April 3, 2025

Acuity Holds Steady Amid Tariff Turbulence and Price Shifts

CEO Neil Ashe highlights strategic pricing moves and tariff headwinds

For Acuity, the second quarter of fiscal 2025 was less about disruption than it was about managing the practical mechanics of scale: integrating a $1.2 billion acquisition, navigating a newly volatile tariff environment, and explaining a pricing strategy that is increasingly nuanced — and increasingly necessary.

The company reported second quarter net sales of $1.01 billion, up 11.1% from the prior year. That figure includes two months of contribution from QSC, the AV control systems company Acuity acquired in January. Without QSC’s $95.1 million in revenue, core sales would have been effectively flat.

Acuity's longstanding lighting & controls division, ABL, posted a modest 0.3% revenue decline to $840.6 million. Then again, last year came with a bonus day: February 29th. So we can probably call it a wash.

Most major channels — retail, corporate accounts, and OEM — were down year-over-year. But the spotlight has clearly shifted elsewhere. AIS, the rebranded Intelligent Spaces segment, now accounts for 17% of the business, up from roughly 6-8% in recent years.

That change is intentional. As CEO Neil Ashe put it during today's earnings call, “the whole company is basically a data and controls company with a luminaire business, as opposed to a luminaire business with a small electronics business.”

Margins: Up on Adjusted Basis, But GAAP Tells Another Story

Adjusted operating profit rose 16.3% to $162.9 million, with margin expansion to 16.2%. Diluted adjusted EPS climbed to $3.73, up 10.4%. But the GAAP results were less flattering: operating profit fell 6.7%, and GAAP EPS dropped 13.7%, reflecting $52.7 million in acquisition-related charges, amortization, and inventory revaluations.

The QSC acquisition explains much of that friction. AIS revenue surged 152% year-over-year, but adjusted margins in the segment fell 230 basis points to 18.7%. Integration costs and initial inefficiencies were expected. Ashe reiterated the company’s guidance originally updated in Q1 to reflect QSC’s addition.

| $ millions USD | Three Months Ended | Six Months Ended | ||

| February 28, 2025 | February 29, 2024 | February 28, 2025 | February 29, 2024 | |

| Acuity Brands Lighting: | ||||

| Independent sales network | $ 615.2 | $ 612.3 | $ 1,259.1 | $ 1,237.5 |

| Direct sales network | 97.4 | 93.0 | 204.6 | 190.4 |

| Retail sales | 41.0 | 46.4 | 85.9 | 102.0 |

| Corporate accounts | 35.6 | 38.1 | 68.3 | 79.6 |

| OEM and other | 51.4 | 53.7 | 108.7 | 110.4 |

| Total Acuity Brands Lighting (ABL) | 840.6 | 843.5 | 1,726.6 | 1,719.9 |

| Total Acuity Intelligent Spaces (AIS) | 171.5 | 68.1 | 245.0 | 132.3 |

| Eliminations | (5.8) | (5.7) | (13.7) | (11.6) |

| Total | $ 1,006.3 | $ 905.9 | $ 1,957.9 | $ 1,840.6 |

Tariffs & Price Increases

Tariffs were a central topic on the earnings call — and a fresh source of cash flow pressure. Acuity states that 18% of its sourcing comes from Asia (including China and Cambodia), while about 50% comes from Mexico, most of which is USMCA-compliant and exempt from current tarrifs. The company emphasized its nimble and diversified global supply chain, but noted near-term financial impacts.

“There is obviously uncertainty in the industry,” Ashe said, adding that the company began to “see the impact of that uncertainty” during the quarter as it rolled out pricing increases. Tariffs, he explained, are payable within 30 days — well before customers settle their invoices — leading to short-term strain on working capital.

The response? Strategic pricing. “We will be taking pricing actions,” Ashe said. While the actual percentage increase was not disclosed (“we're not going to share that because of competitive reasons”), he described the recent increase as “lower, middle, single digits.” He later clarified that Acuity would not absorb tariff impacts: “If there's $100 of impact, we will pass on at least $100 of price.”

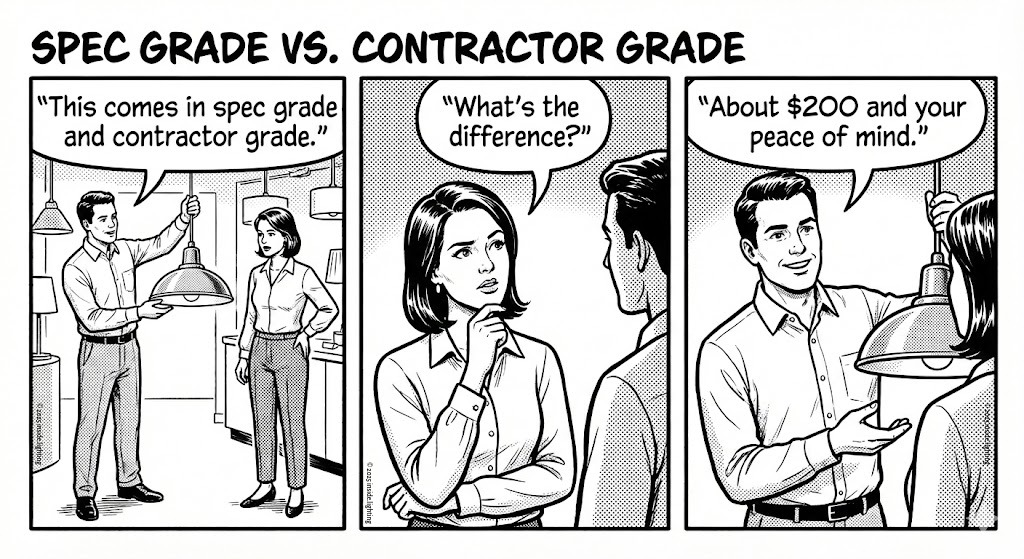

There is, however, a built-in delay. The company described a 30 to 90 day lag before price increases show up in earnings, depending on the channel and product category. Ashe outlined distinct pricing strategies for three areas: Contractor Select, Design Select, and made-to-order products.

One anecdote captured the current pricing environment: “We were speaking to one of the major distributors yesterday, and they were sharing with us that they had 120 different price increase letters that they were processing currently.” Ashe noted.

ABL Flat, AIS Repositioned, and the Bigger Bet on Vertical Integration

The flat performance in the lighting & controls business, ABL, masked mixed results within the segment. Revenue was up slightly in the independent agent and direct sales networks, but down sharply in retail (–11.6%) and corporate accounts (–6.6%). Despite that, ABL’s adjusted operating margin improved 60 basis points to 16.8%.

AIS, powered by QSC, Distech and Atrius, recorded $171.5 million in sales. Even with added scale, profitability slipped. Adjusted margin fell from 21.0% last year to 18.7%, a sign that integration work is still in early stages. Still, the company is betting heavily on this side of the business. Alongside QSC’s AV control stack, Acuity highlighted the strength of its portfolio — “from the driver to the sensor to the control to the software, and then with Atrius data lab to the cloud” — as a long-term differentiator.

M&A Outlook: No Pause, But No Repeat of QSC (Yet)

Asked about the company’s M&A pipeline, Ashe said financial capacity is not a limiting factor. But he signaled that while smaller bolt-ons remain possible, there’s nothing of QSC’s scale on the near-term horizon. “Not in the next 6 to 12 months,” he said, though he left open the door for larger acquisitions down the line.

The company is clearly leaning into infrastructure and integration — not just new lighting SKUs. Product mentions during the call were brief: the Gotham IVO deep regress downlight, Gotham IVO cylinder, Aculux precision spot, and the integration of QSC into the broader offering. Distech’s international expansion also earned a mention, with new systems integrator capacity added in the UK and Asia.

A Company in Motion

On the surface, Acuity’s quarter reads as steady — flat core sales, rising adjusted margins, no major surprises. But peel it back, and what emerges is a company quietly reengineering itself under pressure: from tariffs, from integration drag, from the awkward math of passing costs downstream in a delayed pricing cycle. The tone is calm. The work is anything but.