January 23, 2025

LSI Reports Strong Quarter, Lighting Segment Lags

As Display division surges, Lighting is now 41% of LSI’s overall business.

LSI Industries Inc. (NASDAQ: LYTS) reported a 36% increase in net sales to $147.7 million for its fiscal second quarter ended December 31, 2024, though net income declined slightly from the year-ago period.

The lighting and display solutions manufacturer saw organic sales growth of 14% excluding contributions from its EMI acquisition completed in April 2024. Net income was $5.6 million, or $0.18 per diluted share, compared to $5.9 million, or $0.20 per diluted share, in the prior year quarter.

The company's Display Solutions segment drove growth with sales surging 103% to $89.5 million, including $23.4 million from the EMI acquisition. Organic sales in this segment grew 50%, powered by increased demand across product categories and vertical markets. The grocery vertical saw sales rise over 50% as industry consolidation uncertainty eased.

In early trading this morning, LSI's stock price surged to $23.38, and 18% increase from yesterday's closing price of $19.78.

LSI is still a major lighting company, but…

LSI Industries has undergone a significant transformation in its business mix over the past five years. While the Lighting Segment dominated with two-thirds of the business in 2020, Display Solutions has now emerged as the company's primary revenue driver, representing 61% of total business in the first half of fiscal year 2025.

This shift reflects both organic growth and strategic acquisitions, particularly the acquisitions of JSI Store Fixtures in 2021 and EMI in 2024. The evolution is evident in the most recent fiscal year 2024 numbers, where Lighting represented 56% of net sales and Display Solutions accounted for 44%. Despite this realignment, the two segments maintain strong operational synergies, with the display and lighting businesses remaining closely intertwined.

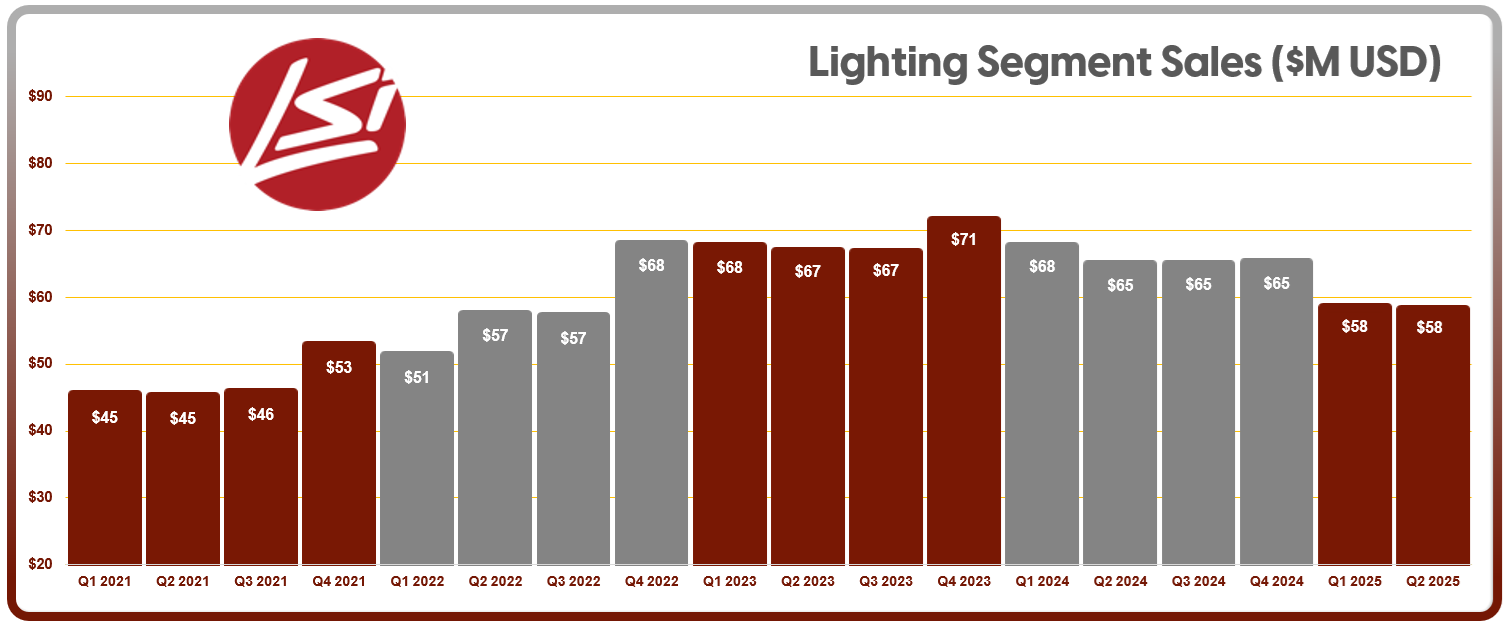

Lighting Segment Performance

LSI's Lighting segment faced headwinds in fiscal Q2 2025, with sales declining 10% to $58.2 million compared to $64.8 million in the prior year period.

The decrease primarily stemmed from reduced large project activity, particularly when compared to the previous year's significant installations, including a major EV battery plant complex project. While small project activity remained healthy during the quarter, it wasn't sufficient to offset the decline in large-scale installations.

Despite current challenges, indicators suggest potential improvement ahead. "Lighting segment project quote activity remains above prior-year levels, contributing to a segment book-to-bill of 1.1 exiting the second quarter which, on a historical basis, is elevated entering a seasonally slower period for our construction markets," said Jim Clark, President and CEO of LSI Industries.

The segment's backlog grew 6% year-over-year entering Q3, with management expecting order rates to accelerate in the second half of fiscal 2025. The company continues to focus on innovation, launching multiple commercial programs during the quarter to accelerate adoption of recent product introductions, including the V-LOCITY series of outdoor area lights, new continuous indoor Linear fixtures, and Zone High Bay for sports court applications.

Financial Position Remains Strong

LSI generated free cash flow of $8.8 million in the quarter and reduced its ratio of net debt to trailing twelve-month adjusted EBITDA to 0.6x, down from 1.3x at the time of the EMI acquisition. The company maintained $67 million in cash and credit facility availability at quarter end.

The board declared a quarterly cash dividend of $0.05 per share, payable February 11, 2025, maintaining its annual dividend rate of $0.20 per share.

Key Financial Metrics at a Glance:

- Q2 adjusted net income: $8.0 million ($0.26 per share) vs. $7.2 million ($0.24 per share) year-over-year

- Adjusted EBITDA: $13.3 million (9.0% of net sales)

- Working capital: $84.9 million, including $4.7 million in cash