June 29, 2023

Acuity Delivers $1B Quarter Amidst Market Challenges

Sales down, profits up, markets mixed and other enlightening insights

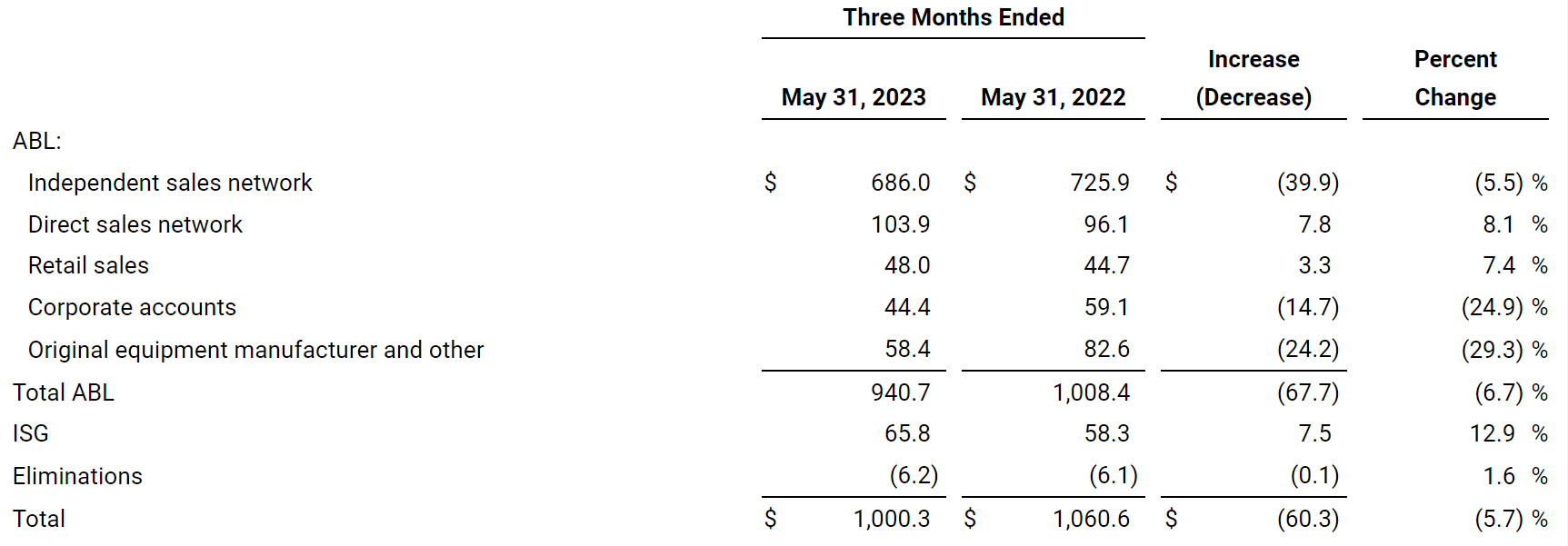

ATLANTA, GA – Today, Acuity Brands reported its Fiscal Year 2023 third quarter performance for the period ended May 31, 2023. The company's quarterly net sales were $1.00 billion, a decrease of $60.3 million, compared to the same quarter in 2022. Despite the revenue dip, the company delivered an increase in profits.

In early intraday trading on Thursday, Acuity Brands (NYSE: AYI) common stock was trading at $160.80 a slight, less-than-one-percent increase over yesterday's close.

The financial performance of Acuity Brands in Q3 2023 presents a mix of takeaways. The short story is that the company delivered profit margin and favorable cash flow despite the 5.7% decline in sales. Other insights relate to how Acuity Brands is framing its new Design Select initiative and how macro market activity is impacting North America’s largest lighting company.

In today’s earnings call led by Neil Ashe, Chief Executive Officer, and Karen Holcom, CFO and Senior Vice President, the executives described numerous factors that are contributing to the company’s performance. Here are some takeaways from the quarterly results and earnings call:

Another $4 billion year?

Year to date through three quarters, the company has generated $2.94 billion in sales. During today’s earnings call, Holcom gave insights in how the company expects to close the fiscal year which ends on August 31, “We now expect full year net sales to be between $3.9 billion and $4 billion.” In order to hit $4 billion in sales for the second year in a row, Acuity Brands would need to deliver $1.06 billion in revenue in its final quarter.

Sales:

The company's quarterly net sales decreased by 5.7%, or $60.3 million, compared to the prior year, which could be a concern if this trend continues. The number moved due to a sales decline in the Acuity Brands Lighting and Lighting Controls (ABL) segment, which comprises 94% of total company sales.

Independent sales network

The independent sales network – or lighting agent network – consistently represents around two-thirds of company revenues and has consistently been performing well in recent years. This particular quarter was a step back on the top-line for the channel as sales dipped $39.9 million compared to the same quarter last year. Year to date through nine months the channel is up 1%.

Industrial and C&I markets

Holcom shed light on some of the end markets by stating, "Sales decreases by vertical are really what you would expect to see. We had declines in industrial. If you recall, last year, we had a lot of warehouse and logistics projects that were taking place. And then also we're seeing declines in healthcare and commercial office due to the impact of the wider macro environment. So really nothing surprising on the vertical front."

Ashe added an anecdote to that, "Everybody saw the Wall Street Journal article about the building on Market Street in San Francisco that had a $300 million valuation in 2019 and then was sold for $60 million recently. So while it's an unpleasant experience for the capital side of that trade, the reality with that building is that it will now be reset at a different rate. New tenants will move in and they will need to customize the space to what they want. And they're going to need lighting and lighting controls."

Order rates, shipment rates and backlog

In his prepared remarks for today’s earning call Ashe stated “While our order rates and our shipment rates are returning to closer alignment with each other, we have not yet returned to normal sequential seasonality.”

Responding to a follow-up question by analyst Ryan Merkel of William Blair, Ashe elaborated “Looking back to last year we had a combination of longer lead times and a price increase environment which basically pulled forward a lot of orders. We had a swell backlog and we've been working through that backlog through this year.” Ashe continued, “through this quarter it's starting to be back to about normal, which means that in any period we will basically ship what’s ordered.”

Direct Sales & OEM Sales

Ashe provided an explanation regarding various market aspects. Firstly, he discussed the timing of projects for both major customers on the corporate account side and the original equipment manufacturer (OEM) side. Additionally, he mentioned the ongoing destocking in the driver market on the OEM side. Furthermore, Ashe mentioned that the order rate for commercial and industrial (C&I) projects within their direct sales network is currently relatively low.

Design Select seems to be a major focus for Acuity Brands

For years, Acuity Brands has flexed the success of its Contractor Select program that has positively impacted its sales and also seemingly pleased electrical distributor, retailer and contractor customers.

Ashe, whose effective leadership communication often demonstrates the “rule of three” opened today’s earnings call framing the company’s new Design Select initiative:

-

Contractor Select is 300 of the most important everyday lighting and lighting control products available in stock at retailers and electrical distributors.

-

Design Select is 3000 configurable products that meet the key choices of lighting specifiers with dependable service.

-

The remainder is made to order

Design Select seems to include the framework of what would commonly be referred to as a quick ship program for architectural brands, but also adds more emphasis to other areas. Ashe explained, “Design Select is about configurable products for the specification community, and what this allows them to do is choose to basically make good choices among the product families. So this is the next step in that process. So our expectations aren't that this creates a new line of revenue but it is our expectations are that will create a lot more efficiency for them as well as for us.”

Profitability:

Despite a decrease in net sales, the company improved its operating profit margin by 80 basis points year over year and adjusted operating profit margin by 100 basis points year over year. This is an indicator of efficient cost management and suggests that the company has been able to maintain or even improve profitability levels despite lower sales.

Intelligent Spaces Group (ISG):

Although the ISG segment, which is comprised of Atrius and Distech Controls, showed an increase in net quarterly sales of 12.9% compared to the prior year, with $65.8 million. Its operating profit and adjusted operating profit both decreased, indicating challenges in profitability in this segment.

Former Microsoft cloud and software veteran Peter Han is the President of Acuity Brands’ Intelligent Spaces Group. As the group enters its third year as an individual business unit, the group may tolerate lower margins as it invests in future growth like how other tech- and cloud-focused companies play the long game.

Earnings Per Share (EPS):

Acuity Brands’ diluted EPS increased by 7% year over year, from $3.07 to $3.28. This suggests that the company has been able to increase its earnings available to each share of common stock, which is generally viewed positively by investors.

Cash Flow:

The company demonstrated strong cash flow from operations and allocated capital to strategic activities such as the acquisition of KE2 Therm and repurchasing outstanding shares. Net cash from operating activities was $471.5 million for the first nine months of fiscal 2023, a substantial increase of $305.8 million compared to the prior year.

Balance Sheet Strength:

As of May 31, 2023, the company had substantial cash and cash equivalents of $359.3 million, an increase from $223.2 million as of August 31, 2022. This improved liquidity could help support ongoing operations and strategic initiatives.

Accounts Receivable and Inventories:

The company's accounts receivable decreased from $665.9 million to $545.0 million, and inventories also decreased from $485.7 million to $400.5 million compared to the prior year. We sense that these decreases are due to supply chain improvements and efficiency gains, and not necessarily due to lower sales.

As the industry moves forward into market conditions that appear unprecedented, Acuity Brands seems to be taking a measured approach. The company’s balance sheet looks healthy and considering its large size, Acuity Brands seems to continuously demonstrate a nimbleness that enables it to adapt quickly to uncertain or changing markets.