October 4, 2022

Acuity Brands Hits $4 Billion in Sales

-

CEO comments on product, agents and vertical integration.

-

Company cites "strong demand" – and an ability to “capture price” and “drive volume”.

ATLANTA, GA – Today, Acuity Brands reported its Fiscal Year 2022 fourth quarter and full-year performance for the period ended August 31, 2022. For the sixth consecutive quarter, the company has reported double-digit percentage revenue growth compared to prior year. For the first time ever, Acuity Brands’ net annual sales exceeded $4 billion.

In today’s earnings call led by Neil Ashe, Chief Executive Officer, and Karen Holcom, Senior Vice President and Chief Financial Officer, Ashe shared his belief that Acuity Brands’ lighting segment is outperforming the market by stating “We have taken share and we expect to continue taking share.”

Here are more takeaways from Acuity's published reports and earnings call:

Strategy

Ashe “We are positioned for long-term growth by taking advantage of two of the most important megatrends; minimizing the impact of climate change and maximizing the impacts of technology.”

A common talking point of Acuity Brands messaging is its Better, Smarter, Faster operating system which is the company’s initiative to collect and analyze customer feedback, strengthen customer touchpoints, and identify processes and tools to close the communication gap between product orders and delivery. Ashe credits Better, Smarter, Faster as an important contributor to the company growth.

Financials

-

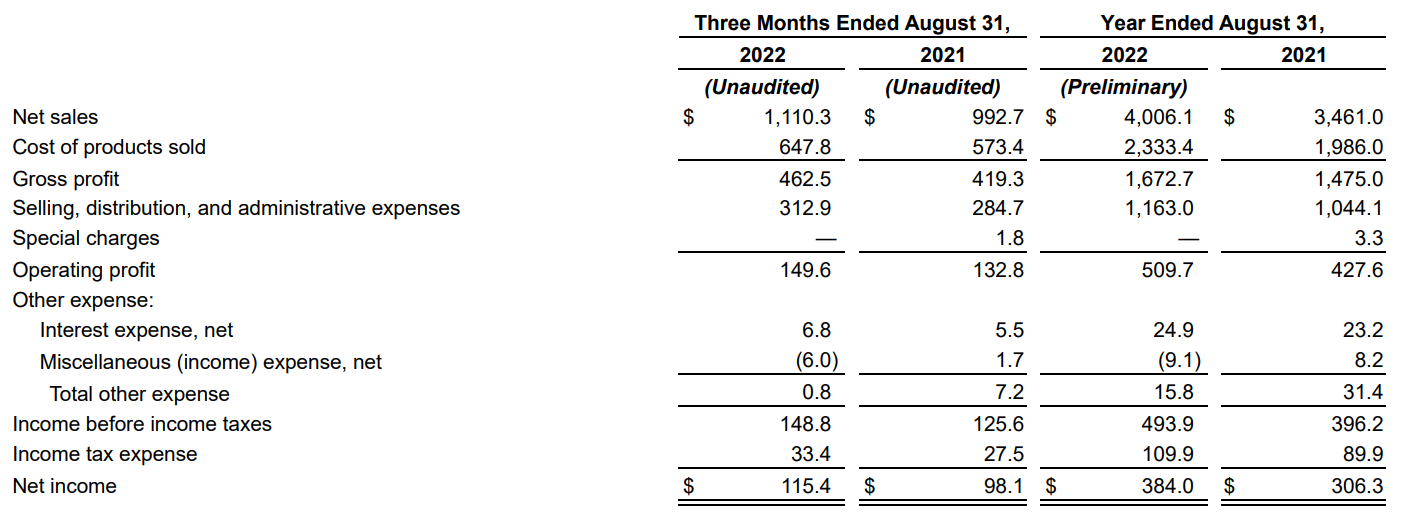

For the year, revenue was reported as $4.01 billion. The company reported profit of $384 million, or $11.08 per share.

-

Cost of sales for the quarter increased more than sales, rising 13.0% to $647.8 million, as gross margin contracted to 41.7% from 42.2%.

-

Increased net sales 12% in Q4'2022; 16% in FY'2022 over the prior year.

-

Increased diluted EPS 28% in Q4'2022; 32% in FY'2022 over the prior year.

-

Deployed additional $107M to share repurchases in Q4'2022; $512M for FY'2022.

Product Mentions

Contractor Select is the company’s collection of value-priced everyday lighting products. Ashe explained, “Contractor Select is growing faster than our broader portfolio and provides a consistent foundational relationship with electrical distributors.”

OSRAM DS: It’s been over one year since Acuity Brands further strengthened its vertical integration through the acquisition of OSRAM’s North America Digital Systems business. Acuity has rebranded the portfolio to “Optotronic” as part of its EldoLED product family. The company shared that it has integrated more Optotronic drivers in its luminaire portfolio, grown its OEM sales and has integrated Optotronic production into its Mexico operations.

When asked about the percentage of Acuity Brands luminaires that utilize the company’s own Optotronic and EldoLED drivers Ashe replied, “It’s not yet quite half. We are still both a large consumer of external drivers and obviously a large OEM provider of external drivers now.”

Intelligent Spaces Group: Ashe stated, “Distech had strong sales in the fourth quarter, notably in the sales of our Eclipse controller.” Atrius recently launched improvements to Atrius Locator and Atrius Vision.

Architectural Products: The company reported that performance of the Acuity Brands architectural portfolio has been stronger this year compared to the previous two years.

Lighting Agent Performance and Consolidation

For the entire year, sales through the independent agent network increased 13% to $2.7 billion. Agent sales represent a 68% share of total Acuity Brands sales which is fairly consistent with recent years.

Ashe commented, “We feel really good about our independent sales network and our collection of agents. We are in the process of… working through those agents and improving some of our representatives in different markets which we feel really good about… “ Ashe continued, “The world is changing and we’re going forward – and our first choice is to take them with us.”

Ashe went on to explain that there is a national gravitation that causes the best agent in each local market wanting to be aligned with Acuity Brands – and he sees that continuing. Alluding to agency changes and consolidation happening industry wide, Ashe commented “that, frankly, creates an opportunity for us for our local agents in each market going forward.”

Ashe indicated that the lighting segment is currently carrying “higher than normal backlog” and indicated that agents are still successful in bidding business.

Mergers & Acquisitions

Ashe stated, “On the acquisition front I believe that as we look forward over the next year, two years, we are better positioned to execute, integrate and manage additional businesses based on all the work that we’ve done around Better, Smarter, Faster…”

When asked about M&A and the types of acquisitions the company would consider, Ashe seemed to focus on bolt-ons that are in the strategic realm of Acuity Brands’ current business, and while he didn’t dismiss the notion of outright diversification, Ashe seemed to steer the answer towards adjacent businesses – mentioning technology and components as examples of attractive targets – but he left the door open for any M&A opportunity, adjacent or not.

In the slide deck that the company published today, Acuity Brands provided an estimate of 2023 share repurchases in the range of $125-150 million, but the company has not built anything into its 2023 financial assumptions for M&A.

Operations

The company touted its ability serve business when others could not. In the fourth quarter when the lighting business encountered sourcing interruptions with some electronic components, Acuity Brands described its ability leverage its strong supplier relationships to finish the quarter with a strong August.

Holcom described that operating profit was impacted by three key factors (1) higher cost of inventory, (2) increased cost for transportation and (3) higher commission rates for certain project business. Later, Ashe explained that container costs were $16,000 - $18,000 a few months ago and they’re more in the $6,000 - $8,000 range now.

Both Ashe and Holcom made references to seven price increases that occurred during the last fiscal year.

Ashe described that the company is building “a more consistent position in the marketplace where contractors, distributors, lighting specifiers know that we have the highest quality and highest value products for them and we can service them on a consistent basis.”

The company cited driver components as one of the biggest challenges in recent months, but Ashe indicated that he has line of sight to improved conditions.

Looking Forward to Fiscal 2023

Acuity Brands expects 2023 to be a dynamic environment and aims to make the organization as nimble as possible to respond to market conditions.

Net sales are expected to be in the range of $4.1 – 4.3 billion. At the midpoint, that would represent 4.8% growth. The Lighting segment is expected to grow “low to mid-single digits” and the (much smaller) Intelligent Spaces Group will “generate sales growth in the low-to-mid teens.”

Once again, the company will not be providing quarterly guidance in 2023.

See full Q4 and FY 2022 results »