April 27, 2023

Eight in a Row: Another Growth Quarter for LSI Industries

Lighting Segment paces growth. Current fourth quarter might prove challenging to extend streak.

Today, LSI Industries Inc. reported its fiscal third quarter financial results for the three months ended March 31, 2023.

LSI Industries reported a 7% increase in fiscal third-quarter sales, reaching $117.5 million. This quarter marks the eighth consecutive quarter that LSI’s overall revenues exceeded those of the comparable quarter a year prior. The current winning streak has been fueled by both organic growth across the business as well as M&A growth that stems from the May 2021 acquisition of JSI Store Fixtures.

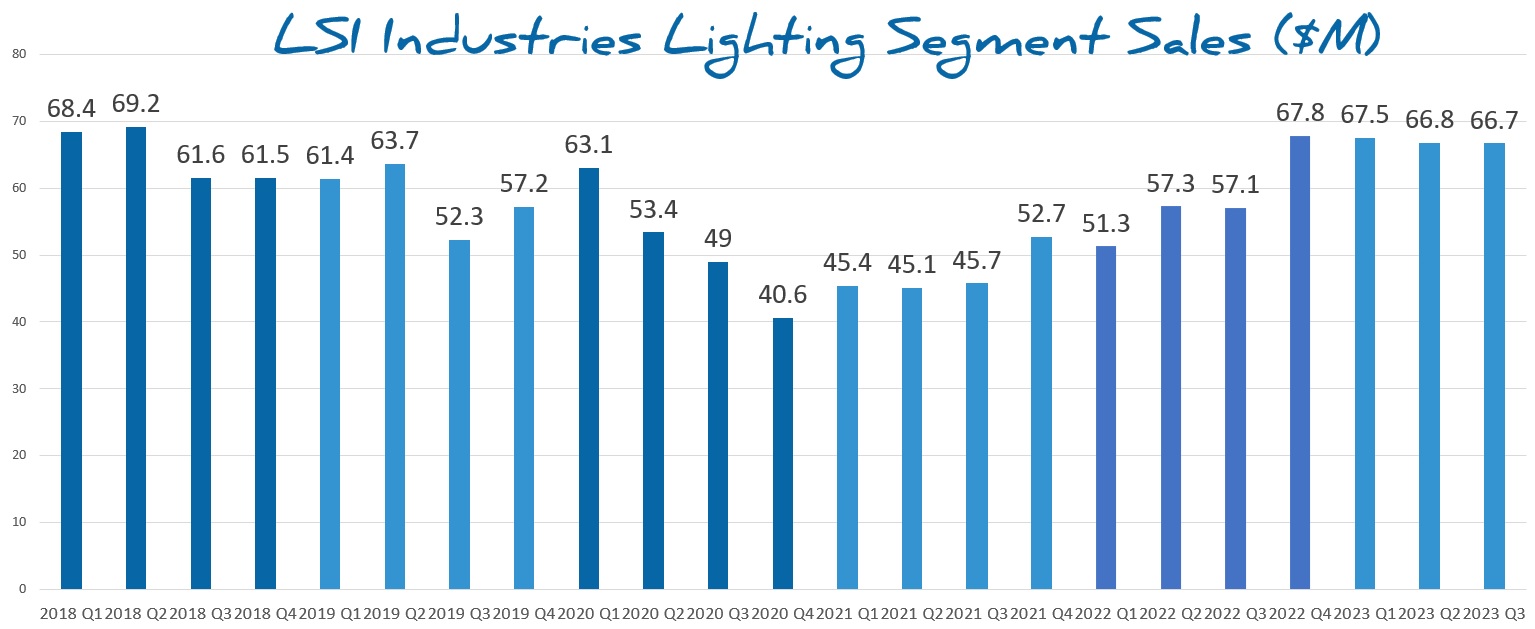

The Lighting segment was the primary driver of growth this quarter, which offset a small decline year-over-year in the Display Solutions segment. For the quarter, Lighting Segment net sales of $66.7 million increased 17% compared to the same quarter last year. Year-to-date, the Lighting Segment is up 21% with nine-month sales of $201.1 million.

James A. Clark, President and Chief Executive Officer of LSI, stated, "Our team delivered another solid quarter, achieving year-over-year growth in sales and profitability, exceeding a very strong prior year comparison." He added, "Within our Lighting Segment, sales increased 17% in the fiscal third quarter, driven by continued growth in both indoor and outdoor applications, across multiple verticals. Lighting operating income increased 31% in the period, with the gross margin rate improving 120 basis points versus last year."

Clark also mentioned that LSI Industries recently won a multi-million dollar lighting order for a large automotive components company, saying "Winning an order of this size in the Industrial vertical while satisfying demanding customer requirements demonstrates our progress with large accounts who value our unique, integrated suite of solutions."

LSI Industries’ fast recovery from pandemic doldrums and consistent growth has been rewarded by a stock price (Nasdaq: LYTS) that was trading at $5.73 one year ago and today opened at $13.25.

Vertical markets

According to Clark, automotive projects are “moving at an incredible speed. And they've come back with a vengeance, and... they're really willing to invest.” Warehouse projects, however, have slowed down a bit. On the other hand, large manufacturing investments in US manufacturing have taken over and are seeing a lot of activity, especially with EV power plants. While some projects are making headlines, there are also many that are not, but they are still driving a lot of activity in the market.

Quote-to-Order timelines are lengthening

LSI Industries' project quotation activity for Lighting remains high, but the quote-to-order conversion period has lengthened over the last few months. As a result, the number and value of outstanding quotes have grown. While overall business activity is expected to remain favorable, timing of realized sales may fluctuate somewhat until the conversion period returns to a more historical cadence.

During today’s earnings call, Jim Galeese, Chief Financial Officer, shared "We are experiencing a lengthening quote to order conversion period, which has increased the backlog of outstanding quotes. While we expect activity to remain healthy, the length and quote to order conversion could cause timing fluctuations moving forward."

Jim Clark explained that construction projects are highly sensitive to delays due to various factors such as the availability of materials and the coordination of different components. He gave examples like the concrete guys needing extra time to get their projects done, or delays in roughing in electrical equipment due to unavailable switchgear or cables. Clark noted that the complexity of these projects adds to the lengthening cycle, as they require numerous components and pieces.

These comments from Clark and Galeese do not exactly mimic what Acuity Brands CEO, Neil Ashe, shared with investors on April 4, but there seems to be some correlation to Ashe’s observations. Discussing the company's most recent quarter, Ashe stated that Acuity Brands “began to see a slowing in the order rate for our project business, while we continue to work through our extended backlog.”

A high bar on the current Q4

With $127.7 million in sales, fourth quarter 2022 was LSI’s second strongest quarter since 2018. So the company has its work cut out in order to exceed that quarter’s performance in the current quarter. The company has impressively strung together eight consecutive quarters of quarterly revenue gains, so even if a miss occurs in Q4, its 2023 entire fiscal year performance is almost a certain lock to be considered a notable step forward for the company.

But many have learned not to underestimate LSI Industries in recent years.