July 16, 2025

Current’s Sales Numbers Vanish After Steady Decline

Self-disclosed financial and staffing data disappear without explanation

In the high-turnover, high-stakes world of private equity, six years is an eternity. But that’s how long American Industrial Partners (AIP) has held onto Current — the commercial lighting company formerly known as GE Current, a Daintree company. For a private equity firm whose average current hold time is closer to four years, and with only one-third of its 27 industrial portfolio companies older than six years, Current now stands among AIP’s longer-term investments.

Still, the bigger anomaly may be what’s disappeared, not what’s lingered.

Once a billion-dollar brand boasting over 4000 employees, Current has faded from the data-rich company snapshots AIP reliably provides for its other holdings. For a firm that’s long provided vivid portfolio transparency — publishing revenue and headcount figures for every single company — the recent omission of Current headcount and revenue data is both curious and conspicuous.

A Lighting Rollup, Then a Leadership Change

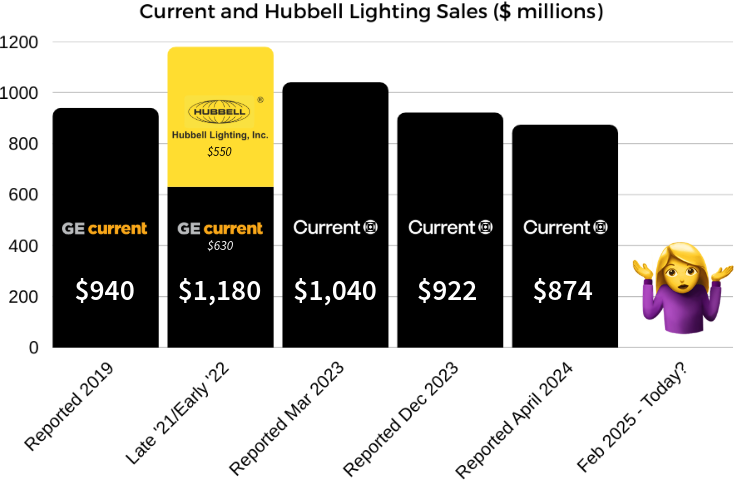

Current’s story under AIP started in April 2019, when the private equity firm acquired GE’s commercial lighting business. At the time, annual revenues hovered around $940 million. By 2021, that number had declined to $630 million — prompting a strategic play.

AIP announced it would acquire Hubbell Lighting’s commercial portfolio in late 2021. That deal, finalized in early 2022, added an estimated $550 million in revenue to Current’s books and pushed the newly combined company back over the $1 billion mark. In short, the sum of the parts equaled the former whole — a calculated consolidation in a market still finding its post-COVID footing.

By March 2023, AIP listed Current’s revenue at $1.04 billion.

Then, in May 2023, AIP brought in new leadership. Steve Harris, a veteran of another AIP company (Shape Technologies), took the helm as CEO. Colleagues and agents described him as highly capable, but the timing was tough. Within months, Current underwent restructuring, including layoffs in October and then months later, the sale of its Arize horticultural lighting brand to Acuity Brands. While both companies said the transaction wasn’t financially material, Arize had been one of Current’s differentiators. Its quiet exit said something — even if no one said much about it.

Note: A previous version of this bar graph, published for three hours, mistakenly swapped the sales figures for Current and Hubbell Lighting in the Late ’21/Early ’22 column. We regret the error.

Transparency Breaks at a Historically Transparent Firm

Until early this year, AIP’s website functioned as an unofficial investor relations page for its portfolio, offering unaudited but detailed company statistics — revenue, headcount, factory count — across all 27 companies. That level of transparency was rare in private equity, and especially valuable to industry watchers trying to track a fast-changing sector.

To be clear, AIP is under no obligation to disclose any of this information. Private equity firms typically keep such details private. That AIP shares them at all is unusual — and commendable. But within that outlier behavior, Current has now become an outlier of its own.

Current: Reported Revenue & Employee Count

- March 2023: $1.04 billion | 4,415 employees

- December 2023: $922 million | 2,910 employees

- April 2024: $874 million | 2,683 employees

- February 2025: Reporting ceased

The trend line dipped. Then it vanished.

Today, Current is the only one of AIP’s 27 portfolio companies without any financial or staffing data listed. No explanation. No updated figures.

What Changed, and Why It Matters

The change matters for two reasons: First, because AIP had been so consistent. Second, because Current’s numbers weren’t trending up.

Pulling back that transparency — selectively — raises fair questions:

- Is Current preparing for a sale?

- Are declining numbers being shielded for a specific reason?

- Is AIP shifting its disclosure philosophy across the board — or just for this company?

Inside Lighting asked AIP and Current for comments in recent months. Neither responded.

AIP Portfolio Snapshot

AIP’s portfolio of 27 industrial companies spans a wide range of sectors, with total disclosed revenues across 26 of them amounting to $29.5 billion.

Uncertainty, Not Conspiracy

There’s no evidence that anything nefarious is happening behind closed doors. Omitting data doesn’t necessarily signal distress — it could reflect internal realignment, a shift in communications strategy, or simply a decision by Current’s leadership to avoid drawing attention to declining figures and headlines like 2023’s “Sales at Current Continue to Decline.”

But it breaks precedent. And in the absence of official commentary, silence becomes the story.

One thing is clear: someone decided it’s better if we don’t know.