February 16, 2026

NEMA Survey Reveals Boost in Forward-Looking Confidence

Business confidence index retreats from December’s elevated peak.

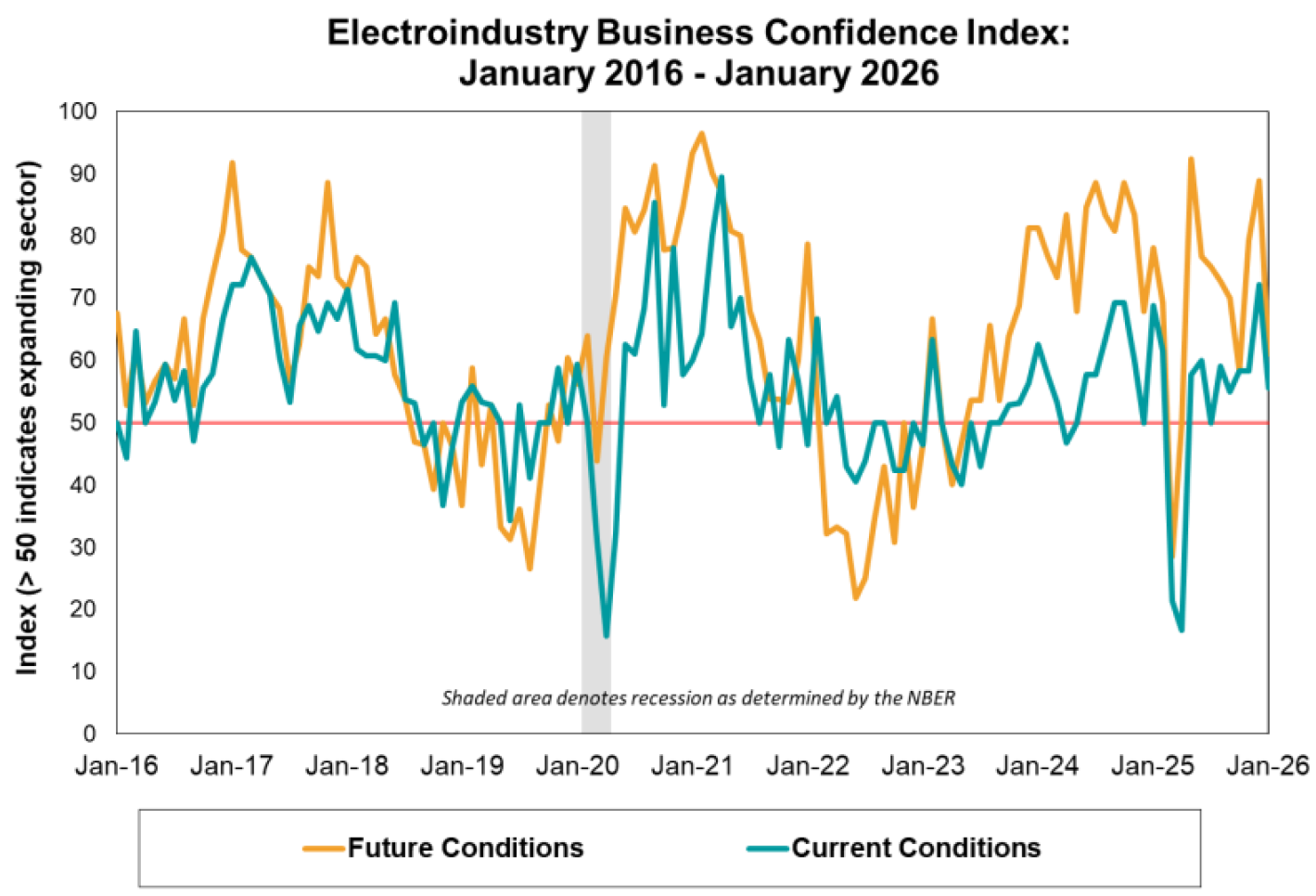

Each month, the National Electrical Manufacturers Association (NEMA) publishes the Electroindustry Business Confidence Index (EBCI). The index is based on surveys of senior managers at NEMA member companies – designed to gauge the business environment of the electroindustry in North America. Member companies include most of the ten largest lighting manufacturers in North America, along with other manufacturers of lighting, electrical and medical imaging products.

If December felt like a surge of late-year momentum, January reads more like a collective exhale. The latest EBCI report shows confidence cooling from its year-end highs, with both current and future conditions pulling back from December’s elevated levels . The industry remains in expansionary territory, but the tone has shifted. More respondents reported flat conditions, and a measurable share now see deterioration ahead, a contrast to the unambiguous optimism that closed 2025.

In other words, the electroindustry has not turned pessimistic. It has turned cautious. The survey’s distribution tells the story: fewer declarations of “better,” more acknowledgments of “unchanged,” and a noticeable reemergence of “worse” in the six-month outlook . Panelists pointed to supply chain uncertainty and tariff and broader economic risks as factors tempering enthusiasm.

This most recent ECBI shows how makers of electrical equipment view current and future market conditions. Below are the details:

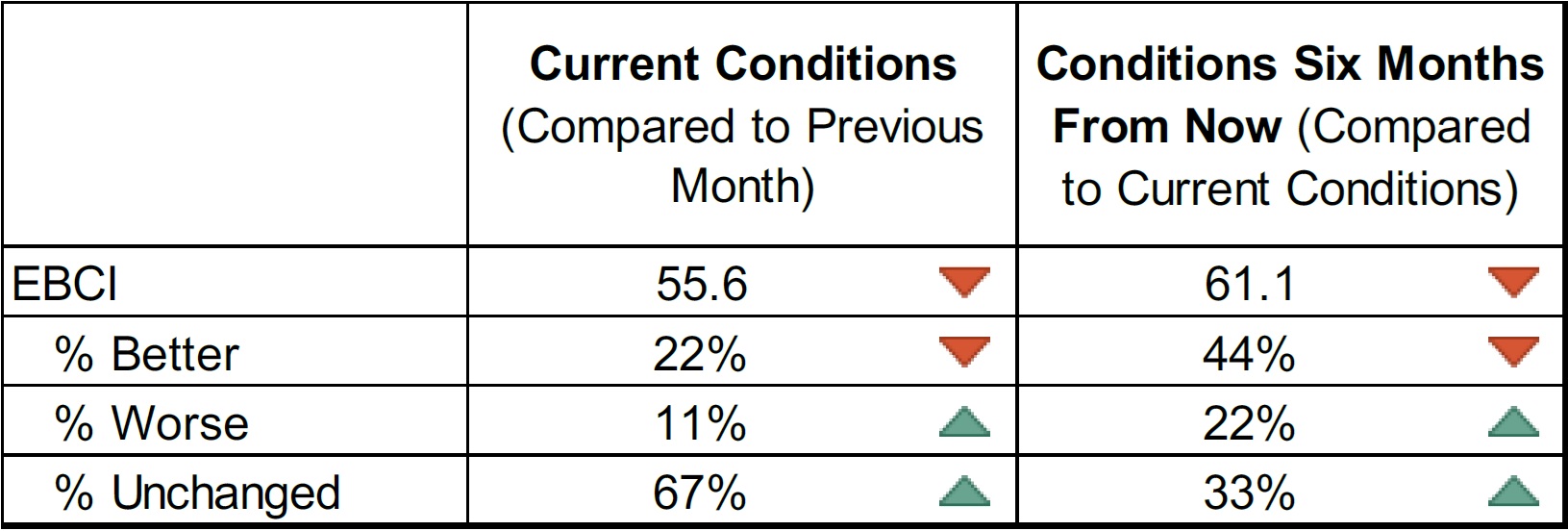

The Current Conditions component declined to 55.6, down sharply from 72.2 in December. Respondents reported that 22 percent experienced “better” conditions, 11 percent reported “worse,” and 67 percent saw conditions remain unchanged. Compared to last month, the distribution of responses reflects a pullback in momentum and greater variability in operating conditions across firms. Overall sentiment

remains slightly expansionary, but at a notably weaker level than in December.

The median value for the magnitude of change in current conditions moved back to zero, reflecting more limited month‑to‑month movement than reported previously. Responses indicate that, for most panelists, conditions either stabilized or shifted modestly, consistent with the lower index reading. Panelists are asked to report the magnitude of change on a scale ranging from –5 (deteriorated significantly) through 0 (unchanged) to +5 (improved significantly).

Forward-looking confidence cooled compared to the prior month, as the Future Conditions component declined to 61.1 from 88.9 in December. Looking ahead six months, 44 percent of respondents expected conditions to be “better,” 22 percent anticipated conditions will be “worse,” and 33 percent expected conditions to remain unchanged. While expectations remained in expansionary territory, the distribution of responses suggested increased uncertainty relative to last month. Despite nods to potential improvement, most comments highlighted downside risks from uncertainty in supply chains and tariff and economic.

SURVEY RESULTS:

- Values reflect the percentage of respondents expecting "Better" conditions, plus one-half of the percentage of respondents expecting "Unchanged" conditions.

- A score of 50 or higher suggests conditions appropriate to expansion of the electroindustry sector.

- Please note that survey responses were collected from the period of January 12-22, 2026.

EBCI METHODOLOGY:

The EBCI indexes are based on the results of a monthly survey of senior managers at NEMA member companies and are designed to gauge the business environment of the electroindustry in North America (defined here as the United States and Canada).

The survey contains the following questions:

-

How would you rate current economic conditions in North America, as they affect your business, compared to the previous month?

-

Using the following scale, please describe the magnitude of change in economic conditions in North America this month compared to economic conditions last month? [Scale structured as follows: 5 (improved significantly), 4, 3, 2, 1, 0 (stayed the same), -1, -2, -3, -4, -5 (deteriorated significantly)]

-

How do you expect economic conditions in North America, as they affect your business, to have changed six months from now?

Respondents are asked to indicate whether conditions are better, worse, or unchanged. The survey also provides space for respondents to comment on current conditions. These comments are included below the table containing the index levels.

The index value is the percentage of respondents expecting “Better” conditions, plus one-half of the percentage of respondents expecting “Unchanged” conditions, which follows the methodology used by the Institute for Supply Management (ISM; formerly the National Association of Purchasing Management) in the construction of their manufacturing index.

Reprinted by permission of the National Electrical Manufacturers Association (NEMA)