June 5, 2023

Shrinking Inventories and Economic Uncertainty Erode Industry Confiedence

Lowest NEMA industry confidence index recorded since 2020 lockdowns

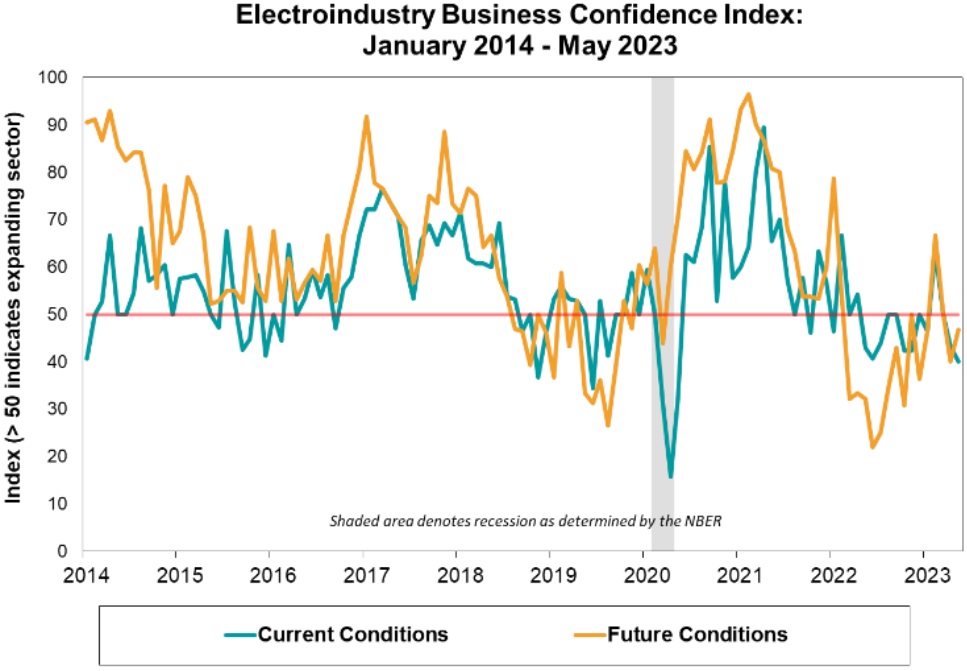

Each month, the National Electrical Manufacturers Association(NEMA) publishes the Electroindustry Business Confidence Index (EBCI). The index is based on surveys of senior managers at NEMA member companies – designed to gauge the business environment of the electroindustry in North America. Member companies include most of the ten largest lighting manufacturers in North America, along with other manufacturers of lighting and electrical products.

This most recent ECBI shows how makers of electrical equipment view current and future market conditions. Below are the details:

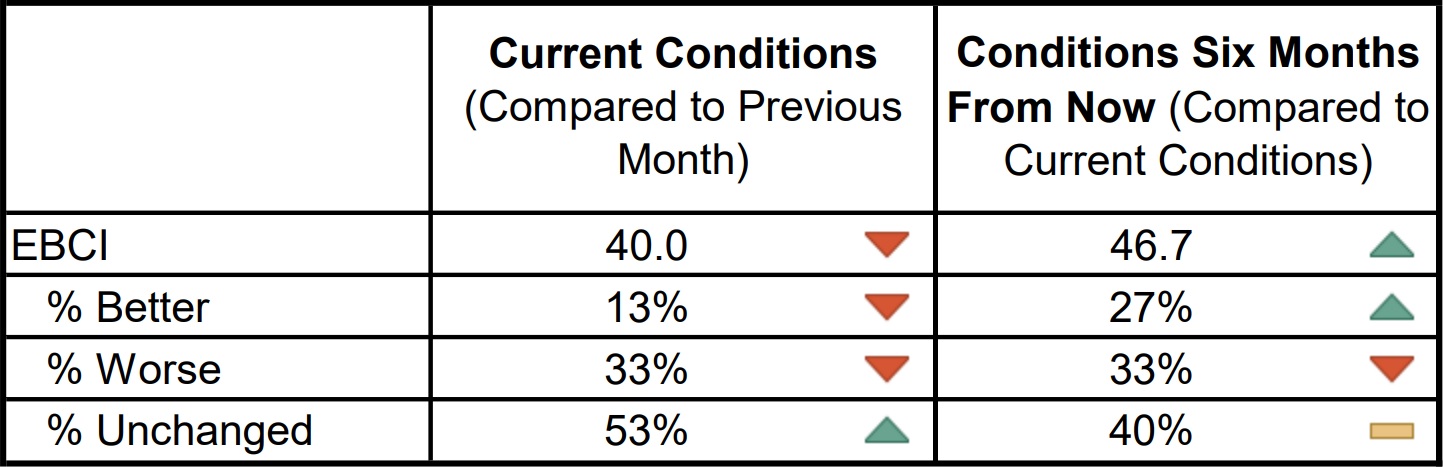

Dipping to its lowest reading since the immediate aftermath of the lockdown era recession, the current conditions component shed 3 points from April’s score to hit 40.0 this month. The share of respondents indicating “unchanged” conditions reached 53 percent, and less than 15 percent of May’s panelists noted “better” conditions. In some cases, reports of unchanged conditions may have reflected a sense of healthy markets remaining so: “order intake has increased vs Q4 2022 and is on par with Q1 2023.” The main concerns pointing to worsened conditions included distributor destocking and worries about the debt ceiling.

The reported magnitude of change in current conditions remained flat to slightly negative as the median value edged up to 0.0 this month after slipping to -1.0 in April, while the mean measure inched down from -0.2 last month to -0.4 in May. Panelists are asked to report the magnitude of change on a scale ranging from –5 (deteriorated significantly) through 0 (unchanged) to +5 (improved significantly).

Although improved, the future conditions component failed to reach expansionary territory for the fourteenth time out of the last 15 months, notching a nearly 7-point increase compared to April that nevertheless left it short of a reading that would suggest better conditions in six months. Compared to April’s survey, fewer respondents expected “worse” conditions in half a year this time. From the comments, geopolitical concerns, along with uncertainty surrounding the debt ceiling status, provided a counterweight to upbeat expectations borne of the re-electrification push backed by massive federal government spending via the IIJA and climate legislation.

SURVEY RESULTS:

-

Values reflect the percentage of respondents expecting "Better" conditions, plus one-half of the percentage of respondents expecting "Unchanged" conditions.

-

A score of 50 or higher suggests conditions appropriate to expansion of the electroindustry sector.

- Please note that survey responses were collected from the period of May 10-26, 2023.

EBCI METHODOLOGY:

The EBCI indexes are based on the results of a monthly survey of senior managers at NEMA member companies and are designed to gauge the business environment of the electroindustry in North America (defined here as the United States and Canada).

The survey contains the following questions:

- How would you rate current economic conditions in North America, as they affect your business, compared to the previous month?

- Using the following scale, please describe the magnitude of change in economic conditions in North America this month compared to economic conditions last month? [Scale structured as follows: 5 (improved significantly), 4, 3, 2, 1, 0 (stayed the same), -1, -2, -3, -4, -5 (deteriorated significantly)]

- How do you expect economic conditions in North America, as they affect your business, to have changed six months from now?

Respondents are asked to indicate whether conditions are better, worse, or unchanged. The survey also provides space for respondents to comment on current conditions. These comments are included below the table containing the index levels.

The index value is the percentage of respondents expecting “Better” conditions, plus one-half of the percentage of respondents expecting “Unchanged” conditions, which follows the methodology used by the Institute for Supply Management (ISM; formerly the National Association of Purchasing Management) in the construction of their manufacturing index.

Reprinted by permission of the National Electrical Manufacturers Association (NEMA)