It is not optional. It is essential.

Understanding the Regional Rollup Reality

The term “super-regional agency” barely existed a decade ago.

Today, agencies spanning five to fifteen markets and touching multiple coasts are changing the board. We saw this trend accelerate dramatically in 2024 and 2025 with multiple mergers announced or in play.

The drivers are familiar. We see rising costs, technology thresholds, and growing operational complexity. We also see manufacturer business models that are increasingly incompatible with maintaining fully independent territories (often due to economic constraints rather than intentional planning). Add to this a desire for “dirt.” This is one of my least favorite phrases in the industry because it reveals the truth. The primary currency is territory, not customer delight. When the goal is to acquire land rights rather than to earn market position, the logic of consolidation serves the consolidator. It does not necessarily serve the channel.

This is not a critique of consolidation itself. Some regional rollups operate with excellence. They bring scale advantages, investment capacity, and professional management, benefiting manufacturers and customers. The challenge for independent manufacturers is discernment. You must understand which forces are at play in any given relationship and structure your agreements accordingly.

Three Foundational Principles (And Why They Matter Now)

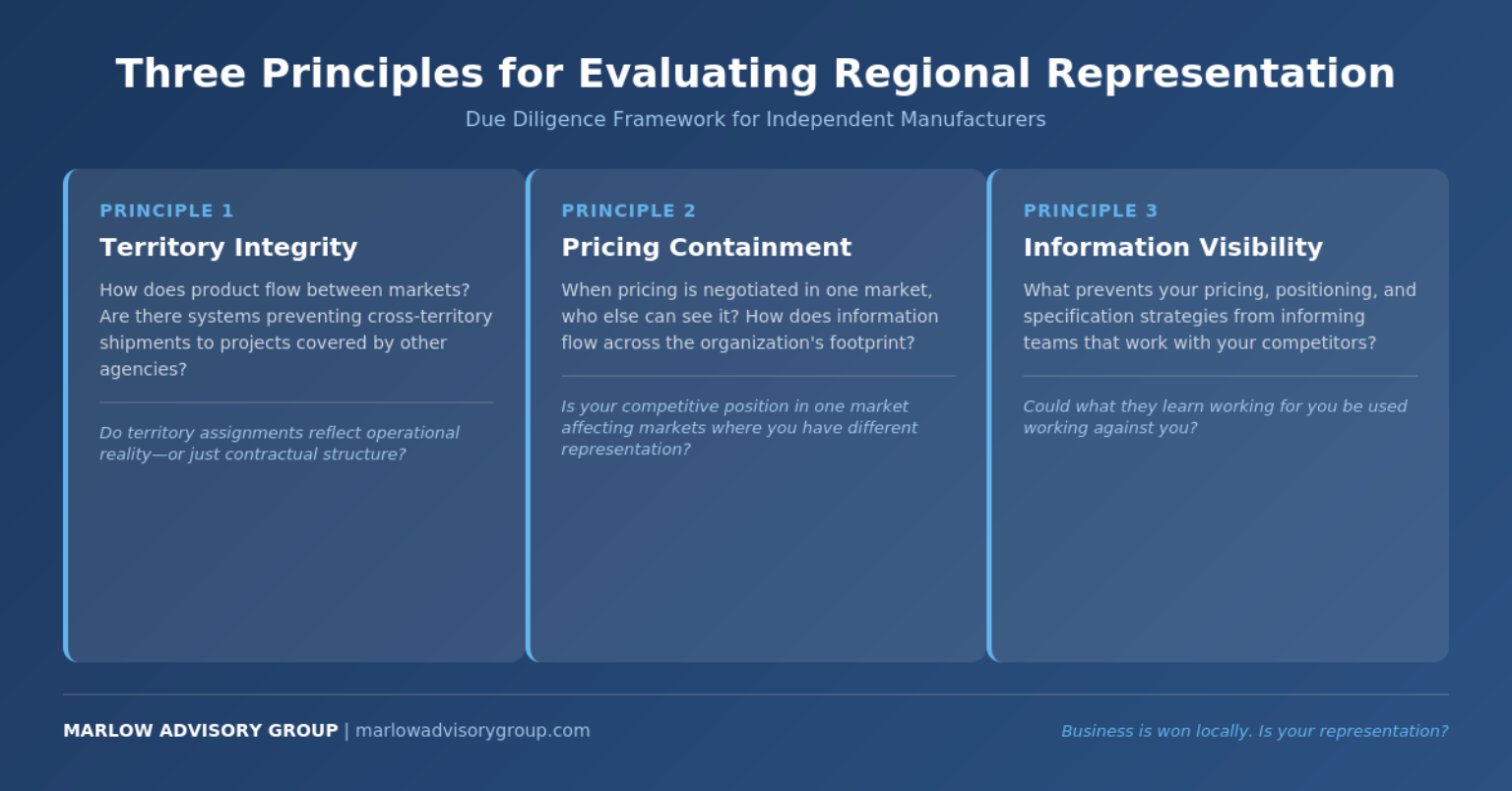

The traditional channel operated on principles that aligned the manufacturer’s and the rep’s interests. As the environment changes, you need to understand how these principles translate into consolidated structures. This helps you ask better questions and build better partnerships.

1. Territory Integrity and Cross-Market Shipments

In the traditional model, bootlegging was grounds for immediate dismissal. Shipping a product represented in one territory to projects where another rep held the contract was a fundamental breach of contractual trust.

Early in my career, a foolishly boastful representative said to me, “I sell more of XYZ’s product in this market than the rep for XYZ.” I asked how that was possible. Bootlegging was the answer. That was once shadow talk or bragging after one too many cocktails. Today, it is institutionalized in some organizations. There are profit centers within regional rollups established specifically to advance cross-market fulfillment.

When an agency spans multiple markets, the incentive structure can shift. A project specified in one territory can be serviced from another. Orders flow through whichever office offers operational convenience. The boundaries that once protected local representation (and the local investment that earned it) may blur into internal logistics decisions made without manufacturer visibility.

The takeaway for independent manufacturers: Territory assignments that exist on paper may not reflect how business actually flows through a rollup’s internal channels. You must understand the operational reality, not just the contractual structure.

2. Pricing Containment and Information Flow

Pricing discipline was never merely about competitive protection. It was about market development. A rep who invested in cultivating a local market expected the pricing advantages earned through that effort to remain within their territory.

Regional rollups can disrupt this equation. When a single entity operates across multiple territories, pricing information may flow freely across internal systems. Project pricing negotiated in one market becomes visible to teams in other markets.

For an independent manufacturer, this creates risk. Pricing becomes exposed everywhere the rollup operates, regardless of whether you contracted for representation in those markets. Project pricing, special bid structures, and volume negotiations all become data points within a network you did not authorize to receive them.

The takeaway for independent manufacturers: When you negotiate pricing in one market, consider whether it will be visible across the rollup’s entire footprint. Your competitive position in markets where you have different representation may be affected.

3. Linecard Composition and Information Visibility

The traditional norm of limiting non-strategic competitive lines across CSI Division 26 categories existed for a reason. Divided loyalty dilutes focus. A representative’s ability to champion a product is likely diluted when multiple functionally equivalent competitive lines are carried. In those situations, Enterprise Risk reminds manufacturers that they cannot be everything to everybody all the time and cautions representatives against drifting from strategy into collection. Quality and Delivery test whether perceived differences are real or merely assumed, with execution often revealing the truth. Cost and price demand particular discipline, as short-term advantages can create misleading perceptions of equivalence. Innovation ultimately separates lines by whether they move markets and customers forward in meaningful ways. When products appear equal, clarity—not coverage—creates conviction.

The issue is not that different markets have different linecards. That has always been true. The issue is visibility. When a rollup represents you in one market, they likely have complete access to your pricing, your positioning, your specification strategies, and your competitive advantages. In another market where they represent your competitor, that intelligence does not disappear. They can use what they learned working for you to compete against you.

Consider the deeper conflict when reps cross into manufacturing. They represent your product. They absorb your brand’s value proposition. They see the engineering decisions and the specification advantages you built over years. Despite contract language around intellectual property protection, they carry that knowledge directly to their own manufacturing operation.

The takeaway for independent manufacturers: Your competitive position may be visible to people within the same organization who also work with your competitors. You must understand how information flows and what controls exist to structure appropriate protections.

A Strategic Observation: When Manufacturers Sponsor Consolidation

Some of the industry’s largest manufacturers actively sponsor and encourage regional rollup formation. The logic is understandable. They have fewer agency relationships to manage, streamlined communication, and consolidated points of contact.

However, this approach warrants careful examination against a fundamental truth. Wins are governed locally, and demand is created at the customer level.

When manufacturers optimize their channel strategy around representative convenience rather than customer demand, they may inadvertently distance themselves from the dynamics that drive specification and purchase decisions. There is a strong argument that scale at the representative level does not automatically translate to strength at the customer level. If anything, the relationship can be inverse. The larger and more dispersed the agency, the harder it becomes to maintain the local intimacy that drives specification loyalty.

Independent manufacturers watching larger competitors embrace consolidation should recognize an opportunity. Remaining close to local markets and local customers may prove to be a durable competitive advantage rather than a limitation.

Due Diligence Questions Before Assigning Representation

These are not interrogation points. They are the foundation for transparent partnership conversations.

Territory Protection and Cross-Market Operations

- What systems and policies govern how products represented in one territory flow to projects in territories covered by other agencies?

- How do you track and report cross-territory shipments, and can this data be shared with us?

- Would you consider contractual commitments to treat assigned territories as operationally independent (with auditable controls)?

Pricing Visibility and Control

- What systems govern pricing data within your organization? Who has access to project-specific pricing across territories?

- Can you demonstrate that pricing negotiated in one market remains isolated from visibility in markets where we have different representation?

- Would you accept contractual limitations on pricing data sharing across territories where we have different representation?

Linecard Composition and Competitive Dynamics

- Can you provide a complete list of all manufacturers you represent across your entire footprint (organized by product category and CSI division)?

- Do you own, operate, or hold equity in any manufacturing operations? If so, what products do those facilities produce?

- What prevents information about our products and pricing from being shared with teams representing competing manufacturers or used in your own product development?

- If a merger brings competitive lines into your portfolio in the future, what notice and exit provisions would apply to our agreement?

Value Engineering and Specification Integrity

- What is your organizational philosophy on value engineering specifications for products you represent?

- How do you handle situations where a specifier requests your assistance defending a specification against value engineering attempts?

- Would you commit to specification protection policies and make them auditable?

Governance and Accountability

- How do you measure and report performance at the local market level versus aggregate regional performance?

- If performance falls short in one territory, can we address that specific territory without unwinding the entire relationship?

- How do you ensure that the individuals who originally committed to representing our line remain engaged rather than being rotated to other priorities?

Responses That Warrant Further Discussion

Reluctance to provide complete linecard transparency. Understanding the full picture helps both parties structure an appropriate relationship.

Emphasis on legal separation between units. Legal separation and operational separation are different things. Systems, data, and people often flow across corporate structures within rollups regardless of legal entities.

Insistence on all-or-nothing territory structures. Understanding why flexibility is not possible helps clarify whether the relationship serves both parties’ interests.

Focus on scale benefits without addressing conflict management. Scale is valuable. So is understanding how potential conflicts will be managed. Both conversations matter.

Contractual Protections Worth Considering

Transparency conversations should translate into contractual clarity. Depending on your situation, consider discussing these protections:

- Audit rights. The ability to review cross-territory shipment data, pricing visibility controls, and competitive line exposure on reasonable notice.

- Territory-specific performance metrics. Clear benchmarks for each market are reported independently rather than only in aggregate.

- Competitive line notification requirements. Notice periods before the rollup add any manufacturer whose products compete with yours in any territory.

- Territory-by-territory flexibility. The ability to address underperforming markets without unwinding entire regional relationships.

- Specification protection commitments. Expectations around defending specifications against value engineering (including from other principals on their linecard).

The Continuing Value of Independent Agencies

Nothing in this analysis suggests regional rollups are inherently problematic. Many operate with integrity, clear boundaries, and professional discipline. At the same time, the case for working with truly independent agencies remains compelling. These local operations offer clear accountability, focused loyalty, and structural alignment with manufacturer interests.

- Single-principal focus in the category. When an independent agency represents your architectural fixtures, they do not also represent your competitor’s architectural fixtures somewhere else in their organization.

- Clear accountability chains. The owner you negotiate with is the owner who delivers. There is no organizational distance between commitment and execution.

- Natural pricing containment. A single-territory agency has neither the systems nor the incentive to share its pricing across markets it has not authorized.

- Local relationship depth. Independent agencies often maintain deeper relationships with local specifiers, contractors, and distributors than regional operations can sustain across broad geographies.

The Path Forward: Informed Partnership

The lighting industry’s channel structure is evolving. Regional consolidation will continue. The economic pressures driving rollups are not temporary. They are structural.

Independent manufacturers do not need to resist these changes, but they must understand them. The goal is not to avoid regional rollups. The goal is to engage them (when appropriate) with clear eyes and appropriate protections.

Business remains local. Success remains local. Trust remains local.

The question is not whether regional rollups can represent your line effectively. The question is whether the structure of the relationship ensures accountability when it matters most. Both parties must be clear about expectations from the beginning.

Multi-market representation is not a shortcut. It only works when a manufacturer has a clearly defined and executable path to the customer. That path must be local, differentiated, and intentional.

Ask good questions. Have honest conversations. Build clarity into your agreements.

The best partnerships start with transparency.

Geoffrey Marlow

Geoff Marlow brings over 30 years of unparalleled experience and achievement to the industry, solidifying his reputation as a principled leader and innovative strategist. He has held senior-most executive roles across mid-sized specialty manufacturers, multi-billion-dollar manufacturing enterprises, and as an entrepreneurial start-up manufacturer's representative within a top 10 construction market. Most notably, Geoff led his start-up representative agency to unprecedented success, growing it into the largest agency in its market within just five years.