June 30, 2022

Takeaways from Acuity Brands’ $1 Billion Quarter

Company reports bigger-than-expected revenues and profits

-

Acuity Brands reaches $1 billion quarterly sales milestone for second time in history

-

Company announced a new price increase yesterday

-

Acuity Brands has access to a new $600 million credit facility. Does this foreshadow bigger things ahead?

ATLANTA, GA – Today, Acuity Brands reported its Fiscal Year 2022 third quarter performance for the period ended May 31, 2022. For the fifth consecutive quarter, the company has reported double-digit percentage revenue growth compared to prior year.

Acuity Brands (NYSE: AYI) stock was trading near $157.00 (+1.0%) around 10:00 am EDT. Here are takeaways from Acuity's published reports and the earnings call led by Neil Ashe, Chief Executive Officer, and Karen Holcom, Senior Vice President and Chief Financial Officer.

FINANCIALS

For the second time in Acuity Brands’ history and the first time since 2018, quarterly sales exceeded $1 billion. Among the financial analysts that report on Acuity Brands, the lowest sales estimate was $969 million, and the highest estimate came in at $998 million.

-

Acuity Brands announced net sales of $1.06 billion in the third quarter, an increase of 17.9 percent or $160.9 million, compared to the same period in fiscal 2021.

-

Gross profit was $445.1 million in the third quarter of fiscal 2022, an increase of $58.5 million, or 15.1 percent, compared to the same period in fiscal 2021. Adjusted EBITDA was $176 million.

-

The Independent Agent Sales Network generated sales of $725.9 million, an increase of $97.9 million, or 15.6 percent, compared to the same period in fiscal 2021.

MARKET DEMAND

Ashe indicated that “market demand in the third quarter remained strong” and that the company is working through its backlog which “continues to be at above-normal levels.”

Acuity reports having “above normal backlog” and with one quarter left in Fiscal Year 2022, Ashe indicated that "the algebra would suggest that we will be above single-digit growth for the remainder of the full year."

ELECTRICAL DISTRIBUTOR CHANNEL

In support of Acuity Brands’ report that service levels are strong, Ashe shared an anecdote about recently attending the National Association of Electrical Distributors (NAED) annual conference during which he and other Acuity Brands Lighting (ABL) team members met with many key electrical distributor partners. Ashe stated that “each company we met with had the same feedback for us: Acuity has the right products and was able to deliver throughout the pandemic and the subsequent supply chain shortages when others could not.”

OSRAM DIGITAL SYSTEMS ACQUISITION

The 2021 acquisition of the Osram Digital Systems (DS) business seems to be paying off. Total sales in the third quarter were $83 million, an increase of $37 million compared with the prior year. We reached out to Acuity Brands seeking clarification about if the $83 million included intracompany sales, and didn't receive an immediate response.

INTELLIGENT SPACES GROUP: Watch Out for the 6-Percenters?

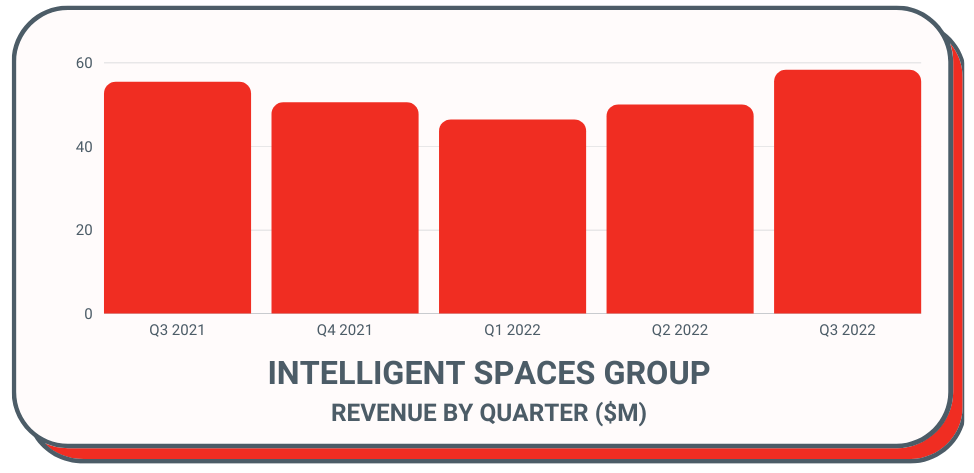

In January 2021, Acuity Brands announced that it would be carving out and separately reporting on a separate business unit initially called "Intelligent Buildings" and now known as the Intelligent Spaces Group (ISG). It is comprised of the cloud-connected brands Distech Controls and Atrius. Everything else (lighting, components and other lighting controls) would be reported as Acuity Brands Lighting (ABL).

One year ago, the company's 3-hour Investor Day presentation dedicated a disproportionate focus on the Intelligent Spaces Group that caused us to cite "Watch Out for the 6-Percenters" as one of the big takeaways from the event. It was obvious that Acuity Brands was serious about growing ISG from a $55 million business unit that represented 6% of Acuity Brands' sales into something much bigger.

Since its 2021 inception, however, we haven't seen ISG deliver substantial revenue or profit growth while the legacy brands, along with their typically shorter sales cycles, seem to be outpacing the growth of the ISG. The business unit now represents 5.5% of Acuity Brands' total revenues. It's possible that the ISG recipe takes longer to bake than other parts of the Acuity Brands business, so we will be eager to see if ISG continues its new streak of consecutive growth quarters.

PRICE INCREASES

Ashe indicated that Acuity Brands announced another price increase yesterday. More details were not provided.

When asked if the market should expect further price increases from this point on, Ashe explained that if inflationary markets continue, that the company will likely continue to adjust its pricing moving forward.

Ashe was asked multiple times about the possibility of deflation and if that would trigger potential price decreases. He didn’t commit or hint at price decreases but explained that the company has been and will continue to be dexterous with its pricing strategy.

With price increases providing tailwind to revenue growth, an analyst from Oppenheimer asked Holcom to provide further details on unit volumes. Holcom explained generally that the company was able to grow its ABL volume year-over-year.

INVENTORY & SUPPLY CHAIN

Holcom explained that Acuity Brands’ inventory “has increased over the prior year in terms of dollars and days.” The leadership indicated that inventory increases are temporary measures in order to mitigate supply chain challenges.

Acuity Brands cites four basic factors affecting inventory:

-

Increased lead times of Asian finished goods

-

Increased inventory from the Osram DS acquisition

-

Ongoing inflationary cost of materials

-

Increased levels of components to mitigate the impact of shortages

Holcom explained that the company is addressing the supply chain challenges as follows:

-

Lowered purchases of Asian finished goods

-

Renegotiated terms with certain finished goods suppliers

-

Controlling purchases of components and manufacturing of products in line with current demand

When asked about how Acuity Brands is navigating the components shortages compared to competitors, Ashe explained that “it all starts with chips” and that raw material inventory is higher due to component shortages.

Ashe shared an unusual anecdote about how Acuity Brands in recent months was “even sourcing products for some of our competitors who are our suppliers because they didn’t have access to them.”

ACCESS TO CASH

Holcom reported that this morning, Acuity Brands closed on a $600 million revolving credit facility which provides the company with “additional flexibility, if needed, to accomplish our capital allocation priorities." The 5-year facility provides an additional $200 million in borrowing capacity compared to its most recent revolving credit facility.

More details on the credit facility »

BOARD OF DIRECTORS GROWS TO 11 MEMBERS

BOARD OF DIRECTORS GROWS TO 11 MEMBERS

The Acuity Brands Board of Directors approved an increase in the size of the Board from 10 to 11 members and elected Marcia J. Avedon, Ph.D. as an Independent Director. Dr. Avedon will serve on the Governance and Compensation and Management Development Committees. She will serve for a term that will expire at the Company’s next annual meeting of stockholders.

Dr. Avedon most recently served as Executive Vice President, Chief Human Resources, Marketing and Communications Officer for Trane Technologies PLC, where she was responsible for all global human resource and reputation management strategies and functions. Ashe commented, “We are pleased that Dr. Marcia Avedon has agreed to join our Board. She has strategic business experience in the industrial space and has demonstrated consistently that she can build companies that compound shareholder wealth."