July 25, 2024

Electric Avenue — News Impacting Lighting Markets: July 2024

A flurry of electrical distributor acquisitions. Plus, rising costs show some early signs of retreating.

Welcome to Electric Avenue, where each month we explore the intersections between the electrical industry and our beloved lighting industry.

With a focus on news, trends, and economic factors shaping the landscape of electrical distribution, construction, contracting, and manufacturing, Electric Avenue is your resource for staying informed of some of the more notable electrical industry events that may impact North American lighting markets.

Each month, Electric Avenue delivers important news on macro market conditions and changing business dynamics affecting commercial lighting projects and general lighting "stock & flow" distribution across North America. Stay tuned for wide-spanning coverage of distributor acquisitions, electrical agent news, economic trends, and more, as we illuminate the path forward in the intersecting fields of electrical and lighting.

Here's what's happening since our last Electric Avenue digest was published on June 19:

Electrical Distributor News

Sonepar Enters Agreement to Acquire Echo Electric Supply Company

Yesterday, Sonepar announced an agreement to acquire Echo Electric Supply Company, a Council Bluffs, Iowa-based distributor ranked among the top 30 of Electrical Wholesaling’s 2024 largest North American electrical distributors. Echo Electric operates 23 branches across Iowa, Nebraska, Minnesota, South Dakota, and Missouri, with over 600 employees.

This acquisition marks Sonepar’s seventh Midwest purchase in three years, adding to its portfolio alongside Springfield Electric, Richards Electric, Pepco, Holt, Sunrise Electric, and Standard and Madison. Terms of the deal were not disclosed. Echo Electric’s leadership structure post-acquisition was not detailed. The acquisition is expected to close by the end of August, pending regulatory approval.

Mayer Acquires Electrical Supplies, Inc.

Mayer, a subsidiary of Rexel USA, has announced the acquisition of Electrical Supplies, Inc., a Miami-based electrical distributor. This acquisition, detailed in a press release by Rexel USA, extends Mayer's footprint into Southeast Florida, enhancing its service offerings to contractors and customers in the region.

Founded in 1976, Electrical Supplies, Inc. operates branches in Pompano Beach, Miami, and Homestead. The company has built a strong reputation under the leadership of Jim Segal, John Hinds, and Bob Devona. The terms of the acquisition were not disclosed. Mayer plans to integrate Electrical Supplies, Inc. into its brand, leveraging the combined expertise and capabilities to drive growth in the dynamic Southeastern Florida market.

Sonepar to Acquire Robertson Electric Wholesale

Sonepar announced on July 3, 2024, that it has entered into an agreement to acquire Robertson Electric Wholesale. Robertson, founded in 1952 and headquartered in Vaughan, Ontario, operates 19 branches across Canada and employs over 400 associates.

The terms of the deal were not disclosed. Sonepar, headquartered in Brampton, anticipates the acquisition will close within the next two months, pending regulatory approval. Both companies will continue to operate independently until then. Sonepar plans to maintain Robertson's leadership team to ensure continuity and leverage their customer-centric model for future growth.

EECOL Electric, Wholly-Owned Subsidiary of Wesco International, Acquires Independent Electric Supply

EECOL Electric, a leading electrical distributor and wholly-owned subsidiary of Wesco International (NYSE: WCC), announced that it has acquired Independent Electric Supply of Toronto. Independent Electric Supply has been serving customers in the Toronto area since 1921 and employs 40 team members.

EECOL Electric operates 64 locations across Canada and has a history of serving customers for 105 years. The company provides a wide range of high-quality electrical products to various sectors, including industrial, oil and gas, manufacturing, government, mining, utility, commercial, and residential construction.

Following the acquisition, Independent Electric Supply will continue its operations under its current leadership, aligning with EECOL’s customer-first focus. The acquisition enhances EECOL's presence in the Toronto market, allowing for a broader range of services and products for customers in the region.

Winsupply Acquires Forge Polyfab

Winsupply announced the acquisition of Forge Polyfab on June 21, 2024. Winsupply, headquartered in Dayton, Ohio, reported $5.5 billion in annual revenue and operates over 600 locations nationwide, employing more than 7,000 people.

Established in 2020, Forge Polyfab specializes in HDPE fabricated products, focusing on producing PE fittings for HDPE infrastructure. Headquartered in the Dallas-Fort Worth metroplex, Forge Polyfab utilizes advanced equipment and certified fabricators to ensure product quality. The terms of the acquisition were not disclosed.

Forge Polyfab will continue to operate under its current leadership, maintaining its commitment to high industry standards and efficient nationwide service.

IMARK Electrical and AD Merger Approved by Shareholders

IMARK Electrical announced that its shareholders have overwhelmingly approved the previously announced merger with AD. This decision was made during a special meeting of shareholders, with the merger initially proposed in early June. The transaction is expected to close later this year, pending customary closing conditions.

The merger combines two member-owned groups, creating a new division within AD called The Independent Electrical Supply Division, U.S. (IESD). This new entity will encompass 725 independently owned electrical distributors across the U.S. and will be part of AD’s larger community, which includes 1,410 independents across various construction and industrial verticals in the U.S., Canada, and Mexico. IMARK Electrical’s current leadership team will remain in place, and both organizations anticipate significant benefits for their members and suppliers.

Capital Electric Gains Approval for Warehouse Expansion

The Washington (D.C.) Business Journal reports that Capital Electric received approval from the Prince George’s County Planning Board to expand its warehouse-and-office headquarters in Upper Marlboro, Maryland by 162,000 square feet. This expansion, a 45% increase, will add light industrial warehouse space to the existing 363,000-square-foot facility. Capital Electric, a subsidiary of Sonepar, moved into the new location in January 2023, after relocating from a nearby site. The expanded facility will continue to serve as the company's headquarters and central distribution center for over 50 branches across several states.

Graybar Among Selling Power's 60 Best Companies to Sell For in 2024

Selling Power has named Graybar as one of the 60 Best Companies to Sell For in the United States for 2024. The list, now in its 24th year, evaluates companies of various sizes based on a range of criteria, including compensation, benefits, incentive programs, sales-rep hiring and onboarding, sales training, sales enablement, diversity, equity, and inclusion (DEI), and AI implementation. The rankings also consider the impact of current economic conditions on sales organizations.

The selection process, which includes a comprehensive application and proprietary scoring systems, ensures objectivity and confidentiality. This year's list presents the final companies in alphabetical order due to close scoring. Graybar's inclusion highlights its robust sales organization and supportive environment for salespeople, reflecting its strong performance across core measurables and additional criteria. The full list is available on Selling Power's website.

Sonepar USA Receives DAV Patriot Employer Special Recognition

Sonepar USA has been honored with the 2024 DAV (Disabled American Veterans) Patriot Employer Special Recognition for Excellence in Veteran Hiring. This award acknowledges Sonepar USA's dedication to supporting disabled American veterans through career-development opportunities.

The DAV Patriot Employer Program honors employers committed to ensuring veterans obtain suitable employment, enabling them to care for their families and live with respect and dignity. For more information on Sonepar's career opportunities for veterans, reservists, and military spouses, visit the link in their Instagram bio. Learn more about DAV's mission at dav.org.

What We are Reading

Cupertino Acquired in Staggering $1.5 Billion Deal

We normally don't report on contractor acquisitions, but an acquisition of one of the largest electrical contractors in the US is not a common occurrence.

Quanta Services, Inc. announced its acquisition of Cupertino Electric, Inc., a leading electrical infrastructure solutions provider, headquartered in San Jose, California. Founded in 1954, CEI offers integrated solutions in engineering, procurement, project management, construction, and modularization services across the United States. With a workforce of approximately 4,300 employees, CEI is the sixth-largest electrical solutions provider in the country and has established a significant presence in the technology, renewable energy, and infrastructure sectors.

CEI's 70-year history includes extensive work with global leaders in the technology and data center industries, and it is a leading renewable infrastructure solutions provider. CEI's management team will remain in place, with Tom Schott continuing as President and CEO. The transaction, valued at approximately $1.5 billion, is expected to significantly enhance Quanta's service offerings and market reach, particularly in the data center and renewable energy sectors.

For The Second Straight Month, Construction Materials Prices Dip Again

Construction input prices fell 0.3% in June, with nonresidential construction input prices declining 0.4%, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics data. Despite the monthly dip, overall construction input prices are up 1.1% from a year ago.

Notably, natural gas prices surged 36.3%, while crude petroleum prices slightly decreased by 0.2%. ABC Chief Economist Anirban Basu attributed the price decline to reduced demand in various construction segments, warning that ongoing inflation concerns could delay interest rate cuts, negatively impacting the construction industry's outlook.

The Case for a Career in Skilled Trades

As manufacturers and construction companies struggle to find large pools of qualified trade workers, Darnell Epps, a recent Yale Law School graduate, shared his transformative experience simultaneously attending Lincoln Technical Institute and Yale Law School. He chose to pair his Doctor of Law degree with a diploma in manufacturing technology and machining to address the skilled labor shortage in the U.S.

Detailing his journey in a recent Washington Post editorial, Epps noted the high demand for manufacturing jobs, with over 12 million positions offering an average annual compensation of $85,000. However, he was struck by the lack of awareness and interest in these careers. At Lincoln Tech, Epps encountered a stark contrast between the number of law students at Yale and the few machinists in training, highlighting the imbalance in career pursuits.

Epps' journey emphasizes the untapped potential of skilled trades in America's economy. He advocates for reshaping the narrative around these essential careers and fostering a cultural appreciation for machinists, welders, and other tradespeople. Epps plans to build a software-driven recruitment company to help people find careers in advanced industry while preparing to take the New York bar exam in 2025.

Construction Boom Tracker

Spending in the manufacturing sector has ballooned since the CHIPS Act was signed into law in August 2022, with projects ranging from chip fabrication and electric vehicle battery plants to consumer goods and car manufacturing. Over $898 billion in private investments have been made, including major projects like NorSun’s $620 million plant in Tulsa, Oklahoma, Philip Morris International’s $600 million facility in Aurora, Colorado, and Kyowa Kirin’s $530 million manufacturing plant in Sanford, North Carolina.

Notable contractor wins include Harvey-Cleary Builders for ABB’s $40 million facility in Albuquerque, New Mexico, and BE&K Building Group for Novo Nordisk’s $4.1 billion healthcare center in Clayton, North Carolina. Since the CHIPS Act, manufacturing construction spending increased 20.3% through May, with a seasonally adjusted annual rate of approximately $234.13 billion.

Economic Factors

Construction Backlog Indicator Rises to 8.4 Months

Associated Builders and Contractors reported that its Construction Backlog Indicator increased to 8.4 months in June, based on a survey conducted from June 20 to July 3. While the backlog has decreased by 0.5 months from June 2023, this decline is solely attributed to the Middle States and Northeast, with the South and West remaining unchanged.

Above: Construction Backlog data, courtesy of Associated Builders and Contractors

Despite slight declines in sales and staffing confidence, profit margin expectations improved, with all three components of the Construction Confidence Index still indicating growth. "Backlog continues to hold up remarkably well despite high interest rates, inflation, and emerging weakness in the broader economy," said ABC Chief Economist Anirban Basu, who anticipates that potential interest rate reductions by the Federal Reserve could further support backlog in softer construction segments like office and commercial.

Nonresidential Construction Spending Dips

National nonresidential construction spending decreased by 0.1% in May, totaling $1.21 trillion annually, according to an Associated Builders and Contractors analysis of U.S. Census Bureau data. Spending fell in nine of the 16 nonresidential subcategories, with private nonresidential spending down 0.3% and public nonresidential construction up 0.4%. “Nonresidential construction spending has fallen for two consecutive months yet remains just 0.2% below the all-time high achieved in March 2024,” said ABC Chief Economist Anirban Basu.

Copper

Copper prices surged above $5.00 per pound in May but have recently retreated to slightly lower, yet still historically high, levels.

Global Container Freight Rates

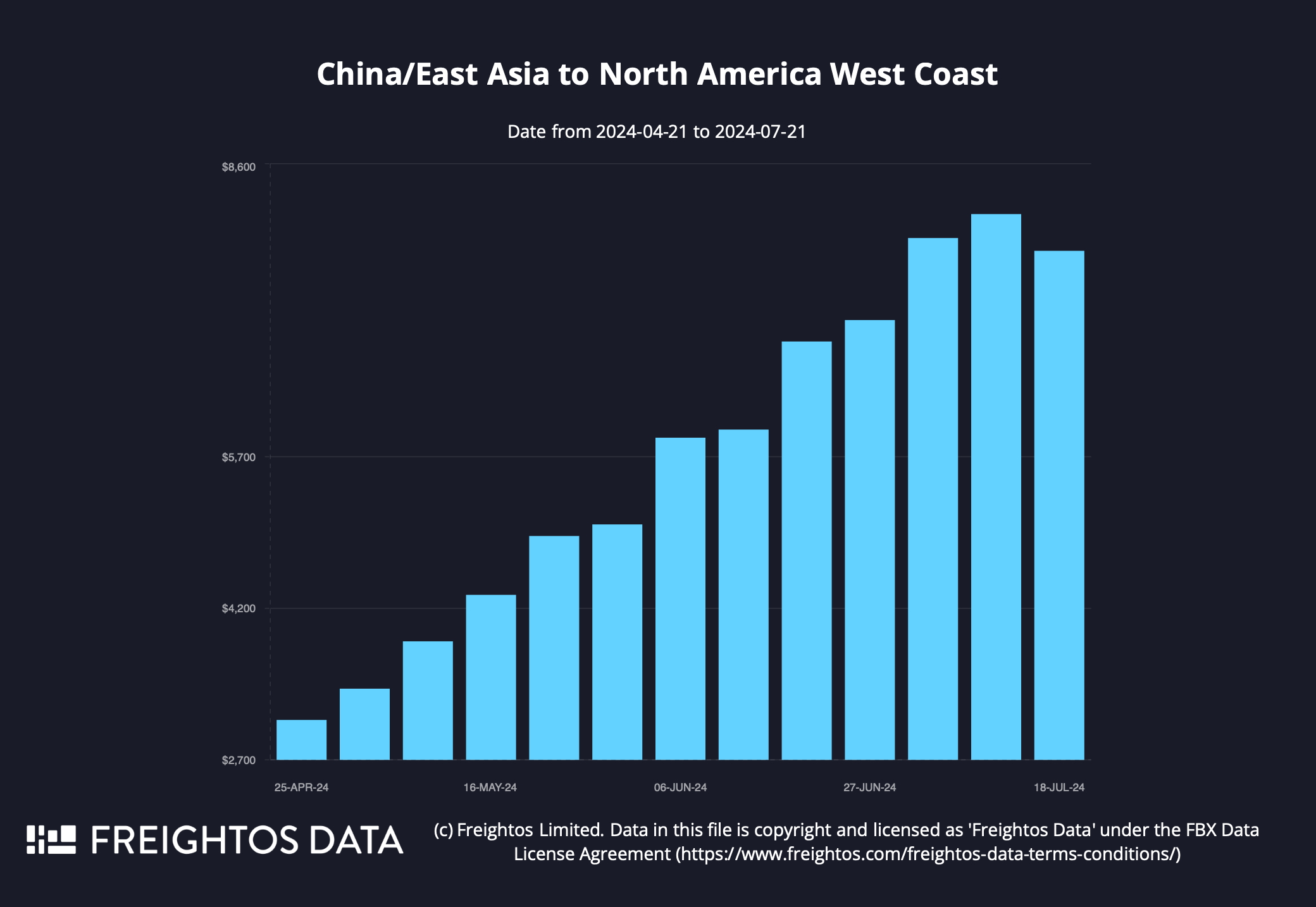

Above: 90-day container rates from China to West Coast USA. Image: Courtesy of Freightos, used under license

The FBX01 global ocean freight container pricing index tracks the cost of shipping 40-foot containers between major ports in China and East Asia and the West Coast of North America. This index, developed in partnership with the Baltic Exchange, includes key Chinese ports like Shanghai (PVG) and Ningbo (NGB), and U.S. ports such as Los Angeles (LAX) and Chicago (ORD).

This trade route is a vital artery for global commerce, facilitating the movement of billions of dollars' worth of goods across the Pacific. Commonly shipped items on this route include electronics, clothing, furniture, toys, and machinery.