April 25, 2024

LSI Industries Earnings: Lighting Sales Dip 3%

Strengthened margins and commercial diversification mark LSI's Q3 financial performance

LSI Industries Inc., a maker in commercial lighting and display solutions, released its financial results for the third quarter of fiscal year 2024, which ended March 31, 2024. The Cincinnati-based company's earnings reflect a challenging economic environment, with overall performance down from the previous year, particularly in its display segment.

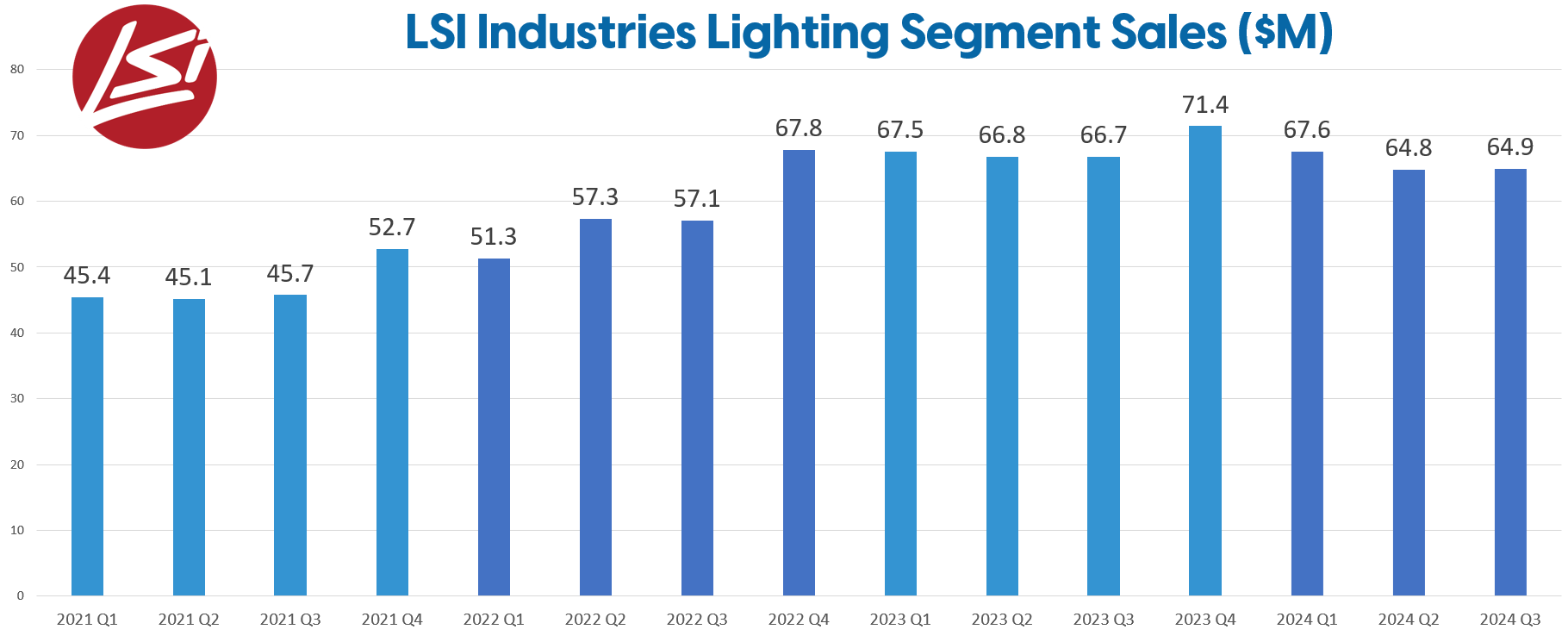

The company reported third-quarter net sales of $108.2 million, an 8% decrease from $117.5 million in the third quarter of 2023. The display solutions segment experienced a significant downturn, with sales dropping 15% year-over-year. Despite this, LSI Industries managed a more modest decline in its lighting segment, with a decrease of 3%, signaling relative stability in this core area of their business.

Lighting Segment Performance

Within the lighting segment – which represents 60% of LSI’s overall business – LSI reported revenues of $64.9 million for the third quarter, a slight reduction from $66.7 million in the same quarter of 2023. The adjusted operating income for this segment grew by 11%, driven by a substantial 280-basis point improvement in the gross margin rate. This was achieved through a strategic mix of products, consistent pricing strategies, moderating material costs, and enhanced productivity at their manufacturing plants.

In comparison to competitors like Acuity Brands and Signify, who have also reported single-digit revenue declines over the last 6-12 months, LSI's performance also indicates a broader industry trend of slowing revenue in the lighting sector.

“Within our Lighting segment, demand conditions were steady during the third quarter, as our book-to-bill ratio finished above 1.0, and backlog increased on a sequential basis. While our quotation pipeline remains highly active, the order conversion period continues to lengthen, specifically for larger projects. Lighting segment adjusted operating income increased 11% during the third quarter, driven by a 280-basis point improvement in the gross margin rate. Multiple items contributed to our improved margin realization, including favorable mix, stable pricing, moderating material input costs, and plant productivity.”

— James A. Clark

President and CEO, LSI Industries

In its official financial results release, LSI highlighted the recent introduction of the Linear Area Light series, a new range of high-value lighting products designed for various outdoor applications. These products are intended for institutional settings such as schools and universities, city beautification projects, and general area lighting, where both performance and aesthetics are vital.

Overall strategy

On April 18, 2024, LSI announced the acquisition of EMI Industries, a manufacturer specializing in fixtures and displays for the convenience store, grocery, and restaurant industries, for $50 million. This acquisition is part of LSI’s strategy to enhance its product and service capabilities, indicating a clear path toward integrating and expanding its commercial offerings across North America.

LSI's approach is multi-pronged, focusing on commercial and industrial business through traditional North American channels. The company emphasizes servicing regional and national accounts across various verticals, including convenience stores, gas stations, quick service restaurants, supermarkets, and other multi-location retail venues. LSI offers a comprehensive range of products that span both lighting and display solutions tailored to these markets.

Looking forward, LSI aims to continue its focus on expanding its presence in high-value vertical markets. The acquisition of EMI Industries is expected to strengthen this approach by broadening LSI’s capabilities and enhancing its market reach. This strategic move is anticipated to support a robust, cash-generative business model, reinforcing LSI's market position in the evolving commercial lighting and display solutions landscape.

Despite current challenges, LSI’s diversified approach and recent strategic acquisition are expected to bolster its resilience and adaptability, offering potential for sustained growth and profitability in the coming periods.