March 28, 2023

Dialight Sales Jump 29% in 2022

US revenues saw strong growth of 37%, aided by order backlog and favorable currency exchange rates

Dialight, the British maker of sustainable LED lighting for industrial applications, this week issued unaudited preliminary results for the year ended December 31, 2022.

Key points

-

Overall Group revenues in 2022 were 29% higher than the prior year (17% at constant currency):

-

Lighting revenues up 34%, with orders up 23%

-

Underlying operating profit increased to £5.0m (2021: £4.5m), which was lower than initially expected due to weaker orders in the very important December trading period

-

Gross margin fell to 2%, reflecting significant cost inflation and supply chain disruption (2021: 35.7%)

-

Net debt of £20.9m (1.7x LTM EBITDA), driven by higher inventory levels

Fariyal Khanbabi, Group Chief Executive, said:

“We made important strategic progress which was reflected in significant sales growth driven by strong demand for our sustainable lighting products. However, the markets we operate within became increasingly difficult during the year due to significant price inflation and continued global supply chain disruptions, which impacted our gross margins. Whilst these headwinds remain, we believe that they are in most cases transitory, and we expect to see some alleviation in H2 2023."

"The strong growth in Lighting orders demonstrates the increasing relevance of our products as energy efficiency became more urgent. We deliver innovative and sustainable lighting solutions to our customers and continue to make progress towards driving our impact on the environment and society.”

Lighting Segment

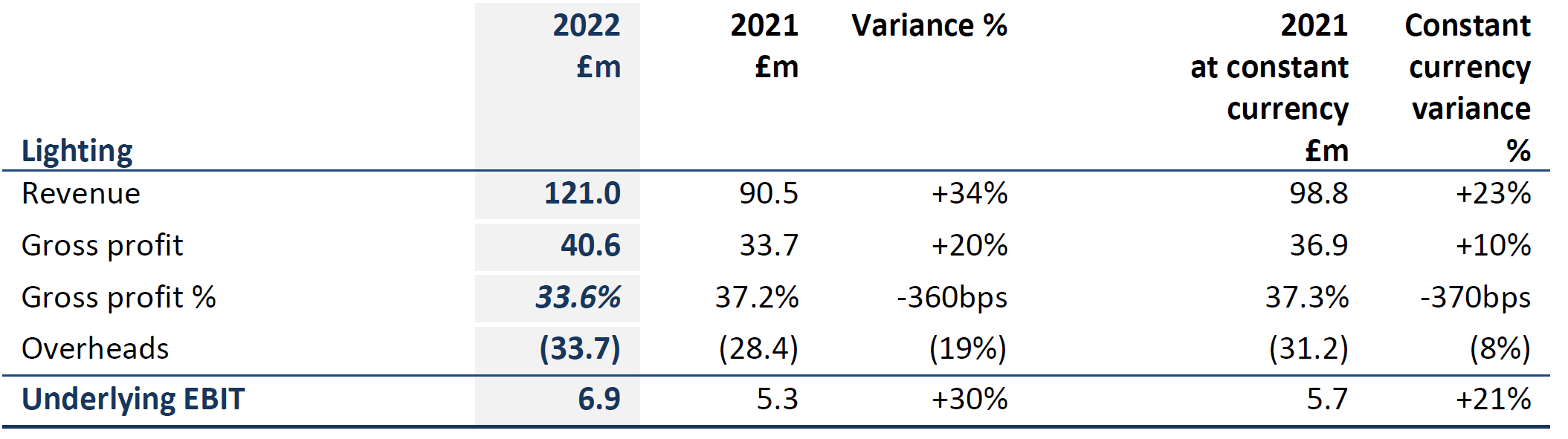

The Lighting segment saw continued strong growth in 2022, with revenue up 34%. Lighting represents 71% of the Group’s revenue (2021: 69%), and consists of two main revenue streams, large retrofit projects and on-going MRO spend.

US revenues saw strong growth of 37% with the region benefitting from a high opening backlog of orders supported by price increases implemented in H1. The company continued to gain market share in the MRO market, saw an increase in the number of sales to retrofit projects and started to see orders generated from the strategic sales team. However, revenue was significantly below our expectations in December, reflecting seasonal demand being below historic levels as well as several strategic customers deferring anticipated orders. Margins reduced in the year due to the challenges of increased material and freight costs, negated in part by operational efficiencies resulting from the capital investment.

EMEA revenue grew by 36% as COVID-19 restrictions lifted, with orders up 53% driven by new product launches. 2023 will see the benefit from price increases implemented in Q4 that will help offset the impacts from economic headwinds.

Following two years of strong growth, Australia suffered from lockdowns and close contact rules that reduced the ability of contractors and our sales teams to get on site, which reduced both sales (4%) and order intake (5%). With the relaxation of restrictions, we are seeing improved enquiry and MRO rates. Revenue growth rates are expected to increase in 2023, with improved product availability following transfer of more production to Penang and the benefit from recent price rises.

Asia, the smallest region, saw revenue grow by 133% to £3.4m as restrictions lifted with strong order growth at 60%. Activity levels remain excellent, with several larger projects under discussion and a strong backlog going into 2023.

Gross margins came under pressure from significant component price increases and a lack of availability, especially for aluminum, microchips, electrical components, and high freight costs. This particularly impacted H2 and was partially offset by the benefits from better fixed overhead absorption (higher production volumes)