September 17, 2025

Why the LED Supply Chain is About to Get Messy

Efficacy gains that once drove adoption are now meaningless to "good enough" buyers

When we opened the latest LED market report from the Taiwanese research firm TrendForce, we expected dense technical data — and we got it. But after translating pages of Chinese text and digging into over 20 charts, what emerged was one of the clearest and most sobering assessments of the global LED industry in recent memory.

Authored by Wang Fei, Deputy Vice President of Research at TrendForce, the report is titled 《漫谈LED企业的困境与未来》 — loosely translated as A Casual Discussion on the Predicament and Future of LED Enterprises.

Though the analysis focuses primarily on Chinese manufacturers and doesn't seem to pull in specific data from other major LED-producing countries like Japan, South Korea, Vietnam or Taiwan, the findings ripple outward to the broader lighting ecosystem, including in North America. For a region still heavily reliant on Asian-made components, the implications are hard to ignore.

The Rise and Stall of LED Installations

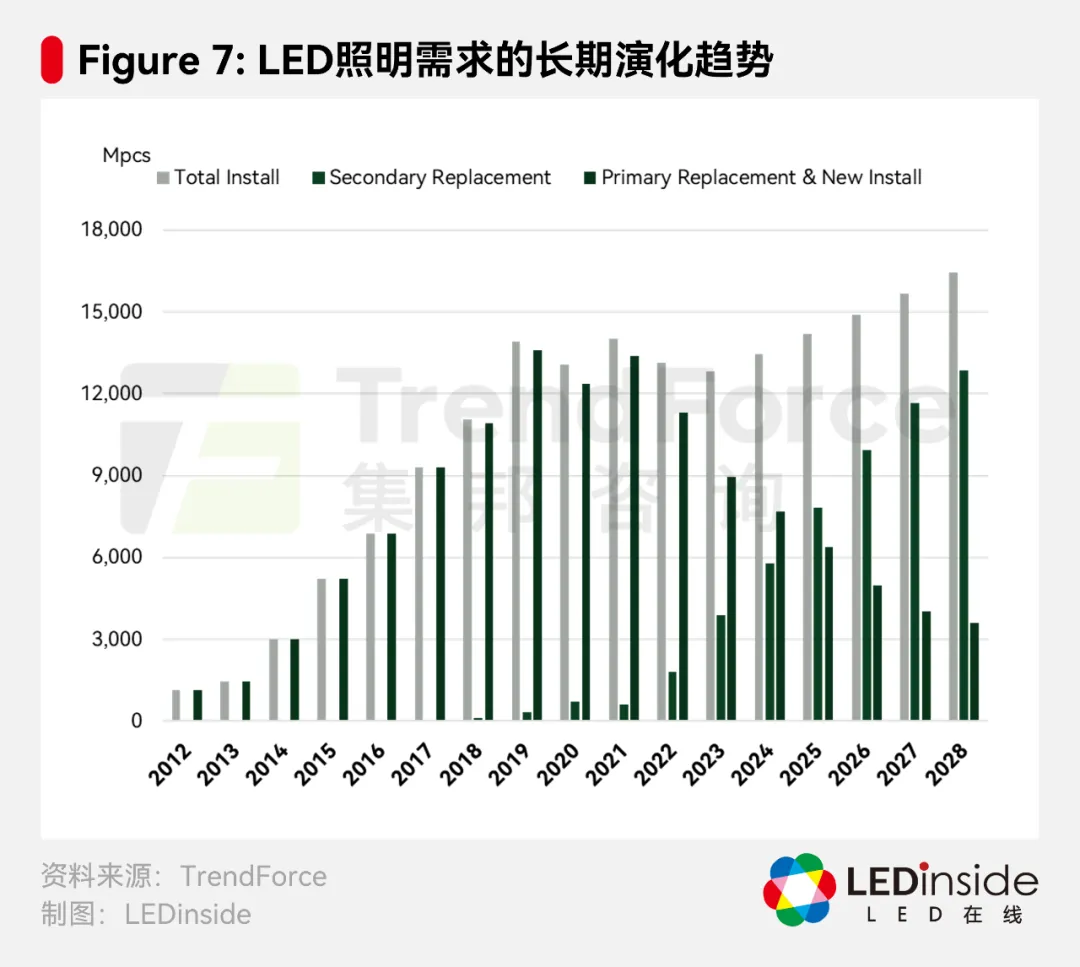

The report’s Figure 7 shows long-term LED lighting demand trends, and the data paints a striking picture: from 2012 through 2018, LED installations surged. But between 2019 and 2024, growth flatlined. The industry had reached a saturation point — most new installations were complete, and new demand was negligible.

Data source: TrendForce, Wang Fei | Graphic: LEDinside

Post-2024, the projected total install curve begins climbing again, but this uptick is driven not by new growth, but by replacement cycles. In other words, the LED industry has shifted from an era of expansion to one of maintenance.

For lighting people in North America, this tracks with anecdotal evidence: longer timelines for relamping projects, slower-moving inventories, and fewer “upgrade” conversations from end users who now consider their lighting good enough.

Fragmentation, Policy Hangovers, and Innovation Fatigue

Wang’s diagnosis of the LED industry is blunt: past glory has not created sustainable prosperity. He calls today’s general lighting market an “involution industry” — a term increasingly used in China to describe economic systems stuck in competitive self-destruction.

Key takeaways include:

- A Fragmented Market with No Profit Cushion

The Herfindahl-Hirschman Index (HHI) for general lighting LEDs sits at 342 — a painfully low number indicating a lack of dominant players. In this environment, no one has pricing power, and margins are paper-thin. - Subsidy-Fueled Overcapacity

Chinese government subsidies for MOCVD equipment (used in LED chip fabrication) led to a gold rush. The result: too many factories, too many products, and too few ways to exit without political cost. These structural problems now weigh down the entire global market. - LED Performance Improvements No Longer Drive Sales

Gains in lumens per watt no longer excite customers. Most commercial buyers consider LED efficacy “good enough.” And since LEDs last years — decades in some cases — replacement cycles are slow and getting slower.

Adding context to these findings, Lawrence Lin, former CEO of LEDVANCE and now, according to his LinkedIn profile, a senior advisor to the Zumtobel Group and IALD, took to LinkedIn and he doesn’t mince words:

“The LED industry is indeed facing a deep structural crisis, not only due to cyclical market fluctuations, but also to the comprehensive challenge of the value creation model. Traditional competitive strategies that rely on cost and scale are no longer sustainable.”

“What is even more alarming is that the negative attitude of leading enterprises and industry organizations is becoming the core pain point… It lacks long-term innovation investment and application guidance, and appears passive in standard, policy, and demand cultivation.”

— Lawrence Lin

Emphasizing Market Consequences, Not Just Company Strategy

While the report maps out four clear strategies among component players — exit, consolidate, optimize, and pivot — the bigger story for the lighting market is what these moves signal: instability in the upstream supply chain. As major players like Samsung and BOE shift focus or bow out entirely, the effects are likely to surface downstream in the form of narrower supplier pools, discontinued SKUs, and longer lead times on once-standard components.

These aren’t hypothetical paths — they’re being walked now. Still, Lin sees a potential turning point:

“The emerging directions represented by smart lighting and health lighting… are gradually forming new value chains and demand scenarios. Combining AIoT, health indicators, and scenario-based solutions, the LED industry still has the opportunity to emerge from ‘silence’ and reconstruct its innovation driver.”

Why It Matters Here

This isn’t just a Chinese market problem. North American lighting professionals live in a global ecosystem, whether they acknowledge it or not. The components behind many domestic luminaires — chips, drivers, phosphors — are still largely sourced from Asia. If upstream manufacturers are struggling or restructuring, those stress fractures will eventually show up in Western supply chains.

Lin offers a final reminder that the future of lighting won’t be won by shaving pennies per fixture:

“Perhaps, the future breakthrough of the LED industry is no longer just a competition between light efficiency and cost, but a return to light itself… to truly release the value of health, wisdom, and sustainable development.”

The TrendForce report is many things: technical, data-rich and at times bleak. But with Lin’s perspective, it becomes clear this isn’t just a market in decline — it’s one awaiting reinvention.