September 15, 2022

Industry Confidence: A Slowing Economy with Pockets of Growth

Most expect future conditions to be unchanged or worse

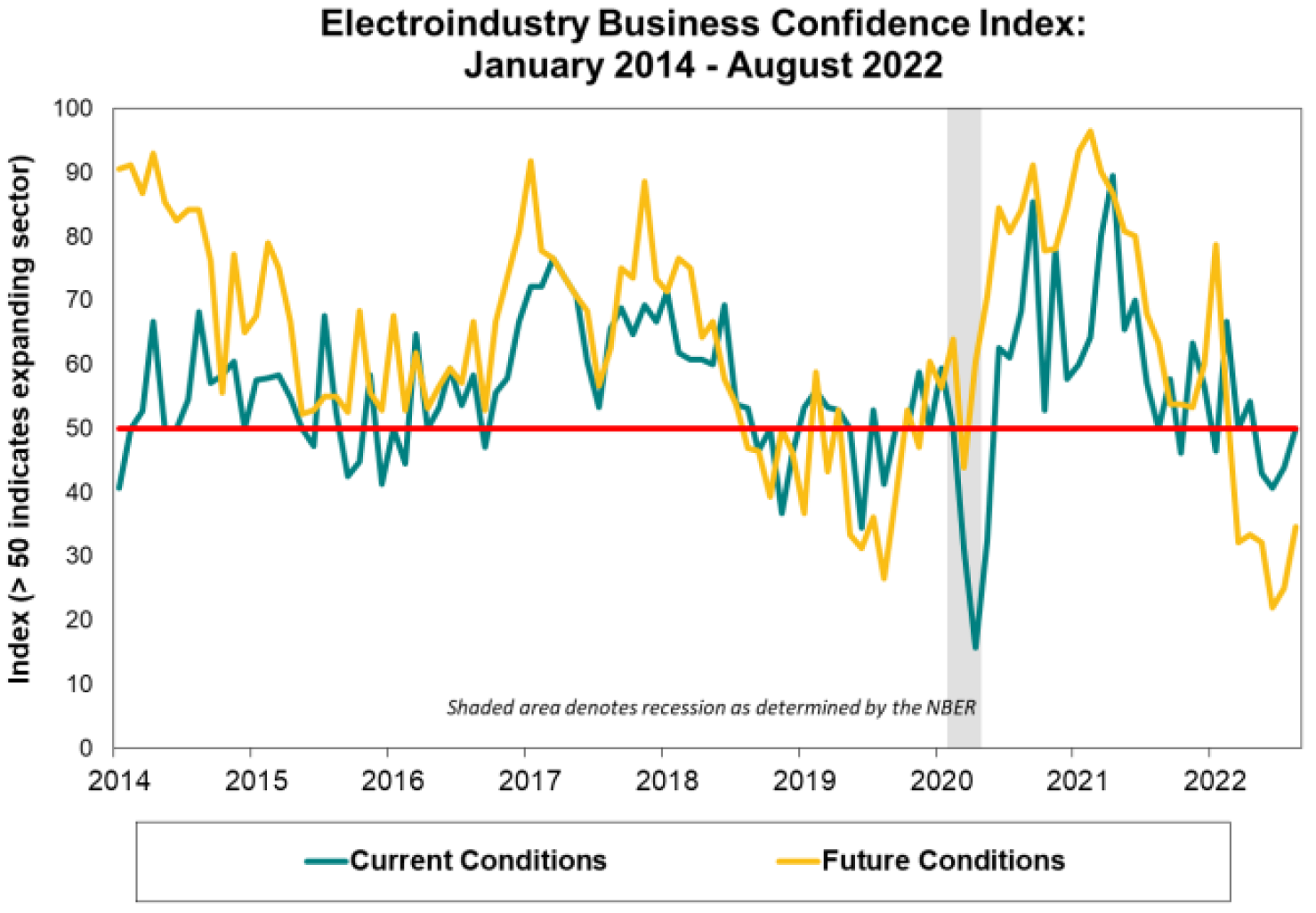

Each month, the National Electrical Manufacturers Association (NEMA) publishes the Electroindustry Business Confidence Index (EBCI). The index is based on surveys of senior managers at NEMA member companies – designed to gauge the business environment of the electroindustry in North America. Member companies include most of the ten largest lighting manufacturers in North America, along with other manufacturers of lighting and electrical products.

This most recent ECBI shows how makers of electrical equipment view current and future market conditions. Below are the details:

Despite improvement, future ECBI component remained underwater

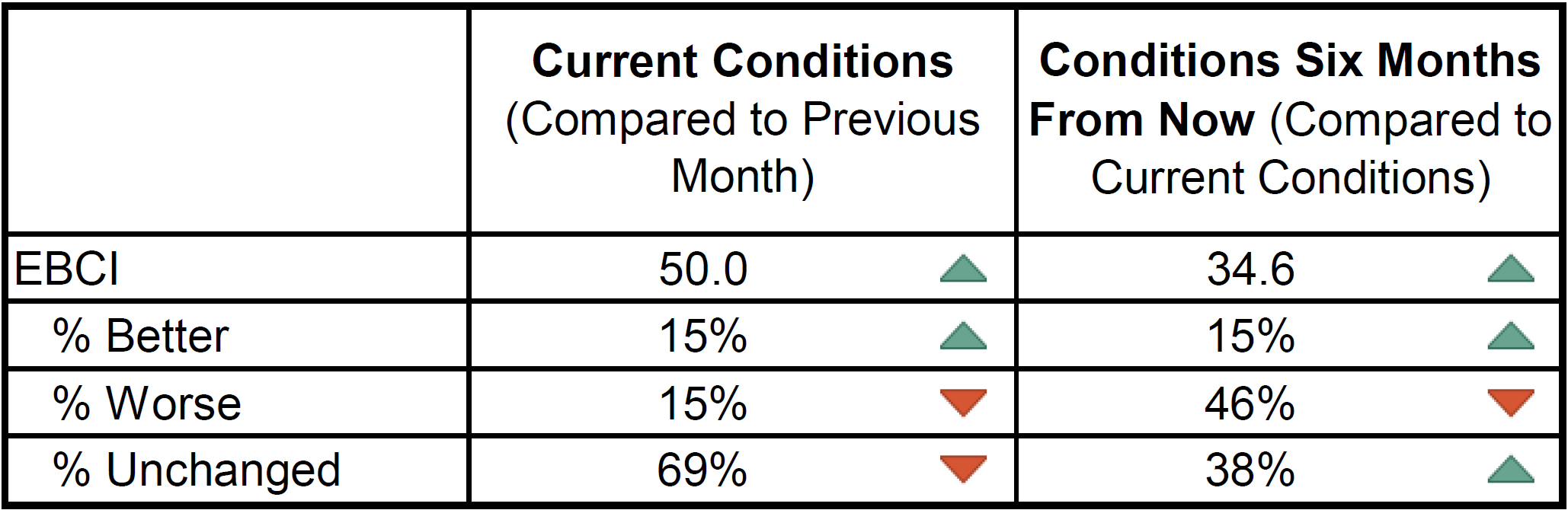

Following three months of downbeat readings on business conditions facing the electroindustry, as measured by the current conditions component of the EBCI, sentiment reached 50 points, signaling unchanged conditions from the previous month. The more than six-point gain from July’s 43.8 was led by an uptick in the share of respondents that reported “better” conditions in August. However, the largest proportion of panel members continued to note “unchanged” conditions. Comments indicated that some respondents have seen pockets of growth in an otherwise slowing economy. In a striking change from comments submitted over the past 15 months, the only mention of supply problems in August’s current conditions commentary pointed to “minimal improvement in supply chain issues.”

The reported magnitude of change in current electroindustry business conditions improved in August, as the median edged up to 0.0 from -0.5, while the mean value moved from -0.5 to -0.2. Panelists are asked to report the magnitude of change on a scale ranging from –5 (deteriorated significantly) through 0 (unchanged) to +5 (improved significantly).

Despite gaining nearly 10 points to a reading of 34.6 in August, the future conditions component remained well underwater for the sixth consecutive month. Although the greatest percentage of respondents indicated they anticipated “worse” conditions six months ahead, that sentiment no longer constituted a majority, as in increase in the number of “unchanged” responses displaced some of the prior month’s negative expectations. Comments were mixed on the likelihood of continued momentum, but expectations for supply chain and labor market improvement, coupled with still-significant orders backlogs, supported the bump up in the forward-looking metric.

SURVEY RESULTS:

- Values reflect the percentage of respondents expecting "Better" conditions, plus one-half of the percentage of respondents expecting "Unchanged" conditions.

- A score of 50 or higher suggests conditions appropriate to expansion of the electroindustry sector.

- Please note that survey responses were collected from the period of August 10-26, 2022.

EBCI METHODOLOGY:

The EBCI indexes are based on the results of a monthly survey of senior managers at NEMA member companies and are designed to gauge the business environment of the electroindustry in North America (defined here as the United States and Canada).

The survey contains the following questions:

- How would you rate current economic conditions in North America, as they affect your business, compared to the previous month?

- Using the following scale, please describe the magnitude of change in economic conditions in North America this month compared to economic conditions last month? [Scale structured as follows: 5 (improved significantly), 4, 3, 2, 1, 0 (stayed the same), -1, -2, -3, -4, -5 (deteriorated significantly)]

- How do you expect economic conditions in North America, as they affect your business, to have changed six months from now?

Respondents are asked to indicate whether conditions are better, worse, or unchanged. The survey also provides space for respondents to comment on current conditions. These comments are included below the table containing the index levels.

The index value is the percentage of respondents expecting “Better” conditions, plus one-half of the percentage of respondents expecting “Unchanged” conditions, which follows the methodology used by the Institute for Supply Management (ISM; formerly the National Association of Purchasing Management) in the construction of their manufacturing index.

Reprinted by permission of the National Electrical Manufacturers Association (NEMA)