May 2, 2023

Weakness in Key Segments Cools Industry Confidence

Survey respondents predicting "worse" conditions in the next six months has increased

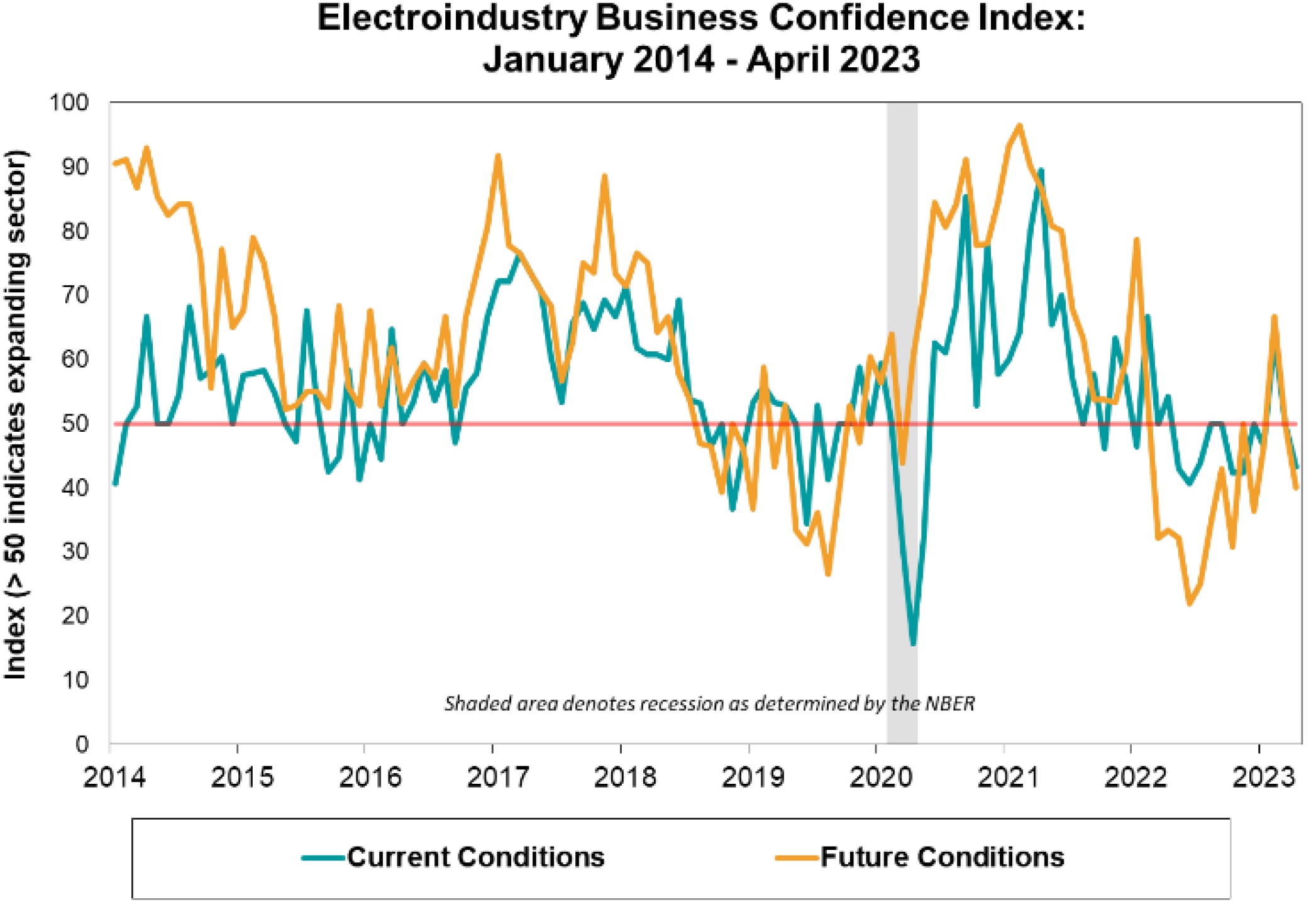

Each month, the National Electrical Manufacturers Association (NEMA) publishes the Electroindustry Business Confidence Index (EBCI). The index is based on surveys of senior managers at NEMA member companies – designed to gauge the business environment of the electroindustry in North America. Member companies include most of the ten largest lighting manufacturers in North America, along with other manufacturers of lighting and electrical products.

This most recent ECBI shows how makers of electrical equipment view current and future market conditions. Below are the details:

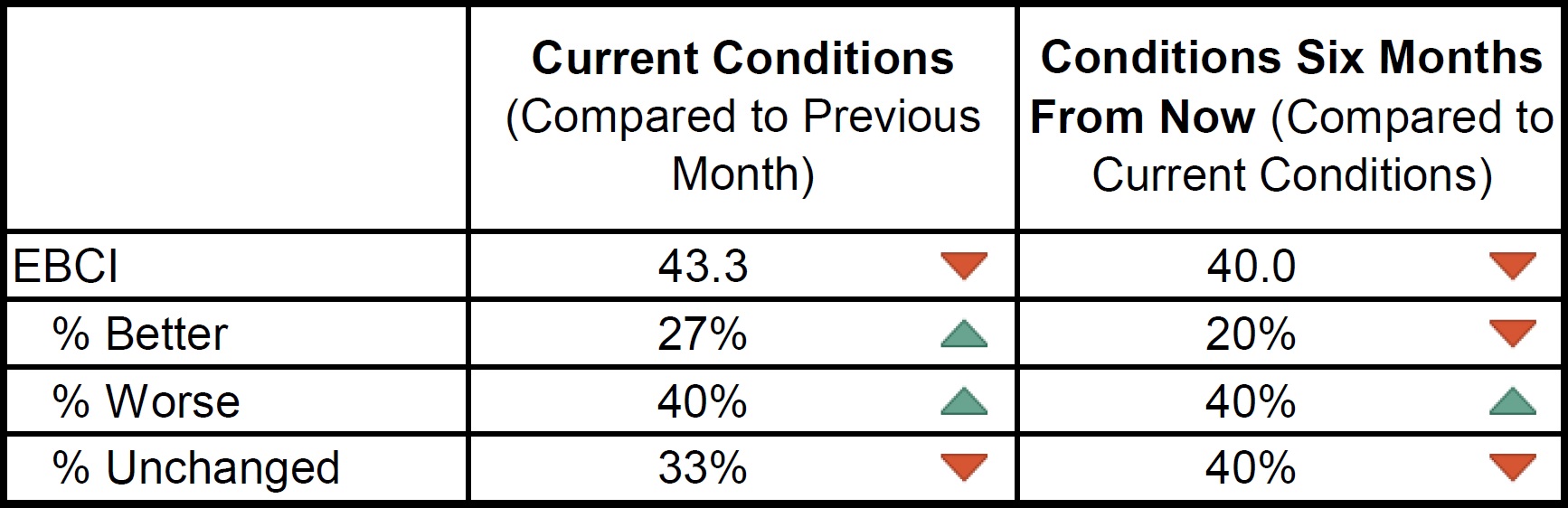

After a momentary bump into expansionary territory in February, followed by a brief hold at “unchanged” last month, the current conditions component signaled cooling in April with a nearly 7-point retreat to 43.3. The share of participants reporting “unchanged” conditions declined precipitously this month, and although several respondents noted “better” conditions, many more indicated that conditions were “worse” in April. Comments displayed evidence of this dichotomy as one described “slowing demand across most…

segments,” even as another declared “records and more records.”

The reported magnitude of change shifted left, with a long tail to the right, as the median measure dropped to -1.0 from March’s reading of 0.0, and the mean measure inched into the negative, slipping from +0.1 last month to -0.2 in April. Panelists are asked to report the magnitude of change on a scale ranging from –5 (deteriorated significantly) through 0 (unchanged) to +5 (improved significantly).

Following a similar path – from solidly expansionary two months ago, then remaining “unchanged” in March – the future conditions component also slid into the range suggesting a slowdown ahead. This change is marked by a 10-point drop, resulting in an April reading of 40.0. The ratio of respondents anticipating “worse” conditions in six months has grown, as the percentages of “better” and “unchanged” responses have declined. Although the data suggest a turbulent future, the comments received were, at worst mixed. They highlighted headwinds to an otherwise positive outlook, while also noting strong backlogs and an expected boost from infrastructure and efficiency spending.

SURVEY RESULTS:

-

Values reflect the percentage of respondents expecting "Better" conditions, plus one-half of the percentage of respondents expecting "Unchanged" conditions.

A score of 50 or higher suggests conditions appropriate to expansion of the electroindustry sector.

Please note that survey responses were collected from the period of April 10-21, 2023.

EBCI METHODOLOGY:

The EBCI indexes are based on the results of a monthly survey of senior managers at NEMA member companies and are designed to gauge the business environment of the electroindustry in North America (defined here as the United States and Canada).

The survey contains the following questions:

- How would you rate current economic conditions in North America, as they affect your business, compared to the previous month?

- Using the following scale, please describe the magnitude of change in economic conditions in North America this month compared to economic conditions last month? [Scale structured as follows: 5 (improved significantly), 4, 3, 2, 1, 0 (stayed the same), -1, -2, -3, -4, -5 (deteriorated significantly)]

- How do you expect economic conditions in North America, as they affect your business, to have changed six months from now?

Respondents are asked to indicate whether conditions are better, worse, or unchanged. The survey also provides space for respondents to comment on current conditions. These comments are included below the table containing the index levels.

The index value is the percentage of respondents expecting “Better” conditions, plus one-half of the percentage of respondents expecting “Unchanged” conditions, which follows the methodology used by the Institute for Supply Management (ISM; formerly the National Association of Purchasing Management) in the construction of their manufacturing index.

Reprinted by permission of the National Electrical Manufacturers Association (NEMA)