July 5, 2022

"Myriad of External Shocks" Impact Industry Confidence

Three-quarters of respondents anticipate worse conditions in six months.

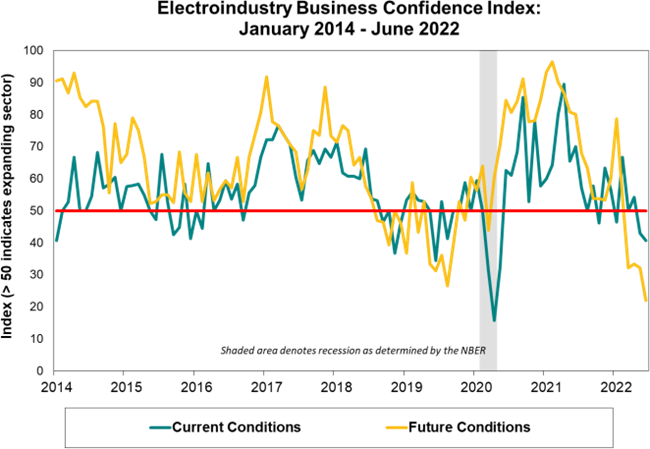

Each month, the National Electrical Manufacturers Association (NEMA) publishes the Electroindustry Business Confidence Index (EBCI). The index is based on surveys of senior managers at NEMA member companies – designed to gauge the business environment of the electroindustry in North America. Member companies include most of the ten largest lighting manufacturers in North America, along with other manufacturers of lighting and electrical products.

This most recent ECBI shows the number of negative sentiments recording the highest reading in many months. Below are the details:

Monetary policy fallout weighs on business confidence

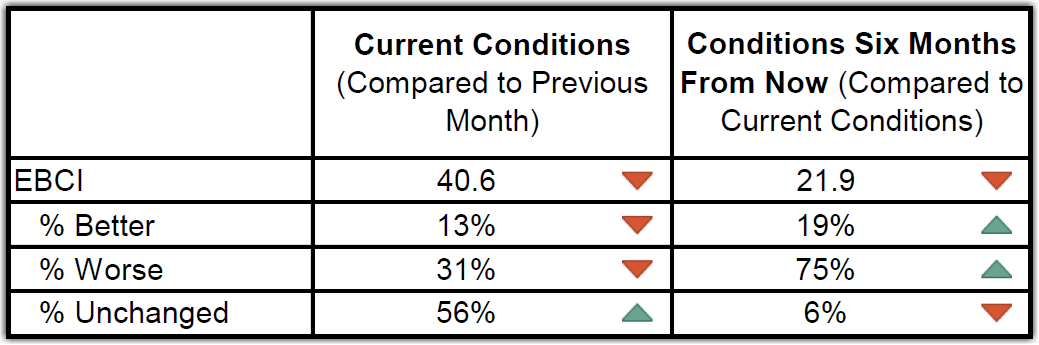

The current conditions component edged lower, staying below the no-change threshold level of 50 for the second consecutive month with a score of 40.6 in June. Somewhat counterintuitively, the June reading’s erosion came as a result of an increase in the proportion of respondents indicating “unchanged” conditions and despite a drop in the share of “worse” conditions. Much of the provided commentary could be considered mixed, with some panel members noting strong demand hampered by continued supply constraints. On the flip side, one commenter experiencing a reduction in demand characterized it positively because it allowed for catching up with backlogs.

After sliding below zero last month, the median reported magnitude of change in current electroindustry business conditions returned in June to 0.0, where it has perched for 9 or the previous 11 months. The mean value held unchanged from May at -0.1.

Panelists are asked to report the magnitude of change on a scale ranging from –5 (deteriorated significantly) through 0 (unchanged) to +5 (improved significantly).

Confidence reflected in the future conditions component broke through the low-thirties range it had maintained for a handful of months. Declining by more than 10 points to a reading of 21.9 in June, the forward-looking metric reached its lowest point since the depths of the Great Recession. Three-quarters of survey respondents anticipate “worse” conditions in six months. Although some positive embers remain, most of the comments suggest the myriad of external shocks, such as inflation and the bitter medicine the Fed will use to fight it, dogged supply chain problems, domestic and international conflict, and cooling economies around the world, will create headwinds for electrical manufacturers.

SURVEY RESULTS:

- Values reflect the percentage of respondents expecting "Better" conditions, plus one-half of the percentage of respondents expecting "Unchanged" conditions.

- A score of 50 or higher suggests conditions appropriate to expansion of the electroindustry sector.

- Please note that survey responses were collected from the period of May 10-20, 2022.

EBCI METHODOLOGY:

The EBCI indexes are based on the results of a monthly survey of senior managers at NEMA member companies and are designed to gauge the business environment of the electroindustry in North America (defined here as the United States and Canada).

The survey contains the following questions:

- How would you rate current economic conditions in North America, as they affect your business, compared to the previous month?

- Using the following scale, please describe the magnitude of change in economic conditions in North America this month compared to economic conditions last month? [Scale structured as follows: 5 (improved significantly), 4, 3, 2, 1, 0 (stayed the same), -1, -2, -3, -4, -5 (deteriorated significantly)]

- How do you expect economic conditions in North America, as they affect your business, to have changed six months from now?

Respondents are asked to indicate whether conditions are better, worse, or unchanged. The survey also provides space for respondents to comment on current conditions. These comments are included below the table containing the index levels.

The index value is the percentage of respondents expecting “Better” conditions, plus one-half of the percentage of respondents expecting “Unchanged” conditions, which follows the methodology used by the Institute for Supply Management (ISM; formerly the National Association of Purchasing Management) in the construction of their manufacturing index.

Reprinted by permission of the National Electrical Manufacturers Association (NEMA)