December 14, 2023

Sales at Current Continue to Decline

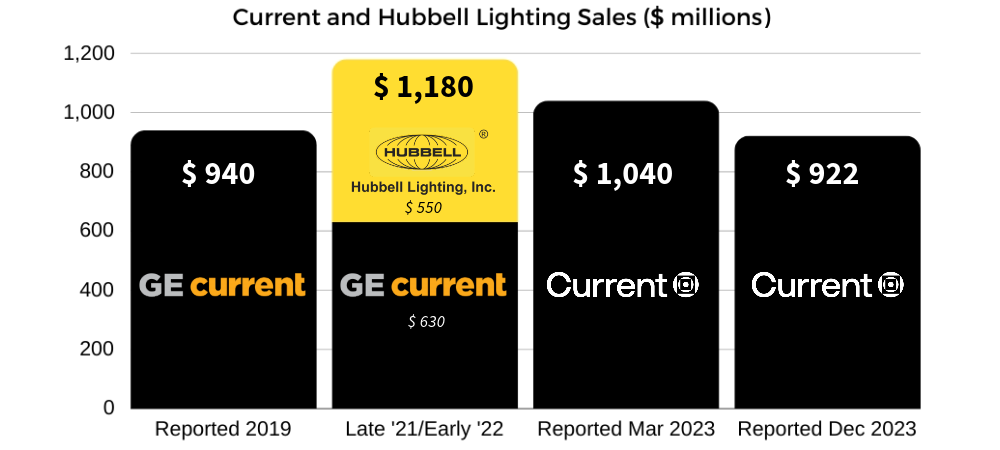

Company revenues return to pre-COVID, pre-Hubbell acquisition levels

Current, formerly known as GE Current, a Daintree Company, and a portfolio company of private equity firm, American Industrial Partners (AIP), has witnessed a steady decline in its reported sales revenue. The company's annual revenues, most recently updated last week by AIP, have notably regressed to levels observed before the COVID-19 pandemic and prior to its February 2022 acquisition of Hubbell Lighting.

AIP disclosed that Current's annual sales have decreased to $922 million. This decline is particularly noteworthy considering the company's financial trajectory since AIP's acquisition. In 2019, when AIP acquired the business from General Electric, GE Current reported $940 million in revenue. Post the acquisition of Hubbell Lighting announced in October 2021 and closed four months later, the combined revenues of Current and Hubbell Lighting exceeded $1.1 billion. However, the latest figures show a continued downturn, with Current's total revenue at $922 million, down from $1.04 billion in March 2023.

-

General Electric sold the Current, powered by GE commercial lighting business to American Industrial Partners in 2019.

-

After the acquisition, American Industrial Partners cited Current revenues as $940 million.

-

In late 2021, with reported revenues down to $630 million, the company announced that it was acquiring Hubbell Lighting – a company that was generating $550 million in revenue at the time.

-

The Hubbell Lighting price tag was $350 million.

-

Putting that in perspective, in 2008, Hubbell acquired architectural lighting company Kurt Versen for $100 million.

-

In March 2023, AIP reported that the Current generates a reported $1.04 billion in revenue.

-

Last week, Current's annual revenue number was updated to $922 million.

Leadership and Structural Changes

In May 2023, Steve Harris was appointed as the new CEO of Current. Harris, previously a leader in another AIP portfolio company, Shape Technologies, has been at the helm during a transitional phase. While anecdotal reports indicate that Harris is highly regarded among Current's employees and agents, it may be too early in his tenure to attribute the sales numbers to his leadership.

Current also underwent significant restructuring in October, including employee layoffs and then in November the company announced the sale of its horticultural lighting brand, Arize, to Acuity Brands. This transaction impact, according to statements from both companies, is not material on either company’s finances.

Market Dynamics

Signify, the world's largest lighting maker, characterizes the global market environment as challenging. The company's operations, distinct from those of Current, are globally diversified, with substantial involvement in the residential and consumer sectors. This diversification offers a rationale for Signify's market performance, suggesting that their challenges are not necessarily indicative of a significant loss in market share in North American commercial and industrial (C&I) markets.

In contrast, Current's focus on C&I markets, primarily in North America, aligns more closely with the strategies of Acuity Brands and LSI Industries. Both Acuity and LSI, as publicly traded entities, have reported notable revenue increases over the past two years. However, recent quarters have witnessed a stabilization or slight regression in their financial growth.

The P.E. factor:

Recent years have seen frequent mergers and acquisitions in the lighting industry, often involving private equity firms that quickly flip a portfolio company. A notable instance was Legrand's 2022 acquisition of Encelium, which had been previously owned by private equity firm SkyView Capital for just 15 months.

American Industrial Partners adopts a different strategy. Many of their 44 portfolio companies are properties that remain in their portfolio for five to ten years or sometimes longer. This contrasts with the rapid turnover approach of other P.E. firms. Thus, while it is conceivable that Current may be acquired, there seems to be little expectation of a quick sale in the typical private equity manner displayed by other firms.

Moving forward

The commercial and industrial lighting market continues to present mixed signals, with material costs, labor shortages, and project delays creating challenges, all while construction starts seem steady. Interest rates, despite recent stability from the Federal Reserve, pose challenges to lighting projects. In 2024, we look forward to observing how the lighting market adapts to these varied economic indicators, and how Current will operate to reverse its revenue trends.