November 14, 2025

What the Hell Is Going On at Cree Lighting?

Another furlough extension, a shrinking workforce, and a quiet lien paint an increasingly uncomfortable picture

Cree Lighting has extended its furlough once again. What began on October 1 as a three‑week pause “due to limited availability of materials” has morphed into an eight‑week shutdown with no visible roadmap back to normal operations.

The tone of the letters has changed, too. The latest announcement, sent yesterday, stretches the furlough another two weeks through November 28 and acknowledges that the company is not navigating a temporary supply chain snag, but something far more structural:

“This extension comes as we make progress in our ongoing efforts to pursue strategic and financial solutions to strengthen our business for the future.”

— Sabu Krishnan, President, Cree Lighting and ADLT

If that sounds fuzzy, that’s because it is. Even in Washington’s recent 43‑day government shutdown, the language was clearer. Cree Lighting’s messaging, by contrast, has become increasingly vague, even as the situation grows more serious.

Phone lines are still down. Support runs through a single shared inbox. Agents and distributors say communication is sporadic at best. And as the restart dates slide further, customers aren’t waiting around — they’re moving on.

Employees Are Leaving, And Maybe That’s the Point

Employees have now gone six weeks without a paycheck. Many are leaving. Some because they must. Others because the writing is on the wall. And the uncomfortable truth is that this may be exactly what ownership wants.

Cree Lighting is owned through CLNA Holdings, a subsidiary of ADLT, LLC, a private‑equity structure built on layers of leverage. And in that model, voluntary attrition may be financially useful:

- Furloughs avoid legal (WARN Act) obligations relating to mass layoffs or shutdowns.

- Departing employees eliminate severance costs.

- A shrinking workforce lowers future liabilities.

- No formal layoff means no formal restructuring announcement.

In other words, attrition can become a strategy — not a symptom.

Feit Electric Bought Part of the Brand — Then Filed a Lien

This past summer, Feit Electric quietly acquired certain assets of Cree Lighting and added a tagline to its new website:

“Cree Lighting – A Brand of Feit Electric.”

That wasn’t a partnership announcement. It was a reveal. Weeks ago, Inside Lighting was first to report that Feit had acquired Cree Lighting’s residential lamp portfolio, which also includes the “Cree Lighting” brand name, trademark, and intellectual property. Both Feit and Cree Lighting confirmed the deal to Inside Lighting, and U.S. trademark records back it up.

But we uncovered another fact — and it’s even more telling.

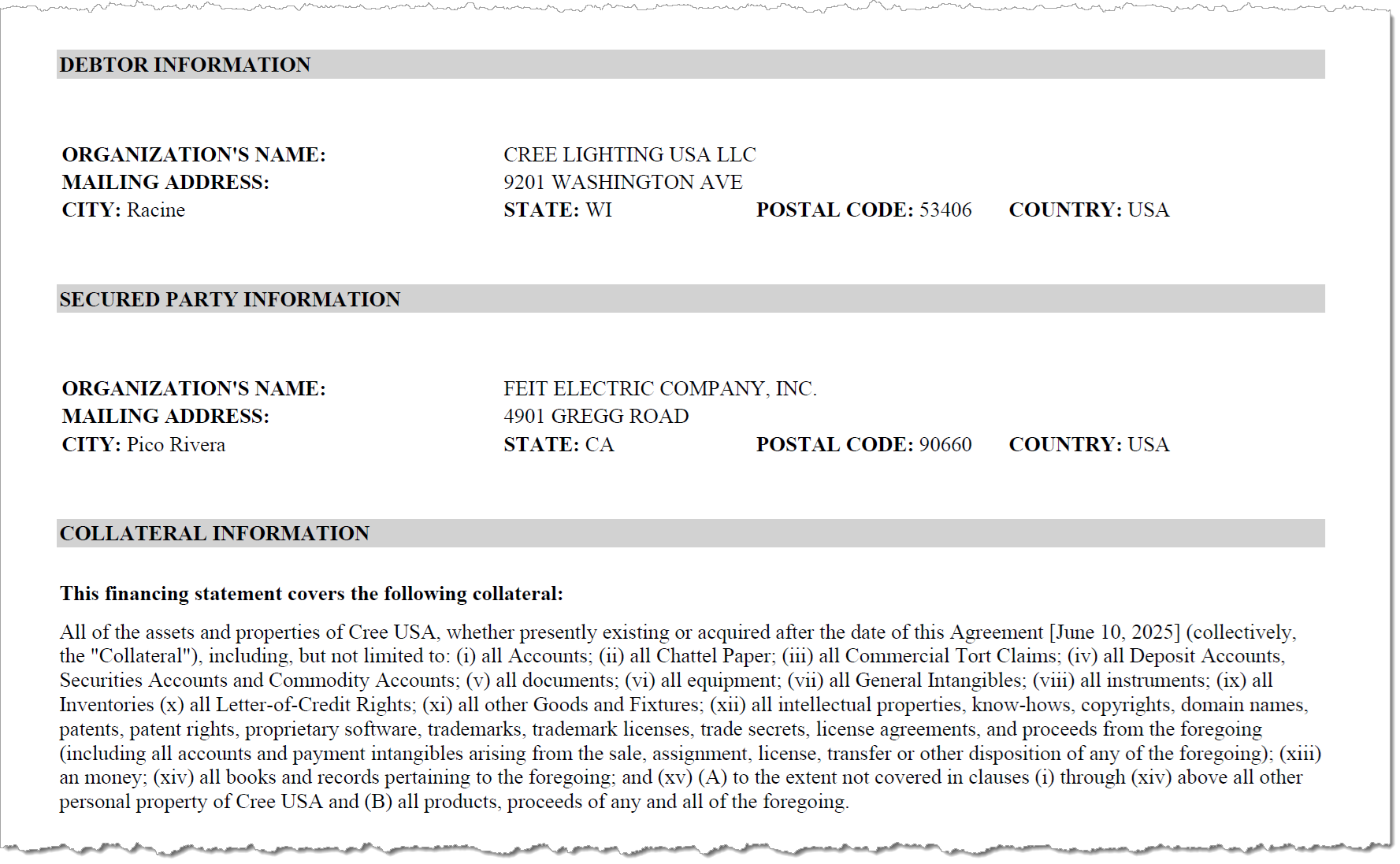

On October 2, one day after Cree Lighting’s furlough began, Feit Electric filed a UCC financing statement in Wisconsin, naming Cree Lighting as the debtor.

A UCC filing gives the secured party a legal claim on specific collateral. In plain English: Feit is protecting its interests in case Cree Lighting collapses.

Feit’s lien isn’t limited to the Cree Lighting lamp assets it purchased. According to the public filing, since June 2025 Feit has held a blanket security interest over all assets of Cree Lighting USA LLC — including equipment, inventory, accounts receivable, trademarks, software, and all future proceeds. In other words, Feit is not merely a buyer; it is a secured creditor with the right to step ahead of most other stakeholders if the business fails.

When a buyer files a lien right as a company starts furloughing workers, that’s not coincidence. That’s concern.

COMMERCIAL LUMINAIRES

Ideal Industries (2019-2023)

ADLT (2023 - present)

RESIDENTIAL LAMPS

Ideal Industries (2019-2023)

ADLT (2023-2025)

Feit Electric (2025 - present)

COMPONENTS

Penguin Solutions

(2021 - present)

The Leverage Behind the Curtain

Feit’s filing isn’t happening in a vacuum. Public records show that Cree Lighting’s owner, ADLT, has been carrying significant secured debt for years:

- FGI Worldwide LLC holds a blanket first‑position lien on all ADLT assets (2021).

- CLO Partners III, LLC filed a subordinate lien earlier this year (April 2025).

This means nearly every asset within the ADLT ecosystem — including Cree Lighting — is encumbered. If a sale occurs or assets are liquidated, secured lenders get paid first. Employees, vendors, agents, and even customers with open orders stand far further down the line.

This is the context in which Cree Lighting was acquired by ADLT in 2023. Private equity didn’t buy a growth engine. It bought collateral.

And when the collateral stops producing cash, the next step is almost never “fix the business.” It’s recover value.

Yellow Flags Turning Red

Individually, none of these signs prove Cree Lighting is being wound down. But together, they form a pattern that’s hard to ignore:

- Three successive furlough announcements with increasingly generic explanations

- No clear restart plan

- No phone support and shrinking communication

- Lighting agents steering orders elsewhere

- Employees leaving with no pushback

- A major buyer (Feit) filing a lien immediately after furlough launch

- A parent company carrying multiple layers of secured debt

- A sold‑off portion of the brand that once carried meaningful market cachet

These aren’t the moves of a company preparing for a comeback. These appear to be the moves of one being unwound carefully, quietly, and with minimal liability.

This is what a slow‑motion shutdown looks like:

- Keep the shell alive just long enough to fulfill final orders

- Reduce headcount without announcing layoffs

- Offload IP, product lines, and tooling

- Avoid triggering government WARN requirements

- Maintain just enough warranty support to avoid lawsuits

- Let the business fade without a formal obituary

Not a crash. A glidepath — smooth, quiet, and designed to land without turbulence or litigation.

Confidence Is Gone. What Comes Next?

Cree Lighting has not said it’s closing its doors. But customers aren’t waiting for the announcement. Agents aren’t waiting. Employees certainly aren’t waiting.

Confidence is the currency of the specification market, and it has evaporated week by week. Even if Cree Lighting announces a restart tomorrow, it’s unclear who will return, who will order, or who will trust them with a major project.

A buyer could still emerge. A refinancing could materialize. But the pattern is no longer ambiguous.

This doesn’t look like a turnaround.

It looks like a teardown.

The kind done in silence.

And in slow motion.