October 4, 2023

Acuity Brands 2023: Solid Performance Amidst Choppy Markets

Company ends year with slight sales dip and $35 million in "noisy" charges

Today, Acuity Brands reported its results for the fourth quarter and the full Fiscal Year 2023, ending on August 31, 2023.

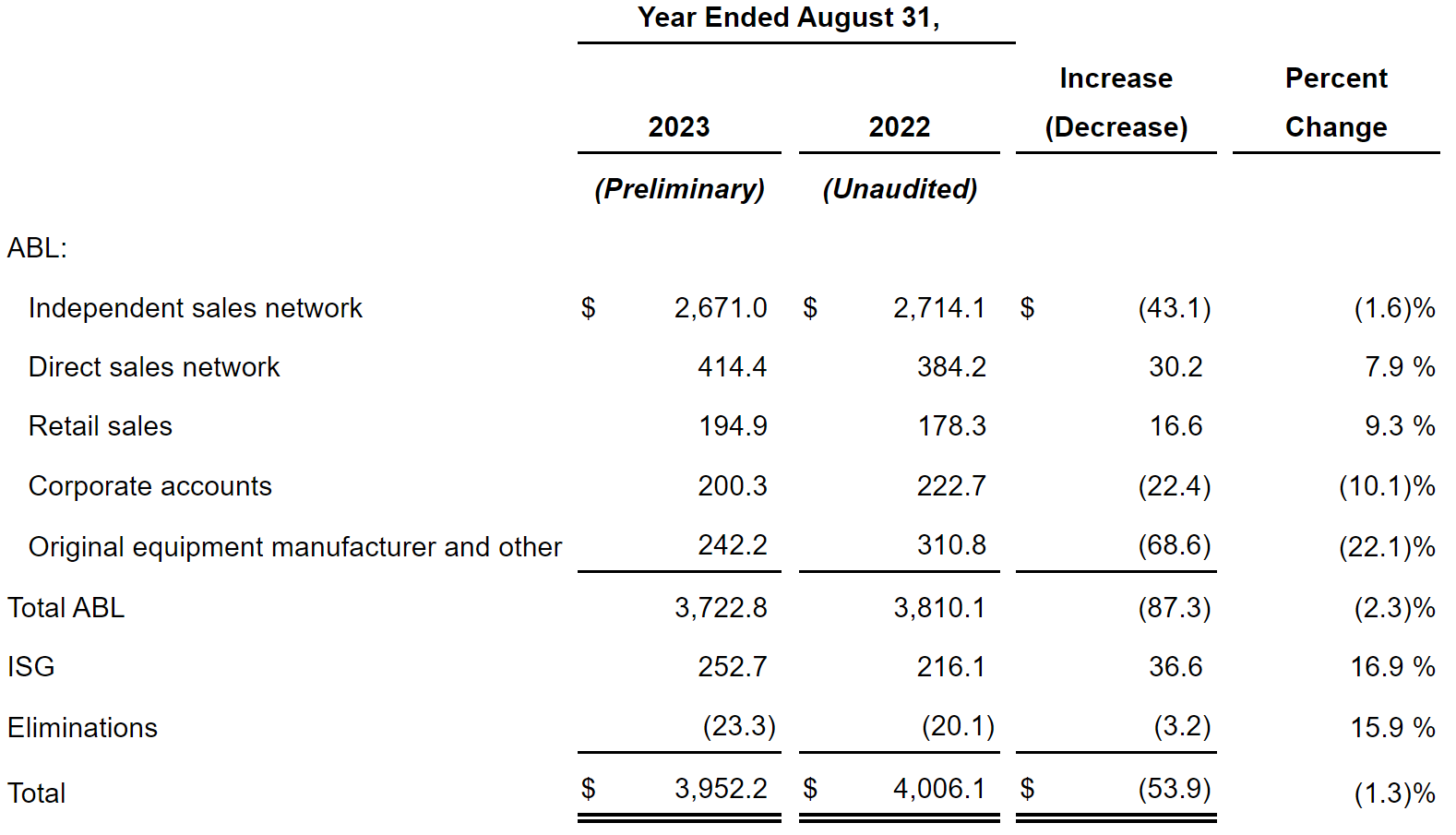

The company's net sales for the quarter were $1.01 billion, marking a decline of 9% or $99.9 million from the same period last year. For the entire Fiscal Year 2023, the sales stood at $3.95 billion, representing a slight 1% dip compared to the previous year. Despite the reduction in sales, the company highlighted a 10% growth in its adjusted diluted earnings per share for the year, emphasizing its focus on margin expansion and strong cash flow generation.

In early intraday trading on Wednesday, Acuity Brands (NYSE: AYI) common stock was trading at $177.03 a 5.77% increase over yesterday's close.

Acuity Brands demonstrated positive earnings per share growth and strong cash flow generation, it faced challenges in terms of declining net sales, operating profit, and charges. The performance of the Intelligent Spaces Group segment is a bright spot, but the decline in overall revenue may be a key area of concern for the company.

In today’s earnings call led by Neil Ashe, Chief Executive Officer, and Karen Holcom, Senior Vice President and Chief Financial Officer, Ashe described end markets as consistent in some areas and choppy in others. Here are the takeaways:

Distech & Atrius perform well

Intelligent Spaces Group (ISG), which contains Distech Controls and Atrius, showed significant improvement in both quarterly and full-year results. ISG's net sales increased by 17.1% in the fourth quarter and 16.9% for the full year, and its operating profit increased as well. The segment seems to be performing well and contributing positively to the company's overall results. This year’s acquisition of KE2 Therm Solutions, Inc. is not believed to affect the overall numbers in a significant manner.

When ISG was carved out as a separate business unit in 2021, the revenue share of the division was 6%. We’ve seen sales increase year over year, and the total revenue share of Acuity Brand’s overall business has inched up to 6.4%. We deem this good progress, but wonder if CEO Ashe had more ambitious 2-year goals when he parsed out the business unit.

Sales Channels

For the quarter, Retail Sales were the only channel with positive performance, up 5.7%. Lighting agent sales, which represent about two-thirds of total company sales, were down 9% for the quarter, matching the pace for the entire business. For the year, the lighting agent channel was down 1.2%. Notably, OEM sales, which include eldoLED and OPTOTRONIC products, were down 22.1% year-over-year and 30.9% for the quarter.

Product Portfolio

Ashe stated that Acuity Brands has refreshed around 20% of its product portfolio this year, introducing several new product lines. Notably, the American Electric Lighting (AEL) brand unveiled AutoConnect, a robust, value-focused outdoor infrastructure lighting solution with connected fixtures for roadways, industrial, and commercial use.

Ashe proudly reported that in the fourth quarter, six of Acuity Brands lighting solutions were selected for the 2023 Illuminating Engineering Society (IES) Progress Report. He went on to give a shout out to three of the included products:

-

Aculux Warm Dim technology

-

Emergency battery backup cylinders from Gotham

-

Hydrel Flame

Quarter after quarter, Ashe consistently mentions growing the business in Europe, primarily Distech, which has offices in France. He specifically highlighted progress with Distech in the UK, where sister brand Holophane maintains a strong presence.

There's a bit of noise in the numbers

Before the earnings call opened up to analyst questions, Ashe got ahead of some of the financial nuances by explaining “There's a bit of noise in the numbers this quarter resulting from a series of actions.”

During the quarter, Acuity recognized pre-tax charges of $35.5 million that affected net income. This included a pre-tax charge of $22.5 million related to severance costs and non-cash charges for impairments of certain trade names based upon the company’s annual impairment review, of which $20.0 million is included in operating income.

Severence

A significant portion of the severance costs may be linked to Acuity's decision to divest its daylighting business, Sunoptics, which involved the layoff of 98 workers at its factory in South Sacramento, California. While there have been some reports of additional layoffs at Acuity Brands in recent months, the scale of these layoffs does not appear to be substantial.

We asked Acuity Brands for more detail on the severance matter and were informed that the company has "redefined our work – where and how it is done – resulting in organizational changes that will lead to greater efficiencies."

Trade name costs:

We asked Acuity Brands to provide more clarity on the trade name matter. We received a prompt and friendly response, but didn’t get the additional clarity we were hoping for. She informed us that the impairment “included certain trade names related to prior acquisitions. We transitioned several of those trade names from indefinite to definite lives to more accurately reflect their value.”

We interpret this matter as a company adjustment in the recorded value of certain brand name assets Acuity Brands had acquired, likely because they believe those names won't bring as much value in the future as previously thought. This is a way for the company to align its financial records with reality.

Apparent Behind the Scenes $13M Dispute with Vendor

Numerous mainstream media reports cite that various streets and highways in the U.S. and Canada have been washed with purple light in recent years due to LED phosphor degradation in certain Acuity Brands AEL lighting fixtures. As a luminaire maker, Acuity Brands doesn’t make the actual LED component, as those are sourced from semiconductor supplier(s). The company also sources certain outdoor LED modules from suppliers.

Today Holcom explained that the company has swallowed a “$13 million pre tax non cash charge for the impairment of a receivable based on its collectability.” She went on to explain, “The receivable is from a supplier who owes us a warranty obligation related to the recovery of quality costs we have incurred for certain ABL outdoor lighting products manufactured and sold between 2017 and 2019. We are pursuing recovery from the supplier.”

We reached out to our contact at the semiconductor company, whom we believe is Acuity Brands' supplier involved in this matter. He is located in Asia, and understandably due to time zone differences, we did not receive an immediate response before publishing this article.

Capital Allocation:

The company repurchased approximately 1.6 million shares of common stock for a total of $269 million during fiscal 2023. Share buybacks can be seen as a positive sign, indicating confidence in the company's future prospects.

EPS Growth:

The company reported adjusted diluted earnings per share (EPS) of $14.05 for fiscal 2023, which is a 10% increase over the prior year. This indicates that the company managed to grow its profitability despite facing challenges.

Cash Flow Generation:

Acuity Brands generated $578 million in cash flow from operations in fiscal 2023. This strong cash flow generation demonstrates the company's ability to manage its finances effectively.

Decrease in Operating Profit:

The company's operating profit decreased in both the fourth quarter and the full year of fiscal 2023. In the fourth quarter, it was down by $39.9 million compared to the prior year, and for the full year, it decreased by $36.3 million. This suggests that the company faced challenges in managing its operational costs.

Looking ahead:

The Acuity Brands Lighting and Lighting Controls (ABL) segment faced challenges, with a decrease in both net sales and operating profit for both the fourth quarter and the full year. This decline in a significant segment of the company's business may be a cause for concern, but as Ashe wrapped up the earnings call, and already five weeks into fiscal year 2024, he projected optimism.

Ashe expressed pride in the company's financial performance while highlighting Acuity Brands’ success in improving the lighting business and growing the Intelligent Spaces Group. Looking ahead, their priorities for the next year include enhancing operational excellence in the lighting business, making it more predictable and scalable. Additionally, they plan to focus on growing the ISG business and maintaining consistency in their capital allocation strategy. Overall, Acuity Brands aims to build on their recent strengths and continue to drive growth in key areas of their business.

Full Fiscal Year 2023 Report »