February 24, 2022

5 Eye-Opening Details from Signify's Annual Report

Online sales, Non-LED and Average Salary info provides unique insights into Signify's initiatives

Yesterday, the world’s largest lighting company, Signify, published its 189-page 2021 Annual Report.

After last month’s earnings call, we provided a detailed overview of the financial performance of the company. It was a good year with both sales and profits trending up.

Like most annual reports, Signify’s was a healthy mix of messaging from the Marketing department and detailed metrics from the Finance team. Here are our favorite takeaways from the Signify report. All currency cited below is in U.S. currency, using 1 EUR = 1.12 USD conversion. Also, it's important to note that 38% of Signify sales are generated in North America and South America.

Signify generated over $1 billion in direct online sales in 2021

“Digitalizing and transform for the future” is one of Signify’s 5 Strategic Frontiers. According to the report, the sole target of that frontier is to increase B2C and B2B online sales. This initiative seems to be working as the company generated approximately $1.02 billion in direct online sales last year.

The company mentions both B2C and B2B channels as part of this initiative. We believe that the vast majority of 2021 online sales are tied to consumer products like Philips Hue. We will try to monitor how this "frontier" is impacting Signify's B2B channels.

Online sales as a percentage of sales was 13.4%, up 12% versus 2020.

Non-LED Sources are Still Good Business

Conventional products like HID, linear and compact fluorescent, halogen, incandescent and electronic ballasts are still relevant. UV-C sources might be the only R&D related expenses in this category, which may enable the impressive margins in Conventional Products category.

Conventional segment sales were approximately $962 million. The category was down 8.7% from 2020 and represents 12.5% of overall sales.

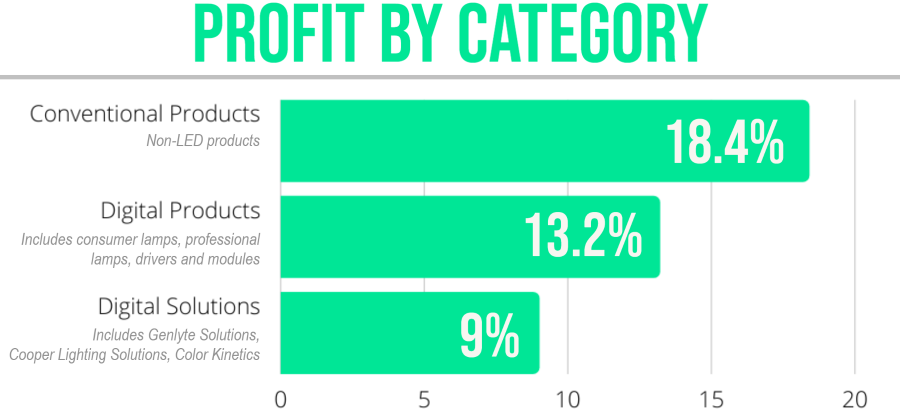

The figures above are EBITA as a percentage of sales.

There were approximately $184 million of Signify expenses that were not allocated to specific business units.

Please refer to the 2021 Annual Report for a complete definition of business units

Employee makeup: Average Salaries Decline, Female Leadership Increases

In 2017, the average Signify employee earned over $72,000. In each consecutive year since then, the company has seen a steady decline to where the average employee now makes less than $58,000.

Signify attributes the steady decline in average employee compensation to a "change in employee geographic spread." They go on to report the following:

-

Since 2018, a greater proportion of the employee population has shifted from Western Europe to South East Asia, Asia, and Latin America.

-

The acquisitions of Cooper Lighting and Klite resulted in an increase in the employee population from 2019 to 2020 and the majority of that increase was in Latin America, India and China.

-

In addition, Signify has been increasing the employee population in India due to growth in R&D software and IT.

Women in leadership roles: This percentage continues its upward trend. Two years ago, the percentage was 17%. Today it is 25%.

18% of employees are under 30.

Sustainability is More than Just a Few Green Anecdotes:

The company mentioned “sustainability” over 225 times in the 2021 Annual Report. By comparison, “supply chain” was cited 73 times and the COVID-19 pandemic was mentioned 53 times. Sustainability is a big part of Signify’s messaging.

Many corporations promote their sustainability initiatives. Three things we like about Signify’s focus in this area:

-

Signify is tying 20% of CEO’s variable compensation to achieving sustainability goals

-

The company provides an excruciatingly detailed overview of the data that demonstrates progress, and

-

Signify is actually making excellent progress in this area.

Signify stock performance fared better than most competitive companies

As a component of executive compensation, Signify benchmarks its Total Shareholder Return (TSR) against fourteen other publicly traded companies in related industries. They evaluate 3-year stock performance and rank the companies from 1 to 15.

-

All companies had a positive shareholder return 2019 - 2021

-

Cree (Wolfspeed) led the list with an eyepopping 175% return.

-

Signify was ranked fifth with an impressive 117% return.

-

Hubbell (97%), Legrand (88%) and Acuity Brands (70%) were each among the top ten performers.

Don’t miss the next big lighting story…Click here to subscribe to the inside.lighting InfoLetter |