October 23, 2025

Orion Re-Ups With Home Depot, Remains Major Revenue Driver

Renewal secures a vital revenue stream as Orion struggles to grow beyond its largest customer

For Orion Energy Systems, this isn’t just a contract, it’s a lifeline wrapped in a corporate press release.

The Wisconsin-based lighting and energy services provider announced a three-year, $42 to $45 million contract renewal with an unnamed retailer. It wasn’t a minor update tucked into an earnings call. It was a headline — the kind Orion wants investors to see, remember, and build expectations around.

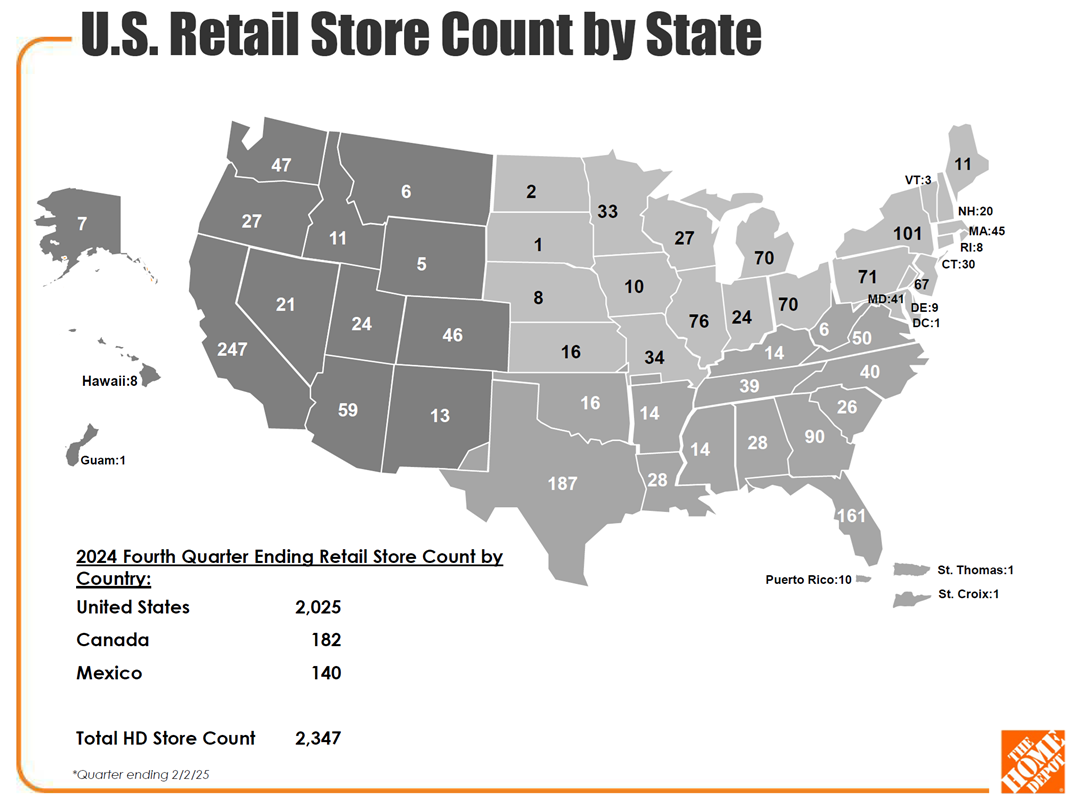

Orion’s press release dances around the name, describing the client as a “Fortune 100 enterprise” and “one of the most respected retailers in the world.” But industry insiders and public filings point clearly to The Home Depot, whose U.S. footprint includes approximately 2,025 stores — a close match to the contract’s 2,050-location figure. That would also align with Orion’s long-documented relationship with the home improvement giant, which has historically oscillated between being a partner and a crutch.

Despite years of messaging around customer diversification and expansion into electric vehicle charging and federal projects, Orion’s top-line performance continues to move in lockstep with its largest customer. Without Home Depot, the company is essentially a ~$64 million operation with much thinner margins and far less predictability. The press release boasts operational success across “all 50 states,” but the real story is buried in what it doesn’t say: this renewal is critical.

Annual Revenue by Customer Type (in millions)

| FY | Total Rev | % Largest Cust | Largest Cust Rev | Other Cust Rev |

|---|---|---|---|---|

| 2022 | $124.4 M | 49.1% | $61.1 M | $63.3 M |

| 2023 | $77.4 M | 16.2% | $12.5 M | $64.9 M |

| 2024 | $90.6 M | 25.2% | $22.8 M | $67.8 M |

| 2025 | $79.7 M | 24.3% | $19.4 M | $60.3 M |

In FY2022, The Home Depot accounted for nearly half of Orion’s revenue — driven by large-scale lighting retrofit and maintenence projects. As those wrapped, the relationship focused more on maintenance, and revenues dipped. Since then, the contract has transformed into a stabilizing, service-driven agreement, with the customer contributing roughly a quarter of total revenue in the past two years.

It’s a reminder of Orion’s hard-earned lesson: scale with caution. The company has experienced both the high of customer concentration and the low of its aftermath. The difference now is the nature of the work — this isn’t short-term, high-dollar retrofitting. It’s scheduled, preventative maintenance. That distinction means less volatility and more predictability, even if it doesn’t quite deliver headline-grabbing spikes in revenue.

Still, the renewal matters — perhaps more than Orion wants to admit outright. The company ended fiscal 2024 with a long-awaited return to profitability, posting $1.6 million in net income in Q4. But the broader financial picture remains fragile. Orion’s business without this customer consistently amounts to around $64 million in annual revenue.

For now, Orion has what it needs: time. This contract runs through early 2029, offering a multi-year buffer to continue building its EV charging division, bolstering its federal project portfolio, and shoring up gross margins. But the clock is already ticking.

Even when unnamed, some customers define the conversation. Orion’s latest announcement isn’t just another contract — it’s a declaration of how much still depends on one.