July 31, 2023

ams OSRAM to Get Smaller, Writes Down €1.3 Billion

The number two LED maker sees stock jump 19% on the news

Austria-based ams OSRAM had quite a day on Friday as it announced its second-quarter results, while also declaring some major changes including an exit from certain businesses, an associated €1.3 billion ($1.43 billion) charge, and the dismissal of some board members. Fueled by the news, the company's stock, which is traded on the Swiss Exchange, surged by 19% to 7.99 Swiss francs (CHF) on Friday.

Exiting Non-core Businesses:

The company will exit non-core semiconductor businesses with a revenue run-rate of €300 to €400 million ($330 million to $440 million). Non-core businesses including, among others, passive Optical Components, will be exited.

The term “non-core” may be code for “unprofitable." We’ve heard this tune before from ams OSRAM, who shed many lighting companies over the last two years, including Fluence, Traxon Technologies and Encelium among others.

The company is getting smaller, thus it is swallowing a €1.3 billion ($1.43 billion) write-down to focus on its core business to drive profits.

The company believes that the exit of non-core businesses and improved cash flow generation from the core portfolio will contribute to strengthening the balance sheet.

Product Portfolio Focus:

The company will concentrate its efforts on differentiated, intelligent sensors, and emitters. It will seek opportunities in Automotive, Industrial, and Medical markets and certain consumer markets, such as microLED.

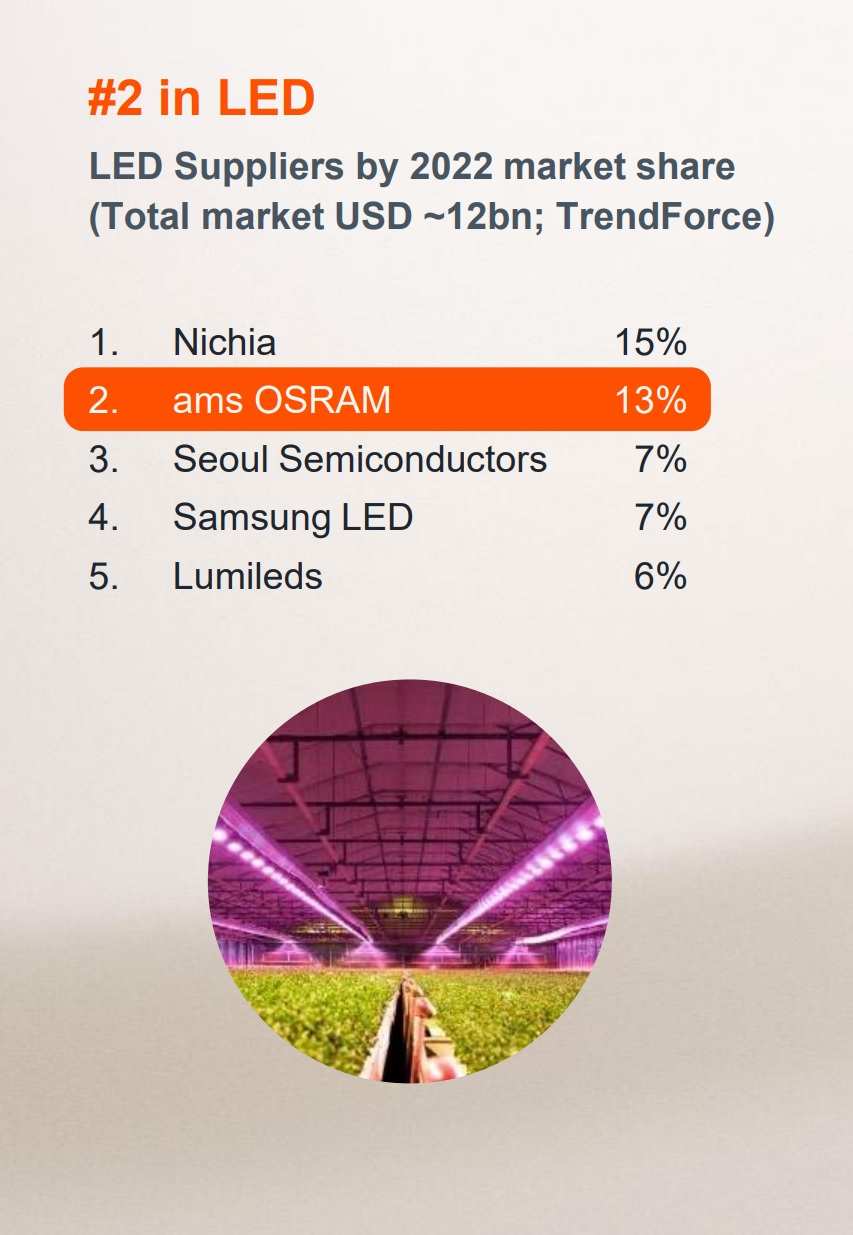

Market Share in LEDs:

Citing TrendForce statistics, ams OSRAM reports that it ranks second globally among LED suppliers, trailing Nichia but leading Seoul Semiconductor, Samsung, and Lumileds.

The same statistics also reveal that ams OSRAM is the foremost worldwide supplier of automotive LEDs. This emphasizes the company's robust standing in the automotive lighting market, a critical sector in alignment with the vertical market focus ams OSRAM maintains across all its products.

Above: Images from the recent ams OSRAM investor presentation.

Organizational Changes:

Effective January 1, 2024, the company's Management Board will be downsized to just the CEO, Aldo Kamper, and CFO, Rainer Irle.

The company will form two Business Units in the Semiconductor segment, dedicated to (1) emitters and sensors and (2) analog mixed signal ICs.

Financial Performance:

Q2 revenues were €851 million ($936.1 million) with an adjusted EBIT margin of 5.9%, and expected Q3 revenues are between €840-€940 million ($924-$1.034 billion) with an adjusted EBIT margin of 5-8%. However, revenues are expected to decline in 2024 due to portfolio decisions.

The company has revised its Target Financial Model to a 6%-10% revenue CAGR based on the reduced base and adjusted EBIT of approximately 15% in 2026.

For the first half of the year, AMS Osram reported a net loss of almost €1.5 billion ($1.65 billion), largely due to write-downs of €1.3 billion.

Americas:

The Americas contribute to 22% of ams OSRAM's total company sales, indicating a significant market presence in this region.

The Push for MicroLEDs:

The company plans to increase its investment in microLED technology. MicroLED is a type of display technology that has the potential for better color accuracy, faster response time, and higher brightness compared to LCD and OLED displays. They predict a significant increase in microLED display shipments to 51.7 million units in 2030, to be used in smartphones, tablets, smartwatches, and other consumer electronics.

Implementing microLED technology would decrease the typical LED die area by 75-95% to 10x10µm, thus allowing for smaller and more energy-efficient devices.