February 28, 2023

7 Key Takeaways from Signify's Just-Released Annual Report

Employee compensation rises, CEO compensation falls and the U.S. is now one-third of global sales

It’s been two months since Signify guided investors that the end of its 2022 would be softer than expected and it’s been one month since the company announced its full year results. Signify reported full-year 2022 sales of EUR 7.5 billion, operational profitability of 10.1% and a free cash flow of EUR 445 million.

The comparable sales growth for the year was 1.2% which may seem light compared to other US lighting makers, but part of Signify’s strength is its global coverage that causes it to have a presence in Europe and Asia that no other major US lighting maker possesses. This was referenced in the words of Signify CEO, Eric Rondolat, who opened the 2022 Annual Report with the comments, “The world endured a third year of exceptionally tough conditions in 2022.”

Given inside.lighting’s large U.S. and Canada audience we curated these takeaways from Signify’s just-published 2022 Annual Report:

1. U.S. & The Americas performance

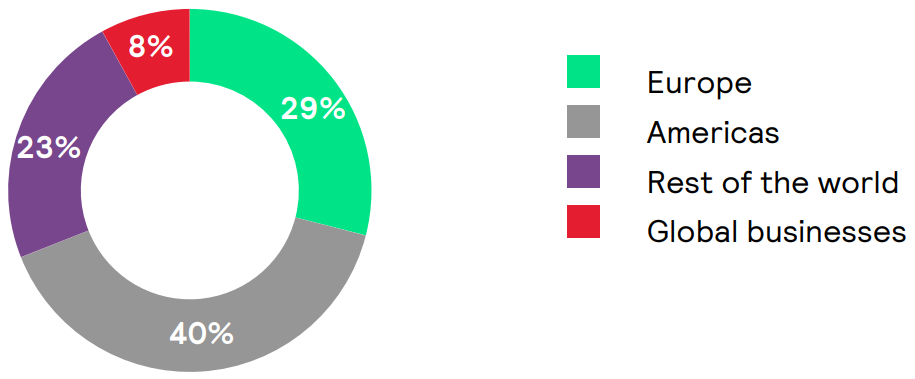

The Americas is one of four global markets broken out in Signify financials. In 2022, the region was responsible for 40% of global revenues the largest share on record likely due to recent years’ acquisitions of Cooper Lighting (then $1.6 billion) and Fluence. In 2017, the company – then known as Philips Lighting – cited 31% of sales in The Americas region.

The Americas as a region saw 15.4% growth, but with the US Dollar growing stronger against the Euro in 2022, the currency effects gave 12.2% lift with comparable growth contributing 3.2% “with a solid contribution from Cooper Lighting.”

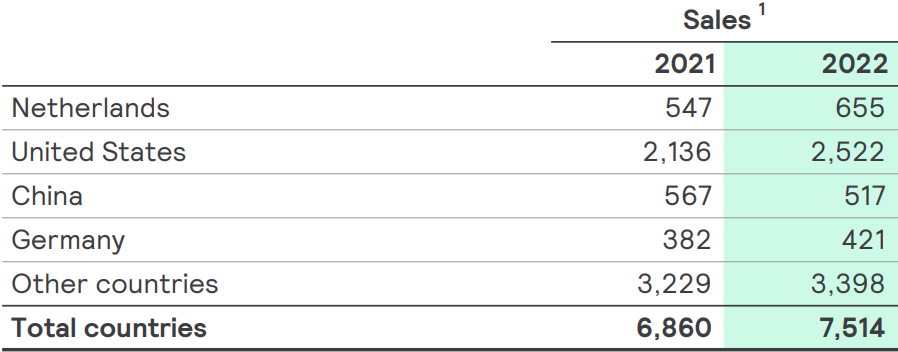

In an unusual disclosure, Signify broke out sales in a number of countries, including the United States. The granularity by country shows that Signify's United States revenues in 2021 and 2022 were approximately 83-85% of total revenues in the global region that it calls " The Americas."

One-third (33%) of global sales are derived from the United States. If the Euro gains noticeable strength compared to the US Dollar, it may cause the US share to decline.

1Includes Fluence since May 2, 2022 and the acquisition of Australian company, Pierlite, since April 29, 2022.

2. Signify versus its Publicly Traded Peer Group

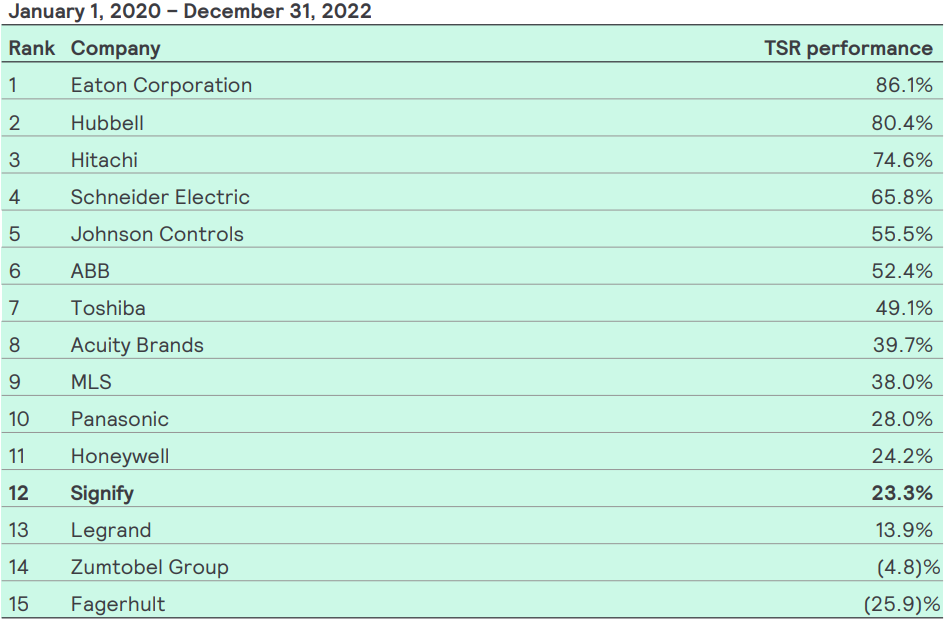

The total shareholder return achieved by Signify from 2020 to 2022 was 23.3%. This positioned Signify as the 12th ranked company in the peer group shown in the following table:

As of January 1, 2022 Cree was replaced by MLS Co Ltd. If Signify’s ranking among the peer companies had been in the top half of the list, Rondolat a portion of his compensation plan would have been triggered with a sliding reward scale based on how high the company ranks.

3. More Risk Shifts to US Commercial Market

With the acquisition of US-based Cooper Lighting (2020) and Fluence (2022), Signify's overall risk profile changed. As a result, Signify is more exposed to developments in the professional lighting market, and in particular, in the North American market. Therefore, going forward, any developments in those markets are expected to have a bigger impact on the company’s results, operations and prospects. More importantly, in case of negative developments in North America, it might have a reduced ability for offsets through its other business activities and markets in which it is active.

Additionally, the Signify financial reports issued throughout 2022 showed a significantly positive currency effect of the US Dollar strengthening against the Euro. When the pendulum swings the other way, the negative effect of this growing global region will be felt more significantly than in past years.

With more bulbs now in America’s basket, Signify’s Supervisory Board made a two-day visit in September to the company's North American teams in the company's offices in Bridgewater, New Jersey and Peachtree City, Georgia. Presentations were given on various topics, including the company's North America performance, strategy, customers, culture and talent.

4. CEO Compensation

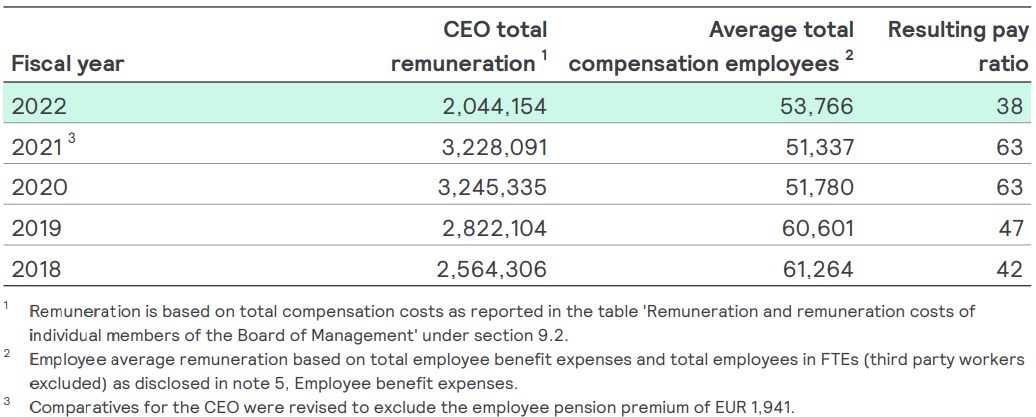

Eric Rondolat in 2022 received a base salary of EUR 947,330 and a total compensation just over EUR 2.0 million. In each of the two previous years, his total compensation was just over EUR 3.2 million. Given the challenges of 2022, the variable payout was less compared to prior years. This level of compensation is in line – and possibly on the lighter side – when compared to other CEOs who lead publicly traded multi-billion dollar global corporations.

In addition to the expected financial metrics that impact Rondolat’s variable compensation, one notable aspect of Rondolat's income is that the goals of Signify’s Brighter Lives, Better World 2025 program are baked into the CEO’s long term compensation. Metrics relating to carbon footprint reduction, circular revenues, something called "brighter lives revenues" and women in leadership positions are each calculated into the CEO's compensation.

5. Employee Compensation

Signify noted that since 2018, a greater proportion of its employee population has shifted from Western Europe to South East Asia, Asia, and Latin America.

The table below indicates that average total compensation per employee is EUR 53,766, up 4.7% versus 2021. The total compensation includes worldwide employees and also includes the costs of benefits associated with each employee.

6. “Brighter Lives, Better World”

Signify’s Brighter Lives, Better World 2025 program sets bold targets across the areas of climate action, circularity, and societal impact. Those initiatives were emphasized numerous times throughout the company’s 194-page Annual Report document.

Signify is on track to deliver against the ambitious goal of doubling the pace of the Paris Agreement's 1.5ºC scenario. Circular revenues have exceeded the ambition set for 2022 with an increase in contributions from circular products, systems or services. Brighter lives revenue has delivered an increase in revenues coming from lighting innovations that increase food availability, safety and security, or health and well-being and remains on track to double by 2025.

7. Women in Leadership

Women in leadership positions has increased by 11% from 2019, however, it is behind the more ambitious path that was set for 2022 for the trajectory to double the percentage of women in senior leadership roles by 2025.

At the end of 2022, 28% of leadership roles were held by women. Notably, 67% of 2022 new hires into leadership roles were women. Women in Leadership initiatives are part of Signify’s Better Lives, Better World program.