March 13, 2023

Survey Reveals No Major Shift in Industry Confidence

Slight decline in optimism accompanied by predictions for unchanged market conditions

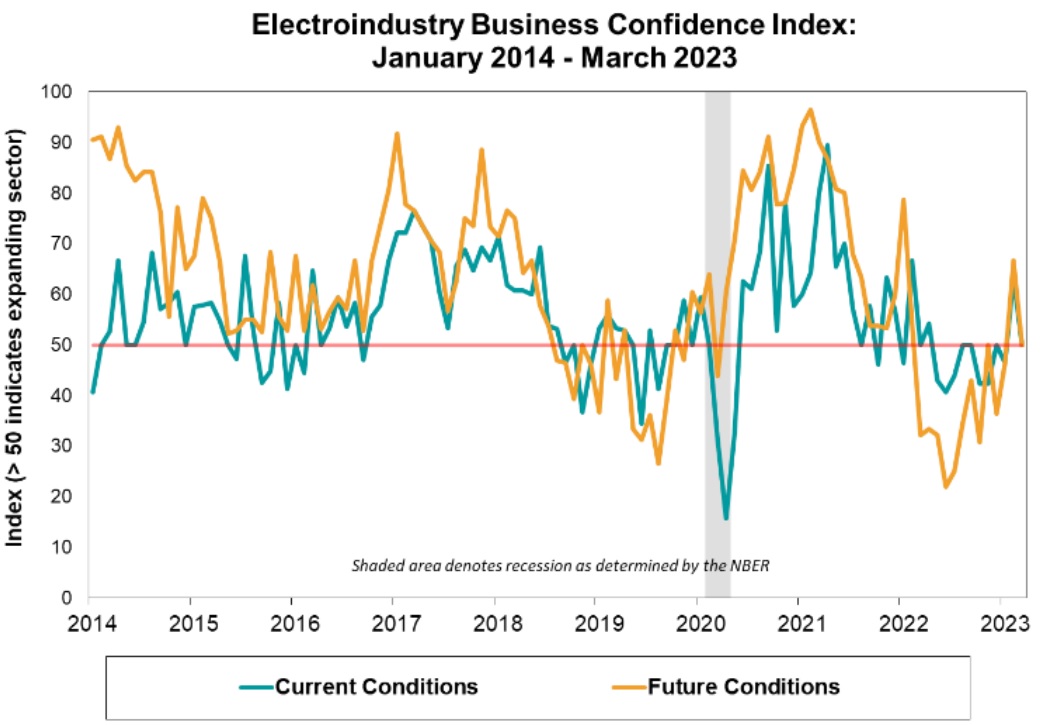

Each month, the National Electrical Manufacturers Association (NEMA) publishes the Electroindustry Business Confidence Index (EBCI). The index is based on surveys of senior managers at NEMA member companies – designed to gauge the business environment of the electroindustry in North America. Member companies include most of the ten largest lighting manufacturers in North America, along with other manufacturers of lighting and electrical products.

This most recent ECBI shows how makers of electrical equipment view current and future market conditions. Below are the details:

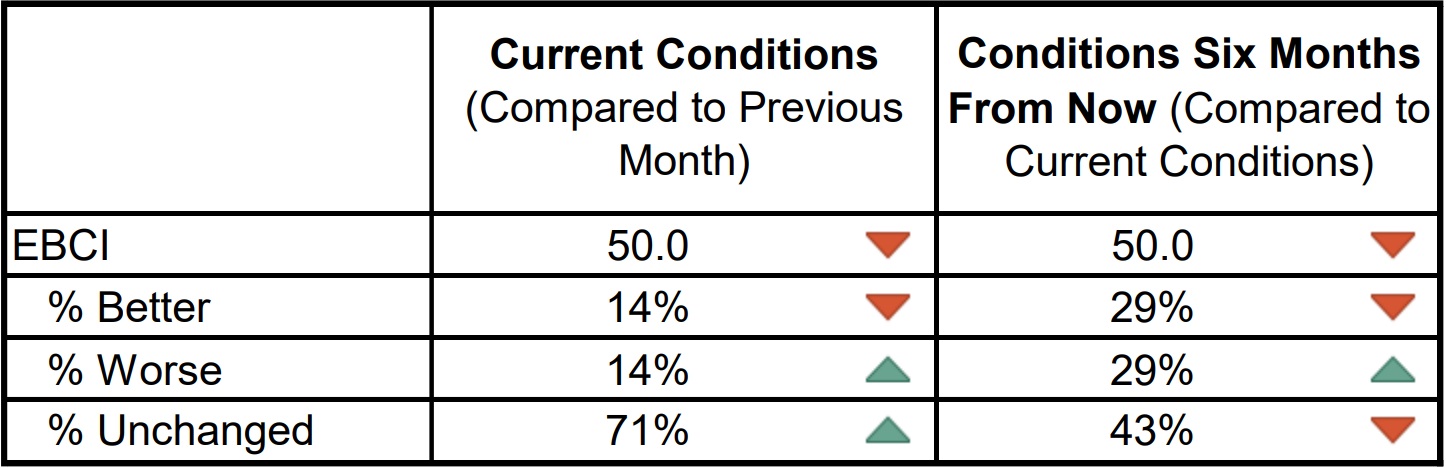

The current conditions component’s move into expansionary territory was unambiguous last month for the first time in almost a year as it hit 63.3 points. That surge of confidence was short-lived, with March’s reading falling back to 50, suggesting that conditions were unchanged from the prior month.

The share of respondents who indicated “better” conditions declined significantly to a level on par with those who reported “worse” conditions. Much of the commentary supported the numerical result, with many noting mixed conditions to include overall strong business activity but softening in certain end markets becoming noticeable and concern about supply chain issues still in play.

The median value of the reported magnitude of change held steady at 0.0 in March for the third month in a row. The mean value of the magnitude measure, while remaining positive, edged down to +0.1 this month from February’s reading of +0.8. Panelists are asked to report the magnitude of change on a scale ranging from –5 (deteriorated significantly) through 0 (unchanged) to +5 (improved significantly).

Expectations for future conditions also pulled back from a solid expansionary reading in

February to unchanged in this month’s survey. Last month’s future component score of 66.7 points marked the highest level reached in more than a year but concerns about the fallout from higher interest rates and a slowing global economy, including reduced consumer spending and higher capital acquisition costs, contributed to a less sanguine outlook this time. Panel members’ responses were evenly split between “better” and “worse” expectations, causing the March future component to match its current conditions counterpart at 50 points.

SURVEY RESULTS:

-

Values reflect the percentage of respondents expecting "Better" conditions, plus one-half of the percentage of respondents expecting "Unchanged" conditions.

-

A score of 50 or higher suggests conditions appropriate to expansion of the electroindustry sector.

-

Please note that survey responses were collected from the period of March 10-24, 2023.

EBCI METHODOLOGY:

The EBCI indexes are based on the results of a monthly survey of senior managers at NEMA member companies and are designed to gauge the business environment of the electroindustry in North America (defined here as the United States and Canada).

The survey contains the following questions:

- How would you rate current economic conditions in North America, as they affect your business, compared to the previous month?

- Using the following scale, please describe the magnitude of change in economic conditions in North America this month compared to economic conditions last month? [Scale structured as follows: 5 (improved significantly), 4, 3, 2, 1, 0 (stayed the same), -1, -2, -3, -4, -5 (deteriorated significantly)]

- How do you expect economic conditions in North America, as they affect your business, to have changed six months from now?

Respondents are asked to indicate whether conditions are better, worse, or unchanged. The survey also provides space for respondents to comment on current conditions. These comments are included below the table containing the index levels.

The index value is the percentage of respondents expecting “Better” conditions, plus one-half of the percentage of respondents expecting “Unchanged” conditions, which follows the methodology used by the Institute for Supply Management (ISM; formerly the National Association of Purchasing Management) in the construction of their manufacturing index.

Reprinted by permission of the National Electrical Manufacturers Association (NEMA)