January 30, 2026

Signify to Cut 900 Jobs Amid Ongoing Contraction

Annual revenue hits lowest level since Philips spin-off a decade ago

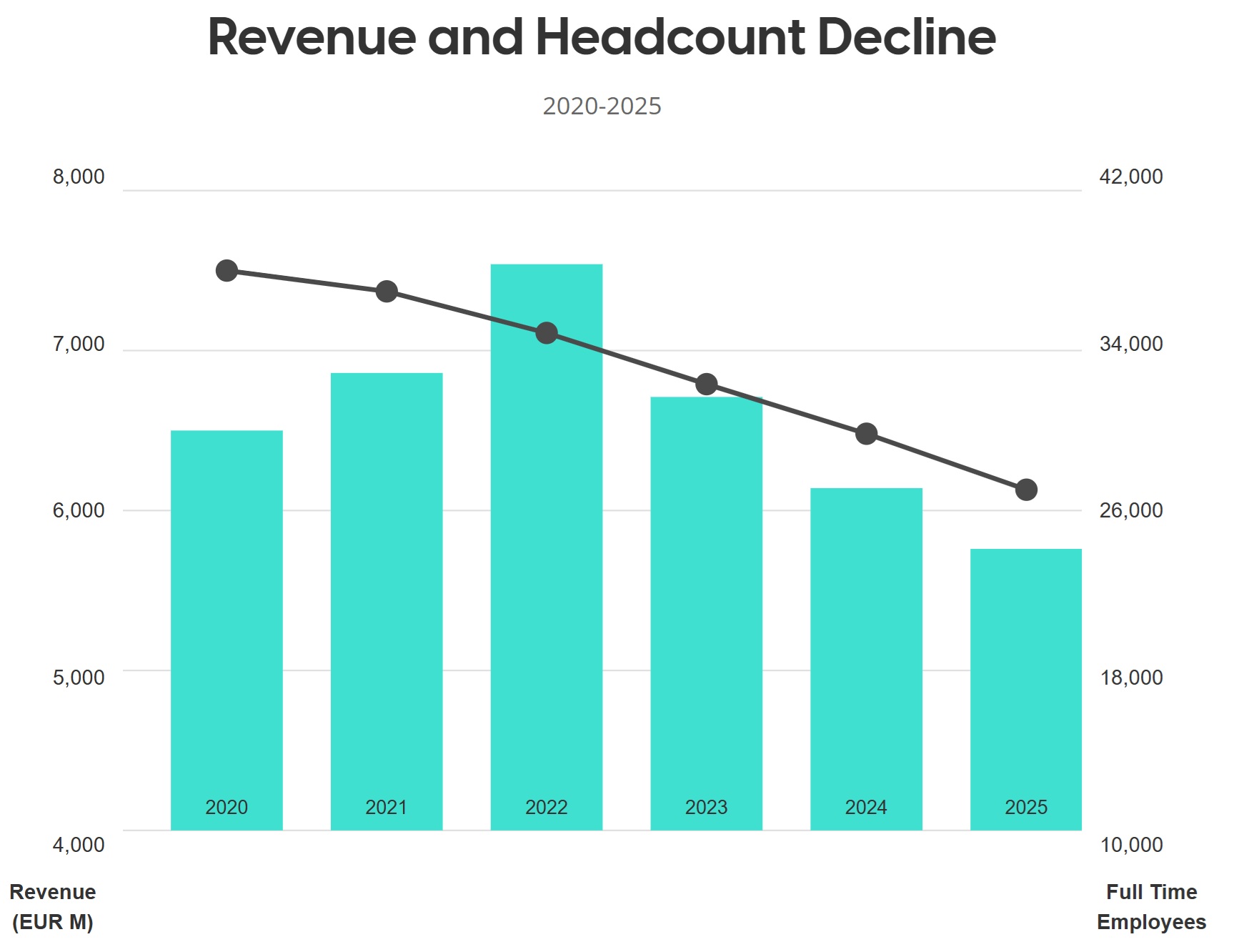

In 2016, when Signify was carved out of Philips and entered the market with over €7 billion in annual revenue, it did so with scale, ambition, and the title of the world’s largest lighting company. It was built to lead — not retreat. But a decade later, the company is operating from a smaller footprint and facing harder questions.

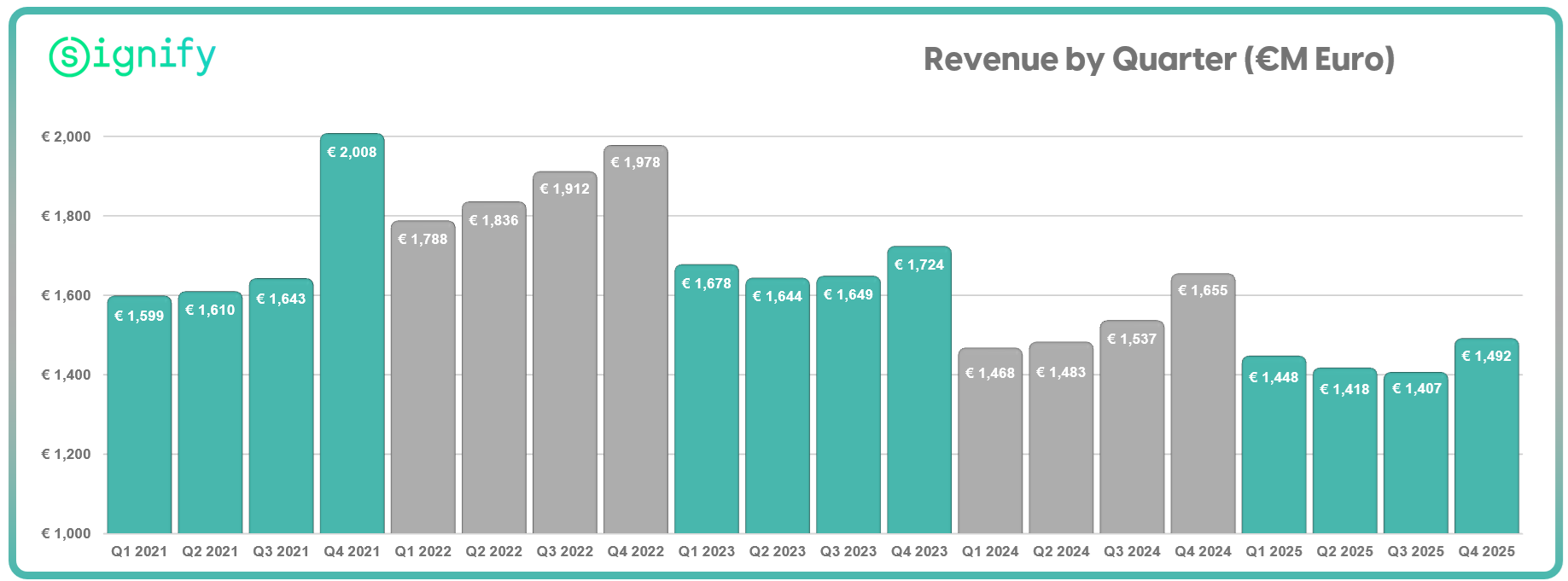

Signify has just closed out 2025 with €5.77 billion ($6.86 billion) in revenue — its lowest annual top line since the spin-off. As part of a newly announced €180 million cost reduction program, it will eliminate another 900 jobs.

That’s not just a miss. It’s a signal.

Over the years, Signify tried to grow its way to safety. The company made bold bets — like its $1.4 billion acquisition of Cooper Lighting in 2020 and the $141 million purchase of horticultural lighting firm Fluence soon after. These moves expanded its U.S. and specialty portfolios, deepened its reach, and theoretically, should have padded its revenue floor.

But the floor has fallen. And 2025 marked the fifth year in a row of declining employee headcount, a shrinking revenue base, and, increasingly, questions about what Signify wants to be.

A Transition Year That Looked Like a Retrenchment

It’s tempting to view 2025 as a reset year. And to some degree, it was. Signify cycled through three CEOs in twelve months. Eric Rondolat stepped down in April. CFO Željko Kosanović held the interim reins through August. And in September, As Tempelman — formerly CEO of Dutch utility Eneco — took over.

But this was not a quiet transition.

Instead, it was a year of deep operational strain. Comparable sales fell 3.4% for the year — an improvement from 2024’s -6.6%, but still negative. The fourth quarter reaccelerated the decline at -5.2%, signaling that the drag is not behind the company.

Profitability also deteriorated. Adjusted EBITA margins dropped 100 basis points to 8.9%. Net income fell 22.5% to €259 million. The OEM segment, once a reliable contributor, saw its margin collapse from 11.1% to just 4.8%. In Q4, company-wide margins slid even further to 10.0%, down from 12.4% a year ago.

“Gross margin resilience” was a theme repeated on the earnings call, but beneath it was a different reality: cost structures built for higher volumes are now too big. And demand — especially in Europe — isn’t cooperating.

Job Cuts Then and Now

In January 2024, former CEO Rondolat announced a 1,000-job reduction to match revenue realities. By the end of that year, 2,461 roles had been shed, including through attrition.

Now, under Tempelman, another 900 roles are on the chopping block as part of a €180 million cost reduction program. The company is clear that this is not a pivot to new models. This is right-sizing for survival.

“This is a reset that is now required,” Tempelman said. “We can make this step change without harming the business.”

The savings, according to management, will come mostly in 2026, with full benefits realized in 2027. About 25% of those cuts will be in countries requiring consultation processes, meaning implementation will be gradual.

Signs of Strength in the U.S.

There’s no question that the U.S. market is one of the company’s brighter spots. Both the Professional and OEM businesses showed growth in America during Q4. Price pressure was less acute stateside, and government investment programs could offer tailwinds.

Still, it’s not enough.

“In Professional, we delivered growth in the U.S. in the fourth quarter, while Europe remained under pressure,” Tempelman said. But growth in North America couldn’t offset declines elsewhere, particularly in Germany, France, and the Netherlands.

Asked directly by an analyst about U.S. market confidence in 2026, Tempelman was measured: “We expect flat to moderate growth… the residential market will remain soft.”

There’s little illusion here. Even with the U.S. contributing about one-third of revenue, its relative strength can’t offset broader global declines.

Guidance, or Lack Thereof

Notably, Signify offered no comparable sales growth guidance for 2026. The omission was explained as a response to “huge divergence” in market dynamics and macro uncertainty. Instead, the company issued EBITA margin guidance of 7.5% to 8.5% — below 2025 levels — and forecast free cash flow at 6.5% to 7.5% of sales.

This signals not just caution but a reluctance to overpromise. After two years of repeated guidance downgrades, the company seems more comfortable managing expectations down than setting stretch targets.

Strategy Still Coming Into Focus

Tempelman’s call was full of careful language, befitting a CEO still in the early months of tenure. This was his second earnings call, but the first for which he owned a full quarter as CEO.

Much of the future direction remains deferred to a Capital Markets Day scheduled for June 23, 2026. There, the company promises to unveil more specifics on portfolio priorities, capital allocation, and divestment or “harvesting” opportunities.

Until then, the message is one of efficiency and review. Investments are being scrutinized. Growth markets are being isolated. And share buybacks have been paused.

The story of 2025 is not of collapse — it’s of contraction. And while management stresses productivity gains, improved working capital, and the growth of connected lighting points (167 million and counting), the bigger picture is clear: this is a company recalibrating for a lower base.

With revenue at its lowest since the spin-off from Philips and strategy still under construction, the stakes for June’s Capital Markets Day are high.

Tempelman, who just completed his first full quarter at the helm, owns the year ahead. There are no more interim titles, no more inherited quarters. If 2025 was transitional, 2026 is his to define.