June 19, 2024

Electric Avenue — News Impacting Lighting Markets: June 2024

Niche distributor acquisitions. Plus, stakeholders react to AD - IMARK Electrical merger.

Welcome to Electric Avenue, where each month we explore the intersections between the electrical industry and our beloved lighting industry.

With a focus on news, trends, and economic factors shaping the landscape of electrical distribution, construction, contracting, and manufacturing, Electric Avenue is your resource for staying informed of some of the more notable electrical industry events that may impact North American lighting markets.

Each month, Electric Avenue delivers important news on macro market conditions and changing business dynamics affecting commercial lighting projects and general lighting "stock & flow" distribution across North America. Stay tuned for wide-spanning coverage of distributor acquisitions, electrical agent news, economic trends, and more, as we illuminate the path forward in the intersecting fields of electrical and lighting.

Distributor News

It’s been only three weeks since our last Electric Avenue feature. While there has been some M&A activity, most moves have been niche strategy plays. Moving forward, we aim to publish Electric Avenue on a 30-day cadence, allowing more time for more substantial M&A moves to present themselves.

Wesco International Acquires entroCIM

Wesco International, headquartered in Pittsburgh, announced the acquisition of entroCIM, a company specializing in data center and building intelligence software. The initial purchase price was $30 million, with potential additional earnout based on performance. Further terms of the acquisition were not disclosed.

entroCIM, known for its Central Intelligence Manager (CIM) application, provides a browser-based service that connects devices and monitoring systems in commercial facilities. Currently, entroCIM's software monitors millions of square feet across various environments including data centers, commercial buildings, airports, and universities. The acquisition aligns with Wesco's strategy to enhance its service offerings and data-driven solutions for global customers and suppliers.

Winsupply Acquires Meter Service and Supply Company

Winsupply Inc., headquartered in Dayton, Ohio, has acquired Meter Service and Supply Company (Meter Supply), a distributor of waterworks products based in Memphis, Tennessee. Meter Supply provides water, electrical, gas, and sewer products to government agencies and general contractors. Financial terms of the acquisition were not disclosed.

Casey Belew, a graduate of Winsupply’s Management Development Training Program, will take over as president of Meter Supply.

Winsupply Acquires General Metals Mfg. & Supply Co.

Winsupply has also acquired Phoenix-based General Metals Mfg. & Supply Co., a manufacturer, fabricator, and wholesale distributor of HVAC equipment and products. General Metals operates three locations in Phoenix and Tucson, Arizona, serving primarily HVAC contractors.

Winsupply owns a majority equity stake in over 650 local companies across the U.S., including Win-branded locations, Noland Company, Carr Supply, APCO, and other regional suppliers. This acquisition enhances Winsupply's vendor relationships and supports its shared-ownership business model.

Rexel Unveils Upgraded Financial Targets

Rexel presented an updated strategic roadmap and new medium-term financial ambitions at its Capital Markets Day in Paris on June 7, 2024. Leveraging its strong foundation in tech-driven operations, value-added services, sustainability, and value-creating mergers and acquisitions (M&A), Rexel aims to capitalize on the ongoing electrification trend.

Key financial targets include a sales growth potential of 5% to 8%, with targeted M&A contributing 2% to 3%. Rexel also aims for an adjusted EBITA margin above 7%, high-single-digit EPS growth, and a 65% EBITDA to Free Cash Flow conversion rate. Capital allocation priorities include a dividend payout of at least 40%, share buybacks of 50 million to 150 million euros annually, M&A contributing 2% to 3% of sales, and maintaining a net financial debt to EBITDA leverage ratio of around 2.0x.

Viking Electric to Open New Wisconsin Branch

Electrical distributor Viking Electric announced it will open a new branch in Oak Creek, Wisconsin in late 2024 or early 2025, according to the Daily Reporter. The company signed a lease with St. John Properties to occupy a multi-tenant building under development at the Rawson Avenue Business Center II, located at 517 E. Rawson Ave.

Viking Electric will utilize approximately 8,800 square feet for an open concept store to better serve Milwaukee customers. Viking Electric has branches across Wisconsin and eastern Minnesota as well as two locations in metro Chicago.

Agent News

Fields Electrical Sales Merges with Forward Solutions

Forward Solutions has merged with Fields Electrical Sales, expanding its electrical division. The terms of the merger were not disclosed. Fields Electrical Sales serves Ohio, West Virginia, Michigan, Southwest Virginia, and Western Pennsylvania, representing Southwire, SLG Lighting and other electrical product manufacturers to distributors, contractors, and engineers. Forward Solutions is the parent company of a diverse group of B2B manufacturer representatives.

Joe Orednick, President and CEO of Forward Solutions, stated that the merger will enhance support for manufacturing and distribution partners across a broader geographic spectrum. Skip Watson, CEO of Fields Electrical Sales, and Paul Staten, President, expressed enthusiasm about the combined strengths and the expanded range of solutions they will offer to customers.

What We are Reading

Top 100 Electrical Distributors According to Electrical Wholesaling

On June 7, Electrical Wholesaling published its 2024 ranking of the 100 largest electrical distributors in North America, providing detailed insights into their revenue, branch location numbers, and employee headcounts. This annual list provides insights into how these companies are navigating the current economic climate, capitalizing on acquisitions, and seizing new market opportunities.

In recent years, this annual list has shrunk from a Top 200 list to a Top 150 list to its current iteration of a Top 100 list. This is driven by the continuous widespread mergers and consolidation that occur in the electrical distribution sector. The top five companies in the 2024 ranking are:

-

Wesco International (Pittsburgh, PA): $19.6 billion in sales, 16,500 employees.

-

Sonepar USA Holdings Inc. (North Charleston, SC): $15.3 billion in sales, 14,024 employees.

-

Graybar Electric Co. (St. Louis, MO): $11 billion in sales, 9,500 employees.

-

Rexel Holdings (Rexel USA) (Dallas, TX): $9.1 billion in sales, 9,388 employees.

-

Consolidated Electrical Distributors (CED) (Irving, TX): Employee count 7,500.

Reaction to the IMARK Electrical & AD Merger

The announcement of a merger between Affiliated Distributors (AD) and IMARK Electrical has sparked significant reactions among stakeholders in electrical distribution and manufacturing. Members who experienced inefficiencies and duplicities within each group expressed strong support for the merger.

FULL DETAILS: AD and IMARK Electrical Announce Merger Plans »

Two media sites, tED Magazine and Electrical Trends, recently published further insights and reactions regarding the strategic move.

The merger will unify 725 independently owned electrical distributors under one buying group umbrella, significantly impacting purchasing dynamics between distributors and manufacturers in the U.S. The new entity, Independent Electrical Supply Division (IESD), will operate within AD's larger community. The merger, pending IMARK shareholder approval, is expected to close later this year.

tED Magazine: Distributors, Manufacturers React to AD, IMARK Intent to Merge »

Electrical Trends: Thoughts on the AD IMARK Merger »

4 Tips for Distributors in the Digital Economy

Distributors can increase sales and drive business growth by considering four key tips, according to MDM Distribution Intelligence. Amid challenges such as the pandemic, economic downturns, and supply chain disruptions, distributors face the threat of removal from the sales process as manufacturers sell directly to customers. To compete in this evolving market, distributors should adopt omnichannel sales options, foster customer-driven strategies, maximize distributor data impact, and use the right technology to operate their business.

Embracing omnichannel sales diversifies operations, enhancing efficiency, increasing revenue, and elevating the customer experience. Distributors should also develop a customer-centric approach, addressing pain points with customized solutions. Making data work involves implementing robust data management and leveraging predictive analytics. Lastly, investing in technology, such as CRM systems and B2B storefronts, streamlines operations and supports seamless omnichannel sales, enabling distributors to thrive in today's digital economy.

Economic Factors

Construction Backlog Dips, Contractors Stay Confident

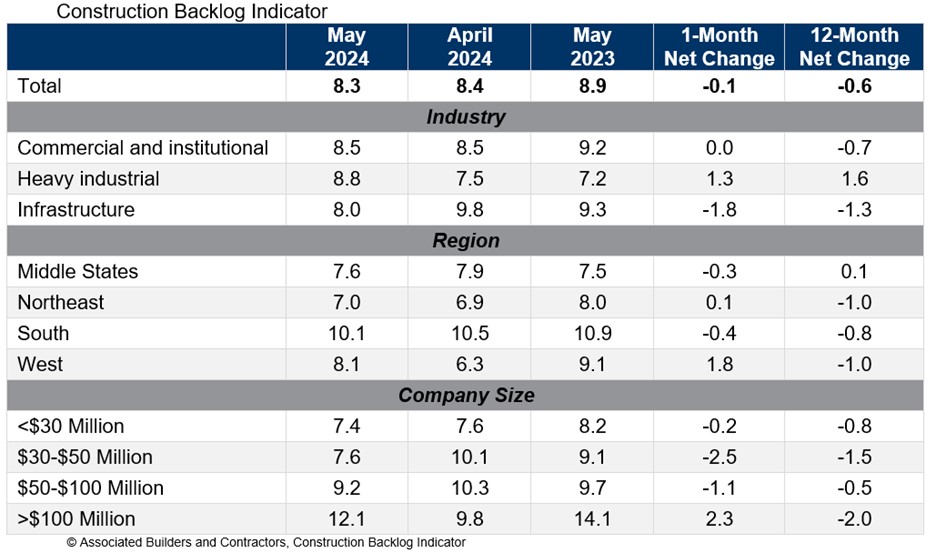

The Construction Backlog Indicator dropped to 8.3 months in May, a decline of 0.6 months from the same period last year, according to a survey by Associated Builders and Contractors (ABC). The backlog decreased monthly for all company sizes except those with annual revenues exceeding $100 million. Despite this, contractors remain optimistic about future sales and staffing levels, with ABC's Construction Confidence Index showing improved sales expectations but slightly lower readings for profit margins and staffing.

Above: Construction Backlog data, courtesy of Associated Builders and Contractors

ABC Chief Economist Anirban Basu noted that while backlogs have been lower in 2024 compared to 2023, they remain stable. Increased activity in manufacturing and infrastructure sectors has kept contractors occupied, though rising input costs have reduced confidence in profit margins to their lowest level since November 2023. Despite high federal interest rates, contractors expect growth in sales and staffing over the next six months.

Construction Industry Adds 21,000 Jobs in May

The construction industry added 21,000 jobs in May, with nonresidential construction contributing 17,100 positions, according to the Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics data. Nonresidential specialty trade saw the most growth, adding 13,000 jobs, while nonresidential building and heavy and civil engineering added 3,000 and 1,100 jobs, respectively. The construction unemployment rate fell to 3.9%, despite an overall unemployment increase to 4.0%.

ABC Chief Economist Anirban Basu highlighted that May's job growth indicates a continuation of consumer spending and job growth, despite concerns over high borrowing costs and a potential recession. Basu noted that while infrastructure spending is a strength, job growth is evident across various industry segments. However, wage pressures in May may delay Federal Reserve rate cuts, despite the nation adding 272,000 jobs according to the establishment survey.

Copper

Copper prices surged above $5.00 per pound in May but have recently retreated to slightly lower, yet still historically high, levels.

Global Container Freight Rates Increase

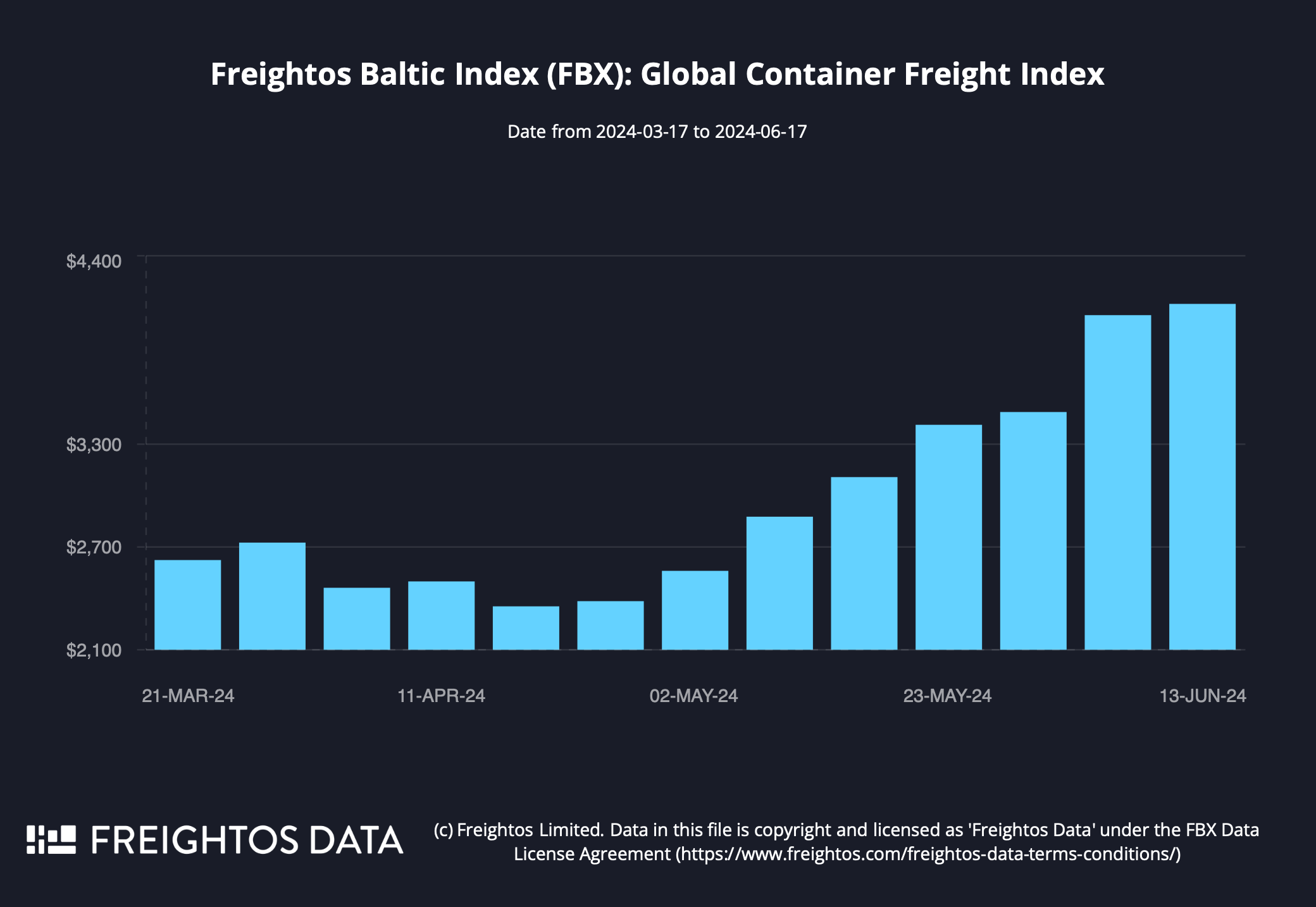

Above: 90-day container rates from China to West Coast USA. Image: Courtesy of Freightos, used under license

The FBX01 global ocean freight container pricing index tracks the cost of shipping 40-foot containers between major ports in China and East Asia and the West Coast of North America. This index, developed in partnership with the Baltic Exchange, includes key Chinese ports like Shanghai (PVG) and Ningbo (NGB), and U.S. ports such as Los Angeles (LAX) and Chicago (ORD).

This trade route is a vital artery for global commerce, facilitating the movement of billions of dollars' worth of goods across the Pacific. Commonly shipped items on this route include electronics, clothing, furniture, toys, and machinery.