May 3, 2023

Signify's Profits Dim as Demand Falls, Shares Drop 10%

CEO sees “a weak consumer market nearly everywhere” but still optimistic about current and future quarters

Shares of Signify (LIGHT.AS), the world's largest lighting manufacturer, fell by 10% during Wednesday intraday trading after the company missed first quarter 2023 profit expectations, largely due to persistent weak demand, particularly in its second-biggest market, China.

The company has faced hurdles with lower consumption, supply chain disruptions, and ongoing COVID restrictions in China that have negatively impacted earnings. Despite these challenges, Signify maintains a more optimistic outlook for the remainder of the year.

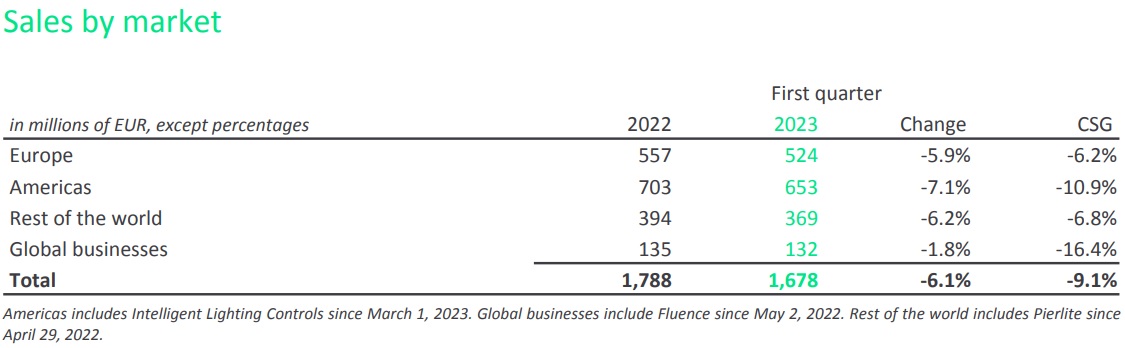

For the quarter ended March 31, Signify reported sales of EUR 1.7 billion, along with an operational profitability of 8.9% and a free cash flow of EUR 51 million. This represents a nominal sales decline of 6.1% and a comparable sales decline of 9.1% from Q1 2022.

The company cited a revenue downturn in the consumer segment and indoor professional business, as well as a dip in Original Equipment Manufacturer (OEM) sales.

CEO Eric Rondolat stated that despite these challenges, the company made significant progress, particularly with gross margin improvement and continued price discipline. Adjusted EBITA margin for their Conventional Products division has returned to historic levels, and free cash flow saw substantial recovery due to improved working capital management.

In an unusual trend, LED-based sales dropped slightly from 84% in Q1 2022 to 82% in Q1 2023. Further, net income saw a more significant decrease, from EUR 87 million in Q1 2022 to EUR 28 million in Q1 2023.

Rondolat foresees the remainder of H1 2023 to be challenging but remains optimistic, “While we expect the remainder of H1 2023 to remain challenging, we continue to see the potential for an improved second half. Given the structural improvements in our gross margin and free cash flow generation, as well as our intensified measures to reduce fixed costs, we confirm our guidance for the full year.”

Outlook:

Signify confirms its guidance for 2023. The company continues to focus its efforts on improving the Adjusted EBITA margin and free cash flow. Signify expects for 2023:

- An Adjusted EBITA margin in the range of 10.5-11.5%

- Free cash flow between 6-8% of sales

Citing volatility, Signify did not provide full-year sales guidance in its January earnings call, and did not offer any further revenue guidance today.

Global Markets:

In Q1 2023, Signify saw continued weakness in the consumer segment and softness in the indoor professional segment across most markets, due in part to a high comparison base. In Europe, comparable sales fell by 6.2%, largely impacted by downturns in Germany, the Benelux, and the UK.

In the Americas, comparable sales decreased by 10.9%, with the US and Canada contributing significantly to this decline. The Rest of the World also experienced a drop in comparable sales by 6.8%, with most markets witnessing a decline. China's sales remained affected by COVID-related disruptions.

“Some geographies may be technically in recession, maybe not saying it very clearly, but the recession is there somewhere and we have to deal with it.”

— Eric Rondolat, Signify CEO

Consumer markets

During today’s earning’s call, Rondolat explained, “So the first one is the consumer market which is continuing to be slow. And I would say that it first started in some regions and expanded to others, but now we see a weak consumer market nearly everywhere. We are still impacted by China. So China for the whole group is also a negative contributor in Q1. And China, given the population is also a big contribution to the consumer market.”

OEM Markets:

Rondolat explained that the OEM business has gone down for many different reasons. “The first one is an end market on the professional side, especially indoor, which is weaker.” Rondolat went on to explain that many OEM customers are de-stocking as they pull back on inventory as supply chain pressures ease.

European Lamp Phase Out

The company outlined the impact of the European ban on compact fluorescent, “From February 24, the Restriction of Hazardous Substances Directive banned the placing of compact fluorescent nonintegrated lamps on the European market. In addition, linear fluorescent lamps T5 and T8 will be phased out as August 24.” The company went on to explain its strong position in providing LED alternatives to the fluorescent sources.

Outdoor Lighting

Rondolat shared, “We can see also the outdoor professional market where we see a good level of traction linked to the different incentives that are being put on the table today by not only Europe and US but also in many other markets. We see incentives for energy efficient solutions and we can bring many to the table with a very fast return on investment.” Rondolat later described promising opportunities connected to US infrastructure projects.

Signify will hold its Annual General Meeting on May 16 and will reports second quarter and half-year results on July 28.