January 9, 2024

Acuity Brands Shows Resilience Amidst 6% Sales Dip

Profits and earnings rise significantly. Shares pop 10+%. Execs “pleased” with “really good start” to FY2024

In a display of operational deftness, Acuity Brands presented its first quarter of fiscal 2024 results marked by contrasting narratives — a dip in sales but a notable rise in profitability and earnings. Despite a 6% year-over-year decrease in net sales, down to $935 million, North America’s largest lighting company managed to expand its margins and grow its earnings per share significantly.

In today's earnings call, Acuity Brands CEO Neil Ashe and CFO Karen Holcom displayed optimism. Ashe praised the fiscal results, twice calling it a "really good start" to the year, while Holcom stated, “we are pleased with our performance.” The upbeat call even featured a moment when Ashe was asked about his predecessor and acknowledged former CEO Vern Nagel, highlighting Nagel's presumed enjoyment of the University of Michigan Wolverines' NCAA Football championship victory the previous night.

Wall Street reacted positively to the news, as Acuity Brands' (NYSE: AYI) shares traded at $225.60 during intraday trading, an increase of $21.08, or 10.3%.

The Atlanta-based company offset the decline in sales with a robust 22% surge in operating profit, which stood at $133 million. Adjusted operating profit also saw a commendable rise of 10% to $154 million. This margin expansion reflects Acuity Brands' adept cost management and operational efficiency.

Earnings per share (EPS) followed suit, with diluted EPS climbing a remarkable 40% to $3.21, and adjusted diluted EPS up by 13% to $3.72, evidencing the company's increased profitability despite the top-line pressure.

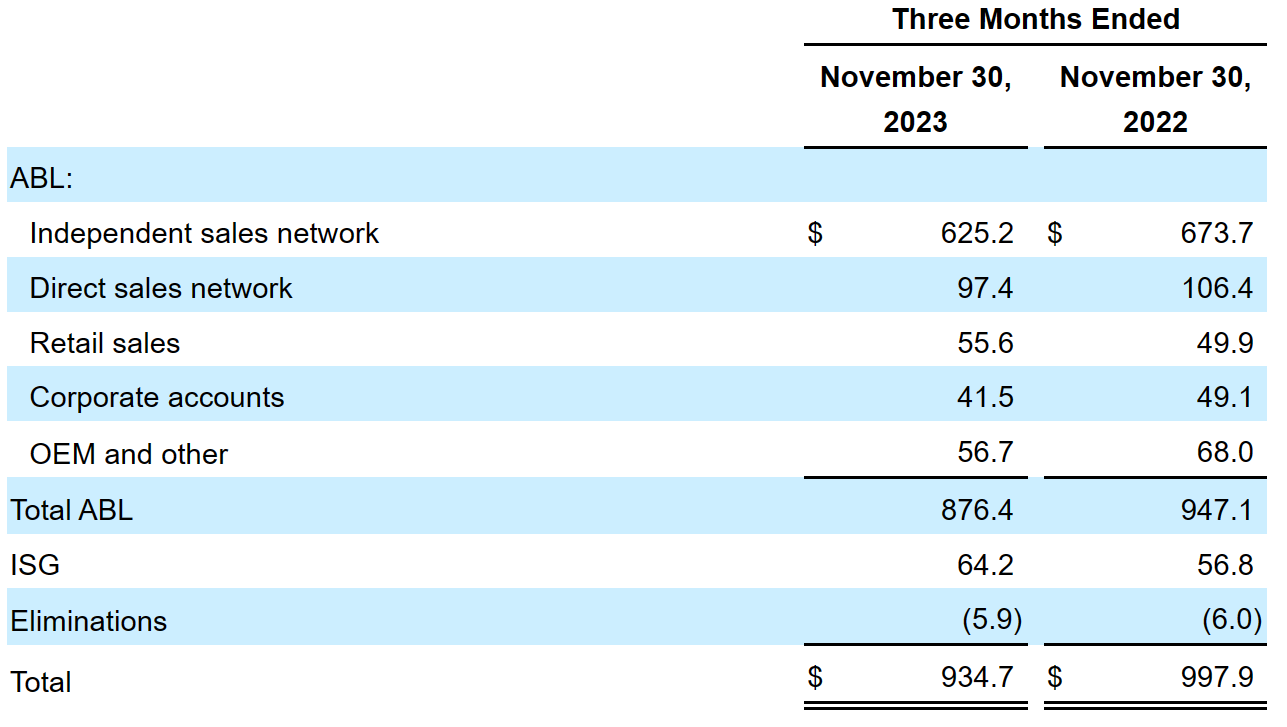

Segment-wise, Acuity Brands Lighting and Lighting Controls (ABL) segment witnessed a 7.5% drop in sales but compensated with a 21.8% increase in operating profit. The Intelligent Spaces Group (ISG), although smaller in scale, told a different tale with sales up 13% yet its operating profit declined by 31.2%.

Order Rates:

Ashe noted that the company experienced an increase in order rates both year over year and sequentially, indicating a positive trend in demand for their products. This improvement in order rates was attributed to the normalization of the business environment post-pandemic, with Ashe emphasizing that Acuity Brands is now operating at a more consistent level.

Ashe clarified that the current order rates, when compared to the daily order rate of the previous year's first quarter and fourth quarter, show modest growth. Ashe also mentioned that absent the excess backlog from last year, the company would be experiencing sales growth. This indicates a shift from the previous year's backlog-driven sales to a more balanced and sustainable order-driven growth. The CEO expressed confidence in the current order rates and the company's performance, suggesting a stable outlook for the business in the near term.

Product mentions & IMARK

-

Lithonia Lighting: Expanded ESXF floodlight family, offering versatile lighting solutions with 36 on-site customizable options for outdoor applications.

-

Design Select: Enhanced portfolio with new downlighting, emergency lighting, and outdoor products, focusing on superior solutions and simplified specifier choices.

-

Distech Controls: Launched advanced AI-powered seven-in-one ceiling sensor for occupancy detection, optimizing indoor air quality and energy efficiency.

-

IMARK: Ashe informed the earnings call audience, “In October, we were once again recognized by the voters of IMARK Electrical as one of the Suppliers of the Year for 2023.”

Managing Price:

-

Price Increases Implementation: Ashe mentioned that the company is implementing a price increase in the in the current quarter. These steps are part of Acuity Brands' strategy to manage prices in line with the value delivered by their products and services.

-

Value Perception and Strategic Price Management: Ashe emphasized that the company's products are increasingly perceived as valuable in the marketplace, enabling strategic price management. This approach involves ensuring products merit their value and managing prices to optimize profits.

-

Impact on Margins: The strategy of managing prices strategically, along with efforts in product vitality and cost management, has significantly contributed to the company's margin performance. Holcom noted that this approach had led to higher margins.

Growth Area

Acuity Brands frequently praises its Contractor Select program during earnings calls, and this trend continued in today's call.

Ashe pointed out that the Contractor Select and retail channels were notable growth spots, with the retail channel demonstrating particularly strong performance despite an overall decline in net sales. He emphasized the company's strategic focus on these areas, attributing their success to a combination of product vitality, elevated service levels, and effective use of technology.

Acquisition of Current’s Arize business

Without citing Current by name, Ashe made reference to the recently announced plans to acquire Current’s Arize horticulture lighting business. He mentioned a small investment in horticulture, indicating the company's interest in this area as a potential growth opportunity.

Ashe noted that this move is part of Acuity Brands' broader strategy to explore new markets and verticals where the company has either been underrepresented or entirely absent. He described this investment in horticulture as "tiny" but significant for the company's future positioning, suggesting a long-term view of the potential in this market segment.

Distech International Expansion

Ashe highlighted the geographic expansion of Distech Controls, a key segment of their Intelligent Spaces Group (ISG). Ashe noted that Distech is focused on expanding its market reach both geographically and in terms of control capabilities in built spaces. This quarter, Distech added several new system integrators in the UK, Asia, and Australia, marking significant steps in their geographic growth strategy. Furthermore, in France, Distech was recognized by the Building Services Research and Information Association for "dominating" the building automation and control systems market.

Mexico Operations

Acuity Brands has opened a new state-of-the-art production facility in the Monterrey Mexico region, featuring a highly efficient new paint line. This facility integrates advanced technology to enhance product quality for customers while improving the efficiency of the paint line process.

"We relocated an existing facility to the new Santa Rosa facility without any service interruption and now have capacity available for future growth." The combined paint and natural gas savings are delivering the required financial return for the facility while meeting sustainability objectives.

Acuity Brands, Inc. has demonstrated a resilient performance in the first quarter of fiscal 2024, marked by a combination of challenges and successes. Despite a 6% decrease in sales, the company has shown significant profitability. The overall financial health of the company, as indicated by the positive trends in order rates and profitability, suggests a stable outlook for Acuity Brands in the near term.