November 9, 2021

Distribution Roundup: Graybar, WESCO & Rexel

By David Gordon of Electrical Trends

David Gordon breaks down recent news from three major Electrical Distribution players. "If you’re not up by close to 20%, you’re losing share."

Over the past few weeks three of the industry’s major distributors (Graybar, Rexel and WESCO) either made news and/or shared their Q3 performance which provides some insights into the industry and customer segments.

Graybar

Graybar doesn’t share much information in its press releases and we need to wait for their 10-K, however, Graybar outperformed the overall market, reporting a 23.2% increase for Q3. Historically about 55-59% of Graybar sales is contractor-oriented. While they do support a number of large homebuiders, they typically are not targeting the small contractors, many of who are involved in the residential remodeling business.

Year to date, Graybar is up 19.1%, so slightly behind WESCO but, in many instances, different market segments, ahead of Rexel and slightly in arrears of the DISC benchmark. Again, much of this is probably due to business mix as well as density, and share, in faster growing markets.

But the Graybar of tomorrow may not be the Graybar that many perceived of yesteryear.

While many perceived the company as one focused on organic growth, committed to a single distribution equipment strategy and targeting a defined customer profile, the company is changing as observed with two recent acquisitions in Q3 – Steven Engineering and Metro Electric & Lighting Supply. These now represent Graybar’s fourth acquisitions this year (two are in Canada.)

Steven Engineering is an Los Angeles based Schneider Electric automation distributor. Metro is a resi / light commercial contractor-oriented distributor in the St Louis area that also has a lighting showroom.

Given the observed changes, I reached out to Graybar to ask “why”.

The feedback comes down to:

- Graybar has always had a three-tier growth strategy focused on increasing their top line, increasing / improving diversification and improving profitability. Their diversification strategy focuses on geographic, product, customer penetration and customer segments. Many may recall that Graybar has made acquisitions before (Shingle & Gibb, Cape Electric, Advantage Industrial Automation, Steven Engineering). This is a continuation of the strategy. Cape remained in IMARK and Metro will be staying in IMARK.

- The takeaway … there is a new acquirer in town. Graybar is reinvesting in its business to drive growth. They are bringing back-office synergies and letting these companies operate, essentially, as independents. They recognize the value that independents bring – strong customer relationships and, in many instances, are not in markets / segments that Graybar has been in. This is a business diversification play for Graybar.

At the same time, Graybar also announced a dozen leadership changes that are designed to prepare its management team for the future. Some individuals get new responsibilities to get them broader business exposure; some get different territories to learn a different segment of the business. Of interest is David Meyer who will now by VP North American Subsidiaries. He was formerly VP and CiO. The subsidiaries are the acquired companies and Graybar Canada.

It looks like Graybar will become a more “diversified” company.

Rexel

Rexel was the first with their acquisition of Mayer Supply. Shortly thereafter they announced their 3rd quarter performance. Some described their US performance as “solid”, however, a deeper dive shows that some regions had outstanding performance, others are, shall we say nicely, “challenged.

Digging into their quarterly report and focused specifically on their North American results:

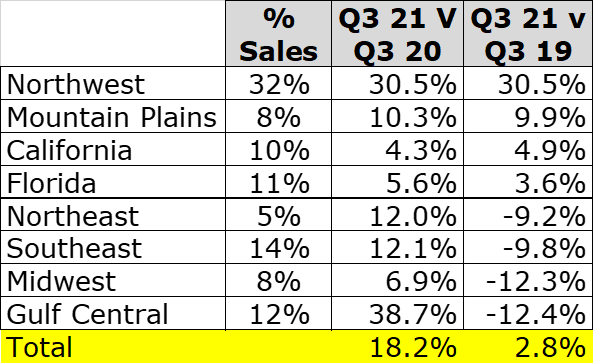

- North American was us 17.4% vs Q3 2020 with the US up 18.2% and Canada up 15%. Compared to the DISC benchmark, Rexel underperformed by almost 2 points, however, given its regionality, their business mix may change significantly by territory.

- US sales were $957.8 million euros. It will be interesting to see if Mayer is consolidated under “US Sales” in the future or if Rexel segments the brand.)

- Globally, sales are now 2.8% ahead of 2019, however, in the US Rexel is 20% below Q3 2019!

- Some sales insights

- Digital sales in North America now represent 9.4% of sales (however, digital sales do not necessarily mean solely online sales as “digital” can also mean EDI, eProcurement and other electronic means of transacting a sales.)

- Regional performance is:

Better performing regions are due to:

- Proximity regions grew (Northwest – Platt, Florida)

- Improvement in the Midwest due to industrial MRO and the Gulf Central (commercial and industrial

- If M&A and/or new branch openings occur, it is evident where Rexel needs sales, as well as performance and perhaps talent

- The Mayer deal filled a strategic hole for Rexel as can be seen by this map (red represents Mayer locations). It will be interesting to see if Rexel keeps the “orphan” (remote) locations, rebrands them to Rexel or keeps them under the Mayer banner. With Mayer Rexel now represents $5.4 billion in sales, 446 branches and over 6500 employees.

A similar exercise in other regions could identify where Rexel may seek acquisition opportunities.

- Rexel, like the entire industry, is seeing the impact of supply chain issues on its project business. They report a strong, and growing, backlog which is slowing growth potential.

- Rexel is positioning its strengths as technical expertise, data / digital enhanced processes, optimized supply chain and its relationship with suppliers. Reportedly they are sharing information with their suppliers to “optimize” the supply chain (and hence support forecasting).

- To put price increases into perspective, globally, copper (wire / cable) price increases contributed 6.5% to sales. Non-cable price increases were up 9.1% in North America!

Observations

Rexel has pockets of strength. The questions become:

- Can Rexel export the Platt proximity model to other regions and be successful?

- Will Rexel pursue other acquisitions and, if so, where and what is the profile of targets? Are they focused on companies with selected distribution equipment brands? Customer segments? Will they keep the brand (and hence follow strategies that others have used successfully) or will the develop a successful national brand?

- Can the current model be successful?

Rexel has the size and the economies of scale but has obviously has uneven success. Suppliers, and competitors, rave about selected areas and distributors comment that they are formidable competitors. In other regions, distributors comment that Rexel is their best growth driver. It represents a challenge, and an opportunity, for Rexel.

WESCO

While WESCO didn’t acquire anyone in Q3, like Rexel and Graybar, their quarterly performance for their electrical division slightly outperformed Rexel and they shared some thoughts regarding acquisitions although it is unknown if they are targeting the electrical industry, other segments or perhaps outside the US, as WESCO has many options.

Insights from WESCO’s quarterly call and their presentation:

- Due to growth and synergies from their integration from their acquisition of Anixter, WESDCO has significantly deleveraged the company, which could put them into position to consider acquisitions. The company is under NDA with some potential targets and believes “bigs are going to get bigger faster now.”

- While their headline number was that the company was up 14%, their electrical division, which is what competes with electrical distributors (hence their EES group) was up 19.9% to $1.98 billion with an EBITDA of $174M or 8.8% (up from 6.6% in Q3 2020). This is a slight out-perform versus the DISC benchmark, however, WESCO plays nominally, if at all, in some market segments – most notably residential and small contractor and small industrial segments. The company’s focus is the medium to large and large customer groups.

- Interesting there was a positive foreign-exchange impact of 2% for the EES group, hence the non-foreign exchange performance (or perhaps could be defined as US dollar performance) was 17%. WESCO does not report sales by geographic area in its quarterly reports (but it may be in their 10-K when released.)

- Overall gross margins, across the platform, have improved to 21.3%. This is due to a corporate-wide commitment to improving pricing strategies (and gaining some insights from Anixter that has been imported into key WESCO segments.) An element of their success is tying sales compensation with gross margin performance.

- Across its platform WESCO estimates that price added 5% to its sales.

- Investing significantly in “digital” and seeing results, especially in analysis based upon feedback, however, did not share any performance so can’t compare versus, for example, Rexel.

- Also providing sales with incentives for cross-sell, and they have a defined criteria (and app) to track this performance.

- When suppliers are going to allocation models, WESCO is getting “it’s fair share” as it is the largest or within the top 3 suppliers for essentially all of its key suppliers (as they exclude the marketing groups as they are aggregation of individual customers and have less supplier leverage / influence.)

- Increasing their backlog every month, across their platform.

- Feel that their EBITDA will expand from historical. An analyst tried to pin WESCO down to commit to 8-9%. WESCO wouldn’t commit but did state it will be significantly better than what is was before.

Observations

- It’s interesting that every distribution company talks about their supplier base and technical expertise being their differentiator … when most represent the same, or very similar, suppliers

- WESCO promotes the success that it is having cross-selling amongst its divisions. While, for the most part, unique to WESCO, it represents an opportunities for others to consider once they evaluate their customers and identify what they buy … which may not be electrical materials.

- With the passing of the infrastructure bill, WESCO and Sonepar may be best positioned, nationally, to benefit from various elements of the bill given their breadth of offering.

Macro Takeaways from the 3 Companies

- If you’re not up by close to 20%, you’re losing share.

- Key is measuring your performance, and share, by market segment.

- From a supply chain viewpoint, everyone is experiencing it but larger companies have ways, from some product categories, to mitigate it and may be receiving some preference.

- Diversification is a strategy for growing tomorrow.

- All the majors are in acquisition mode.

Coincidentally, elements of this tie Channel Marketing Group’s 10 Key Investment Areas for Distributors to support growth and profitability over the next 3-5 years. Contact Channel Marketing Group for a copy.

Don’t miss the next big lighting story…Click here to subscribe to the inside.lighting InfoLetter |