January 2, 2024

Orion Energy Systems Receives NASDAQ Warning

Company eyes financial recovery following Home Depot project gap

Wisconsin-based Orion Energy Systems, Inc., a player in the commercial & industrial (C&I) lighting and electric vehicle (EV) charging markets, recently received a notification of non-compliance from NASDAQ. On December 21, 2023, the company was informed of its failure to meet the NASDAQ minimum bid price requirement, as outlined in the NASDAQ Listing Rule 5550(a)(2), commonly known as the Bid Price Rule.

Recalling Inside Lighting’s December 2nd article, we had foreseen this threat emerging for Orion. At the time, the company's stock had been trading at a precarious $0.91 per share marking a significant decline from its stable trading above $2 per share a year earlier.

Details of the Non-Compliance

The Bid Price Rule stipulates that listed securities must sustain a minimum bid price of $1.00 per share. Orion's stock, trading under the symbol “OESX,” has been below this threshold for 30 consecutive business days prior to the receipt of the notification. This development does not immediately affect Orion's listing on The Nasdaq Capital Market, and its shares continue to be traded.

Orion has been allotted a 180-day grace period, ending on June 18, 2024, to rectify this breach. To regain compliance, the stock must close at or above $1.00 for a minimum of 10 consecutive business days. Failing this, an additional 180-day period may be granted, subject to certain conditions, including the possibility of a reverse stock split.

Company context

In response to this setback, Orion's management has affirmed its commitment to enhancing revenue and maintaining a stringent cost culture. With a reported 17% growth in the fiscal 2024 second quarter and an anticipated 30% revenue increase over fiscal 2023, the company remains optimistic about its financial health and its ability to comply with NASDAQ's requirements.

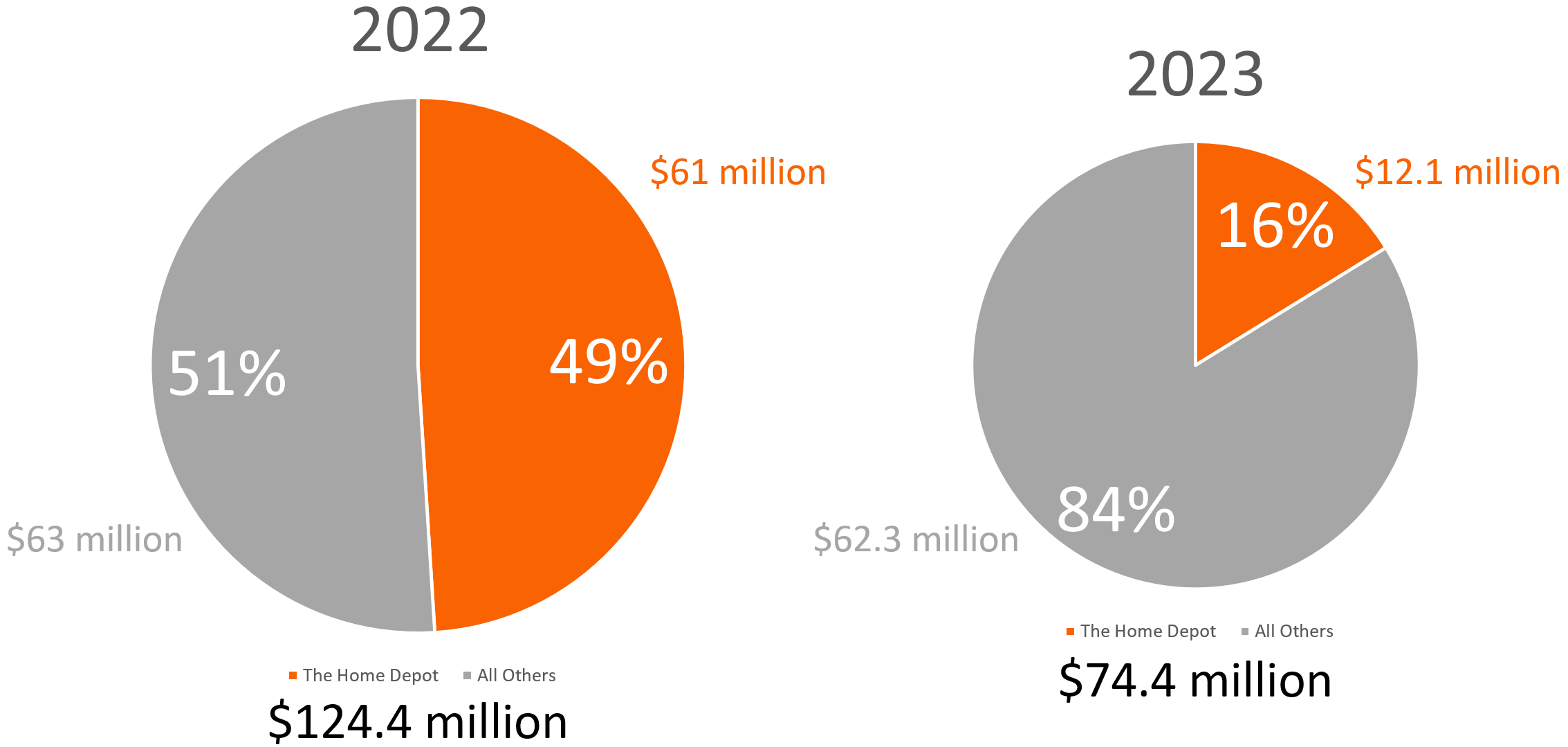

Above: Orion's business has been impacted by a large national account, The Home Depot. Numbers above reflect Orion's fiscal years which end on March 31.

Orion has struggled to recover from the conclusion of a multiyear turnkey project that provided lighting fixtures and services for The Home Depot retail stores in North America. In 2022, The Home Depot accounted for approximately half of the company's sales, amounting to $61 million. The 17% revenue increase to $20.6 million for the quarter ending September 30, 2023, may suggest a positive shift in momentum to a more diversified customer base.

In 2023, Ohio-based Energy Focus faced the threat of NASDAQ delisting under the Bid Price Rule but avoided it through a 1-for-7 reverse stock split. Orion may choose to implement a similar tactic before the June deadline if it cannot sustain a share price increase by then.