August 7, 2025

Orion Shows Signs of Life Beneath the Struggle

Despite continued losses, operational improvements begin to emerge

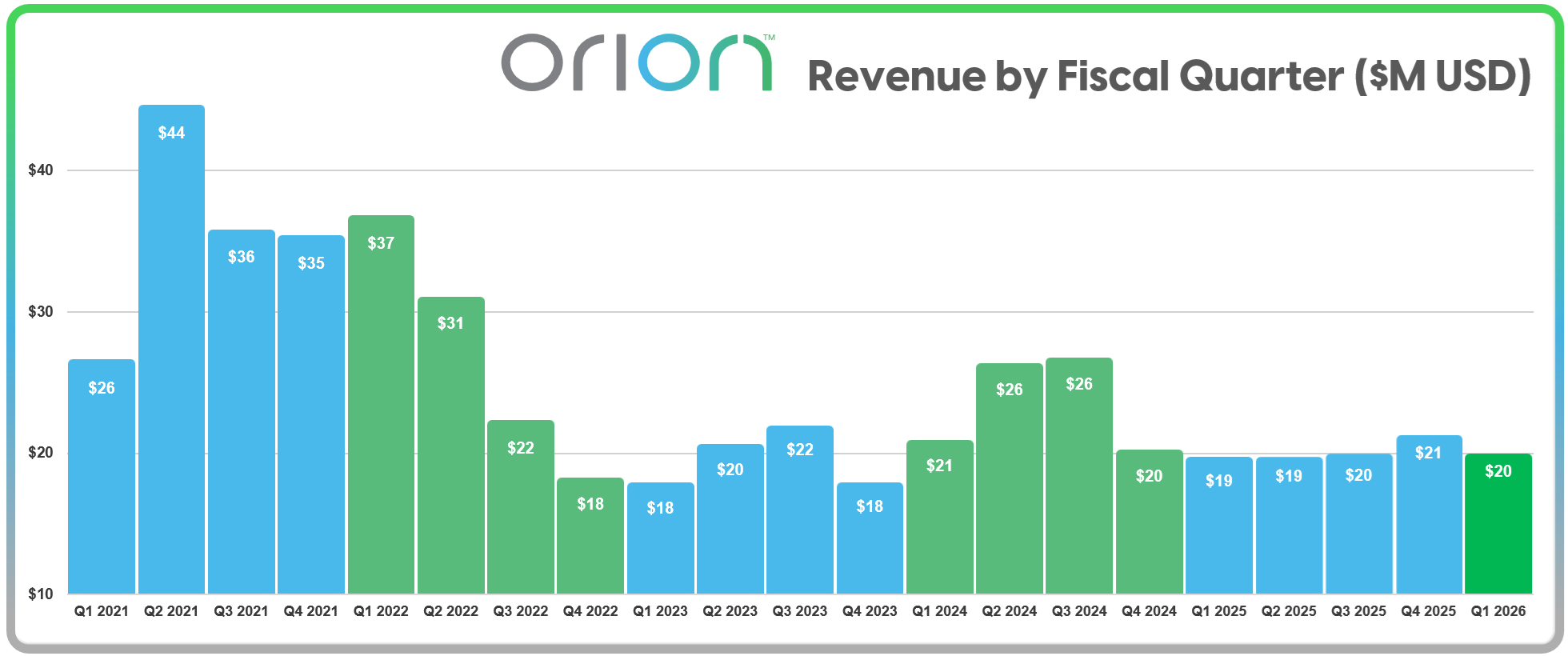

For the last few years, Orion Energy Systems has walked a financial tightrope. Quarterly earnings have brought more red than black, the stock has flirted with delisting, and an acquisition earnout looms like a debt-fueled storm cloud. But in its most recent filings and earnings call, the Wisconsin-based lighting and energy solutions company hinted—just hinted — that it may finally be finding its balance.

In the quarter ending June 30, 2025, Orion posted a net loss of $1.2 million — still a loss, but markedly better than the $3.8 million loss in the same quarter last year. More important, the company logged its third straight quarter of positive adjusted EBITDA, a key metric for cash-conscious investors. Gross margin climbed to 30.1%, the highest in six years.

"Orion's stock popped on that news": The financial analysts at one lighting industry trade mag credited Orion’s 21% one-day stock jump to the announcement of a 90-unit EV charger sale to Boston Public Schools. A charming theory if you ignore the actual earnings report, which showed the company finally stemming losses and improving margins. Investors, unlike headline writers, were likely reacting to the numbers, not a routine press release reframed as market-moving news.

These early signs of stabilization come under the leadership of newly installed CEO Sally Washlow, who took the helm earlier this year. Washlow, a seasoned executive with experience leading through turnaround environments, has emphasized margin discipline, streamlined operations, and a sharper focus on execution—moves that are beginning to show in the numbers.

Revenue Flat, But Business Mix Is Improving

Revenue of $19.6 million came in essentially flat year over year. But beneath that headline, the pieces are shifting. Maintenance services rose 21% to $4 million, and the LED lighting segment saw a modest 1% uptick. EV charging revenue dropped 30%, reflecting the absence of last year’s one-time projects. The company maintains its FY 2026 guidance of 5% revenue growth and potential full-year EBITDA profitability.

In the face of stagnant top-line growth, Orion’s progress has come through aggressive cost-cutting, improved pricing discipline, and operational tightening. Expenses are down, gross margins are up, and the revolving credit facility was trimmed by $1.75 million during the quarter.

Liquidity Remains the Primary Threat

But none of this masks the larger concern: liquidity. Cash is down to $3.6 million. Working capital dropped to $6.1 million. Orion’s financial lifeblood — its Nasdaq listing—is still on life support. If shares don’t close above $1.00 for ten consecutive trading days by September 15, the company faces delisting. That’s why a reverse stock split, already on the ballot for the upcoming shareholder meeting, is no longer a possibility — it’s a near-certainty. On Wednesday, Orion shares closed at $0.69, up from $0.57 the previous day.

And that brings risk. Reverse splits can temporarily boost share price, but they also often trigger volatility or investor flight. If Orion mishandles the messaging—or if the underlying financials don’t improve—this lifeline could bear little fruit.

The EV Cloud Still Looms

Meanwhile, the Voltrek earnout casts a long shadow. Orion still owes millions tied to the 2022 acquisition of the Lawrence, Massachusetts EV charging company, and a portion of that debt will be paid through newly issued shares—diluting existing shareholders at a time when every cent of equity counts.

A recently restructured payout plan includes a $1 million stock issuance and the creation of a subordinated promissory note, raising additional questions about the company’s capital structure if FY 2026 targets aren’t met.

A Narrow Path to Recovery

So where does that leave Orion?

In limbo, but not without hope.

If the company can execute on its current pipeline—including $7 million in new automotive projects and a $12–18 million multi-year retrofit with a building products distributor—it might just bend its trajectory upward. The lighting market isn't offering lifelines, but Orion’s own discipline might be.

In short: the patient isn’t healthy, but it’s showing signs of recovery. And for a company long viewed as a turnaround story, that might finally be more than just talk.