March 24, 2023

5 Things to Know: Week Ending March 25

A Texas electrical distributor was just acquired. A lighting agent seeks to connect its people with new career opportunities.

Here's a roundup of some of the week's happenings curated to help lighting people stay informed.

1. Texas distributor acquisition

Coburn Supply Company, a 63-branch distributor based in Beaumont, Texas, has recently acquired the assets of Bay Electric Supply in League City, Texas.

Bay Electric Supply has been a family-owned and operated, full-line electrical supply store since its founding in 1978.

2. Are you searching for experienced lighting people?

As reported in a recent inside.lighting article about major changes in the Charlotte, North Carolina C&I lighting marketplace, longtime agent, S.L. Bagby, will soon be winding down its operations in late May.

S.L. Bagby Principal, Johnny Morgan, contacted inside.lighting to help match employees with new career opportunities. Morgan shared the following:

“S.L. Bagby team members have been working remotely for over three years and doing so efficiently, accurately, and with enthusiasm. During COVID and their employment at BAGBY, some changed their homes and locations due to the COIVD economy. Some had their spouses go to work so they could split daycare. They improved lifestyles and positivity, allowing them to have a balanced family and work life, while performing with high standards. “

“Tom Taylor from our Quotations team is an excellent example. He and his wife split time with their son, and Tom has fully maintained his performance numbers while staying connected to both his peers and the market. His speed and accuracy are exceptional, and his quote is the ‘standard’ for others in the market.”

Interested employers are encouraged to contact Johnny Morgan ([email protected]) or Laura Bierbrauer ([email protected]) for assistance. You may also contact an individual via the email address cited on the BAGBY website or via LinkedIn. BAGBY requests that you allow team members to stay on board through May 23 so the agency can fulfill its commitments to manufacturers and customers.

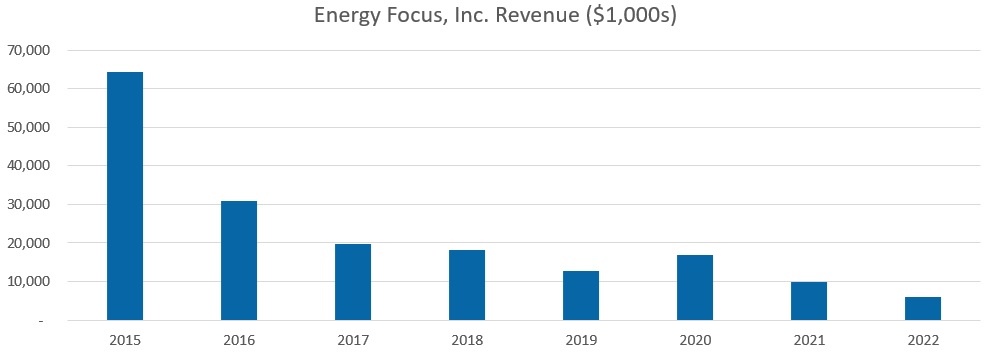

3. Energy Focus revenues continue to decline. $6m for the year, $663K for the quarter.

Energy Focus, Inc. (NASDAQ:EFOI) announced financial results for its fiscal year ended December 31, 2022. Company performance has dropped significantly in recent years since hitting a high revenue mark $64.4 million in 2015.

-

Full-year 2022 sales of $6.0 million, down 39.5% from 2021

-

Sales for the fourth quarter ended Dec 31 were $663,000

-

Negative gross profit margin for the year was -5.3%, down from gross profit margin of 17.2% in 2021

-

Full-year 2022 net loss of $10.3 million compared to a net loss of $7.9 million in 2021

The company cited the following reasons for the drop in revenue: limited product availability from supply chain constraints, entering 2022 with a declining military sales pipeline, and continuing fluctuations in the timing, pace, and size of commercial and military projects.

4. Construction starts dip 17%

Dodge Construction Network has reported that during the first two months of 2023, total construction starts were 17% below that of 2022. On a year-over-year basis, residential starts were down 31%, nonresidential starts were off 14%, while nonbuilding starts gained 6%. For the 12 months ending February 2023, total construction starts were 9% higher than the 12 months ending February 2022. Nonresidential and nonbuilding starts were 27% and 19% higher respectively, while residential starts lost 9%.

The largest nonresidential building projects to break ground in February were:

-

$3.5 billion Honda EV battery plant in Jeffersonville, Ohio

-

$1.4 billion expansion of Concourse D at Hartsfield Jackson Airport in Atlanta, Georgia

-

$500 million Apex-1 Sustainable Lithium-Ion battery plant in Hopkinsville, Kentucky

5. Five ways the electronic supply chain will adapt in 2023

Manufacturers face a delicate supply chain environment in 2023. Missed production schedules from a pandemic-plagued 2020 created an under-supply for much of 2021. And just as supplies began to get straightened out, geopolitical and economic factors have created oversupplies in some industries and drastic shortages elsewhere.

Electronics360 explores the current state of supply chain in the linked article below.