May 9, 2023

Three Years On: Lighting Companies Rebound from Pandemic Lows

The disparate sales recovery paths of Signify, Acuity Brands and LSI Industries

In the wake of the 2020 pandemic, lighting companies faced a challenging landscape, marked by plummeting revenues and an urgent need to adapt to new ways of doing business. Signify, Acuity Brands and LSI Industries, three of the large, publicly-traded players in the industry, were not exempt from this trend, hitting their respective 2020 revenue lows in the same quarter as that pandemic lockdowns occurred. The subsequent rebound from these lows, however, has not been uniform among the trio, and we set out to explore the recovery trajectories of each company.

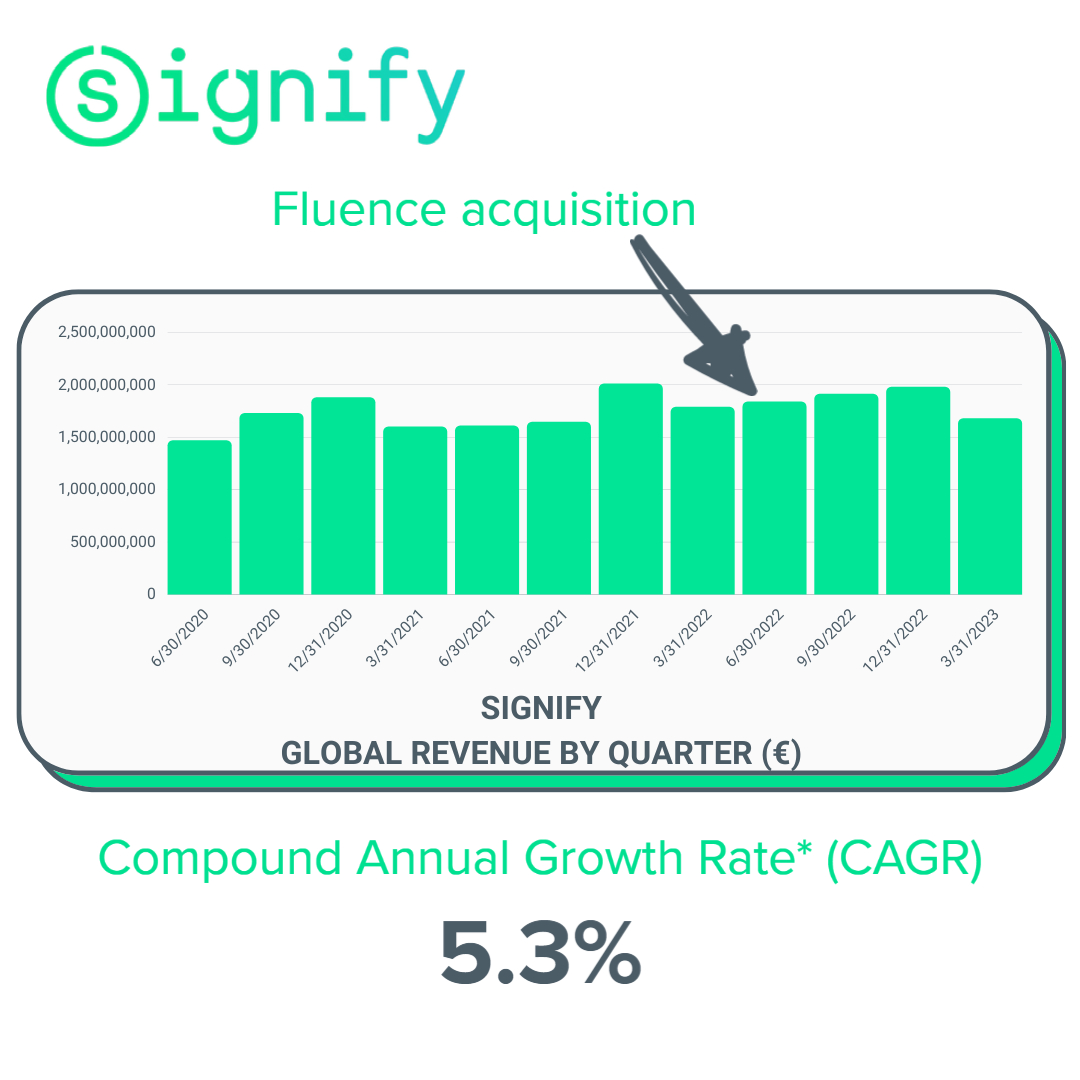

With an impressive 33% compound annual growth rate (CAGR), LSI Industries, the smallest company among the three has emerged as the most agile in the group, outpacing Acuity Brands and Signify in growth rate since the 2020 “low water” marks. This rapid turnaround has been spurred by price increases and a strategic acquisition, demonstrating the company's adaptability amid unprecedented market conditions. Conversely, Signify's 5.3% CAGR, is the slowest growth in the group, as the company grappled with a similar set of challenges on top of other unique factors that affect the global lighting leader.

The companies have had to maneuver through a myriad of complex issues, including the implementation of work-from-home arrangements, disruptions in supply chains, and managing customer relationships during these uncertain times. We decided to evaluate the three year revenue of each company, comparing the most recent twelve months of revenue to the twelve months of revenue that started during the 2020 pandemic lockdowns.

*The compound annual growth rate (CAGR) is based on the company's sales data for the trailing twelve months compared to the first twelve months' of data above.

Company comparisons are not “apples to apples”

Price Increase effect:

There are numerous factors that affect the numbers of each company including price increases, construction sector slowdowns, acquisitions and currency fluctuations. The one variable that likely lifted all boats similarly was the flurry of seemingly quarterly-price increases that many manufacturers implemented in 2020 and 2021. Price increases were connected to rapid increases in components cost, logistics costs and employee wages.

It’s important to note that there’s a distinct difference in price increase announcements and price increase realization. Industry people with who we spoke indicate that the actual, realized increase in prices over the three year period is likely between 12% and 20%. A company like LSI may have been on the higher end of that range possibly due to a larger percentage of sales in steel poles compared to the other companies.

One mid-sized U.S.-based manufacturer with whom we spoke summarized the matter by stating, "If you're not up 15-20% or more since the pandemic, you've lost market share."

Acquisition effect:

The acquisition effect helped boost certain revenues with the largest percentage boost likely affecting LSI’s results:

-

One acquisition was a huge boost to LSI Industries who acquired JSI Store Fixtures in May 2021. At the time JSI was generating approximately $70 million in annual revenues while LSI had produced $282 million in revenues during the twelve months before the acquisition.

-

Signify acquired Texas horticultural lighting leader, Fluence, in 2022. At the time of the announcement, Fluence was a $141 million company. Signify also acquired smart cities lighting and controls company, Telensa, in 2021.

-

All of the data below was collected after Signify acquired Cooper Lighting on March 2, 2020 – one week before Utah Jazz All-Star center, Rudy Gobert, tested positive for coronavirus, which eventually led to the immediate suspension of the NBA season and was quickly followed by mandated COVID lockdowns in the United States.

-

In July 2021, Acuity Brands acquired ams OSRAM’s North American Digital Systems (DS) business.

*The compound annual growth rate (CAGR) is based on the company's sales data for the trailing twelve months compared to the first twelve months' of data above.

Currency effect:

Another effect to weigh when looking at the numbers is the international currency effect on Signify’s financial results. While Netherlands-based Signify exercises some financial levers to hedge global economic swings, the net currency effect over the last three years has created some headwind for the world’s largest lighting company. Unlike U.S.-based Acuity Brands and LSI, Signify has a well-distributed global market diversity that sees about one-third of the company’s business in the United States. In June 2020, €1 EUR = $1.11 USD. Today, €1 = $1.09, but the value dipped to a low of $0.96 in 2022.

*The compound annual growth rate (CAGR) is based on the company's sales data for the trailing twelve months compared to the first twelve months' of data above.

Product diversification:

Signify and Acuity Brands are pure-play lighting companies that derive nearly all company revenues from lighting and controls products. Signify is more diverse globally, as well as product-wise as it has a strong lamp business that also plays in B2C markets. In the most recent quarter, Signify saw a weakened demand in consumer markets, which likely didn’t affect Acuity Brands or LSI in the same manner.

LSI Industries has two business segments, Lighting and Displays. The recent growth and investment in the Displays Segment has caused the Lighting Segment to become a smaller portion of LSI’s overall business. At the end of 2017, Lighting comprised 72% of overall sales. Today the Lighting share is around 57%.

In the wake of the pandemic, the collective resilience of LSI Industries, Acuity Brands and Signify has proven the adaptability of the lighting industry. Despite the myriad of challenges faced, including managing remote workforces, disruptions to supply chains, and unprecedented customer relationship hurdles, all three companies managed to rebound from their pandemic lows. However, the journey to recovery, marked by strategic acquisitions, price increases, and global market volatility, was anything but uniform.

The dynamic landscape of the past three years has underscored the importance of adaptability and strategic decision-making in navigating unprecedented disruptions. While LSI Industries stood out for its rapid recovery, Signify, despite its slower growth rate, faced unique challenges given its global market diversity. Acuity Brands, too, demonstrated its resilience with strategic acquisitions contributing to its recovery. The trajectory of these lighting companies post-pandemic serves as a testament to the resilience of the industry and the significant role of strategic actions in navigating unforeseen challenges.