August 2, 2025

5 Things to Know: August 2

Acuity lays legal groundwork for future financial flexibility. Plus, streetlights get smarter with help from A.I.

Here's a roundup of some of the week's happenings curated to help lighting people stay informed.

1 . Acuity’s Corporate Moves

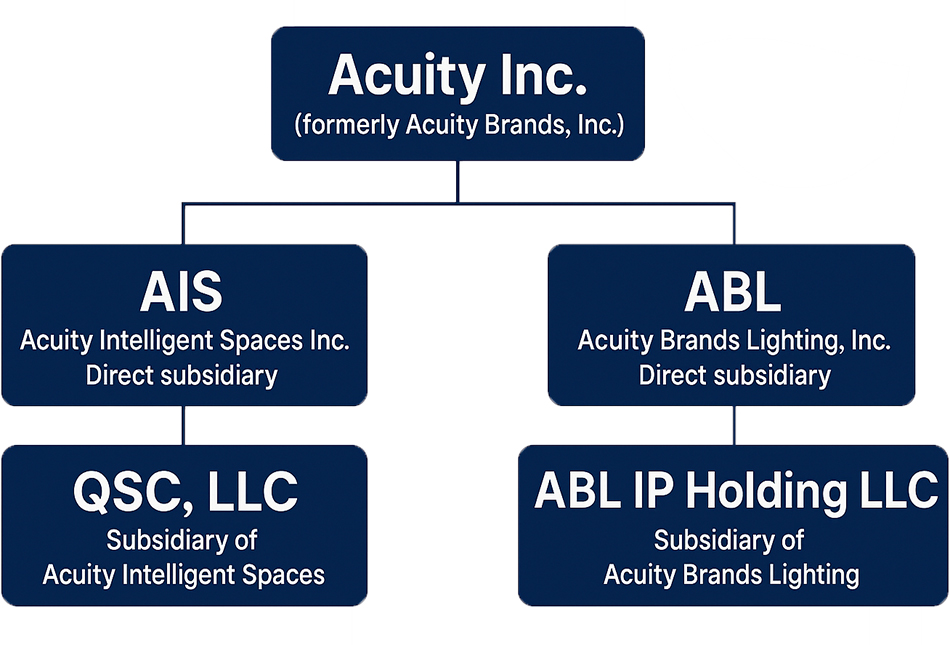

On July 28, Acuity Inc. filed an amendment to its 2023 bond registration — routine paperwork for a “well-known seasoned issuer.” But tucked in the boilerplate was a reconfiguration: the filing officially brought Acuity Intelligent Spaces and its subsidiary QSC, LLC into the fold as co-registrants.

The amendment doesn’t mean bonds are being sold — yet. It simply grants Acuity the legal latitude to issue debt, with guarantees from its layered subsidiaries if needed. In doing so, the company maps its post–Acuity Brands restructuring: from parent (Acuity Inc.) to core lighting unit (Acuity Brands Lighting), to its A/V and smart tech arms.

The amendment doesn’t mean bonds are being sold — yet. It simply grants Acuity the legal latitude to issue debt, with guarantees from its layered subsidiaries if needed. In doing so, the company maps its post–Acuity Brands restructuring: from parent (Acuity Inc.) to core lighting unit (Acuity Brands Lighting), to its A/V and smart tech arms.

There’s no big news here, but there is nuance – a methodical legal step that comes amid a material shift in liquidity. Acuity can now tap debt markets quickly if needed, with multiple subsidiary guarantors providing flexibility.

Acuity’s cash position dropped from $845.8 million at the end of fiscal 2024 to $371.8 million as of May 2025, following its $1.2 billion acquisition of QSC. Bond issuance, while not imminent, could become a lever for future large-scale expenditures — including M&A.

2. Signify Taps Alibaba’s AI to Power Smart Street Lighting

Signify has partnered with Alibaba — China's e-commerce and cloud computing giant — to integrate a generative AI agent into its Interact City Flex connected lighting system, marking a notable advance in its smart city infrastructure. Powered by Alibaba’s Qwen model, the GenAI agent allows cities to control streetlights using natural language, optimize energy use, and identify maintenance issues autonomously.

The collaboration simplifies operations through conversational commands while enabling proactive energy savings. “By making use of Alibaba's Qwen model in our GenAI Agent, we're empowering cities to proactively reduce energy consumption and lower operational costs,” said Hans Nikol, Head of Open Innovation at Signify.

The announcement was reported by IT Brief Asia on July 28, 2025.

3. Yellow's Bankruptcy Blitz Hits Cooper & HVLG

In a burst of post-bankruptcy legal action, the logistics company Yellow filed 87 adversary complaints this past week, targeting dozens of suppliers for alleged preferential payments (payments made less than 90 days before bankruptcy filing.) Among them: Cooper Lighting and Hudson Valley Lighting Group. Each faces clawback demands for payments received during the company’s final, frantic months.

What exactly these lighting companies provided to Yellow, however, remains murky. The complaints lean heavily on formulaic, vague language, leaving even the nature of the services in question. Cooper Lighting was described merely as a vendor “that manufactured and distributed commercial lighting fixtures and systems to or for the Debtors.” Hudson Valley Lighting received a similar treatment, labeled a vendor “that manufactured lighting products to or for the Debtors.”

Yellow now seeks to claw back $33,471 from Cooper Lighting and $74,679 from Hudson Valley Lighting. Yet whether those payments were truly “preferential” or simply part of a routine commercial relationship remains unresolved. For now, Yellow’s lawyers seem more certain about the shape of the clawback strategy than the lighting that once powered its operations.

4. Tracking France’s Midnight Blackouts, One City at a Time

A decade-long study published by Cerema has mapped the transformation of public lighting across 19,262 French municipalities, revealing a national shift toward nighttime darkness. Using NASA’s VIIRS satellite data, researchers found that by 2024, over 11,900 towns had adopted full streetlight shutdowns between midnight and dawn — many triggered by the 2022 energy crisis.

A decade-long study published by Cerema has mapped the transformation of public lighting across 19,262 French municipalities, revealing a national shift toward nighttime darkness. https://t.co/8jjgmUjhPe

— Inside Lighting (@InsLighting) August 1, 2025

The report highlights the trade-offs: energy savings, reduced carbon emissions, and quieter nights for wildlife, but also technical hurdles and uneven impacts on biodiversity. While some species benefit from the darkness, others lose feeding grounds lit by lamp posts. Astronomers gain, ecosystems shift, and local politics increasingly shape how the night is managed.

Though the data remains imperfect, the project offers a rare, time-lapse view of energy sobriety in action — where urban planning, climate strategy, and ecology converge under cover of night.

5. More Pressure on China Factories

Not directly tied to lighting, but a rare piece of frontline reporting from a major U.S. outlet sheds light on the unraveling of China’s manufacturing core.

In a searing report from Guangzhou, The New York Times details the quiet collapse of China’s light-industry backbone — its garment workshops — under the weight of Trump-era tariffs and rising domestic expectations.

The tariffs are steep, but they’re not the only force hollowing out these factory floors. Orders have evaporated. Air-conditioning, once unthinkable, is now expected. Younger workers want higher wages — or skip factory life altogether. Veteran managers, like pajama-maker Li Aoran, are cutting payrolls, slashing shirt prices, and praying for stabilization.

While Shein and Temu once fed these streets with orders bound for American homes, thousands of workshops now sit idle, their lights out, “for sale” signs blooming across facades. The labor pool is shrinking, the workforce aging, and China is tilting toward solar panels and semiconductors. For many in Guangzhou, the sewing machine’s hum has faded into a desperate hope: that geopolitics might pause long enough to bring back the work.