November 5, 2025

Orion Shows Discipline, But Growth Flatlines

Improved margins offset by stagnant revenue and EV charging headwinds

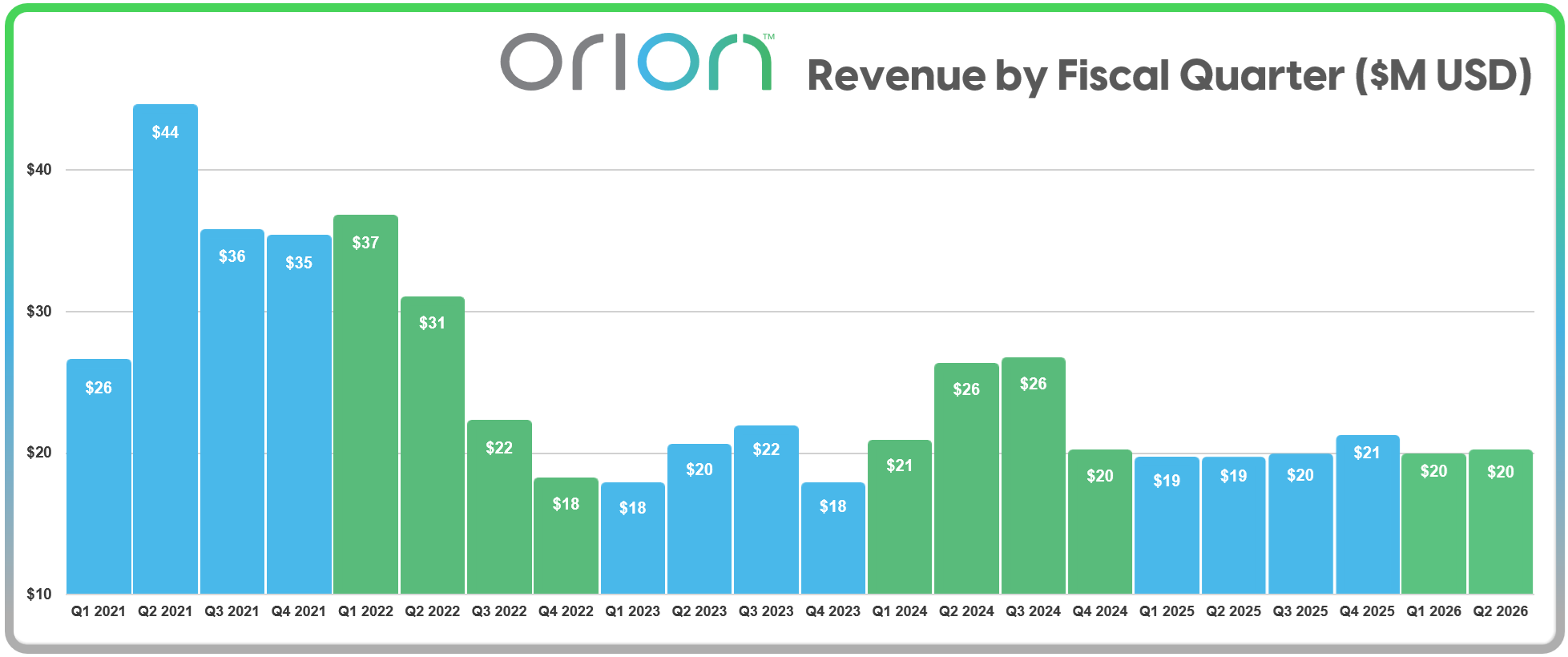

For all the forward-looking optimism, Orion’s top line tells a flatter story. The company has now reported revenue between $19 million and $21 million for seven straight quarters — a pattern that suggests consistency, but also highlights how elusive meaningful growth has been.

In its fiscal second quarter ending September 30, Orion posted modest revenue gains and tightened costs —giving the company something it hasn’t had in a while: breathing room.

The Manitowoc, Wisconsin-based provider of lighting and energy solutions reported a net loss of $571,000 for the quarter, a sharp improvement over the $3.6 million loss posted a year earlier. Adjusted EBITDA came in positive for the fourth straight quarter — a streak Orion hasn’t seen since before the Voltrek acquisition in 2022. Gross margin jumped to 31%, up from 23.1% last year, thanks to a favorable mix and disciplined cost execution across its three operating segments: LED lighting, EV charging, and maintenance services.

Yet beneath the surface, Orion’s familiar balancing act continues. Revenue of $19.9 million was up just 3% year over year and essentially flat compared to the prior quarter. And while gross margins improved, the company’s LED lighting segment — still its core business by dollars — remained stagnant.

Segment Realities: A Flat Core, A Fragile Bet

Orion’s LED lighting business delivered $10.7 million in revenue, roughly unchanged from a year ago, as stronger turnkey and distribution activity was offset by a decline in ESCO sales. Maintenance services rose to $4.5 million, a welcome jump driven by new customer wins and expansions of existing contracts — despite the company having previously allowed some unprofitable deals to expire. EV charging revenue held at $4.8 million, steady but uninspired, as the segment faces headwinds around federal funding, project pacing, and customer readiness.

CEO Sally Washlow, now through her first full quarter in the top job, painted a cautiously optimistic picture in her public remarks. She pointed to $11 million in new business from a U.S. government agency, $8.5 million in EV infrastructure work in Massachusetts, and $7 million in lighting projects from North American auto customers. But as with many Orion announcements, these wins are structured as multi-phase, multi-quarter revenue events — often long on backlog and short on near-term impact.

Cost Discipline and Capital Questions

If there’s a bright spot for Orion, it’s increased discipline. Operating expenses fell to $6.4 million, down from $7.7 million last year. Cash from operations turned positive for the first six months of FY26 — $1.3 million versus a $2.5 million use in the year-ago period — and the company reduced its revolver balance by $1.25 million.

Still, liquidity remains tight. Orion ended the quarter with $5.2 million in cash and $5.75 million in outstanding credit facility borrowings. The Voltrek earnout, which has already led to $1 million in share dilution and a new subordinated debt facility, remains in arbitration — a cloud not fully priced into the balance sheet.

Meanwhile, Orion’s 1-for-10 reverse stock split in August helped the company stay Nasdaq-compliant. Company shares are now trading in the $9 range, well above the $1 threshold required by Nasdaq.

The Turnaround That Hasn’t Yet Turned

Orion’s FY26 guidance remains unchanged: 5% revenue growth and a shot at breakeven adjusted EBITDA. That’s not nothing. But for a company still dependent on its largest customer — The Home Depot — for stability, and facing stiff competition across all segments, the question remains whether this is a pivot point or just another pause in the slide.

The LED lighting market has largely matured, leaving little room for sudden growth. The EV charging space is crowded and policy-sensitive. Maintenance services offer recurring revenue, but lack the margins to transform Orion’s fortunes alone.

Washlow’s leadership appears to be stabilizing the ship. But as we’ve reported before, stability isn’t strategy. Orion needs a breakthrough — not just smaller losses.

Until then, it remains what it’s been for several years: a company on the edge of recovery, with just enough progress to stay afloat, but still no clear engine to drive it forward.