October 22, 2025

Delviro Declares Bankruptcy With $2 Left in Assets

Lighting agents, distributors, and OEM suppliers face long odds of recovery

It is now official. After months of opaque moves, vanishing inventory, and spiraling liabilities, Delviro Energy — once a competitive Canadian lighting manufacturer with an agent footprint across North America — entered full bankruptcy proceedings. The filing marked a formal acknowledgment of what customers and other stakeholders had long suspected: the lights aren’t coming back on.

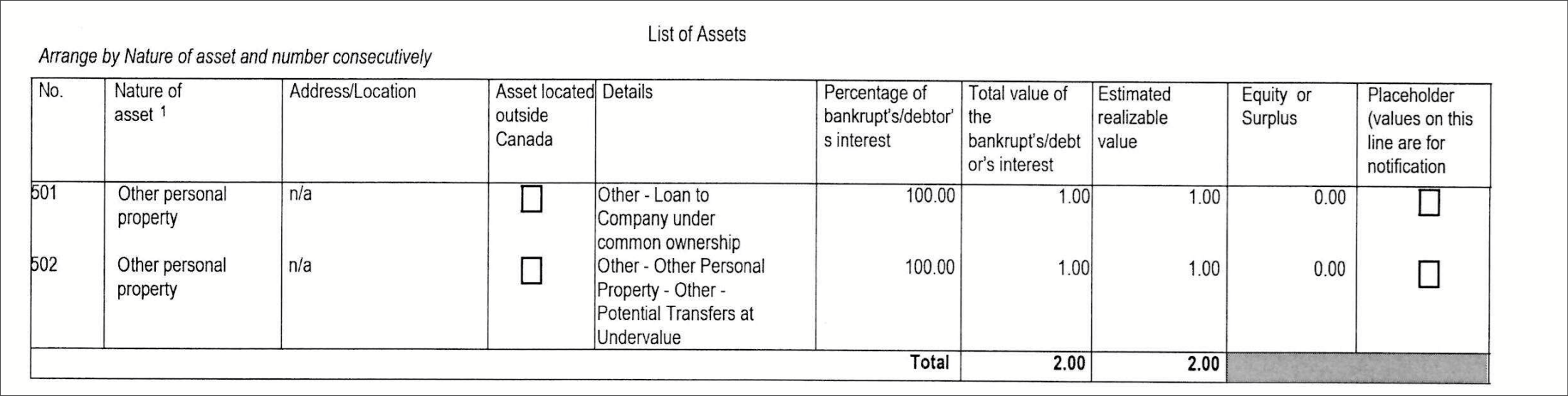

From Delviro Energy’s bankruptcy filing: the company reported just $2 in total assets — likely placeholder entries reflecting the trustee’s expectation that no funds will ultimately be recovered.

The numbers are stark. Delviro’s bankruptcy paperwork lists a mere $2.00 ($1.42 USD) in assets against $8.23 million ($5.84 million USD) in liabilities. It's a figure that would be comical if it weren’t tied to real-world damage. Banks and financial institutions account for the bulk of the losses, led by a more-than-$5-million default to National Bank of Canada. But smaller players, many closer to the ground, are also left holding the bag.

A Trail of Unpaid Partners

Buried in the bankruptcy schedules is a who’s who of the lighting world: agency reps, distributors, OEMs. Names like SDA Lighting & Controls in New York, Peterson Scharck in Houston, and Meglio & Associates in Missouri appear on the creditor list. On the distribution side, Anixter and Sonepar are owed. Even Wattstopper, a longstanding manufacturer in the controls space, is listed among the unpaid. In total, over 200 unsecured creditors await clarity on what, if anything, they’ll recover.

Former employees are in the mix too. Delviro’s filings confirm the company still owes over $67,000 in wages, further complicating the estate’s obligations. And while Ernst & Young, now the court-appointed trustee, has initiated proceedings to realize whatever assets remain, the trail of missing equipment and erratic money transfers suggests recovery will be limited, if not symbolic.

From Pause to Liquidation to Bankruptcy

Delviro’s collapse has played out in slow motion. The unraveling began in March 2025 when the company issued a letter describing a “pause in operations” tied to pending 25% tariffs on Canadian lighting imports. That move was framed as temporary — a chance to regroup and restructure. But behind the curtain, creditor defaults were mounting and operations had already begun to fray.

By April, the Ontario Superior Court stepped in, appointing Ernst & Young as Receiver, acting primarily in the interests of National Bank. That move triggered a court-supervised liquidation, with Maynards Industries hired to auction off manufacturing equipment and fixtures. Alongside the auction, troubling details began surfacing: missing financial records, equipment quietly sold, and over $1 million in questionable transfers to entities controlled by founder Joe Delonghi and his family.

The company’s conduct prompted Ernst & Young to seek enhanced investigative powers in June. Court filings suggested significant gaps in cooperation, digital records, and asset tracking. Investigators even found seven company vehicles sold for $1 each — to Delonghi’s wife and affiliated businesses.

A Shadow Over the Business

Now in bankruptcy, Delviro’s story enters a new legal chapter. The company is no longer simply being disassembled for creditor recovery — it is being forensically examined. Ernst & Young is expected to continue probing Delonghi’s pre-bankruptcy transactions, including unexplained equipment disappearances and real estate dealings. The trustee may also examine whether “transactions at undervalue” — a legal term for improperly discounted asset transfers — played a role in draining company value before collapse.

For lighting agents and distributors across North America, Delviro’s implosion serves as more than a cautionary tale. It raises existential questions about how well partners know the financial health of the companies they represent or buy from. In an industry built on trust and compressed margins, opacity can be as lethal as insolvency.

The bankruptcy doesn’t end the story — it simply codifies its consequences. Delviro, once a nimble Canadian player offering fast-turn fixtures at aggressive prices, now leaves behind court transcripts, auction receipts, and unanswered questions. Whether those questions lead to restitution, civil claims, or something more severe remains to be seen.