December 22, 2025

Halco Acquires Topaz Lighting from Southwire

Topaz’s permanent fixtures shift to Halco after Southwire’s 4-year detour

Southwire, the cable and wire behemoth with a reported $8.4 billion in annual revenue, is offloading a notable piece of its product diversification experiment. Just four years after acquiring Topaz Lighting, Southwire has struck a deal to sell the brand’s Permanent Lighting portfolio to Halco Lighting Technologies, a Norcross, Georgia-based company with a half-century legacy in the lighting sector.

The companies are neighbors by industrial standards — separated by only 70 miles of Georgia highway — but the implications of the deal stretch across North America’s electrical distribution network. Halco has confirmed the acquisition publicly, though its press release refers to the transaction as a future event with no effective date, while Southwire's customer letter states December 18, 2025, as the official handoff.

A Split, Not a Full Exit

Southwire is not completely divorcing the Topaz it bought in 2021. The cable giant is retaining portions of the business—specifically components and temporary lighting—which will remain under Southwire's Electrical Components and Engineered Solutions umbrella. In a letter to customers, Southwire emphasized its ongoing commitment to adjacent categories, drawing a clear boundary around this divestiture: only permanent lighting is leaving the portfolio.

For Halco, the acquisition is a consolidation play. The company has already slimmed its focus by spinning off its specialty pool and landscape lighting business in 2022. Now it adds Topaz’s permanent lighting products—known for competitive pricing and broad distributor reach—back into its fold, expanding its catalog with a line that’s familiar to contractors and reps alike.

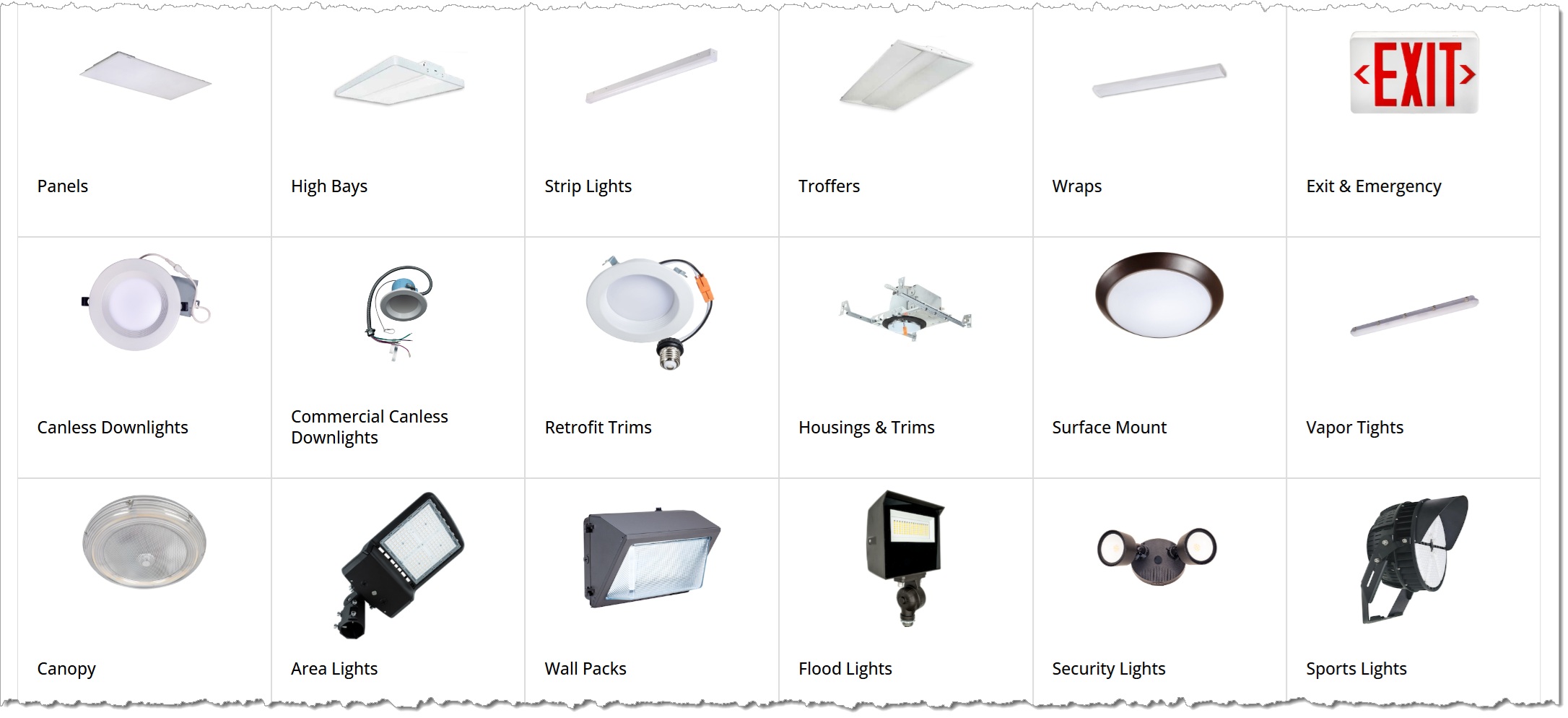

The Topaz portfolio includes commercial mainstays like troffers, high bays, and wall packs, as well as exit and emergency lighting, retrofit trims, and vapor tights — all staples in the commercial and light industrial sectors. On the lamps side, Topaz rounds out its offering with general-purpose LEDs and HID replacements. These are workhorse products, not architectural showstoppers — and that practicality lines up neatly with Halco’s market DNA.

Brand and Rep Strategy: TBA

While the asset sale is public, the go-to-market details are still opaque. Will the Topaz name survive under Halco ownership? Will Halco eventually fold the product line under its own brand? And will rep networks be merged or remain parallel during the transition?

Inside Lighting posed these questions to Halco, and did not receive an immediate answer before press time. We will update this article if we gain more clarity.

Given Halco and Topaz’s overlapping use of electrical distributor reps across North America, it's likely that rep consolidation will occur — eventually. Whether that process begins market-by-market or in a sweeping shift remains to be seen.

Two Very Different Sellers

Southwire’s decision to exit permanent lighting could reflect a recalibration of its broader diversification strategy. Since acquiring Topaz in 2021, Southwire’s lighting footprint has never seemed central to its strategy. For a company primarily known for supplying the arteries of the electrical grid — cable and wire — the relatively modest lighting segment may have simply been a mismatch.

Halco, on the other hand, appears more methodical in aligning its core. The company’s earlier exit from the pool lighting segment signaled an intent to refocus on the broader commercial, residential, and industrial lighting markets. Acquiring Topaz’s permanent lighting products fits squarely within that aim.

For now, distributors and reps are left reading between the lines — waiting to learn how this handoff will affect their shelves, territories, and long-standing relationships.