November 7, 2025

U.S. Lighting People Explore Opportunity in Hong Kong

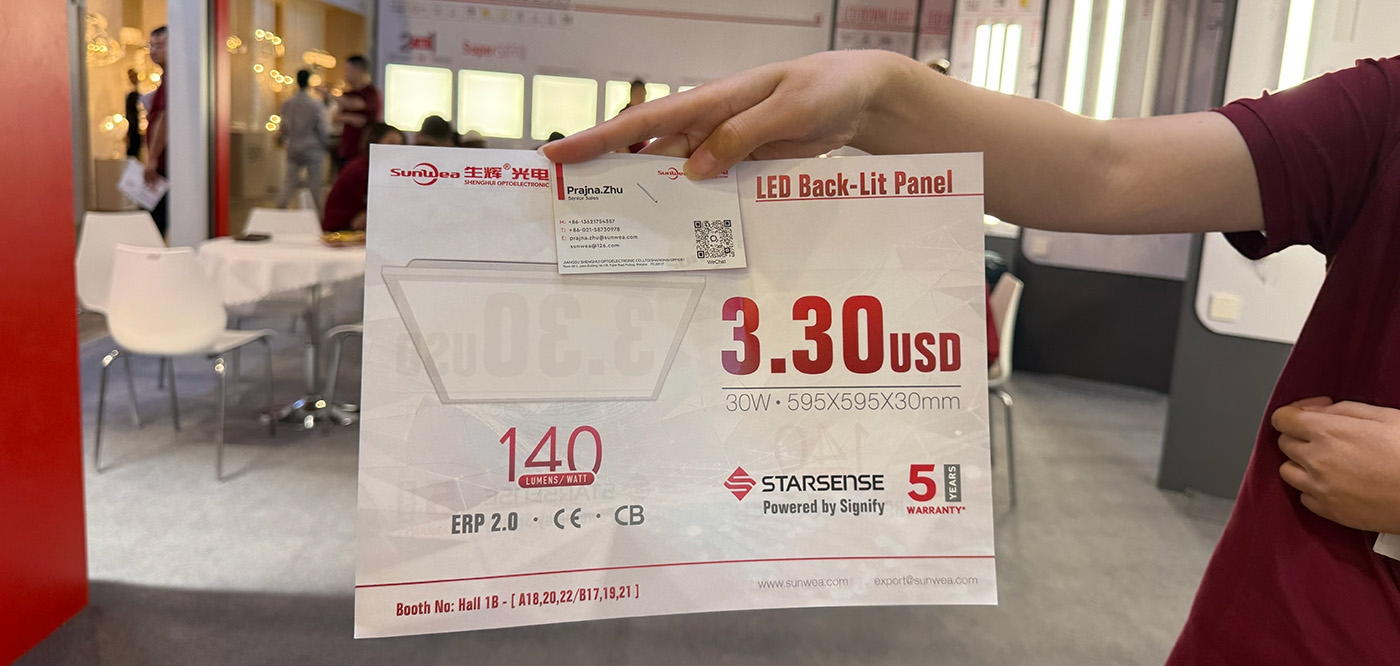

Flat panels for $3.30, persistent salesmanship, and the search for hidden gems in a massive expo

For most North American lighting people, the phrase “trade show” conjures something predictable: a polished exhibit space, several bold architectural fixtures hanging in booths, perhaps a cocktail mixer on the perimeter. What unfolded last week at the Hong Kong Convention and Exhibition Centre was something else entirely — a dizzying, often exhilarating collision of global ambition, low-cost innovation and relentless salesmanship.

The 2025 Hong Kong International Lighting Fair (Autumn Edition), and its sister shows — the Outdoor and Tech Light Expo and Eco Expo Asia — drew nearly 62,000 attendees and more than 3,000 exhibitors. For many U.S. and Canadian visitors, the sheer scale and tone of the event marked a profound shift from their usual circuits. As architectural lighting veteran Scott Hershman put it, “You have to be willing to dig through a lot of dirt to find the diamonds. But it’s worth it.”

Above: Scott Hershman meets with one of 3000 exhibitors at Hong Kong International Lighting Fair

This Isn’t LEDucation or LightFair

What separates the Hong Kong event from a typical North American trade show is more than just its geography. At its core, this is a supply chain expo. Most booths don’t showcase finished luminaires polished for an architect’s eye. Instead, what’s on display are components: light engines, drivers, heat sinks, optics — along with finished goods like wall packs, flat panels, and area lights that North American companies might rebrand as their own. This is an OEM and ODM hunter’s paradise.

To clarify:

- OEM (Original Equipment Manufacturer) produces products to the exact specifications of the buyer’s design.

- ODM (Original Design Manufacturer) designs and builds the product for the buyer to private label.

- OBM (Original Brand Manufacturer) develops, brands, and sells their own products directly.

The nuance matters, especially in the post-tariff era where offshoring isn’t just about production anymore — it’s about leveraging outsourced design services to circumvent cost barriers. That’s one reason why this year’s show featured a heightened focus on ODM capability. As Robert Cirello of SLG Lighting noted, “Offshoring is not exclusive to manufacturing capacity, and tariffs don’t tax services like design or engineering.”

Above: SC Power was one of numerous exhibitors emphasizing manufacturing bases beyond China, a nod to tariff-conscious buyers

Eye-opening Experiences

Shanghai-based SunWea was offering 2x2 LED flat panels “Powered by Signify” for $3.30. The catch? A minimum order of 500 units, and the fixtures lacked certain North American-friendly compliance labels — no UL, no ETL no DLC. Booth staff explained that it was a play mainly aimed at European buyers, but the messaging still landed hard for U.S. visitors. The economics were stunning, even if the product wasn’t viable for the U.S. commercial market.

Encounters like this are common at the Hong Kong show. There’s always something strikingly inexpensive — occasionally impressive, sometimes risky. It reminds attendees just how fast and far the economical lower price thresholds can go.

Roaming the exhibit halls of the fair is not a passive experience. Exhibitors are assertive, even aggressive by Western standards. Walking the aisles often felt like channeling Captain Rex Kramer from Airplane! — maneuvering through the relentless pitches and engaging exhibitors vying for attention.

Bob Ho of ZC Lighting makes an unscheduled appearance in an Inside Lighting Instagram reel

Business cards are pushed into hands. QR codes are waved in front of phones. Badges are scanned unprompted, often with relentless energy. It’s a cultural difference that many Americans find jarring on the first visit — but familiar on the second.

The upside is speed. In a single day, a buyer might interact with dozens of potential suppliers. Sifting through the overload becomes part of the strategy. And for experienced attendees, it quickly becomes clear which booths represent real manufacturing capability — and which are just traders moving catalog stock.

Casambi Flexes Ecosystem Branding

One of the most polished and coordinated presences of a familiar North American brand belonged to Casambi. The Finland-based controls company, which has a deep and growing footprint in U.S. and Canadian markets, set up a multi-booth display. Casambi covered 80+ percent of its booth footprint, but it invited its ecosystem partners to set up small periphery booth vignettes around the outside perimeter of its booth area. US-based CEO Mark McClear was on hand, along with North American GM, Peter Augusta, walking visitors through how Casambi’s brand now travels through its ecosystem.

Dozens of exhibitors at the fair used Casambi signage in their booths in a “Intel inside” sort of way. But in some cases, non-partnered exhibitors displayed the Casambi credential, flexing the association with a known brand which, even unverified, was seemingly enough to attract interest from passing buyers.

McClear’s comment at the show captured the subtle challenge this poses: “Some were not partners… but added the signage because the credential adds value.”

IES Steps Onto the Global Stage

Another notable American presence came from the Illuminating Engineering Society. IES Executive Director and CEO Colleen Harper took the stage in Hong Kong to share the organization’s goals with an international audience — a move consistent with IES’s growing global engagement. Harper continued on to events in mainland China following the show and has become a regular face at Light + Building events in Frankfurt and the Middle East.

Above: Colleen Harper, CEO and Executive Director of the IES addresses a global audience at the Hong Kong International Lighting Fair

While IES remains most relevant in North America, Harper’s presence sent a clear message: the organization is interested in increasing its presence in international standards conversations. And the international lighting world — particularly in Asia — seems increasingly open to that collaboration.

What North Americans Came to Find

Stephen Zhou of mwConnect attended the fair as a speaker, but also spent time meeting with U.S. customers and Asian suppliers. His takeaway was pragmatic: the show floor offered breadth, but the most productive moments came during planned meetings off the floor. Still, the fair served as a “good place to network and meet people face to face in a few short days,” while also noting, "I did not see many innovative products."

Gean Tremaine, CEO of QTL, offered a pragmatic take. “I didn’t see anything revolutionary,” he said, “but there were meaningful improvements in components — light engines, optics, power supplies. Discovering those advancements at the component level often leads to better product development and future innovation.”

Ruby Jadwet of Truly Green Solutions and Brian Stern of Sage Brands also made the trip. Both emphasized the value of maintaining supplier relationships and staying informed on trends that might not be visible from a U.S. desk.

From Commodity to Capability

There was a noticeable shift this year. In past editions, the floor was cluttered with booths showcasing generic A19s and UFO high bays. That noise was significantly reduced in 2025. As Robert Cirello noted, the dramatic decrease in “commodity-focused” booths made it easier to find serious manufacturers. The signal-to-noise ratio, in other words, had improved.

This streamlining is likely tied to tariffs, evolving buyer expectations, and a maturing Asian supply base that’s increasingly positioning itself not just as a factory, but as a design and development partner.

The Hong Kong fair isn’t about glamorous booth design or slick hospitality suites. It’s a blunt-force tool — designed for speed, scale, and efficiency. It’s a place where deals get started, if not always closed. It’s where the questions that shape next year’s product lines begin to form: What’s the MOQ? Can we modify the flange? Can you add a control module? Will it ship in Q1?

And for certain North American lighting brands navigating a volatile global supply chain, the experience, once disorienting, has become essential.