July 10, 2024

Halfway Through 2024, Lighting Stocks Lag Market

Despite a healthy S&P 500, many lighting stocks lag significantly behind

As we pass the midpoint of 2024, the U.S. stock market continues its upward trajectory, with the S&P 500 posting a robust 17% gain year-to-date. However, this broad market performance masks a significant disparity between sectors, with technology giants driving the bulk of the gains while many other industries, including the lighting industry, face headwinds.

The Nasdaq has outpaced other indices with an impressive 22% increase, while the NYSE has seen a more modest 7% rise. These figures, however, don't tell the whole story. It's important to note that a handful of tech behemoths are disproportionately influencing market performance. Microsoft, Nvidia, and Apple now account for over 20% of the S&P 500's value, with Nvidia emerging as a standout performer.

Nvidia's meteoric rise - gaining over 150% year-to-date and recently surpassing Apple as the second-largest S&P 500 holding - has single-handedly contributed to about 30% of the index's return this year. This concentration of gains in a few tech stocks has led to concerns about market fragility, as highlighted by a recent Barron's headline warning, "Nvidia Has Boosted the S&P 500. Now It Could Tank It."

Despite some individual successes, such as Acuity Brands, Dialight, and Orion being up for the year, the collective group of lighting stocks still lags behind market growth.

Against this backdrop of tech-driven market exuberance, the lighting industry presents a somewhat different picture. Many key players in the sector are struggling to keep pace with the broader market, with several seeing flat or negative returns.

-

Nasdaq: 22% gain year-to-date

-

S&P 500: 17% gain year-to-date

-

NYSE: 7% gain year-to-date

Let's take a closer look at how certain lighting stocks have performed in the first half of 2024:

| Company | HQ (Currency) | Market Cap | 2023 Adj Close | July 5 Adj Close | YTD % |

|---|---|---|---|---|---|

| Acuity Brands | USA (USD) | $7.357B | $204.58 | $239.14 | 17% |

| Signify | Netherlands (EUR) | €3.051B | €28.59 | €24.24 | -15% |

| LSI Industries | USA (USD) | $409M | $13.98 | $14.04 | 0% |

| Zumtobel | Austria (EUR) | €262M | €6.32 | €6.12 | -3% |

| Dialight | UK (GBP) | £80M | £1.47 | £2.05 | 39% |

| Orion | USA (USD) | $35M | $0.87 | $1.07 | 23% |

| Energy Focus | USA (USD) | $7M | $1.51 | $1.37 | -9% |

| Legrand | France (EUR) | €24.782B | €94.10 | €94.50 | 0% |

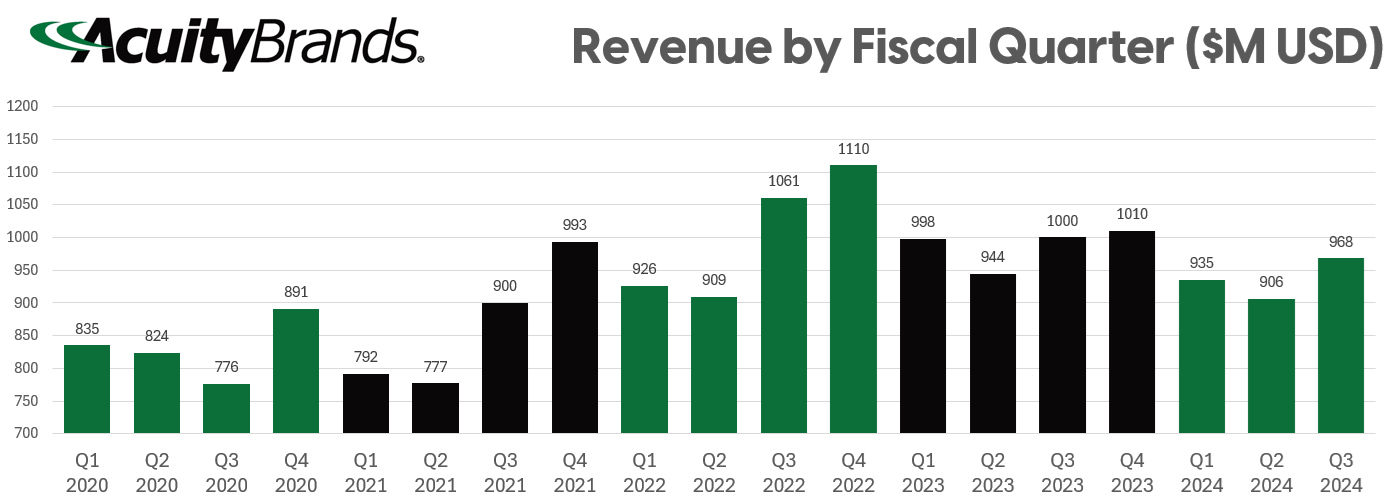

Acuity Brands (AYI +17% YTD)

Acuity Brands, North America's largest lighting maker, has experienced fluctuations in revenue since 2022, but the company continues to maintain excellent profit margins. This resiliency has seen a 17% YTD gain for Acuity Brands stock – which is in line with the solid growth of the S&P 500.

Acuity Brands saw manageable declines in sales but despite this, the company's stock reached its highest level since 2016 earlier this year, significantly benefiting CEO Neil Ashe. Ashe's 2020 executive contract included lucrative incentives tied to the company's stock performance, which he achieved earlier this year, resulting in a bonus exceeding $11 million.

In the most recent quarter ending May 31, 2024, Acuity Brands reported a robust performance. The company's net sales for Q3 FY2024 were €896.4 million ($968.1 million), a 3.2% decrease from the previous year's €925.9 million ($1 billion). The decline was mainly due to a 4.5% drop in the Acuity Brands Lighting and Lighting Controls (ABL) segment, which reported sales of €831.0 million ($898.5 million). However, this was partly offset by a 15% increase in the Intelligent Spaces Group (ISG) segment, which posted sales of €70.1 million ($75.7 million).

Overall, Acuity Brands' strong earnings per share growth and impressive profit margins have positioned the company well, even amid sales declines.

Signify (LIGHT.AS -15% YTD)

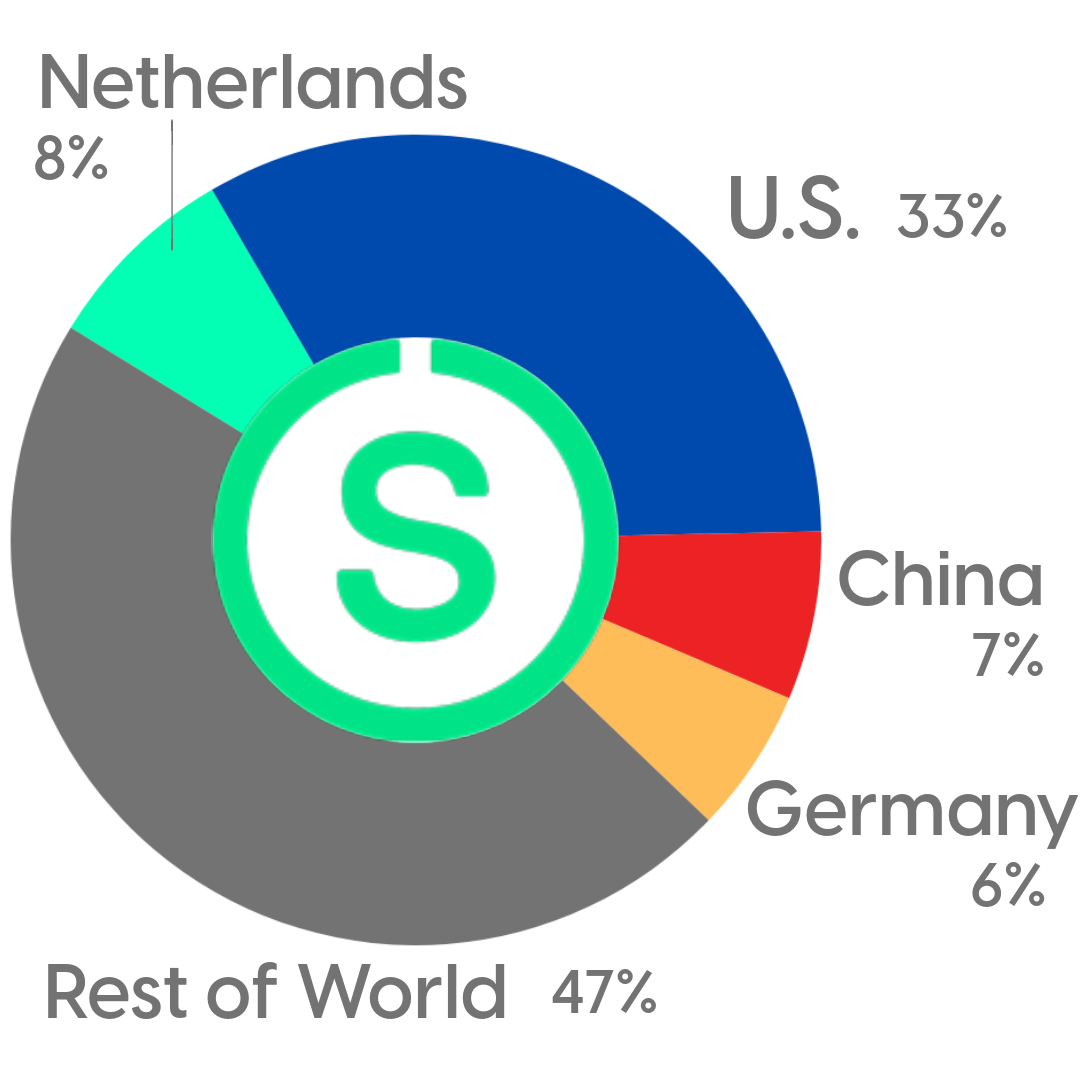

Signify, the worldwide lighting leader, boasts revenues approximately 75% larger than Acuity Brands. However, Signify’s business complexity far exceeds that of Acuity Brands due to its fragmented global diversification across Europe, the Americas, and Asia, alongside its mix of consumer products and commercial markets. Managing such a diverse portfolio, from brands like Philips consumer lamps to Color Kinetics architectural lighting and controls, presents complex challenges. In contrast, Acuity's primary focus on North American commercial and industrial markets better streamlines its operations, likely contributing to consistently healthier profit margins.

Signify concluded 2023 with mixed financial results amid challenging global market conditions. The company's sales fell to €6.7 billion ($7.26 billion), an 8.3% decline compared to 2022. CEO Eric Rondolat described the year as one of "recovery and progression," attributing the downturn to weaknesses in specific markets, including consumer, OEM, and China.

In response to these challenges, Signify is implementing organizational changes to better align non-manufacturing costs with revenue. This restructuring includes significant job cuts in 2024, with 1,000 positions being eliminated – which includes the shutdowns of the company’s longtime San Marcos, Texas manufacturing facility and its Vicksburg, Mississipi factory. These efforts aim to streamline operations and improve financial sustainability across its diverse global markets.

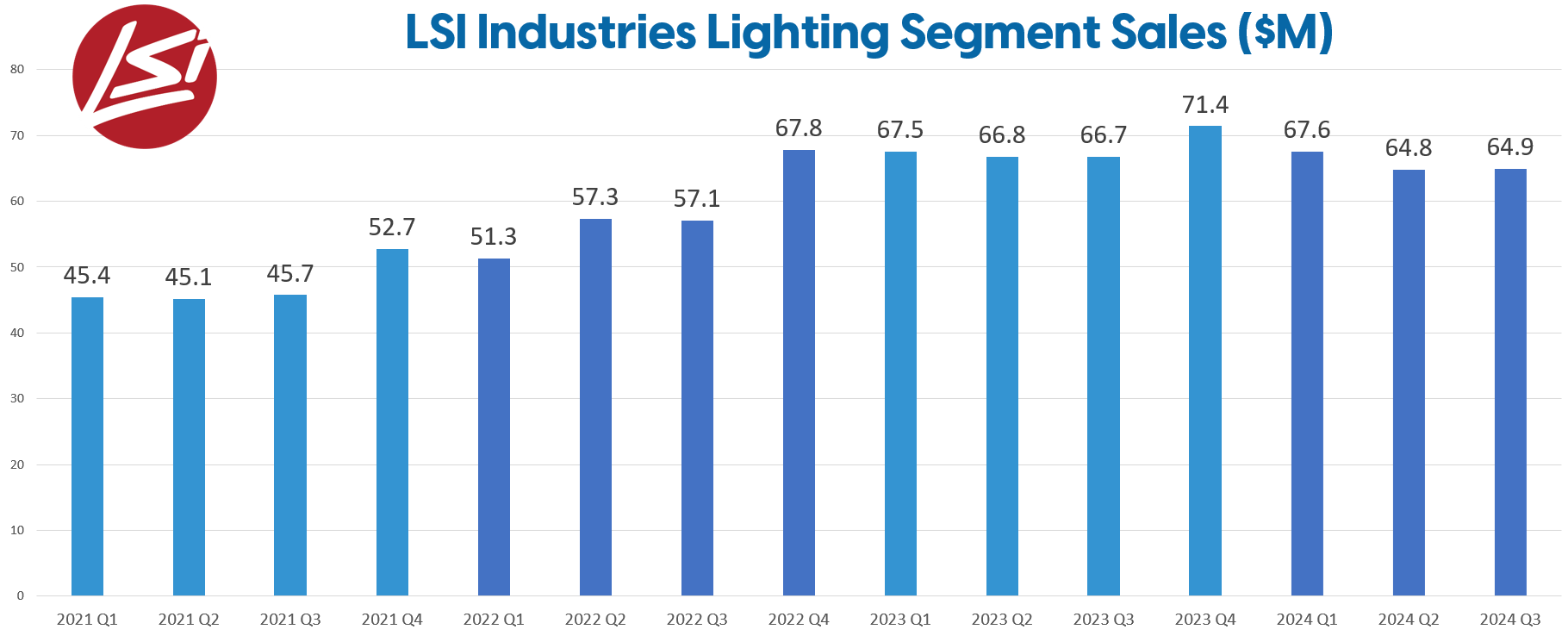

LSI Industries (LYTS 0% YTD)

LSI Industries Inc. saw its stock rise 17% in 2023, but has remained flat in the first half of 2024. The lighting segment, which constitutes 60% of the company's business, faced a 3% sales dip in the most recent quarter, highlighting a challenging economic environment. The Cincinnati-based company's Q3 financial results revealed an 8% decline in total net sales to €108.2 million ($117 million) from €117.5 million ($126.9 million) in the same quarter last year.

Despite the downturn, LSI Industries achieved an 11% increase in adjusted operating income for its lighting segment, driven by a 280-basis point improvement in the gross margin rate. Revenues for this segment were €64.9 million ($70.1 million), down slightly from €66.7 million ($72.1 million) in Q3 2023. This relative stability, amidst significant declines in its display solutions segment and broader industry trends, positions LSI as a resilient player in the lighting industry.

Zumtobel Group (ZAG -3% YTD)

Austrian lighting company Zumtobel reported fiscal year global sales of €1.127 billion ($1.22 billion), with over 80% of revenue generated in Europe. The Americas and MEA (Middle East & Africa) regions collectively contributed €64.9 million ($70.09 million), though the company reported that “revenues in the America & MEA region fell substantially as a result of especially disappointing sales in the USA.”

Zumtobel’s North American operations are based in Hudson Valley, New York, employing fewer than 100 people.

Dialight (DIA +39% YTD)

Dialight PLC, a global provider of industrial LED lighting, is undergoing significant changes with a series of abrupt executive shifts since September 2023, culminating in the appointment of Steve Blair as CEO on February 15, 2024. This period of transition follows a challenging first half of 2023, where revenues fell to £73.2 million ($93.7 million) from £80.8 million ($103.4 million), and the company shifted from profit to loss due to a 12% decrease in orders, high component costs, and lower overhead absorption. Dialight's transformation plan aims to streamline operations and achieve over £180 million ($230.4 million) in sales with improved margins and operating profits in the medium term.

Legrand (LR 0% YTD)

It wouldn’t be accurate to describe France-based Legrand, the largest company on this list, as a “lighting industry stock” as it derives most of its global revenues from its electrical and digital infrastructure products that are not specifically lighting and lighting controls. These categories include power distribution, building systems, cable management, wiring devices, UPS (uninterruptible power supply), and data center products. The company reported €8.4 billion ($9.1 billion USD) in sales for 2024.

The company, similar to Signify, achieves less than half of its sales in the Americas, with North and Central America contributing 38.6% to group revenue. Estimates for Legrand’s American lighting sector, which includes brands like Focal Point, OCL, Finelite, Pinnacle, Kenall along with Wattstopper, and Encelium (which are part of Legrand's Building Control Systems Division), range from €770 million to €1 billion ($850 million to $1.1 billion USD) annually.

Orion (OESX +23% YTD)

The first article published on Inside Lighting in 2024 was titled “Orion Energy Systems Receives NASDAQ Warning.” After evading the threat of delisting due to a sub-one-dollar stock price, the company has seen a gradual rebound in performance reflected by Orion’s 23% gain in stock price year to date. After numerous quarters of consecutive net losses, Orion Energy Systems recently returned to profitability, reporting a net income of €1.48 million ($1.6 million) for Q4 of fiscal 2024.

The Manitowoc, Wisconsin-based company, which saw a 17.1% increase in total revenue to €83.89 million ($90.6 million) for the fiscal year ending March 31, 2024, attributed its success to a strategic shift away from heavy reliance on project installations at The Home Depot and expansion into new markets related to LED lighting, EV charging solutions, and maintenance services.

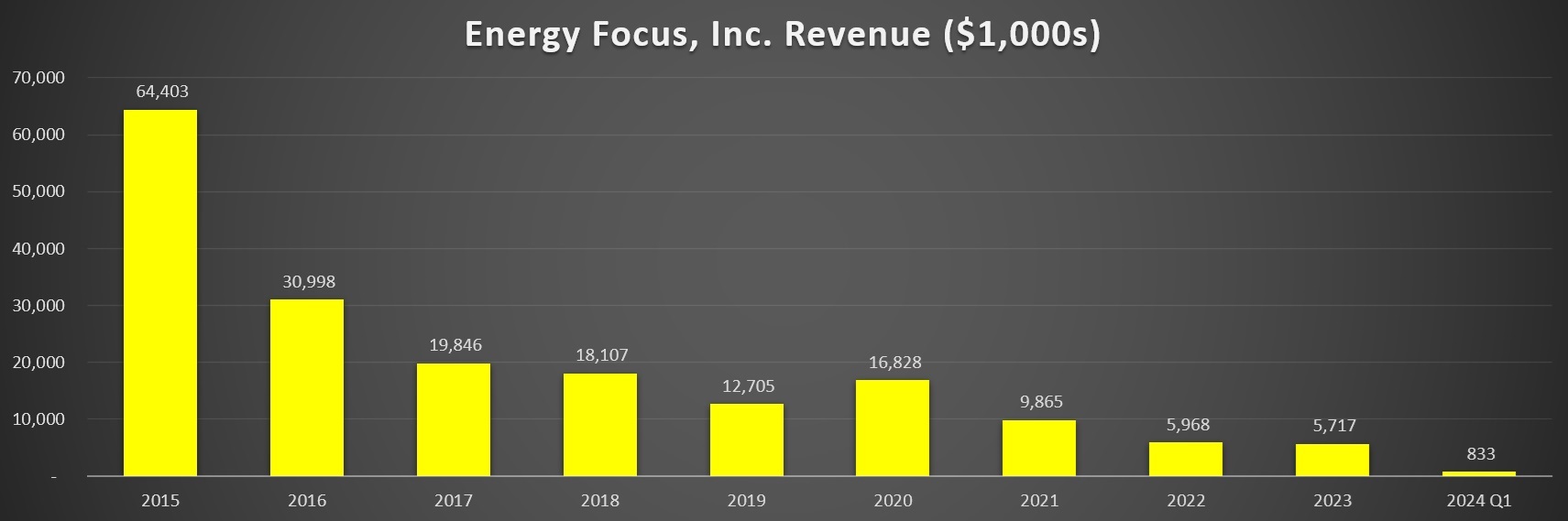

Energy Focus (EFOI -9% YTD)

The financials for Energy Focus, Inc., an Ohio-based maker of energy-efficient lighting solutions, continue to look ugly quarter after quarter.

The company reported a 10.4% decline in net sales to $833,000 in Q1 2024 compared to $930,000 in Q1 2023, largely due to decreased military maritime sales and slightly lower commercial sales. Despite the sales decline, the company's operating loss narrowed to $600,000 from $1.2 million year-over-year, and net loss improved to $400,000 (€370,000), or $(0.09) per share, from $1.3 million (€1.2 million), or $(0.58) per share, in Q1 2023.

As 2024 unfolds, the divergent trajectories between the technology sector and more traditional industries such as lighting are increasingly pronounced. While tech giants like Nvidia have significantly boosted overall market indices, the struggles within the lighting industry highlight the challenges faced by companies not aligned with the rapid growth areas of the economy. With varied performances across major players, from Acuity Brands' resilience to Energy Focus's persistent challenges, the sector reflects broader economic disparities.