August 15, 2024

LSI Sees 2024 Sales Dip, Shows Continued Resilience

CEO emphasizes lighting agent partnerships in driving future success

LSI Industries Inc. reported today on their fourth quarter and full fiscal year ending June 30, 2024, showing single-digit declines across the business, but the numbers demonstrate resilience. Total sales for the year were $469.6 million, a 6% decrease from the previous year's $497 million.

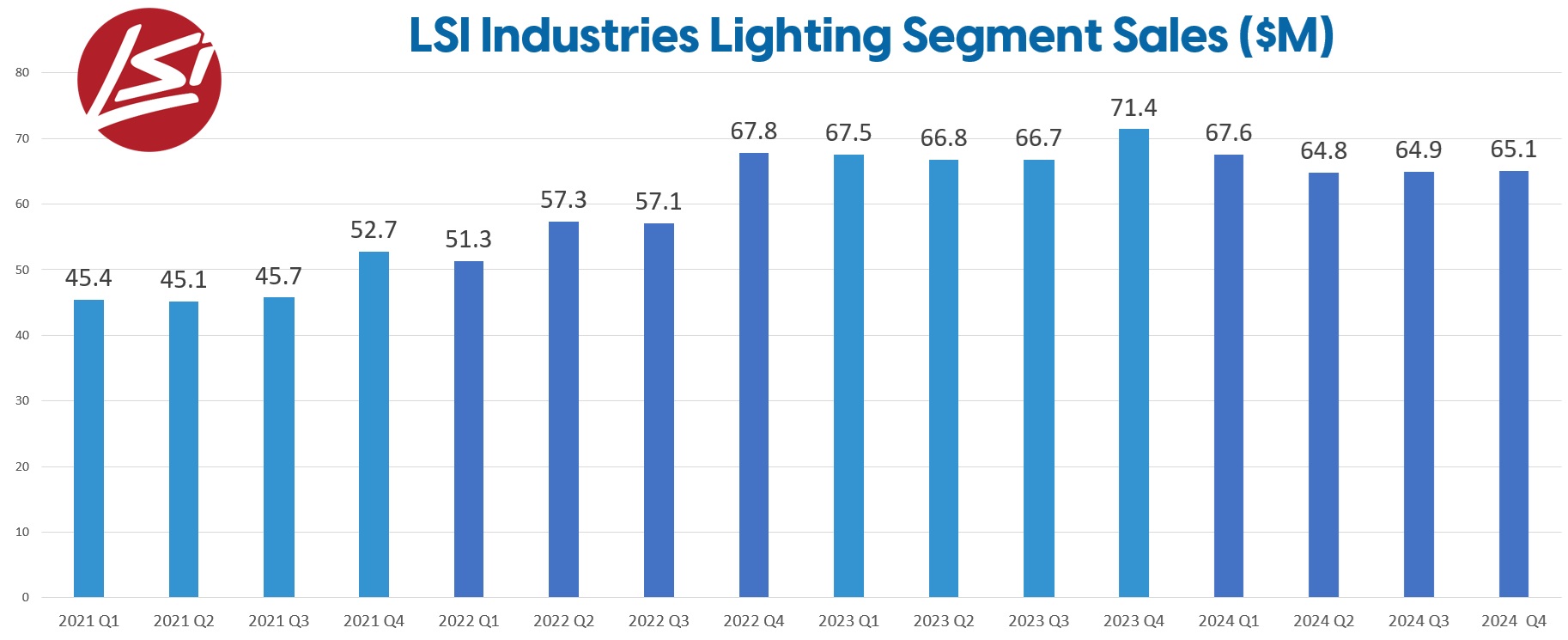

The decline in sales was partly due to a 4% reduction in the company's lighting segment, which generated $262.4 million in sales for the year. Once two-thirds of the business, the lighting segment now constitutes 56% of total annual revenues and is proving resilient in a lighting market where others are facing slightly more significant contraction. This shift in “portfolio allocation” occurred in recent years as LSI acquired two companies that boosted their Display Solutions revenue.

In pre-market trading on Thursday, LSI Industries (Nasdaq: LYTS) stock was trading up 3% at $15.20 per share.

The fourth quarter of fiscal 2024 saw lighting segment sales totaling $65.1 million, down 9% compared to the same period in the previous year. This comparison was particularly notable as it was against LSI's largest revenue lighting quarter ever.

Despite these single-digit declines, LSI Industries continues to execute its multi-year value creation strategy, which includes expanding its vertical market capabilities and integrating recent acquisitions in its display segment.

The company’s strategic focus and operational discipline enabled it to maintain strong profit margins (EBITDA) and generate $38.0 million in free cash flow for the fiscal year. CEO Jim Clark highlighted that while demand fluctuated, particularly in the grocery vertical, the company is well-positioned for profitable growth in fiscal 2025, supported by a robust pipeline and strong market fundamentals.

LSI Lighting Segment Commentary

In the fourth quarter, LSI Industries saw generally stable demand within its Lighting segment across most vertical markets, according to CEO Clark. Although fiscal 2024 sales were 4% lower than the previous year, LSI outperformed the broader market, gaining market share in specific areas. The company reported a 5% increase in operating income for the year, driven by a 200-basis point rise in gross margin.

Despite steady project quotation levels, LSI reports that the conversion from quotes to orders has been extended, especially for larger projects, due to ongoing construction schedule changes. These delays stem from non-lighting supply chain issues and a shortage of skilled labor. Lighting installations, typically occurring late in construction cycles, have led to frequent production schedule adjustments. Pricing for project quotations has remained stable, with expectations for this trend to continue into the first quarter of fiscal 2025.

CEO Jim Clark Details Lighting Agent Collaborations

In the company's fourth quarter financial press release, CEO Clark elaborated on recent activity strategizing with its lighting agent partners.

“Additionally, we continued to strengthen our relationships with our channel partners and end customers throughout fiscal 2024. Our teams conducted a record number of lighting training sessions at our Cincinnati headquarters and other locations last year, including personnel from our external sales agency partners, distributors, contractors, and end users."

"In May, we hosted all our agency principals for a three-day conference, collaborating on growth plans for fiscal 2025 and beyond. With over eighty executives in attendance from over forty firms, we outlined product roadmaps and new product launch schedules, and discussed sales force requirements to be successful."

— Jim Clark, CEO, LSI Industries

Fiscal Year 2025 is Underway

Looking ahead to fiscal 2025, LSI Industries is focused on capitalizing on the strong foundations it has laid through strategic acquisitions and market expansion. The company is optimistic about the resumption of growth within the grocery vertical, where it has secured multiple major customer program wins that bolster its display solutions backlog. Additionally, LSI's recent acquisition of EMI Industries enhances its product offerings and cross-selling opportunities, positioning the company for further integration and value creation.

CEO Clark emphasized that the company's robust pipeline, stable pricing, and strengthened relationships with channel partners and customers place LSI in a favorable position to achieve profitable growth in the coming year. With a well-capitalized balance sheet and continued investment in innovation, LSI is poised to navigate market challenges and drive sustained growth across its key verticals.