October 27, 2023

Mixed Results for Signify: Profits Rise, Sales Fall

Consumer and horticulture segments falter, yet Wall Street cheers strong earnings

Signify, the world’s leading lighting company, presented a mixed bag of results in its third-quarter financial report for the period ending September 30, 2023. Despite grappling with market headwinds, the company showed resilience, particularly in improving margins and advancing its sustainability goals.

Due to higher-than-expected earnings, the company's stock experienced a significant increase. Signify's shares jumped 10% from 22.72 EUR to 25.05 EUR in intraday trading on the Amsterdam Stock Exchange.

On the sales side, Signify continues to trend towards a full-year double-digit decline in revenue, which was explained by CEO Eric Rondolat during today's earnings call. "This quarter, our top line was impacted by continued softness in our markets, particularly in consumer-connected OEM and China," he stated.

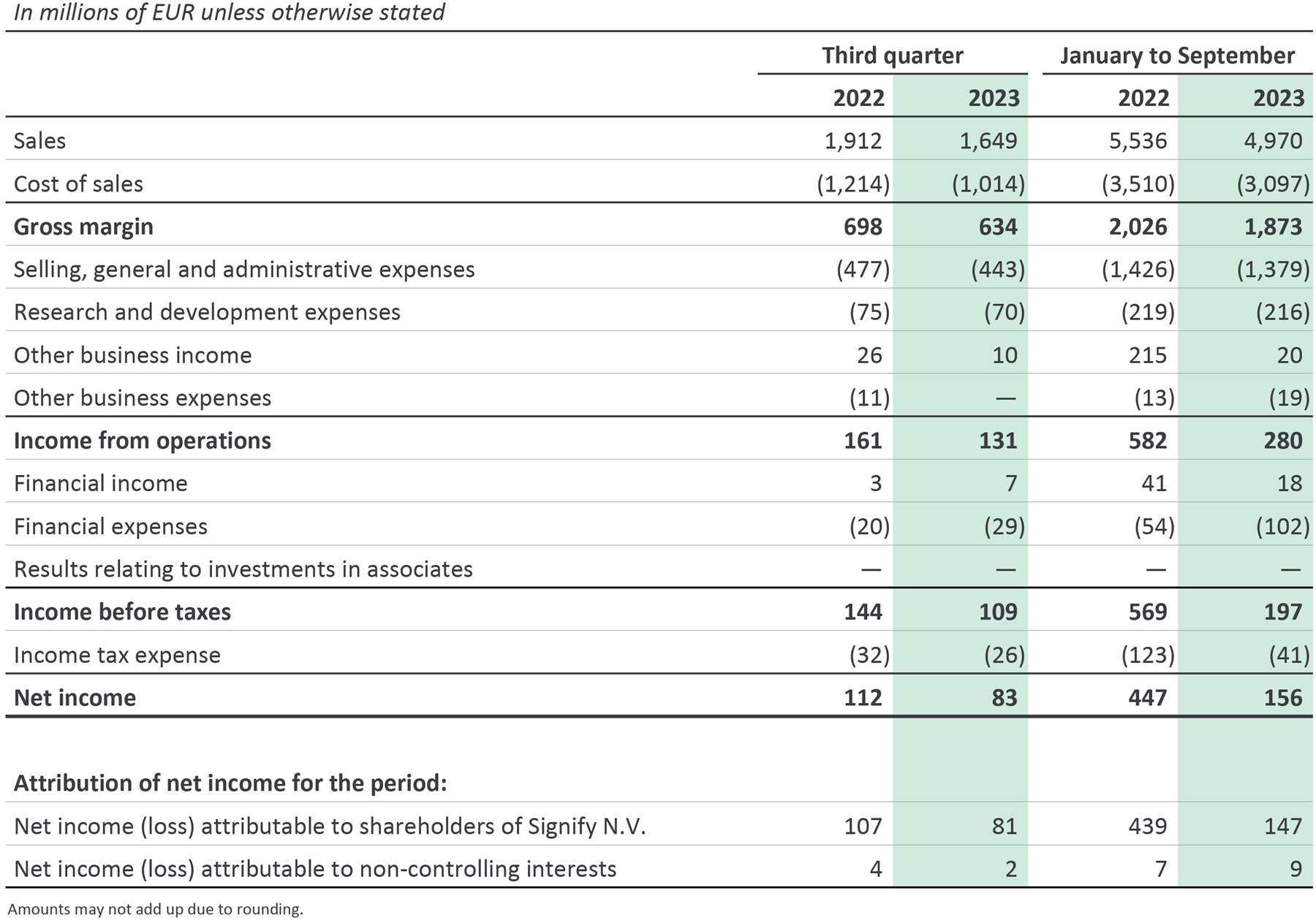

Year-to-Date Sales: Signify's year-to-date sales through the first nine months of 2023 amounted to 4.97 billion EUR, marking a decrease from 5.536 billion EUR in the same period in 2022. This represents a 10.2% decline, indicating challenges in market demand and external economic pressures.

Q3 2023 Sales and Profitability: The company reported third-quarter sales of 1.6 billion EUR, with a nominal decline of 13.8%. However, it's noteworthy that the adjusted EBITA margin improved to 10.7% compared to 10.4% in Q3 2022, reflecting effective cost management.

Guidance for the Year: Signify maintains its full-year guidance for 2023, expecting an adjusted EBITA margin of 9.5-10.5% and a robust free cash flow generation at the higher end of the 6-8% range.

LED-Based Sales: LED-based sales now represent 85% of total sales, up from 83% in Q3 2022. This, of course, indicates that conventional (non-LED) lighting product sales are on the decline, which is expected. Yet, the margins for the conventional business segment continue to impress. The Adjusted EBITA margin increased by 700 basis points to 21.2%, mainly driven by gross margin recovery and cost discipline.

Connected Light Points: The installed base of connected light points increased modestly from 119 million in Q2 2023 to 121 million in Q3 2023, showing gradual progress in the connected lighting segment. During today's earnings call, Rondolat expressed that Signify is ONE OF the companies with the most connected points worldwide. He qualified this by stating, "I'm not going to say THE company in the world because that's what my team is telling me, but I prefer to be cautious."

Performance Across Segments: The company witnessed robust demand in the professional segment, particularly in connected systems and services. However, there was persistent weakness in China, the connected consumer segment, and LED electronics businesses.

Rondolat stated, “During the quarter we saw strength in professional systems and services, which was more than offset by weakness in indoor professional lighting and particularly horticultural lighting. As mentioned in the previous quarter. We are currently seeing some weakness in this segment as we cycled a high conversion base and as we see a lower order intake this year due to high energy costs.”

Customer Destocking: Martin Wilkie, a research analyst at Citi, raised a question about destocking noting that "some other players have been talking about significant destocking continuing." In response Rondolat acknowledged the issue. He explained that when the market softened, many companies found themselves with high levels of stock, which have persisted. As a result, these inventories now need to be depleted in a business environment that has contracted.

Rondolat stated, "we believe that we need one to two more quarters, for this inventory to go back to normal levels," considering the current market traction.

He also highlighted a specific challenge for their business, particularly in the U.S. market. Rondolat noted, "I would add another element for our business, very specifically the situation in the U.S. where the customer is insourcing more than previously."

Pricing and Margins: During today’s earnings call, Rondolat mentioned that pricing contraction and tension were only observed in China, with no abnormalities in other geographies. Emphasizing the management of gross margins, Rondolat highlighted that increasing gross margin was a strategic priority for the year. He pointed out that they have successfully improved the gross margin and will continue to do so, noting a year-to-date increase of 200 basis points compared to the same period last year.

Sustainability Achievements: Signify has made notable progress in its "Brighter Lives, Better World 2025" sustainability program, achieving its 2025 target for circular revenues. The company is also on track to meet its commitments to double the pace of the Paris Agreement.

Headcount decreases by 2,059 employees: In an apparent response to reduced production volumes, the full-time workforce of the company experienced a notable decline over the past year. At the close of the third quarter in 2022, the company's roster boasted 34,273 full-time employees. However, by the end of the third quarter in 2023, this figure had diminished to 32,214, marking a decrease in the workforce.

Looking ahead:

While Signify has faced headwinds due to macroeconomic factors and weaker demand in specific markets, the company's strategic measures in cost reduction seem to position it well for future challenges. The management expects external pressures to continue but remains confident in their strategic actions and cost management initiatives planned through Q1 2024.

Signify’s ability to surpass consensus estimates for earnings in a tough market environment is commendable. Despite a decline in sales year-over-year and challenges in certain business segments, the company has managed to maintain a healthy profit margin and cash flow. Investors and stakeholders will be closely monitoring the company's performance in the upcoming quarter, particularly in comparison to Q4 2022's performance of 1.978 billion EUR.