December 6, 2022

Mixed Economic Indicators Point to “Unchanged” Industry Conditions

Future conditions component points to unchanged conditions in six months

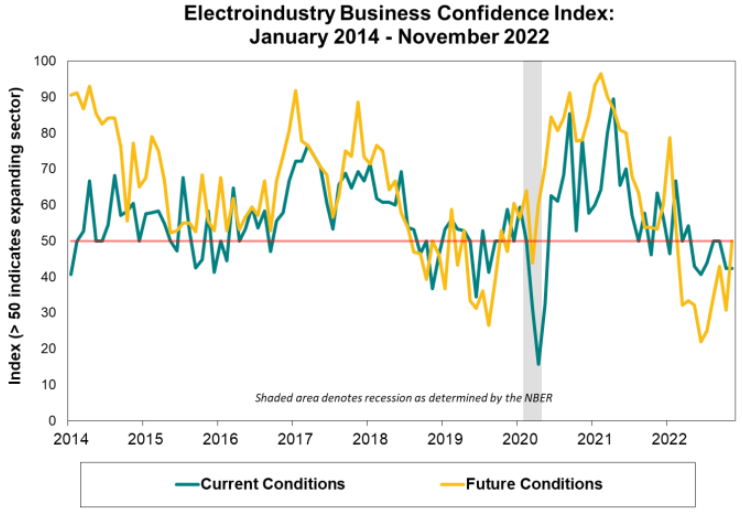

Each month, the National Electrical Manufacturers Association (NEMA) publishes the Electroindustry Business Confidence Index (EBCI). The index is based on surveys of senior managers at NEMA member companies – designed to gauge the business environment of the electroindustry in North America. Member companies include most of the ten largest lighting manufacturers in North America, along with other manufacturers of lighting and electrical products.

This most recent ECBI shows how makers of electrical equipment view current and future market conditions. Below are the details:

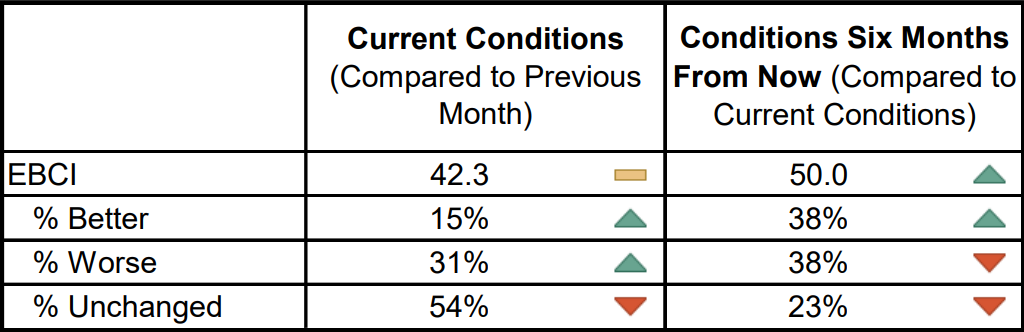

The current conditions component of the Electroindustry Business Confidence Index held steady at the mildly contractionary reading of 42.3 in November even as the share of respondents reporting “worse” conditions crept up this month. At 54 percent, the majority of panel members indicated that conditions remained “unchanged.” Some comments noted continued strong demand, but slower growth, attributed to interest rate hikes and lack of clarity from the Federal government, was already being felt by others.

In a small but noticeable shift toward the negative end of the scale, the reported magnitude of change moved from a median score of 0.0 in October to -1.0 in November, while the mean value edged down to -0.5 in the latest reading from -0.2 previously.

Panelists are asked to report the magnitude of change on a scale ranging from –5 (deteriorated significantly) through 0 (unchanged) to +5 (improved significantly).

Expectations for future business conditions, which had been mired in the contractionary zone since March 2022, broke from the string of negative readings in November as the future conditions component reached the scale midpoint. Although the reading of 50 points marked an improvement compared to recent history, it indicated that the panel collectively expected conditions to remain the same in six months but did not necessarily suggest growth ahead. Of those who expected a change in business conditions ahead, the panel was evenly divided between “better” and “worse” conditions, as each characterization drew 38 percent of respondents. One largely positive comment summed up the outlook as, “anticipating slower growth in the residential market, but most other segments remain positive with record backlogs to execute.”

SURVEY RESULTS:

- Values reflect the percentage of respondents expecting "Better" conditions, plus one-half of the percentage of respondents expecting "Unchanged" conditions.

- A score of 50 or higher suggests conditions appropriate to expansion of the electroindustry sector.

- Please note that survey responses were collected from the period of November 10-23, 2022.

EBCI METHODOLOGY:

The EBCI indexes are based on the results of a monthly survey of senior managers at NEMA member companies and are designed to gauge the business environment of the electroindustry in North America (defined here as the United States and Canada).

The survey contains the following questions:

- How would you rate current economic conditions in North America, as they affect your business, compared to the previous month?

- Using the following scale, please describe the magnitude of change in economic conditions in North America this month compared to economic conditions last month? [Scale structured as follows: 5 (improved significantly), 4, 3, 2, 1, 0 (stayed the same), -1, -2, -3, -4, -5 (deteriorated significantly)]

- How do you expect economic conditions in North America, as they affect your business, to have changed six months from now?

Respondents are asked to indicate whether conditions are better, worse, or unchanged. The survey also provides space for respondents to comment on current conditions. These comments are included below the table containing the index levels.

The index value is the percentage of respondents expecting “Better” conditions, plus one-half of the percentage of respondents expecting “Unchanged” conditions, which follows the methodology used by the Institute for Supply Management (ISM; formerly the National Association of Purchasing Management) in the construction of their manufacturing index.

Reprinted by permission of the National Electrical Manufacturers Association (NEMA)