August 14, 2025

Energy Focus Inches Closer to the Brink

Company once again cites “substantial doubt” about its ability to continue

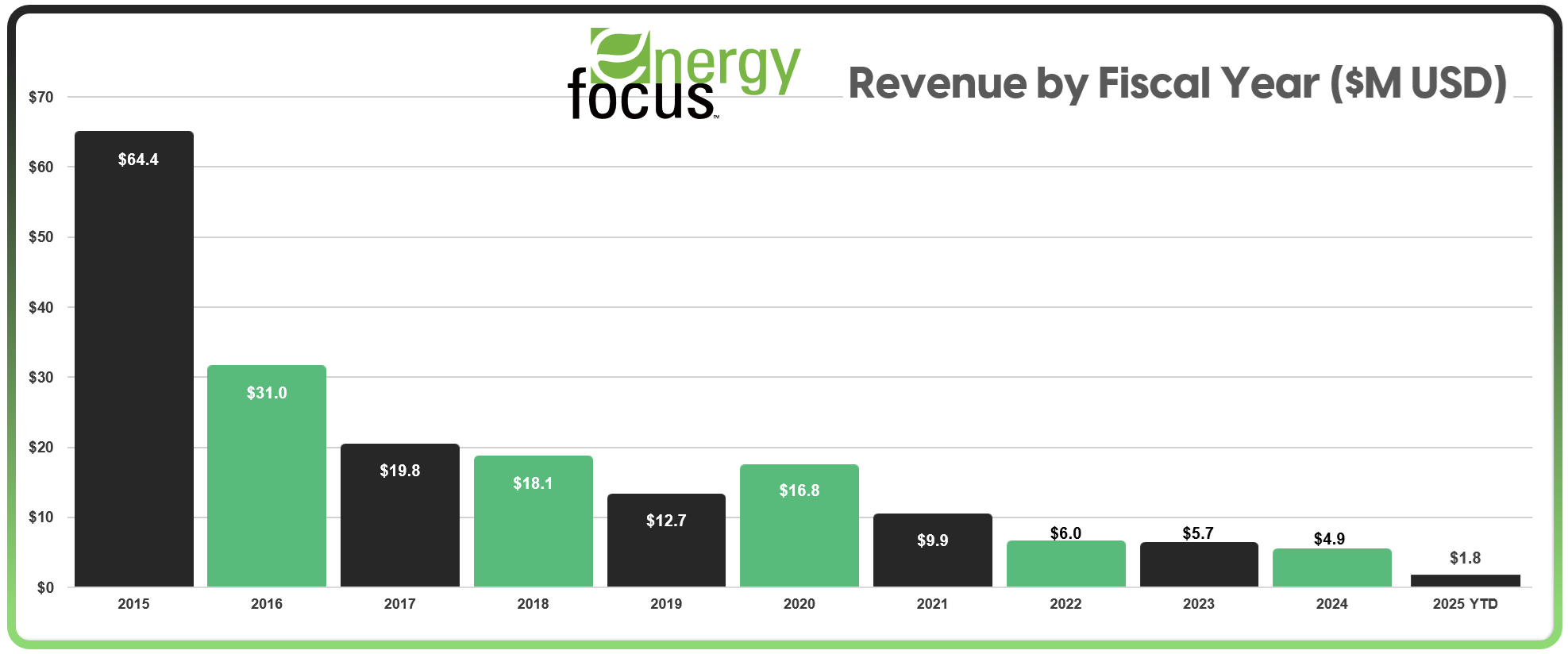

Ten years ago, Energy Focus (Nasdaq: EFOI) stood tall as a promising $64 million lighting maker; an Ohio-based LED company riding high on military contracts and LED adoption. Today, the company’s cash reserves are measured in thousands, not millions. Its revenue for the second quarter of 2025? Just $1.1 million. And its cash on hand? A sobering $499,000.

Yesterday’s freshly filed quarterly earnings don’t break the narrative. They cement it. Energy Focus is not just fighting for relevance. It’s fighting for survival.

A Flash of Commercial Light, But Shadows Persist

The latest filings reveal a brief commercial sales uptick — more than doubling sales from the same quarter last year, driven largely by a one-off high-dollar UPS project in Taiwan. But the company’s once-reliable military segment cratered, down 71% from the same quarter in 2024, battered by federal budget delays and procurement inertia. Gross margins dropped sharply from Q1’s 31.5% to just 12.9%, with low-margin Taiwan work offsetting cost gains elsewhere.

Losses were trimmed. The Q2 net loss came in at $231,000, compared to $554,000 a year ago, but the core business remains fragile. Cumulative losses now top $155 million. And while CEO Jay Huang once again wrote a personal check — this time for $200,000 in June, following a similar outlay in March — it’s hard to read that as anything more than triage.

Cash Drain, Delisting Threats, and the New Frontier

The numbers tell a consistent story: Energy Focus is a company with too little cash, too much inventory and shrinking room to maneuver. In its own words, the 10-Q admits “substantial doubt” about its ability to continue as a going concern. And while the company maintains technical compliance with Nasdaq's $2.5 million minimum stockholders’ equity rule — for now — it makes no assurances that compliance will continue.

What’s left of its war chest is being diverted into big bets: AI-powered UPS systems, energy storage, and microgrid tech. New geographies are also on the radar, particularly the Gulf Cooperation Council and Central Asia. But as we’ve reported throughout 2025, those are capital-intensive plays.

Meanwhile, the 10-Q lists among its risk factors the company’s ability to “attract and retain a new chief financial officer” — a line that reads less like boilerplate and more like a blinking red light when your cash balance is around $500,000. Energy Focus is seemingly trying to leap into the future while wading through quicksand.

The Long Decline

What’s remarkable isn’t that Energy Focus is struggling. It’s how long the company has been navigating this downward slope. For the last several years Energy Focus has been on a slow, grinding descent. Strategic pivots, new product rollouts, and military dependence couldn’t arrest the trend. Now, with sales hovering near the $1 million mark per quarter, the contrast is stark.

Is there a future for Energy Focus as a niche AI-energy player? Possibly. But even the company admits that survival depends on finding fresh capital, retaining investor confidence, and catching a wave in volatile markets. And none of those outcomes are guaranteed.